by Calculated Risk on 12/13/2022 02:38:00 PM

Tuesday, December 13, 2022

CoreLogic: 1.1 million Homeowners with Negative Equity in Q3 2022

Note: This was released last Friday. From CoreLogic: CoreLogic: US Home Equity Gains Rose Annually in Q3 but Fell Sharply From Q2

CoreLogic® ... today released the Homeowner Equity Report (HER) for the third quarter of 2022. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 15.8% year over year, representing a collective gain of $2.2 trillion, for an average of $34,300 per borrower, since the third quarter of 2021.

Nationwide, annual home equity gains began to slow in the third quarter of 2022, with the average borrower netting $34,300, compared with the nearly $60,000 year-over-year gain recorded in the second quarter. Slowing prices also caused an additional 43,000 properties to fall underwater. The quarter-over-quarter decline in equity is partially due to cooling home price growth across the country, as annual appreciation fell from about 18% in June to just slightly more than 10% in October. As home price gains are projected to relax into single digits for the rest of 2022, then possibly move into negative territory by the spring of 2023, equity increases will likely decline accordingly in some parts of the country.

“At 43.6%, the average U.S. loan-to-value (LTV) ratio is only slightly higher than in the past two quarters and still significantly lower than the 71.3% LTV seen moving into the Great Recession in the first quarter of 2010,” said Selma Hepp, interim lead of the Office of the Chief Economist at CoreLogic. “Therefore, today’s homeowners are in a much better position to weather the current housing slowdown and a potential recession than they were 12 years ago.”

“Weakening housing demand and the resulting decline in home prices since the spring’s peak reduced annual home equity gains and pushed an additional number of properties underwater in the third quarter,” said Hepp. “Nevertheless, while these negative impacts are concentrated in Western states such as California, homeowners with a mortgage there still average more than $580,000 in home equity.”

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the third quarter of 2022, the quarterly and annual changes in negative equity were:

• Quarterly change: From the second quarter of 2022 to the third quarter of 2022, the total number of mortgaged homes in negative equity increased by 4% to 1.1 million homes or 1.9% of all mortgaged properties.

• Annual change: In the third quarter of 2021, 1.2 million homes, or 2.2% of all mortgaged properties, were in negative equity. This number declined by 9.8% in the third quarter of 2022, to 1.1 million homes or 1.9% of all mortgage properties.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q3 2022 to Q2 2022 equity distribution by LTV. There are still a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.2 million to 1.1 million.

Housing, Inflation and Why the Fed Should Consider a Pause

by Calculated Risk on 12/13/2022 09:38:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing, Inflation and Why the Fed Should Consider a Pause

A brief excerpt:

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate tomorrow and increase the "terminal rate" to 5-5.25%.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

However, it appears the Fed is missing the recent sharp slowdown in household formation. The surge in household formation during the pandemic was unrelated to monetary policy (it was mostly due to work-from-home and the pickup in divorces). And the recent slowdown in household formation is also unrelated to monetary policy.

This “dramatic shift” in household formation is leading to Rents Falling Faster than "Seasonality Alone". Since rents are falling - and will likely continue to fall - it probably makes sense to look at inflation ex-shelter for monetary policy over the next several months.

This graph shows the year-over-year change in Core CPI ex-Shelter (blue), and the one month change annualized (red). The year-over-year change was at 5.2% in November, down from 5.9% in October. And the annualized one-month change was negative in both October and November! Core CPI ex-shelter fell at 1.5% annual rate in November.

BLS: CPI increased 0.1% in November; Core CPI increased 0.2%

by Calculated Risk on 12/13/2022 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.Both CPI and core CPI were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter was by far the largest contributor to the monthly all items increase, more than offsetting decreases in energy indexes. The food index increased 0.5 percent over the month with the food at home index also rising 0.5 percent. The energy index decreased 1.6 percent over the month as the gasoline index, the natural gas index, and the electricity index all declined.

The index for all items less food and energy rose 0.2 percent in November, after rising 0.3 percent in October. The indexes for shelter, communication, recreation, motor vehicle insurance, education, and apparel were among those that increased over the month. Indexes which declined in November include the used cars and trucks, medical care, and airline fares indexes.

The all items index increased 7.1 percent for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021. The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index increased 13.1 percent for the 12 months ending November, and the food index increased 10.6 percent over the last year; all of these increases were smaller than for the period ending October.

emphasis added

Monday, December 12, 2022

Tuesday: CPI

by Calculated Risk on 12/12/2022 08:08:00 PM

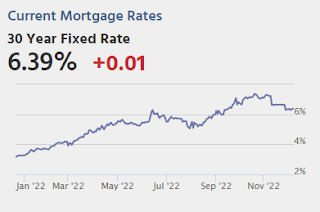

It's been more than a month since the last CPI report sent mortgage rates lower at the fastest single-day pace on record. Since then, apart from one interesting reaction to Powell's speech two weeks ago, the main order of business has been to wait for the next CPI report and the Fed announcement that would follow a day later. As the new week begins, we're a mere 24 hours away. That makes today a placeholder of the highest order. Volatility is possible, especially after the 1pm 10yr Treasury auction, but it pales in comparison to what tomorrow may bring. [30 year fixed 6.39%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.

Second Home Market: South Lake Tahoe in November

by Calculated Risk on 12/12/2022 02:18:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes, rising mortgage rates or the easing of the pandemic.

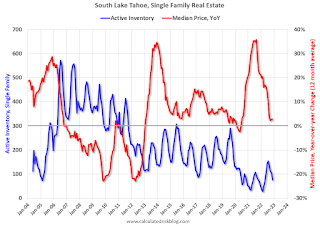

This graph is for South Lake Tahoe since 2004 through November 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is a 12-month average, and is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but still up almost 3-fold from the record low set in February 2022, and up 12% year-over-year. Prices are up 2.9% YoY (and the YoY change has been mostly trending down).

2nd Look at Local Housing Markets in November; Another step down in sales in November

by Calculated Risk on 12/12/2022 11:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in November

A brief excerpt:

This is the second look at local markets in November. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in November were mostly for contracts signed in September and October. Mortgage rates moved higher in September, and 30-year mortgage rates were over 7% for most of October (no points), and that likely impacted closed sales in November and December.

...

Here is a summary of active listings for these housing markets in November.

Inventory in these markets were down 35% YoY in January and are now up 87% YoY! So, this is a significant change from earlier this year, and a larger YoY inventory increase than in October (up 75% YoY).

...

Many more local markets to come!

Housing December 12th Weekly Update: Inventory Decreased 2.5% Week-over-week

by Calculated Risk on 12/12/2022 09:19:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 34.1%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/12/2022 08:56:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 11th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 5.3% below the same week in 2019 (94.7% of 2019). (Dashed line)

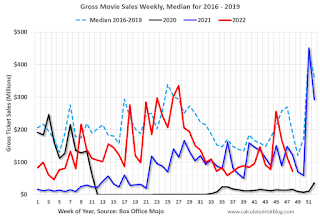

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $72 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 3rd. The occupancy rate was down 7.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 2nd, gasoline supplied was down 7.5% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 11, 2022

Sunday Night Futures

by Calculated Risk on 12/11/2022 06:13:00 PM

Weekend:

• Schedule for Week of December 11, 2022

• FOMC Preview: 50bp Hike, Increase "Terminal Rate"

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $71.02 per barrel and Brent at $76.10 per barrel. A year ago, WTI was at $71, and Brent was at $74 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.21 per gallon. A year ago, prices were at $3.33 per gallon, so gasoline prices are down $0.12 per gallon year-over-year.

FOMC Preview: 50bp Hike, Increase "Terminal Rate"

by Calculated Risk on 12/11/2022 10:21:00 AM

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week and increase the "terminal rate" to 5-5.25%.

"A relatively soft November inflation report is unlikely to affect the Fed’s decision. It has clearly telegraphed a 50bp hike in December, which would take the federal funds rate to 4.25-4.5%. The big question is where the Fed goes next. We expect another 50bp rate hike in February and then a 25bp hike in March for a terminal rate of 5.0-5.25%. We think the Fed will need to see material weakening in the labor market to stop hiking."From Goldman Sachs:

emphasis added

"Aside from a widely expected 50bp rate hike, the main event at the December FOMC meeting is likely to be an increase in the projected peak for the funds rate in 2023. We expect the median dot to rise 50bp to a new peak of 5-5.25% ... We continue to expect three 25bp hikes in 2023 to a peak of 5-5.25%, though the risks are tilted toward 50bp in February."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 0.1 to 0.3 | 0.5 to 1.5 | 1.4 to 2.0 | |

The unemployment rate was at 3.7% in November. So far, the economic slowdown has barely pushed up the unemployment rate, and the FOMC will likely revised down the 2022 projection but might revise 2023 up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 3.8 to 3.9 | 4.1 to 4.5 | 4.0 to 4.6 | |

As of October 2022, PCE inflation was up 6.0% from October 2021. This was below the cycle high of 7.0% YoY in June. There was a surge of inflation in Q4 2021, so with less inflation in Q4 this year, it is possible inflation will decline to the top of the projected year-over-year range in Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 5.3 to 5.7 | 2.6 to 3.5 | 2.1 to 2.6 | |

PCE core inflation was up 5.0% in October year-over-year. This was below the cycle high of 5.4% YoY in February. Core inflation has picked up more than expected and will likely be above the September Q4 projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Sept 2022 | 4.4 to 4.6 | 3.0 to 3.4 | 2.2 to 2.5 | |