by Calculated Risk on 7/29/2021 02:44:00 PM

Thursday, July 29, 2021

Las Vegas Visitor Authority for June: Convention Attendance N/A, Visitor Traffic Down 18% Compared to 2019

From the Las Vegas Visitor Authority: June 2021 Las Vegas Visitor Statistics

Marking the sixth consecutive month of MoM gains, June saw the destination host more than 2.9 million visitors, +3.2% MoM and down ‐17.6% vs. June 2019.

While convention and group data continue to be gathered, the return of several conventions including World of Concrete, Surfaces, Nightclub & Bar and the Int'l Esthetics, Cosmetics & Spa Conference helped support midweek business.

Hotel occupancy continued to improve, reaching 75.9% (up 5.0 pts MoM, down ‐15.8 pts vs. June 2019), as Weekend occupancy neared 90% (89.4%) and Midweek occupancy reached 70.9% (up 8.1 pts MoM, down ‐18.8 pts vs. June 2019.)

Click on graph for larger image.

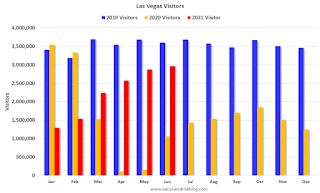

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 17.6% compared to the same month in 2019.

Note: Conventions started again in June, but the data isn't available yet.

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 7/29/2021 11:44:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 7.8% compared to the same week in 2019.

U.S. weekly hotel occupancy reached its highest level since October 2019, while room rates hit an all-time high, according to STR‘s latest data through July 24.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

July 18-24, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 71.4% (-7.8%)

• Average daily rate (ADR): $141.75 (+4.0%)

• Revenue per available room (RevPAR): $101.24 (-4.2%)

Historically, the middle weeks of July are the country’s highest occupancy weeks each year, and 2021 has been no different even as demand slows week to week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Pending Home Sales Decreased 1.9% in June

by Calculated Risk on 7/29/2021 10:04:00 AM

From the NAR: Pending Home Sales Fall 1.9% in June

Pending home sales declined marginally in June after recording a notable gain in May, the National Association of Realtors® reported. Contract activity was split in the four major U.S. regions from both a year-over-year and month-over-month perspective. The Northeast recorded the only yearly gains in June.This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 1.9% to 112.8 in June. Year-over-year, signings also slipped 1.9%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI increased 0.5% to 98.5 in June, an 8.7% rise from a year ago. In the Midwest, the index grew 0.6% to 108.3 last month, down 2.4% from June 2020.

Pending home sales transactions in the South fell 3.0% to an index of 132.4 in June, down 4.7% from June 2020. The index in the West decreased 3.8% in June to 98.1, down 2.6% from a year prior.

emphasis added

A Few Comments on Q2 GDP

by Calculated Risk on 7/29/2021 09:14:00 AM

Earlier from the BEA: Gross Domestic Product, Second Quarter 2021 (Advance Estimate) and Annual Update

Real gross domestic product (GDP) increased at an annual rate of 6.5 percent in the second quarter of 2021, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent (revised).On a Q2-over-Q2 basis, GDP was up 16.7% (Q2 2020 was the depth of pandemic recession).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (the previous peak was in Q4 2019).

This graph is through Q1 2022, and real GDP is now at a new peak; 0.8% above the previous peak.

The advance Q2 GDP report, at 6.5% annualized, was below expectations, due to several factors - a decline in private inventories, a decline in residential investment, a decline in government expenditures and a negative contribution from trade.

Personal consumption expenditures (PCE) increased at a 11.8% annualized rate in Q2, due, in part, to the American Rescue Plan Act.

The second graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased at a 9.8% annual rate in Q2. Equipment investment increased at a 13.0% annual rate, and investment in non-residential structures decreased at a 7.0% annual rate (after getting crushed over the previous year)..

Residential investment (RI) decreased at a 9.8% annual rate in Q2. Equipment investment increased at a 13.0% annual rate, and investment in non-residential structures decreased at a 7.0% annual rate (after getting crushed over the previous year)..On a 3 quarter trailing average basis, RI (red) is still up solidly, equipment (green) is up sharply, and nonresidential structures (blue) is still down.

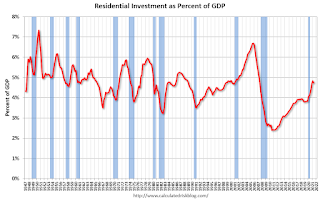

The third graph shows residential investment as a percent of GDP.

The third graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP decreased in Q2, after increasing sharply for several quarters.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The fourth graph shows non-residential investment in

structures, equipment and "intellectual property products".

The fourth graph shows non-residential investment in

structures, equipment and "intellectual property products".

Weekly Initial Unemployment Claims decrease to 400,000

by Calculated Risk on 7/29/2021 08:38:00 AM

The DOL reported:

In the week ending July 24, the advance figure for seasonally adjusted initial claims was 400,000, a decrease of 24,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 419,000 to 424,000. The 4-week moving average was 394,500, an increase of 8,000 from the previous week's revised average. The previous week's average was revised up by 1,250 from 385,250 to 386,500.This does not include the 95,166 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 109,868 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 394,500.

The previous week was revised up.

Regular state continued claims increased to 3,269,000 (SA) from 3,262,000 (SA) the previous week.

Note: There are an additional 5,246,162 receiving Pandemic Unemployment Assistance (PUA) that increased from 5,133,938 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 4,233,883 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 4,134,716.

Weekly claims were at the consensus forecast.

BEA: Real GDP increased at 6.5% Annualized Rate in Q2

by Calculated Risk on 7/29/2021 08:32:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2021 (Advance Estimate) and Annual Update

Real gross domestic product (GDP) increased at an annual rate of 6.5 percent in the second quarter of 2021, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent (revised). ...The advance Q2 GDP report, with 6.5% annualized growth, was well below expectations.

The increase in real GDP in the second quarter reflected increases in personal consumption expenditures (PCE), nonresidential fixed investment, exports, and state and local government spending that were partly offset by decreases in private inventory investment, residential fixed investment, and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

I'll have more later ...

Wednesday, July 28, 2021

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 7/28/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 8.6% annualized in Q2, up from 6.4% in Q1.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 400 thousand from 419 thousand last week.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 0.5% increase in the index.

July 28th COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 7/28/2021 03:32:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 343,361,524, as of a week ago 339,102,867. Average doses last week: 0.61 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 69.3% | 69.1% | 68.4% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 163.6 | 163.3 | 161.9 | ≥1601 |

| New Cases per Day3🚩 | 61,976 | 56,777 | 37,769 | ≤5,0002 |

| Hospitalized3🚩 | 29,383 | 27,973 | 20,395 | ≤3,0002 |

| Deaths per Day3🚩 | 300 | 277 | 206 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 68.0%, Utah at 67.7%, Wisconsin at 67.0%, Nebraska at 67.0%, South Dakota at 66.0%, Kansas at 65.8%, Iowa at 65.4%, Nevada at 65.0% and Arizona at 64.2%.

Click on graph for larger image.

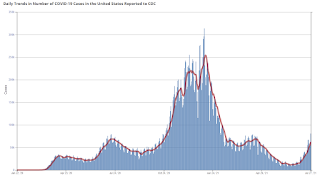

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

FOMC Statement: No Policy Change; Economy has "made progress"

by Calculated Risk on 7/28/2021 02:05:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have shown improvement but have not fully recovered. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

emphasis added

Zillow Case-Shiller House Price Forecast: "Expected to decelerate", 16.2% YoY in June

by Calculated Risk on 7/28/2021 01:02:00 PM

The Case-Shiller house price indexes for May were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: May 2021 Case-Shiller Results & Forecast: Growth Continues Climb

The forces that have propelled home price growth to new highs over the past year remain in place and are offering little evidence of abating.

...

The housing market’s historically tight inventory conditions finally started to ease in May, but that did little to immediately tame the record-strong home price appreciation that the market has experienced in recent months. The number available homes across the nation finally ticked up this spring, albeit from a historically low reference point, after spending most of the last year in a steady decline. Still, price pressures remain very firm and appear ready to stay that way in the months to come. Indeed, sharply-rising prices do appear to have priced out some home shoppers, particularly those looking to enter the market for the first time, and causing fatigue among would-be buyers. But overall demand for homes remains very firm, as bidding wars persist and the still-relatively few homes available for sales continue to fly off the shelves at a historically fast pace. Increased inventory levels should eventually help tame the record-high pace of price appreciation, but it’s going to take a while.

Monthly and annual growth in June as reported by Case-Shiller is expected to decelerate from May and April 2020 in all three main indices. S&P Dow Jones Indices is expected to release data for the June S&P CoreLogic Case-Shiller Indices on Tuesday, August 24.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 16.2% in June, from 16.6% in May.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 16.2% in June, from 16.6% in May. The Zillow forecast is for the 20-City index to be up 16.5% YoY in June from 17.0% in May, and for the 10-City index to be up 16.1% YoY compared to 16.4% YoY in May.