by Calculated Risk on 11/21/2022 12:43:00 PM

Monday, November 21, 2022

Final Look at Local Housing Markets in October

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in October

A brief excerpt:

The big story for October existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down further YoY in October as many potential sellers are locked into their current home (low mortgage rate). And active inventory increased sharply YoY.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the final look at local markets in October. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I update these tables throughout each month as additional data is released.

Important: Closed sales in October were mostly for contracts signed in August and September. Rates increased to around 6% in September and that impacted closed sales in October. In October 30-year mortgage rates jumped to over 7%, and that will negatively impact closed sales in November and December.

...

And a table of October sales. In October, sales were down 28.6% YoY Not Seasonally Adjusted (NSA) for these markets. ... The NAR reported sales were down 29.5% NSA YoY in October.

Sales in some of the hottest markets are down around 40% YoY (all of California was down 37%), whereas in other markets, sales are only down in around 20% YoY.

...

More local data coming in December for activity in November! We should expect an even larger YoY sales decline in November and December due to the increase in mortgage rates in September and October.

Housing November 21st Weekly Update: Inventory Decreased Slightly Week-over-week

by Calculated Risk on 11/21/2022 08:57:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 35.2%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 11/21/2022 08:32:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of November 20th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 2.6% below the same week in 2019 (97.4% of 2019). (Dashed line)

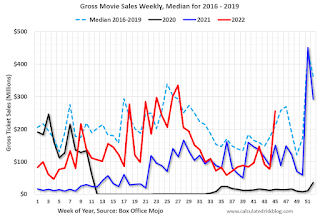

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $255 million last week - almost entirely due to Black Panther: Wakanda Forever - up about 21% from the median for the week.

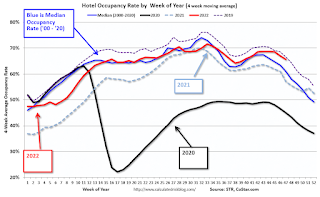

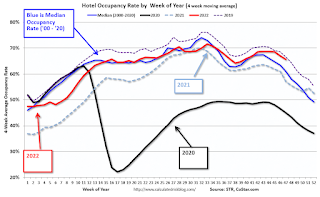

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Nov 12th. The occupancy rate was up 0.9% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

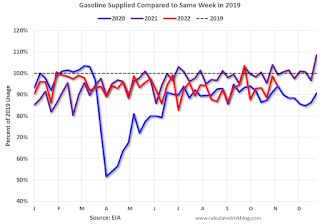

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of November 11th, gasoline supplied was down 6.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, November 20, 2022

Sunday Night Futures

by Calculated Risk on 11/20/2022 07:02:00 PM

Weekend:

• Schedule for Week of November 20, 2022

Monday:

• AT 8:30 AM ET, Chicago Fed National Activity Index for October. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 40 (fair value).

Oil prices were down over the last week with WTI futures at $80.08 per barrel and Brent at $87.62 per barrel. A year ago, WTI was at $77, and Brent was at $81 - so WTI oil prices are up 4% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.67 per gallon. A year ago, prices were at $3.41 per gallon, so gasoline prices are up $0.26 per gallon year-over-year.

Hotels: Occupancy Rate Up 0.9% Compared to Same Week in 2019

by Calculated Risk on 11/20/2022 08:15:00 AM

U.S. hotel performance came in higher than the previous week and showed improved comparisons to 2019, according to STR‘s latest data through Nov. 12.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Nov. 6-12, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 64.6% (+0.9%)

• Average daily rate (ADR): US$148.43 (+17.1%)

• Revenue per available room (RevPAR): US$95.89 (+18.2%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Saturday, November 19, 2022

Real Estate Newsletter Articles this Week: Record Number of Housing Units Under Construction

by Calculated Risk on 11/19/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• October Housing Starts: Record Number of Housing Units Under Construction

• NAR: Existing-Home Sales Decreased to 4.43 million SAAR in October

• 3rd Look at Local Housing Markets in October; California Sales off 37% YoY, Prices Fall; Early Read on October Sales

• Lawler: Are US Rents Falling?

• 2nd Look at Local Housing Markets in October

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of November 20, 2022

by Calculated Risk on 11/19/2022 08:11:00 AM

The key report this week is October New Home sales.

For manufacturing, the Richmond Fed manufacturing survey will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 222 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.4% increase in durable goods orders.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 570 thousand SAAR, down from 603 thousand in September.

2:00 PM: FOMC Minutes, Meeting of November 1-2, 2022

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

Friday, November 18, 2022

COVID Nov 18, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 11/18/2022 08:27:00 PM

NOTE: COVID stats are updated on Fridays.

On COVID (focus on hospitalizations and deaths). Data has switched to weekly.

Weekly deaths bottomed in July 2021 at 1,666.

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 280,711 | 289,884 | ≤35,0001 | |

| Hospitalized2 | 21,275 | 21,722 | ≤3,0001 | |

| Deaths per Week2 | 2,222 | 2,347 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Early Q4 GDP Tracking

by Calculated Risk on 11/18/2022 02:47:00 PM

From BofA:

Existing home sales actually fell less than we expected, implying slightly stronger brokers’ commissions in 4Q. As a result, our tracking estimate for residential investment in 4Q edged up. That said, after rounding, our 4Q GDP tracking estimate was unchanged at 1.3% q/q saar. [Nov 18th estimate]From Goldman:

emphasis added

We lowered our Q4 GDP tracking estimate by 0.1pp to +0.9% (qoq ar). [Nov 18th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.2 percent on November 17, down from 4.4 percent on November 16. [Nov 17th estimate]

More Analysis on October Existing Home Sales

by Calculated Risk on 11/18/2022 11:41:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.43 million SAAR in October

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).The median existing-home price for all housing types in October was $379,100, a gain of 6.6% from October 2021 ($355,700), as prices rose in all regions. This marks 128 consecutive months of year-over-year increases, the longest-running streak on record.Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and has now slowed to 6.6%. The YoY increase in October was the lowest since June 2020. Note that the median price usually starts falling seasonally in July, so the 1.1% decline in October in the median price was partially seasonal, however the 8.4% decline over the last four months has been much larger than the usual seasonal decline.

It is likely the median price will be down year-over-year in a few months.