by Calculated Risk on 10/04/2021 08:34:00 AM

Monday, October 04, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 3rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.1% from the same day in 2019 (76.9% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 2, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 7% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $50 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through September 25th. The occupancy rate was down 11.0% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 24th, gasoline supplied was up 2.7% compared to the same week in 2019.

There have been six weeks so far this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 2nd for the United States and several selected cities.

This data is through October 2nd for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 116% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, October 1st.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 03, 2021

Sunday Night Futures

by Calculated Risk on 10/03/2021 07:06:00 PM

Weekend:

• Schedule for Week of October 3, 2021

• Measuring Rents

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 15 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $76.00 per barrel and Brent at $79.42 per barrel. A year ago, WTI was at $37, and Brent was at $38 - so WTI oil prices are UP 100%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.19 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $1.01 per gallon year-over-year.

Measuring Rents

by Calculated Risk on 10/03/2021 05:30:00 PM

Today, in the Newsletter: Measuring Rents

Excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through Aug 2021, except ApartmentList is through Sept 2021.

The Zillow measure is up 7.4% YoY as of August, and the ApartmentList measure is up 15.1% as of September.

Saturday, October 02, 2021

Newsletter Articles this Week

by Calculated Risk on 10/02/2021 02:11:00 PM

At the Calculated Risk Newsletter this week:

• The Home ATM, aka Mortgage Equity Withdrawal (MEW)

• Mortgage Rates Increasing, Mortgage Rates and the Ten Year Yield

• House Prices Increase Sharply in July, Case-Shiller National Index up Record 19.7% Year-over-year in July

• Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in July, And a look at "Affordability"

• As Forbearance Ends

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Schedule for Week of October 3, 2021

by Calculated Risk on 10/02/2021 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM Services index and the August trade deficit.

No major economic releases scheduled.

8:00 AM ET: Corelogic House Price index for August

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $70.5 billion in August, from $70.1 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM Services Index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 430,000 jobs added, up from 374,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 345 thousand initial claims, down from 362 thousand last week.

8:30 AM: Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.

8:30 AM: Employment Report for September. The consensus is for 460 thousand jobs added, and for the unemployment rate to decrease to 5.1%.There were 235 thousand jobs added in August, and the unemployment rate was at 5.2%.

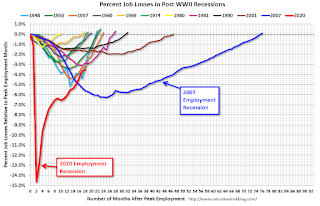

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

Friday, October 01, 2021

September Vehicles Sales Decreased to 12.2 Million SAAR

by Calculated Risk on 10/01/2021 06:30:00 PM

Wards Auto released their estimate of light vehicle sales for September this evening. Wards Auto estimates sales of 12.18 million SAAR in September 2021 (Seasonally Adjusted Annual Rate), down 6.7% from the August sales rate, and down 25.2% from September 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for September (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

October 1st COVID-19: Progress

by Calculated Risk on 10/01/2021 04:12:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.7% | 55.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 184.9 | 183.0 | ≥2321 | |

| New Cases per Day3 | 104,649 | 118,371 | ≤5,0002 | |

| Hospitalized3 | 71,944 | 81,647 | ≤3,0002 | |

| Deaths per Day3 | 1,489 | 1,523 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: Colorado at 59.4%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah and Ohio at 50.3%.

Next up (total population, fully vaccinated according to CDC) are North Carolina 49.9%, Montana at 48.5%, Indiana at 48.4% and Missouri at 48.0% .

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

As Forbearance Ends

by Calculated Risk on 10/01/2021 02:16:00 PM

Today, in the Newsletter: As Forbearance Ends

Excerpt:

An analysis from CoreLogic today suggests “Nearly three-in-four loans in forbearance are expected to reach the 18-month maximum limit at the end of September.”

...

In Forbearance Will Not Lead to a Huge Wave of Foreclosures, I presented some data from Black Knight and argued “that most homeowners in forbearance have sufficient equity in their homes, and there will not be a huge wave of foreclosures like following the housing bubble.” But there will be some increase in foreclosure activity. I’ll track the data over the next few months, but this isn’t a huge concern.

Q3 GDP Forecasts: More Downgrades

by Calculated Risk on 10/01/2021 12:42:00 PM

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

| 9/17/21 | 4.5% | 4.5% | 3.6% |

| 9/24/21 | 4.5% | 4.5% | 3.7% |

| 10/1/21 | 4.1% | 4.25% | 2.3% |

From BofA Merrill Lynch:

Following this week's data, 3Q GDP tracking dropped to 4.1% qoq saar from 4.5% previously. The August deterioration in the goods trade deficit was the main driver. [Oct 1 estimate]From Goldman Sachs:

emphasis added

Following this morning’s data, we left our Q3 GDP tracking estimate unchanged at +4¼% (qoq ar). [Oct 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 2.3 percent on October 1, down from 3.2 percent on September 27. After recent releases from the US Bureau of Economic Analysis, the US Census Bureau, and the Institute for Supply Management, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth decreased from 2.2 percent and 15.9 percent, respectively, to 1.4 percent and 12.9 percent, respectively, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth increased from -1.36 percentage points to -1.27 percentage points. [Oct 1 estimate]

Construction Spending unchanged in August

by Calculated Risk on 10/01/2021 10:21:00 AM

From the Census Bureau reported that overall construction spending was "virtually unchanged":

Construction spending during August 2021 was estimated at a seasonally adjusted annual rate of $1,584.1 billion, virtually unchanged from the revised July estimate of $1,584.0 billion. The August figure is 8.9 percent above the August 2020 estimate of $1,455.0 billion. During the first eight months of this year, construction spending amounted to $1,034.5 billion, 7.0 percent above the $966.7 billion for the same period in 2020.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,242.2 billion, 0.1 percent below the revised July estimate of $1,243.7 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $341.9 billion, 0.5 percent above the revised July estimate of $340.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 16% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 10% above the bubble era peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 9% above the peak in March 2009, but weak recently.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 24.3%. Non-residential spending is down 2.3% year-over-year. Public spending is unchanged year-over-year.

Construction was considered an essential service during the early months of the pandemic in most areas, and did not decline sharply like many other sectors. However, some sectors of non-residential have been under pressure. For example, lodging is down 30.7% YoY, multi-retail down 2.0% YoY (from very low levels), and office down 4.2% YoY.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |