by Calculated Risk on 12/22/2022 11:12:00 AM

Thursday, December 22, 2022

Lawler: Update on Rent Trends

Today, in the CalculatedRisk Real Estate Newsletter: Lawler: Update on Rent Trends

Excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

Recently released data from various private entities that track US rent trends indicate that US rent growth has weakened considerably this Fall, and several measures suggest that rents have fallen by more than the seasonal norm over the last few months.

Here is a table showing monthly % changes in the Apartment List Rent Index (ALRI, not smoothed), the Zillow Observed Rent Index (ZORI, smoothed via 3-month moving average), and the CoreLogic Single Family Rent Index (CLSFRI, smoothed via 3-month moving average.) I’ve included the ALRI on a 3-month moving average basis to be comparable to the other two indices.

...

These rent indices show not only has US rent growth slowed sharply, but that rents have actually begun to fall this Fall, and by more than the seasonal norm.

Q3 GDP Growth Revised Up to 3.2% Annual Rate

by Calculated Risk on 12/22/2022 08:39:00 AM

From the BEA: Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), Third Quarter 2022

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 1.7% to 2.3%. Residential investment was revised down from -26.8% to -27.1%.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. For more information, refer to "Updates to GDP."

...

Real gross domestic income (GDI) increased 0.8 percent in the third quarter, an upward revision of 0.5 percentage point from the previous estimate. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.0 percent in the third quarter, an upward revision of 0.4 percentage point.

emphasis added

Weekly Initial Unemployment Claims increase to 216,000

by Calculated Risk on 12/22/2022 08:33:00 AM

The DOL reported:

In the week ending December 17, the advance figure for seasonally adjusted initial claims was 216,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 211,000 to 214,000. The 4-week moving average was 221,750, a decrease of 6,250 from the previous week's revised average. The previous week's average was revised up by 750 from 227,250 to 228,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 221,750.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Black Knight: Mortgage Delinquency Rate Increased in November; Prepayments at Record Low

by Calculated Risk on 12/22/2022 07:00:00 AM

From Black Knight: Black Knight’s First Look: Prepayments Hit Third Consecutive Record Low in November, While Mortgage Delinquencies Top 3.0% and Foreclosure Starts Bounce 19%

• Prepayment activity in November dropped 15.6% to a single month mortality (SMM) rate of 0.40% – once again marking the lowest rate on record since before 2000 when Black Knight started reporting the metricAccording to Black Knight's First Look report, the percent of loans delinquent increased 3.5% in November compared to October and decreased 16% year-over-year.

• The national delinquency rate rose another 3.5% in November to 3.01%, up 10 basis points since October, driven by a 31K (+3.9%) increase in 30-day delinquencies and a 25K (+11%) rise in 60-day delinquencies

• The delinquency rate in Florida rose another 18 basis points in the month to 3.60% as the impact of Hurricane Ian on homeowners’ ability to make mortgage payments continues

• Improvement among seriously past-due loans continues to stagnate, with the population of 90-day delinquencies ticking down -0.2% from the month prior

• Foreclosure starts rose again (+19%) on the heels of October’s increase, but the month’s 23.4K starts are still below the recent high seen in June 2022 and remain 30% below pre-pandemic levels

• Foreclosure was started on 4.3% of serious delinquencies in November, up 7 basis points from October but still 44% less than the rate seen in the years leading up to the pandemic

• Active foreclosure inventory rose 5.3%, though 2022 volumes remain subdued after the record lows of 2021 due to widespread moratoriums and forbearance protections

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.01% in November, up from 2.91% in October.

The percent of loans in the foreclosure process increased in November to 0.37%, from 0.35% in October.

The number of delinquent properties, but not in foreclosure, is down 294,000 properties year-over-year, and the number of properties in the foreclosure process is up 64,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2022 | Oct 2022 | Nov 2021 | Nov 2020 | |

| Delinquent | 3.01% | 2.91% | 3.59% | 6.33% |

| In Foreclosure | 0.37% | 0.35% | 0.25% | 0.33% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,612,000 | 1,557,000 | 1,906,000 | 3,381,000 |

| Number of properties in foreclosure pre-sale inventory: | 196,000 | 186,000 | 132,000 | 176,000 |

| Total Properties | 1,808,000 | 1,743,000 | 2,039,000 | 3,557,000 |

Wednesday, December 21, 2022

Thursday: Unemployment Claims, Q3 GDP (Third Estimate)

by Calculated Risk on 12/21/2022 08:31:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 211 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2022 (Third estimate). The consensus is for real GDP at 2.9% annualized, unchanged from the second estimate of 2.9%.

• Also at 8:30 AM, Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

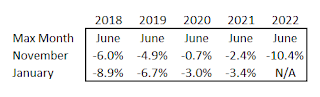

The Normal Seasonal Pattern for Median House Prices

by Calculated Risk on 12/21/2022 12:39:00 PM

Earlier, in the CalculatedRisk Real Estate Newsletter on Existing-Home Sales for November, I mentioned that the median price was down more than normal seasonally.

Seasonally prices typically peak in June (closed sales for contracts signed mostly in April and May).

And seasonally prices bottom in January (contracts signed in November and December). I've included the decline from the peak for November for each year to compare to this year.

Existing-Home Sales Decreased to 4.09 million SAAR in November; Median Prices Down 10.4% from Peak in June 2022

by Calculated Risk on 12/21/2022 10:48:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.09 million SAAR in November

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!The median existing-home price for all housing types in November was $370,700, an increase of 3.5% from November 2021 ($358,200), as prices rose in all regions. This marks 129 consecutive months of year-over-year increases, the longest-running streak on record.Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and has now slowed to 3.5%. The YoY increase in November was the lowest since June 2020. Note that the median price usually starts falling seasonally in July, so the 2.1% decline in November in the median price was partially seasonal, however the 10.4% decline over the last five months has been much larger than the usual seasonal decline.

It is likely the median price will be down year-over-year in a few months - and Case-Shiller will follow.

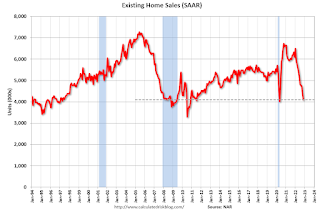

NAR: Existing-Home Sales Decreased to 4.09 million SAAR in November

by Calculated Risk on 12/21/2022 10:14:00 AM

From the NAR: Existing-Home Sales Dipped 7.7% in November

Existing-home sales declined for the tenth month in a row in November, according to the National Association of REALTORS®. All four major U.S. regions recorded month-over-month and year-over-year declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 7.7% from October to a seasonally adjusted annual rate of 4.09 million in November. Year-over-year, sales dwindled by 35.4% (down from 6.33 million in November 2021).

...

Total housing inventory registered at the end of November was 1.14 million units, which was down 6.6% from October, but up 2.7% from one year ago (1.11 million). Unsold inventory sits at a 3.3-month supply at the current sales pace, which was identical to October, but up from 2.1 months in November 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (4.09 million SAAR) were down 7.7% from the previous month and were 35.4% below the November 2021 sales rate.

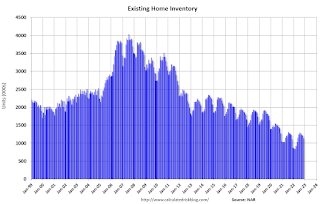

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.14 million in November from 1.22 million in October.

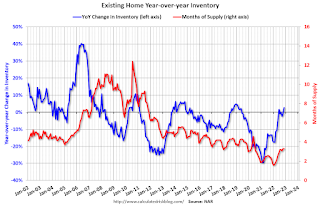

According to the NAR, inventory decreased to 1.14 million in November from 1.22 million in October.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 2.7% year-over-year (blue) in November compared to November 2021.

Inventory was up 2.7% year-over-year (blue) in November compared to November 2021. Months of supply (red) was unchanged at 3.3 months in November from 3.3 months in October.

This was below the consensus forecast. I'll have more later.

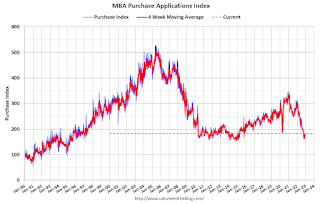

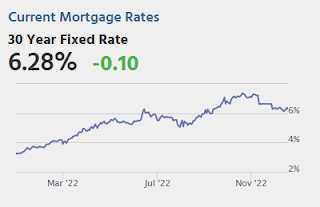

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/21/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

— Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 16, 2022.

... The Refinance Index increased 6 percent from the previous week and was 85 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 36 percent lower than the same week one year ago.

“The Federal Reserve raised its short-term rate target last week, but longer-term rates, including mortgage rates, declined for the week, with the 30-year conforming rate reaching 6.34 percent – its lowest level since September,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Refinance application volume increased slightly in response but was still about 85 percent below year-ago levels. This is a particularly slow time of year for homebuying, so it is not surprising that purchase applications did not move much in response to lower mortgage rates.”

Added Fratantoni: “The latest data on the housing market show that homebuilders are pulling back the pace of new construction in response to low levels of traffic, and we expect this weakness in demand will persist in 2023, as the U.S. is likely to enter a recession. However, if mortgage rates continue to trend down, as we are forecasting, more buyers are likely to return to the market later in the year, as affordability improves with both lower rates and slower home-price growth.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 6.34 percent from 6.42 percent, with points decreasing to 0.59 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 20, 2022

Wednesday: Existing Home Sales

by Calculated Risk on 12/20/2022 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.43 million