by Calculated Risk on 12/08/2022 10:51:00 AM

Thursday, December 08, 2022

2023 Housing Forecasts

Today, in the Calculated Risk Real Estate Newsletter: 2023 Housing Forecasts

A brief excerpt:

Towards the end of each year, I collect some housing forecasts for the following year.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

For comparison, new home sales in 2022 will probably be around 640 thousand, down from 771 thousand in 2021.

Total housing starts will be around 1.55 million in 2022, down slightly from 1.60 million in 2021.

Existing home sales will be around 5.1 million in 2022, down from 6.1 million in 2021.

As of September, Case-Shiller house prices were up 10.6% year-over-year, but the year-over-year change is slowing rapidly.

...

There is an especially wide range in the forecasts for house prices and shows the difficulties in modeling this housing cycle. My view is house prices will decline in 2023 and will fall 10% or more from peak-to-trough (see House Prices: 7 Years in Purgatory).

AAR: November Rail Carloads Down Slightly Year-over-year, Intermodal Down

by Calculated Risk on 12/08/2022 09:51:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

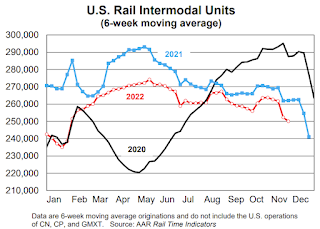

Total U.S. rail carloads in November were down 0.9% from last year, but the weekly average for the month (232,547) was slightly higher than the weekly average so far in 2022 (231,961). In November, eight of the 20 carload categories we track had gains. ... U.S. intermodal originations, which are not included in carloads, fell 5.4% in November — their ninth straight decline and 15th in the past 16 months. Year-to-date intermodal was down 4.8%.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

Total originated carloads in November on U.S. railroads averaged 232,547 per week, down 0.9% from November 2021 but slightly higher than the average week so far in 2022.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):U.S. intermodal originations, which are not included in carloads, fell 5.4% in November 2022 from November 2021 — their ninth straight year-over-year decline and 15th in the past 16 months. In 2022 through November, intermodal volume was down 4.8% (637,473 containers and trailers) from last year but was up 1.7% (211,419 units) over 2020. Much of what railroads haul in intermodal service fills the shelves of big-box and other retailers, and retailers’ demand for items to fill their shelves depends in part on inventory levels.

Weekly Initial Unemployment Claims increase to 230,000

by Calculated Risk on 12/08/2022 08:36:00 AM

The DOL reported:

In the week ending December 3, the advance figure for seasonally adjusted initial claims was 230,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 225,000 to 226,000. The 4-week moving average was 230,000, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 228,750 to 229,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 230,000.

The previous week was revised up.

Weekly claims were at the consensus forecast.

Wednesday, December 07, 2022

Thursday: Unemployment Claims

by Calculated Risk on 12/07/2022 09:37:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 225 thousand last week.

Recession Watch

by Calculated Risk on 12/07/2022 02:41:00 PM

The recession callers were back in the first half of 2022, and some like ARK's Cathie Wood and Home Depot's Ken Langone claimed the US was already in a recession. I disagreed and noted I wasn't even on recession watch!

The next recession will probably be caused by one of the following (from least likely to most likely):Unfortunately, in 2020, one of those low probability events happened (pandemic), and that led to a recession in 2020.

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

emphasis added

2) Significant policy error. Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession.Refusing to "pay the bills" (not raising the debt ceiling), would be a policy error - but that seems unlikely (you never know).

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession.And this most common cause of a recession is the current concern. Since inflation picked up, mostly due to the pandemic (stimulus spending, supply constraints, WFH impacts on household formation) and due to the invasion of Ukraine, the Fed has embarked on a tightening cycle to slow inflation.

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single-family starts turned down last year, but that was partly due to the huge surge in sales during the pandemic - and then rebounded somewhat. Now both new home sales and single-family starts have turned down in response to higher mortgage rates. Residential investment has also peaked.

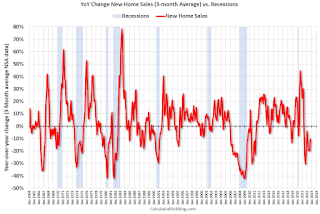

The second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 13% year-over-year.

The second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 13% year-over-year.Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception was in late 2021 - we saw a significant YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. I ignored that pandemic distortion.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). This has happened, but this usually leads the economy by a year or more. So, we might be looking at a recession in 2023.

1st Look at Local Housing Markets in November

by Calculated Risk on 12/07/2022 11:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter:

1st Look at Local Housing Markets in November

A brief excerpt:

This is the first look at local markets in November. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in November were mostly for contracts signed in September and October. Mortgage rates moved higher in September, and 30-year mortgage rates were over 7% for most of October (no points), and that likely impacted closed sales in November and December.

...

In November, sales were down 45.7%. In October, these same markets were down 39.1% YoY Not Seasonally Adjusted (NSA).

Note that in November 2022, there were the same number of selling days as in November 2021, so the SA decline will be similar to the NSA decline. And this suggests another step down in sales!

Many more local markets to come!

Wholesale Used Car Prices Declined Slightly in November; Prices Down 14.2% Year-over-year

by Calculated Risk on 12/07/2022 09:15:00 AM

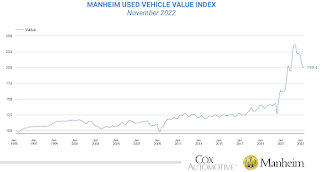

From Manheim Consulting today: Wholesale Used-Vehicle Prices See Minimal Decline in November

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 0.3% in November from October. The Manheim Used Vehicle Value Index (MUVVI) declined to 199.4, down 14.2% from a year ago. This is the first time the MUVVI has dropped below 200.0 since August 2021. The non-adjusted price change in November was a decline of 1.6% compared to October, moving the unadjusted average price down 12.4% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/07/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

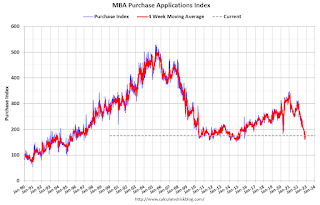

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 2, 2022. Last week’s results include an adjustment for the observance of the Thanksgiving holiday.

... The Refinance Index increased 5 percent from the previous week and was 86 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 31 percent compared with the previous week and was 40 percent lower than the same week one year ago.

“Mortgage applications decreased 2 percent compared to the Thanksgiving holiday-adjusted results from the previous week, even as mortgage rates continued to trend lower. Rates decreased for most loan products, with the 30-year fixed declining 8 basis points to 6.41 percent after reaching 7.16 percent in October,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The 30-year fixed rate was 73 basis points lower than a month ago – but was still more than three percentage points higher than in December 2021. Additionally, the pace of refinancing remained around 80 percent lower than a year ago.”

Added Kan, “Purchase activity slowed last week, with a drop in conventional purchase applications partially offset by an increase in FHA and USDA loan applications. The average loan size for purchase applications decreased to $387,300 – its lowest level since January 2021. The decrease was consistent with slightly stronger government applications and a rapidly cooling home-price environment.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 6.41 percent from 6.49 percent, with points decreasing to 0.63 from 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

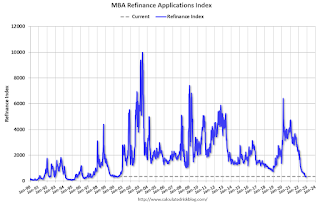

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 06, 2022

FDIC: Problem Banks Increased to 42 in Q3 2022

by Calculated Risk on 12/06/2022 06:23:00 PM

The FDIC released the Quarterly Banking Profile for Q3 2022 last week:

Net Income Increased Quarter Over Quarter and Year Over Year: Quarterly net income totaled $71.7 billion in third quarter 2022, an increase of $7.3 billion (11.3 percent) from the second quarter.

...

Asset Quality Metrics Were Favorable Overall Despite Growth in Early Delinquencies: Loans that were 90 days or more past due or in nonaccrual status (i.e., noncurrent loans) continued to decline and the noncurrent rate was down 3 basis points to 0.72 percent from second quarter 2022. The noncurrent rate for total loans is at the lowest level since second quarter 2006. Total net charge-offs increased 6 basis points from a year ago to 0.26 percent, driven by higher credit card and auto loan net charge offs. Early delinquencies (i.e., loans past due 30-89 days) increased 3 basis points from last quarter and 7 basis points from the year-ago quarter to 0.51 percent. Both the quarterly and annual increases were driven by an increase in past due credit cards, C&I, and auto loans.

emphasis added

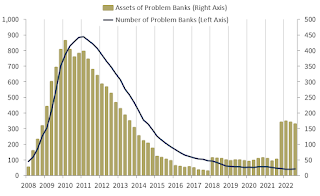

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks increased to 42.

The number of banks on the FDIC’s “Problem Bank List” increased by two from second quarter to 42. Total assets of problem banks declined $5.7 billion to $163.8 billion.7 No banks failed in the third quarter.This graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger bank was added to the list last year, although the identity of the bank is unclear.

Update: Framing Lumber Prices Close to Pre-Pandemic Levels

by Calculated Risk on 12/06/2022 12:26:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through December 6th.

Prices are close to the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.It is unlikely we will see a runup in prices as happened at the end of last year due to the housing slowdown.

Canfor Corporation (TSX:CFP) is announcing a temporary reduction in Canadian production due to very weak market conditions. The production will be reduced through curtailments at all solid wood facilities in B.C. and Alberta. This will remove approximately 150 million board feet in December and January. The curtailments will start to be implemented on December 19, 2022 and will range from one to four weeks across its Canadian operations. The Company will continue to adjust operating rates to align with market conditions and anticipates that the majority of its BC facilities will operate below full capacity in the New Year.