by Calculated Risk on 12/28/2020 10:39:00 AM

Monday, December 28, 2020

Dallas Fed: "Texas Manufacturing Activity Expands at a Faster Pace" in December

From the Dallas Fed: Texas Manufacturing Activity Expands at a Faster Pace

Expansion in Texas factory activity picked up in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rebounded from 7.2 to 25.5, indicating an acceleration in output growth.This was the last of the regional Fed surveys for December.

Other measures of manufacturing activity also point to stronger growth this month. The new orders index pushed up 11 points to 17.8, and the growth rate of orders index rose from 9.7 to 16.5. The capacity utilization index moved up 11 points to 17.7, and the shipments index advanced from 13.7 to 21.9.

Perceptions of broader business conditions continued to improve in December. The general business activity index remained positive but edged down from 12.0 to 9.7. Meanwhile, the company outlook index pushed further into positive territory, rising from 11.0 to 16.8. Uncertainty regarding companies’ outlooks continued to rise; the index increased six points to 13.4.

Labor market measures indicated an increase in employment and work hours. The employment index increased from 11.7 to 19.6, suggesting a pickup in hiring.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The ISM manufacturing index for December will be released on Monday, January 4th. Based on these regional surveys, the ISM manufacturing index will likely decrease slightly in December from the November level.

Note that these are diffusion indexes, so readings above 0 (or 50 for the ISM) means activity is increasing (it does not mean that activity is back to pre-crisis levels).

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/28/2020 08:17:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of December 27th.

The seven day average is down 57.7% from last year (42.3% of last year). (Dashed line)

There has been a slow increase from the bottom, with ups and downs due to the Thanksgiving and Christmas holidays.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 26, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York. Note that California dining is off sharply with the orders to close.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through December 24h.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through December 24h.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, but were at $10 million (compared to usually around $400 million per week at this time of year).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through December 19th. Hotel occupancy is currently down 26.4% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

| 12/19 | -26.4% |

This suggests no improvement over the last three months.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of December 18th, gasoline supplied was off about 13.8% YoY (about 86.2% of last year).

Note: People driving instead of flying might have boosted gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 26th for the United States and several selected cities.

This data is through December 26th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 41% of the January level. It is at 28% in Chicago, and 49% in Houston - and mostly trending down over the last few months (this dips on holidays like Thanksgiving and Christmas).

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data for this year.

This graph is from Todd W Schneider. This is daily data for this year.This data is through Friday, December 25th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 27, 2020

Sunday Night Futures

by Calculated Risk on 12/27/2020 09:24:00 PM

Weekend:

• Schedule for Week of December 27, 2020

• Ten Economic Questions for 2021

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 8 and DOW futures are up 55 (fair value).

Oil prices were down over the last week with WTI futures at $47.73 per barrel and Brent at $50.72 barrel. A year ago, WTI was at $62, and Brent was at $69 - so WTI oil prices are down over 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.25 per gallon. A year ago prices were at $2.57 per gallon, so gasoline prices are down $0.32 per gallon year-over-year.

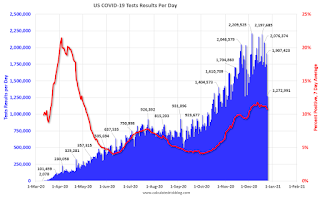

December 27 COVID-19 Test Results; Expected dip in the data over the holidays

by Calculated Risk on 12/27/2020 07:04:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,373,305 test results reported over the last 24 hours.

There were 152,461 positive tests.

Over 65,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

Question #10 for 2021: How much damage did the pandemic do to certain sectors?

by Calculated Risk on 12/27/2020 04:55:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

10) Economic Scarring: Some sectors were hit especially hard during the pandemic, like travel (hotels, airlines, cruise ships), and entertainment (restaurants, theaters, concerts). Also some areas of Commercial Real Estate (retail, hotels, offices) might suffer long term damage. How much damage did the pandemic do to certain sectors?

The pandemic will likely cause some medium to long term economic scarring. As an example, the lack of in person education for part of the year, might slow learning for many children. But that is beyond the scope of this question - I'm focused on the impact on the 2021 economy.

If we could flip a switch, and end the pandemic today, there would be certain sectors that would still have problems. And the end to the pandemic will probably be more like a dimmer switch, and slowly fade away in Q2 and Q3 (we hope).

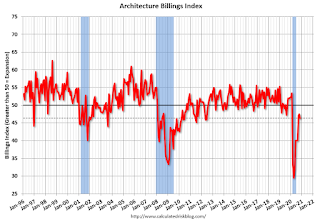

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.3 in November, down from 47.5 in October. Anything below 50 indicates contraction in demand for architects' services.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Saturday, December 26, 2020

December 26 COVID-19 Test Results; Be Careful with Holidays Numbers

by Calculated Risk on 12/26/2020 07:04:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,133,757 test results reported over the last 24 hours.

There were 189,268 positive tests.

Almost 64,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

Schedule for Week of December 27, 2020

by Calculated Risk on 12/26/2020 08:11:00 AM

Happy New Year! Wishing you all the best in 2021.

Note: If the government shuts down, some government data will be delayed (the DOL initial weekly unemployment claims was still released during the last shutdown). All Fed Reserve data will still be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 7.2% year-over-year increase in the National index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:45 AM: Chicago Purchasing Managers Index for December.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.2% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released.

All US markets will be closed in observance of the New Year's Day Holiday.

Friday, December 25, 2020

December 25 COVID-19 Test Results; Holiday Decline in Numbers

by Calculated Risk on 12/25/2020 07:16:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,272,991 test results reported over the last 24 hours.

There were 124,498 positive tests.

Over 62,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

Ten Economic Questions for 2021

by Calculated Risk on 12/25/2020 01:11:00 PM

Here is a review of the Ten Economic Questions for 2020

Below are my ten questions for 2021. These are just questions, I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2021, and if there are surprises - like in 2020 - to adjust my thinking.

1) Economic growth: Economic growth was probably around negative 3% in 2020 due to the pandemic (maybe 2.5% Q4 over Q4). The FOMC is expecting growth of 3.7% to 5.0% Q4-over-Q4 in 2021. How much will the economy grow in 2021?

2) Employment: Through November 2020, the economy lost 9.37 million jobs. By April 2020, the economy had lost 21.7 million jobs, and then added back 12.33 million jobs by November. But job growth slowed over the last few months. Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

3) Unemployment Rate: The unemployment rate was at 6.7% in November, up 3.2 percentage points year-over-year, but down from the peak of 14.7% in April. Currently the FOMC is forecasting the unemployment rate will be in the 4.7% to 5.4% range in Q4 2021. What will the unemployment rate be in December 2021?

4) Participation Rate: In November 2020, the overall participation rate was at 61.5%, down year-over-year from 63.2% in November 2019. Long term, the BLS has been projecting the overall participation rate will decline to 61.2% by 2028 due to demographics. Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

5) Inflation: Core PCE was only up 1.4% YoY through November. Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

6) Monetary Policy: The Fed cut rates to zero in 2020 in response to the pandemic, and has signaled they will be on hold for some time. Will the Fed raise rates in 2021? Will the Fed end - or taper - the asset purchase program?

7) Residential Investment: Residential investment (RI) was solid in 2020, and housing was a strong sector during the pandemic. Through November, starts were up 7.0% year-over-year compared to the same period in 2019. New home sales were up 19.1% year--to-date through November. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2021? How about housing starts and new home sales in 2021?

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 8% to 9% in 2020. What will happen with house prices in 2021?

9) Housing Inventory: Housing inventory decreased sharply in 2020 to record lows. Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

10) Economic Scarring: Some sectors were hit especially hard during the pandemic, like travel (hotels, airlines, cruise ships), and entertainment (restaurants, theaters, concerts). Also some areas of Commercial Real Estate (retail, hotels, offices) might suffer long term damage. How much damage did the pandemic do to certain sectors?

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

A Christmas Present for UberNerds

by Calculated Risk on 12/25/2020 08:11:00 AM

NOTE: If you are not familiar with Tanta, please read about her here. You will be happy you did - she was amazing.

A special present for UberNerds - an unpublished Tanta post written Dec 31, 2007: (I did post this for Christmas once before)

And from Tanta's 2007 Post: A Very Nerdy Christmas (see her post for an explanation of the origins of the Mortgage Pig™)Pig Rulz

There have been some misconceptions in the comments about Mortgage Pig™. I do not wish to enter a new year on the wrong track.

Mortgage Pig™ does not have a "name" except Mortgage Pig™. Assertions about Mortgage Pig™'s "name," "address," "job," "significant other," or favorite swill are not canonical. Anyone who asserts knowledge of such things in any communication, written or otherwise, is creating an Internet Urban Legend. Next thing you know they'll be telling you that you can Get Rich Qwik in RE investing.

Happy Holidays to all! CR