by Calculated Risk on 6/24/2021 04:20:00 PM

Thursday, June 24, 2021

New Home Prices

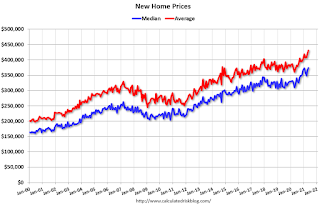

As part of the new home sales report released yesterday, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in May 2021 was $374,400. The average sales price was $430,600."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in May 2021 was $430,600, up 17% year-over-year. The median price was $374,400, up 18% year-over-year.

The second graph shows the percent of new homes sold by price.

Very few new homes sold were under $200K in May 2021 (about 1.4% of all homes). This is down from 56% in 2002. In general, the under $200K bracket is going away.

Very few new homes sold were under $200K in May 2021 (about 1.4% of all homes). This is down from 56% in 2002. In general, the under $200K bracket is going away. The $400K and greater than $500K+ brackets increased significantly over the last decade. A majority of new homes (about 61% in May) in the U.S., are in the $200K to $400K range.

June 24th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/24/2021 03:53:00 PM

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 320,687,205, as of a week ago 314,969,386. Average daily doses: 0.82 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.7% | 65.6% | 65.0% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 151.3 | 150.8 | 147.8 | ≥1601 |

| New Cases per Day3,4 | 11,342 | 11,288 | 11,866 | ≤5,0002 |

| Hospitalized3 | 12,329 | 12,402 | 13,826 | ≤3,0002 |

| Deaths per Day3,4 | 287 | 285 | 273 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri | ||||

KUDOS to the residents of the 16 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia and D.C. are all over 70%.

Next up are Minnesota at 69.4%, Delaware at 69.3%, Colorado at 69.1%, Oregon at 68.9%, Wisconsin at 64.9%, Nebraska at 64.7%, and South Dakota at 63.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

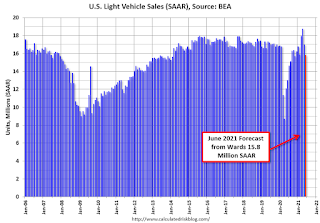

June Vehicle Sales Forecast: Supply Issues Pull Down Sales Again

by Calculated Risk on 6/24/2021 01:06:00 PM

From WardsAuto: Withering Supply Dragging Down U.S. Light-Vehicle Sales Second Straight Month in June (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for June (Red).

The Wards forecast of 15.8 million SAAR, would be down 7% from last month, and up 21% from a year ago (sales collapsed at beginning of pandemic).

Hotels: Occupancy Rate Down 10% Compared to Same Week in 2019

by Calculated Risk on 6/24/2021 10:59:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 9.9% compared to the same week in 2019. Leisure (weekend) occupancy has recovered, but weekday (more business) is still down double digits.

U.S. weekly hotel occupancy hit its highest level in 85 weeks, according to STR‘s latest data through June 19.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

June 13-19, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 68.0% (-9.9%)

• Average daily rate (ADR): US$128.90 (-4.4%)

• Revenue per available room (RevPAR): US$87.62 (-13.8%)

In addition to occupancy reaching its highest point since the week ending November 9, 2019, ADR and RevPAR were pandemic-era highs.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Weekly Initial Unemployment Claims decrease to 411,000

by Calculated Risk on 6/24/2021 08:42:00 AM

The DOL reported:

In the week ending June 19, the advance figure for seasonally adjusted initial claims was 411,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised up by 6,000 from 412,000 to 418,000. The 4-week moving average was 397,750, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 1,250 from 395,000 to 396,250.This does not include the 104,682 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 97,762 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 397,750.

The previous week was revised up.

Regular state continued claims decreased to 3,390,000 (SA) from 3,534,000 (SA) the previous week.

Note: There are an additional 5,950,167 receiving Pandemic Unemployment Assistance (PUA) that decreased from 6,125,524 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,273,180 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 5,165,249.

Weekly claims were higher than the consensus forecast.

Q1 GDP Growth Unchanged at 6.4% Annual Rate

by Calculated Risk on 6/24/2021 08:30:00 AM

From the BEA: Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), 1st Quarter 2021

Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 4.3 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up slightly to 11.4%. Residential investment was revised up from 12.7% to 13.1%. This was at the consensus forecast.

The “third” estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was also 6.4 percent. Upward revisions to nonresidential fixed investment, private inventory investment, and exports were offset by an upward revision to imports, which are a subtraction in the calculation of GDP

emphasis added

Wednesday, June 23, 2021

Thursday: GDP, Unemployment Claims, Durable Goods, Bank Stress Tests

by Calculated Risk on 6/23/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 390 thousand from 412 thousand last week.

• Also at 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 3.0% increase in durable goods orders.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2020 (Third estimate). The consensus is that real GDP increased 6.4% annualized in Q1, unchanged from the second estimate of a 6.4% increase.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June. This is the last of regional manufacturing surveys for June.

• At 4:30 PM, Federal Reserve releases Results from 2021 Bank Stress Tests

June 23rd COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/23/2021 04:05:00 PM

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 319,872,053, as of yesterday 319,223,844. Daily change: 0.65 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.6% | 65.5% | 64.7% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 150.8 | 150.4 | 146.5 | ≥1601 |

| New Cases per Day3,4 | 11,282 | 11,251 | 12,146 | ≤5,0002 |

| Hospitalized3 | 12,402 | 12,633 | 14,015 | ≤3,0002 |

| Deaths per Day3,4 | 287 | 293 | 276 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri | ||||

KUDOS to the residents of the 16 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia and D.C. are all over 70%.

Next up are Minnesota at 69.3%, Delaware at 69.2%, Colorado at 68.9%, Oregon at 68.9%, Wisconsin at 64.8%, Nebraska at 63.8%, and South Dakota at 63.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

AIA: "Architecture billings continue historic rebound" in May

by Calculated Risk on 6/23/2021 01:53:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings continue historic rebound

Demand for design services from U.S. architecture firms continues to grow at a vigorous pace, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April (any score above 50 indicates an increase in billings). May’s ABI score is one of the highest in the index’s 25-year history. During May, the new design contracts score reached its second consecutive record high with a score of 63.2, while new project inquiries also recorded a near-record high score at 69.2.

“Despite ballooning costs for construction materials and delivery delays, design activity is roaring back as more and more places reopen,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, concern over rising inflation and ongoing supply chain disruptions, as well as emerging labor shortages, could dampen the emerging construction recovery.”

...

• Regional averages: Midwest (63.4); South (59.0); West (57.4); Northeast (54.2)

• Sector index breakdown: commercial/industrial (60.6); multi-family residential (59.5); mixed practice (57.9); institutional (57.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 58.5 in May, up from 57.9 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index had been below 50 for eleven consecutive months, but has been solidly positive for the last foure months.

Black Knight: National Mortgage Delinquency Rate Increased in May

by Calculated Risk on 6/23/2021 01:25:00 PM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight’s First Look at May 2021 Mortgage Data

• The national delinquency rate rose to 4.73% from 4.66% in April, driven largely by the three-day Memorial Day weekend foreshortening available payment windowsAccording to Black Knight's First Look report, the percent of loans delinquent increased 1.5% in May compared to April, and decreased 39% year-over-year.

• Similar occurrences are rare; the last time was in May 2004, at which time mortgage delinquencies jumped by more than 15% in a single month; this month saw a 1.5% increase

• Early-stage delinquencies (those 30 or 60 days past due) rose by 110,200 in May, while serious delinquencies (90 or more days but not yet in foreclosure) improved for the ninth consecutive month

• Despite this improvement, nearly 1.7 million first-lien mortgages remain seriously delinquent, 1.26 million more than there were prior to the pandemic

• Foreclosure inventory hit yet another new record low as both moratoriums and borrower forbearance plan participation continue to limit activity, keeping foreclosure starts near record lows as well

• Mortgage prepayments fell to their lowest level in more than a year, driven by falling refinance activity as well as purchase-related headwinds

emphasis added

The percent of loans in the foreclosure process decreased 2.5% in May and were down 26% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.73% in May, up from 4.66% in April.

The percent of loans in the foreclosure process decreased in May to 0.28%, from 0.29% in April.

The number of delinquent properties, but not in foreclosure, is down 1,612,000 properties year-over-year, and the number of properties in the foreclosure process is down 52,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2021 | Apr 2021 | May 2020 | May 2019 | |

| Delinquent | 4.73% | 4.66% | 7.76% | 3.36% |

| In Foreclosure | 0.28% | 0.29% | 0.38% | 0.49% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,511,000 | 2,500,000 | 4,123,000 | 1,760,000 |

| Number of properties in foreclosure pre-sale inventory: | 148,000 | 153,000 | 200,000 | 255,000 |

| Total Properties | 2,659,000 | 2,653,000 | 4,323,000 | 2,015,000 |