by Calculated Risk on 4/11/2021 07:27:00 PM

Sunday, April 11, 2021

Sunday Night Futures

Weekend:

• Schedule for Week of April 11, 2021

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 5 and DOW futures are down 20 (fair value).

Oil prices were down over the last week with WTI futures at $59.32 per barrel and Brent at $62.95 per barrel. A year ago, WTI was at $22, and Brent was at $20 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $1.84 per gallon, so gasoline prices are up $1.00 per gallon year-over-year.

April 11th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/11/2021 07:25:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 187.0 million doses have been administered. 28.1% of the population over 18 is fully vaccinated, and 45.9% of the population over 18 has had at least one dose (118.4 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

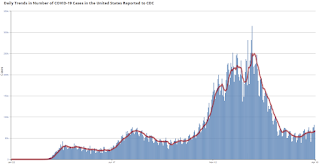

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Boston Real Estate in March: Sales Up 21% YoY, Inventory Down 3% YoY

by Calculated Risk on 4/11/2021 02:19:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For Boston (single family and condos):

Closed sales in March 2021 were 1,872, up 21.0% from 1,547 in March 2020.

Active Listings in March 2021 were 3,201, down 3.0% from 3,299 in March 2020.

NMHC: Rent Payment Tracker Shows Households Paying Rent Increased 1.9% YoY in Early April

by Calculated Risk on 4/11/2021 09:56:00 AM

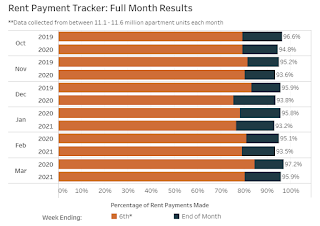

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 79.8 percent of apartment households made a full or partial rent payment by April 6 in its survey of 11.6 million units of professionally managed apartment units across the country. This marks one year of tracking rent payment data following the onset of the pandemic.

This is a 1.9 percentage point increase from the share who paid rent through April 6, 2020 and compares to 82.9 percent that had been paid by April 6, 2019. This data encompasses a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“This month’s data is more evidence of a recovering economy and the resilience of the multifamily industry,” said Doug Bibby, NMHC President. “While we are not out of the woods yet, there is light at the end of the tunnel. The recently passed American Rescue Plan included $26 billion in rental assistance as well as billions more of housing resources that will prove critical to keeping families safely and securely housed and the nation’s rental housing sector stable.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month compared to 2019 and to the first COVID year.

This is mostly for large, professionally managed properties.

The second graph shows full month payments through March compared to the same month the prior year.

This shows a decline in rent payments year-over-year.

This shows a decline in rent payments year-over-year.Saturday, April 10, 2021

April 10th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/10/2021 11:41:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 183.5 million doses have been administered. 27.3% of the population over 18 is fully vaccinated, and 45.1% of the population over 18 has had at least one dose (116.4 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Atlanta Real Estate in March: Sales Up 15% YoY, Inventory Down 58% YoY

by Calculated Risk on 4/10/2021 09:43:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the GAMLS for Atlanta:

Total Residential Units Sold in March 2021 were 9,021, up 14.6% from 7,874 in March 2020.

Active Residential Listings in March 2021 were 7,418, down 58.3% from 17,802 in March 2020.

Months of Supply was 0.89 Months in March 2021, compared to 2.27 Months in March 2020.

This graph from the Georgia MLS shows inventory in Atlanta over the last several years - and the sharp decline in inventory at the start of the pandemic.

Schedule for Week of April 11, 2021

by Calculated Risk on 4/10/2021 08:11:00 AM

The key reports this week are March housing starts, CPI and retail sales.

For manufacturing, the March Industrial Production report and the April NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for 0.5% increase in CPI, and a 0.2% increase in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

12:00 PM: Discussion, Fed Chair Jerome Powell, Economic Club of Washington Interview, At the Economic Club of Washington

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 720 thousand from 744 thousand last week.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 5.5% increase in retail sales. The consensus is probably low (given the stimulus checks).

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 5.5% increase in retail sales. The consensus is probably low (given the stimulus checks).This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 7.0% on a YoY basis in February.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 18.2, up from 17.4.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 43.0, down from 51.8.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 3.0% increase in Industrial Production, and for Capacity Utilization to increase to 75.8%.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 83, up from 82. Any number above 50 indicates that more builders view sales conditions as good than poor.

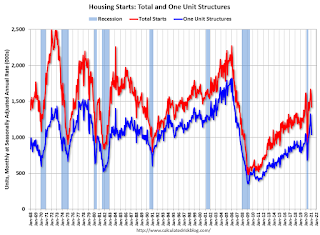

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and total housing starts since 1968.

The consensus is for 1.600 million SAAR, up from 1.421 million SAAR in February.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April).

10:00 AM: State Employment and Unemployment (Monthly) for March 2021

Friday, April 09, 2021

April 9th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/09/2021 05:08:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 178.8 million doses have been administered. 26.4% of the population over 18 is fully vaccinated, and 44.1% of the population over 18 has had at least one dose (113.7 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

North Texas Real Estate in March: Sales Up 7% YoY, Inventory Down 65% YoY

by Calculated Risk on 4/09/2021 02:10:00 PM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

From the NTREIS for North Texas (including Dallas/Ft. Worth):

Single Family Homes sold in March 2021 were 9,712, up 5.0% from 9,252 in March 2020.

Combined, sales were up 7.4% year-over-year.

Single Family Active Listings in March 2021 were 6,859, down 67.1% from 20,853 in March 2020.

Combined, active listings declined 64.5% year-over-year.

Q1 GDP Forecasts: Around 7%

by Calculated Risk on 4/09/2021 01:48:00 PM

Note that the forecasts of the automated systems (based on released data) are lower than the forecasts of economists. Economists are expecting March to be very strong.

From Merrrill Lynch:

We continue to track 7.0% for 1Q GDP growth. [Apr 9 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +7.5% (qoq ar). [Apr 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 6.0% for 2021:Q1 and 1.5% for 2021:Q2. [Apr 9 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 6.0 percent on April 9, down from 6.2 percent on April 7. [Apr 9 estimate]