by Calculated Risk on 6/19/2021 06:06:00 PM

Saturday, June 19, 2021

June 19th COVID-19 New Cases, Vaccinations, Hospitalizations

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 317,117,797, as of yesterday 316,048,776. Daily change: 1.07 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.3% | 65.1% | 64.3% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 149.1 | 148.5 | 143.1 | ≥1601 |

| New Cases per Day3,4 | 11,432 | 11,976 | 14,274 | ≤5,0002 |

| Hospitalized3 | 13,344 | 13,538 | 15,304 | ≤3,0002 |

| Deaths per Day3,4 | 284 | 284 | 350 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri | ||||

KUDOS to the residents of the 15 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, Washington, New York, Illinois and D.C. are all over 70%.

Next up are Virginia at 69.9%, Minnesota at 69.1%, Delaware at 68.9%, Oregon at 68.6%, Colorado at 68.6%, Wisconsin at 64.5%, Nebraska at 63.4%, and South Dakota at 63.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Schedule for Week of June 20, 2021

by Calculated Risk on 6/19/2021 08:11:00 AM

The key reports this week are the third estimate of Q1 GDP, May New and Existing Home Sales, and Personal Income and Outlays for May.

For manufacturing, the June Richmond and Kansas City Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

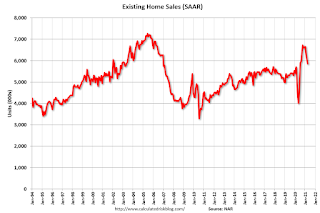

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.72 million SAAR, down from 5.85 million.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.72 million SAAR, down from 5.85 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.78 million SAAR for May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

2:00 PM: Testimony, Fed Chair Jerome Powell, The Federal Reserve's Response to the Coronavirus Pandemic, Before the Select Subcommittee on Coronavirus Crisis, U.S. House of Representatives

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

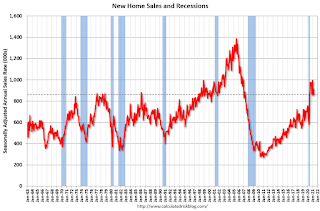

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 880 thousand SAAR, up from 863 thousand in April.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 390 thousand from 412 thousand last week.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 3.0% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 1st quarter 2020 (Third estimate). The consensus is that real GDP increased 6.4% annualized in Q1, unchanged from the second estimate of a 6.4% increase.

11:00 AM: the Kansas City Fed manufacturing survey for June. This is the last of regional manufacturing surveys for June.

4:30 PM: Federal Reserve releases 2021 bank stress tests results

8:30 AM ET: Personal Income and Outlays, May 2021. The consensus is for a 2.5 decrease in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.6% (3.4% YoY).

10:00 AM: University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 86.8.

Friday, June 18, 2021

The Housing Conundrum

by Calculated Risk on 6/18/2021 02:50:00 PM

I've seen several housing booms and busts in my life. The biggest boom was the housing bubble in the mid-'00s, and the worst bust followed the bubble. Booms and bust have always been frequent in real estate.

My Spidey senses are tingling again, however it isn't obvious why this time - or what the outcome will be.

In general, demographics are very favorable for home buying. In Housing and Demographics: The Next Big Shift, I presented these graphs:

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group last decade (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase further over this decade.

The current demographics are now very favorable for home buying - and will remain positive for most of the decade.

And on the supply side for demographics:

This graph is from 2010 to 2060 (all data from BLS: current to 2060 is projected).

The next big housing shift will be when the Baby Boom generation starts to downsize and move to retirement communities. No cohort is monolithic - some people will age-in-place until they pass away, others will move in with family (or family will move in with their parents), and some will move to retirement communities.

There is no magic age that people reach and start to transition, but looking at prior generations, it seems to start when people are around 80 years old.

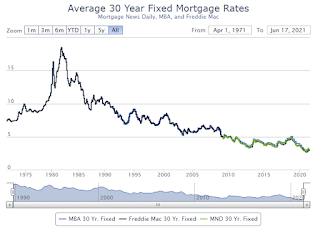

Provisional data from the CDC suggest that from April 1 of last year to April 1 of this year the so-called “natural” increase in the US population was barely positive. Provisional data show US births over the 12 month period ending March 2021 at 3.565 million, and US deaths over that period at 3.521 million.Another positive for the housing market is the near record low mortgage rates.

This graph from MortgageNewsDaily shows the 30 year mortgage rate since 1971.

This graph from MortgageNewsDaily shows the 30 year mortgage rate since 1971.Currently 30 year rates are around 3.25%, up from around 2.75% last year, but still near record lows.

With solid demographics, low mortgage rates, and record low inventory, it is no surprise that house prices are increasing rapidly.

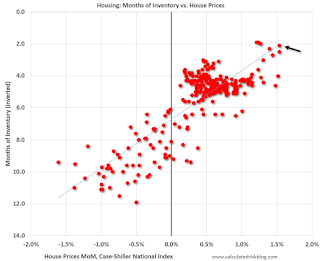

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through March 2021).

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through March 2021).In the April existing home sales report released last month, the NAR reported months-of-supply increased to 2.4 month in April. There is a seasonal pattern to inventory, but this is still very low - and prices are increasing sharply.

Here is a similar graph using the Case-Shiller National and Composite 20 House Price Indexes.

Here is a similar graph using the Case-Shiller National and Composite 20 House Price Indexes.This graph shows the price to rent ratio (January 2000 = 1.0). This suggested prices were way too high during the housing bubble, and also suggests prices might be high now - but not as high as the housing bubble.

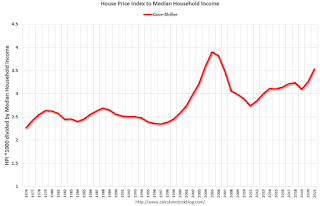

Here is another measure - house prices to the Median Household income.

This graph uses the year end Case-Shiller house price index - and the nominal median household income through 2020 (from the Census Bureau). 2021 median income is estimated at a 5% gain.

This graph uses the year end Case-Shiller house price index - and the nominal median household income through 2020 (from the Census Bureau). 2021 median income is estimated at a 5% gain.This graph shows the ratio of house price indexes divided by the Median Household Income through 2021 (the HPI is first multiplied by 1000).

This uses the year end National Case-Shiller index since 1976 (2021 estimated).

In 2012, housing economist Tom Lawler dug through some data and calculated that real prices increased 0.83% per year (See: Lawler: On the upward trend in Real House Prices)

This graph shows there have been four surges in real prices since the early '70s. One in the late '70s, one in the late '80s, the housing bubble, and the current surge in prices.

This graph shows there have been four surges in real prices since the early '70s. One in the late '70s, one in the late '80s, the housing bubble, and the current surge in prices.It is important to note that nationally nominal house prices did not decline following the surges in the '70s and '80s. However, there were regional declines.

Since homeowners are concerned about nominal prices (not real prices), I wasn't concerned in December 2018, when Professor Shiller wrote in the NY Times: The Housing Boom Is Already Gigantic. How Long Can It Last?

During the housing bubble, the difference between a slight upward slope in real prices (0.2% per year according to Shiller's index) and a slightly larger increase in real prices using other indexes (probably between 1% and 1.5% per year) didn't make any difference; there was obviously a huge bubble in house prices. But when comparing price "booms" over time, there is a huge difference.

If we use 1.5% per year for real price increases, the current "boom" in prices would be the fourth largest since the 1970s (and only about half the size of the late '70s and late '80s price boom), and if we use a 1.0% real increase, the current "boom" is on the same order as the late '70s and '80s price booms.

No big deal, and definitely not a "gigantic" boom in house prices.

Now, I'd argue house prices are too high based on historical fundamentals. I wouldn't call this a "bubble" because of the lack of both speculation and loose lending (see: Is there a New Housing Bubble?). But I am concerned about house prices.

And there doesn't appear to be any end in sight to the sharp increases in house prices. Goldman Sachs economists' model is projecting double digit price gain in 2021 and 2022:

Strong demand for housing looks sustainable. Even before the pandemic, demographic tailwinds and historically-low mortgage rates had pushed demand to high levels. ... consumer surveys indicate that household buying intentions are now the highest in 20 years. ... mortgage lending standards have remained fairly tight. With demographic trends still strong, mortgage rates very low, housing affordability still high, and household wealth as a share of income at the highest level in US history, demand should remain strong.The recent price increases make sense from a supply and demand perspective, but prices do seem too high. And I suppose the frenzy is bothering me.

The supply picture offers no quick fixes to the shortage of available homes ... The resulting picture is one of a persistent supply-demand imbalance in the years ahead. ... [Our] model suggests that rising prices will only gradually reduce affordability enough to dampen demand and mitigate the supply-demand imbalance. As a result, the model projects double-digit price gains both this year and next.

June 18th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/18/2021 02:44:00 PM

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 316,048,776, as of yesterday 314,969,386. Daily change: 1.08 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.1% | 65.0% | 64.1% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 148.5 | 147.8 | 142.1 | ≥1601 |

| New Cases per Day3 | 11,432 | 11,976 | 14,274 | ≤5,0002 |

| Hospitalized3 | 13,538 | 13,826 | 15,717 | ≤3,0002 |

| Deaths per Day3 | 284 | 284 | 350 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | ||||

KUDOS to the residents of the 15 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, Washington, New York, Illinois and D.C. are all over 70%.

Next up are Virginia at 69.8%, Minnesota at 69.0%, Delaware at 68.8%, Oregon at 68.5%, Colorado at 68.4%, Wisconsin at 64.4%, Nebraska at 63.4%, and South Dakota at 63.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Q2 GDP Forecasts: Around 10%

by Calculated Risk on 6/18/2021 11:33:00 AM

From Merrill Lynch:

Retail sales boosted our 2Q GDP tracking estimate up to 11% qoq saar from 9.5% previously. [June 18 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +9.0% (qoq ar). [June 16 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.7% for 2021:Q2 and 4.4% for 2021:Q3. [June 18 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 10.3 percent on June 16, down from 10.5 percent on June 15. [June 16 estimate]

Indiana Real Estate in May: Sales Up 25% YoY, Inventory Down 48% YoY

by Calculated Risk on 6/18/2021 10:09:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April and May 2020 due to the pandemic, so the YoY sales comparison is easy.

For for the entire state Indiana:

Closed sales in May 2021 were 8,470, up 24.8% from 6,789 in May 2020.

Active Listings in May 2021 were 6,559, down 48.2% from 12,656 in May 2020.

Months of Supply was 0.8 Months in May 2021, compared to 1.7 Months in May 2020.

Inventory in May was up 4.9% from last month.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased Slightly

by Calculated Risk on 6/18/2021 08:20:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of June 15th.

From Andy Walden at Black Knight: Share of Borrowers in Forbearance Continues to Decline

Forbearance volumes held relatively steady this week, falling by a modest 7K amid an expected mid-month lull in activity, but are down by 117k (5.4%) from the same time last month.

Improvements among GSE (-6K) and FHA/VA (-4K) forbearance plans were partially offset by a 3K increase in the number of active plans among portfolio-held and privately securitized mortgages.

Both plan starts and exits fell this week, with removals down 50% from last week (due to typical mid-month behavior and month-end review cycles). Exits are expected to ramp up toward the end of this month, but more acutely in early July. Meanwhile, new plan starts saw one of their lowest weekly totals since the onset of the pandemic, continuing the trend of gradual declines in start activity.

Click on graph for larger image.

Some 400K plans are still scheduled for quarterly reviews for extension/removal over the next 2 weeks which could lead to additional plan exits as we near the 4th of July.

As of June 15, 2.06M (3.9% of) homeowners remain in COVID-19 related forbearance plans including 2.3% of GSE, 6.9% of FHA/VA and 4.5% of Portfolio/PLS loans.

emphasis added

Thursday, June 17, 2021

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/17/2021 04:54:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.78 million in May, down 1.2% from April’s preliminary pace but up 44.1% from last May’s seasonally adjusted pace.

Local realtor/MLS data suggest that the median existing single-family home sales price last month was up by about 22.4% from last May.

CR Note: The National Association of Realtors (NAR) is scheduled to release May existing home sales on Tuesday, June 22, 2021 at 10:00 AM ET. The consensus is for 5.74 million SAAR.

Existing Home Inventory: Local Markets

by Calculated Risk on 6/17/2021 04:39:00 PM

I'm gathering existing home data for many local markets, and I'm watching inventory very closely this year.

As I noted in Some thoughts on Housing Inventory

The key for housing in 2021 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in house prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.The table below shows some data for May.

Although inventory in these areas is down about 54% year-over-year, inventory is mostly unchanged month-to-month. Seasonally we'd usually expect an increase in inventory from April to May.

| Existing Home Inventory | |||||

|---|---|---|---|---|---|

| May-21 | Apr-21 | May-20 | YoY | MoM | |

| Alabama | 9,363 | 9,582 | 17,042 | -45.1% | -2.3% |

| Atlanta | 7,530 | 6,964 | 19,352 | -61.1% | 8.1% |

| Boston | 3,418 | 3,788 | 4,250 | -19.6% | -9.8% |

| Charlotte | 3104 | 3,018 | 8,177 | -62.0% | 2.8% |

| Colorado | 7,034 | 7,872 | 23,060 | -69.5% | -10.6% |

| Denver | 2,075 | 2,594 | 7,170 | -71.1% | -20.0% |

| Houston | 22,607 | 22,794 | 38,048 | -40.6% | -0.8% |

| Las Vegas | 2560 | 2,346 | 7,567 | -66.2% | 9.1% |

| Maryland | 7,490 | 7,167 | 17,254 | -56.6% | 4.5% |

| Minnesota | 8,953 | 9,020 | 18,074 | -50.5% | -0.7% |

| New Hampshire | 1,959 | 1,852 | 4,331 | -54.8% | 5.8% |

| North Texas | 8,126 | 8,084 | 21,610 | -62.4% | 0.5% |

| Northwest | 5,533 | 5,616 | 10,357 | -46.6% | -1.5% |

| Phoenix | 5218 | 4541 | 11,418 | -54.3% | 14.9% |

| Portland | 2,339 | 2,222 | 4,551 | -48.6% | 5.3% |

| Rhode Island | 1,143 | 1,520 | 3,036 | -62.4% | -24.8% |

| South Carolina | 11,278 | 11,237 | 24,878 | -54.7% | 0.4% |

| Total1 | 96,377 | 96,386 | 208,127 | -53.7% | 0.0% |

| 1excluding Denver (included in Colorado) | |||||

June 17th COVID-19 New Cases, Vaccinations, Hospitalizations; Illinois Reaches 70% Goal

by Calculated Risk on 6/17/2021 03:39:00 PM

Congratulations to the residents of Illinois on joining the 70% club! Go for 80%!!!

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 314,969,386, as of yesterday 312,915,170. Daily: 2.05 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.0% | 64.7% | 64.0% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 147.8 | 146.5 | 141.6 | ≥1601 |

| New Cases per Day3 | 11,717 | 12,223 | 14,420 | ≤5,0002 |

| Hospitalized3 | 13,826 | 14,015 | 16,142 | ≤3,0002 |

| Deaths per Day3 | 282 | 279 | 360 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths | ||||

KUDOS to the residents of the 15 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, New Hampshire, Maryland, Washington, New York, Illinois and D.C. are all over 70%.

Next up are Virginia at 69.5%, Minnesota at 68.9%, Delaware at 68.6%, Colorado at 68.3%, Oregon at 68.3% and Wisconsin at 64.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.