by Calculated Risk on 10/05/2021 04:03:00 PM

Tuesday, October 05, 2021

Update: Framing Lumber Prices Up Year-over-year

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through October 5th.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.There were supply constraints over the last year, for example, sawmills cut production and inventory at the beginning of the pandemic, and the West Coast fires in 2020 damaged privately-owned timberland (and maybe again in 2021).

October 5th COVID-19: 7-Day Average Cases Falls Below 100K, Lowest since August 3rd

by Calculated Risk on 10/05/2021 03:13:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.0% | 55.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 186.1 | 185.3 | ≥2321 | |

| New Cases per Day3 | 97,909 | 111,851 | ≤5,0002 | |

| Hospitalized3 | 66,131 | 76,734 | ≤3,0002 | |

| Deaths per Day3 | 1,444 | 1,492 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 22 states have between 50% and 59.9% fully vaccinated: Colorado at 59.8%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, Ohio and North Carolina at 50.2%.

Next up (total population, fully vaccinated according to CDC) are Montana at 48.8%, Indiana at 48.7%, Missouri at 48.3% and Oklahoma at 48.1%.

Click on graph for larger image.

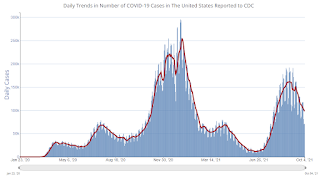

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

On Private Lenders Raising the "Conforming Loan Limit"

by Calculated Risk on 10/05/2021 12:33:00 PM

Today, in the Newsletter: On Private Lenders Raising the "Conforming Loan Limit"

Excerpt:

Some private mortgage industry participants have already increased their “conforming loan limits” in anticipation of the FHFA raising the CLL. This is NOT an official increase.

...

Note that they are only raising the “limit” from $548,250 (low cost areas) to $625,000. That is a 14% increase, and the FHFA will probably increase the limit closer to 18% (like to around $645,000 or so).

ISM® Services Index Increased to 61.9% in September

by Calculated Risk on 10/05/2021 10:05:00 AM

(Posted with permission). The September ISM® Services index was at 61.9%, up from 61.7% last month. The employment index decreased to 53.0%, from 53.7%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: Services PMI® at 61.9%, September 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in September for the 16th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was above the consensus forecast, however the employment index decreased slightly to 53.0%, from 53.7% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® registered 61.9 percent, 0.2 percentage point higher than the reading of 61.7 percent in August. The September reading indicates the 16th straight month of growth for the services sector, which has expanded for all but two of the last 140 months.

“The Supplier Deliveries Index registered 68.8 percent, down 0.8 percentage point from August’s reading of 69.6 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 77.5 percent, up 2.1 percentage points from the August figure of 75.4 percent.”

Nieves continues, “According to the Services PMI®, 17 services industries reported growth. The composite index indicated growth for the 16th consecutive month after a two-month contraction in April and May 2020. The slight uptick in the rate of expansion in the month of September continued the current period of strong growth for the services sector. However, ongoing challenges with labor resources, logistics, and materials are affecting the continuity of supply.”

emphasis added

Trade Deficit Increased to $73.3 Billion in August

by Calculated Risk on 10/05/2021 08:40:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $73.3 billion in August, up $2.9 billion from $70.3 billion in July, revised.

August exports were $213.7 billion, $1.0 billion more than July exports. August imports were $287.0 billion, $4.0 billion more than July imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports increased in August.

Exports are up 23% compared to August 2020; imports are up 21% compared to August 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

CoreLogic: House Prices up 18.1% YoY in August, All-Time High YoY Increase

by Calculated Risk on 10/05/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Record-High Repeat: U.S. Annual Home Price Growth Reaches a New All-Time High in August, CoreLogic Reports

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2021.

Home prices rose to a fever pitch this summer, with annual price gains reaching another all-time high in August at 18.1%. Ongoing affordability challenges within the supply-constricted market have also been exacerbated by an influx in homebuying activity from investors. As the home purchase market continues to boom and buoy the post-pandemic economy, these market factors are unevenly affecting access for some buyers. This is reflected in a recent CoreLogic consumer survey, where 59% of consumers looking to purchase a home reported combined household earnings of at least six figures, compared to the 10% of consumers looking to purchase earning less than $50,000.

“Home prices continue to escalate at a torrid pace as a broad spectrum of buyers drive demand for a limited supply of homes,” said Frank Martell, president and CEO of CoreLogic. “We expect to see the trend of strong price gains continue indefinitely with large amounts of capital chasing too few assets.”

...

Nationally, home prices increased 18.1% in August 2021, compared to August 2020. This is the largest 12-month growth in the U.S. index since the series began (January 1976 – January 1977). On a month-over-month basis, home prices increased by 1.3% compared to July 2021.

...

“Single-family detached homes continue to be in high demand,” said Dr. Frank Nothaft, chief economist at CoreLogic. “These properties offer more living space and distance from neighboring homes than that of attached properties. On average, detached homes have 28% more inside space compared to single-family attached properties and about twice as much space as apartments in multifamily structures.”

emphasis added

Monday, October 04, 2021

Tuesday: Trade Deficit, ISM Services

by Calculated Risk on 10/04/2021 08:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fairly Flat Despite Mixed Signals From Bond Market

Mortgage rates are unchanged to a hair lower compared to last Friday, depending on the lender. While that's welcome news given some of the big jumps in rates seen in the past 2 weeks, the underlying bond market suggests we're still in the middle of a waiting game. [30 year fixed 3.09%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for August

• At 8:30 AM, Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.

• At 10:00 AM, the ISM Services Index for September.

October 4th COVID-19: 56% of Total Population Fully Vaccinated

by Calculated Risk on 10/04/2021 06:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.0% | 55.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 185.8 | 183.9 | ≥2321 | |

| New Cases per Day3 | 86,801 | 112,311 | ≤5,0002 | |

| Hospitalized3 | 64,217 | 77,983 | ≤3,0002 | |

| Deaths per Day3 | 1,327 | 1,502 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 22 states have between 50% and 59.9% fully vaccinated: Colorado at 59.7%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, Ohio and North Carolina at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Montana at 48.8%, Indiana at 48.7% and Missouri at 48.3% .

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.89%"

by Calculated Risk on 10/04/2021 04:00:00 PM

Note: This is as of September 26th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.89%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 2.96% of servicers’ portfolio volume in the prior week to 2.89% as of September 26, 2021. According to MBA’s estimate, 1.4 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 6 basis points to 1.38%. Ginnie Mae loans in forbearance decreased 7 basis points to 3.35%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 14 basis points to 6.77%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 5 basis points relative to the prior week to 3.19%, and the percentage of loans in forbearance for depository servicers decreased 13 basis points to 2.93%.

“The share of loans in forbearance declined at a faster rate last week, dropping by 7 basis points, as exits increased and new requests and re-entries declined,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While 1.4 million homeowners remained in forbearance as of September 26th , this number is expected to drop sharply over the next few weeks as many are reaching the 18-month expiration point of their forbearance terms. Most borrowers exiting forbearance through a workout are opting for a deferral plan, which allows them to resume their original payment, while moving the forborne amount to the end of the loan.”

Added Fratantoni, “Although call volume dropped in the last week of September, we expect that servicers will be very busy through October.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.05% to 0.04%."

Housing Inventory Oct 4th Update: Inventory Down 1% Week-over-week, Up 40% from Low in early April

by Calculated Risk on 10/04/2021 02:40:00 PM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.