by Calculated Risk on 12/23/2020 10:14:00 AM

Wednesday, December 23, 2020

New Home Sales decrease to 841,000 Annual Rate in November

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 841 thousand.

The previous three months were revised down sharply.

Sales of new single-family houses in November 2020 were at a seasonally adjusted annual rate of 841,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.0 percent below the revised October rate of 945,000, but is 20.8 percent above the November 2019 estimate of 696,000.

emphasis added

Click on graph for larger image.

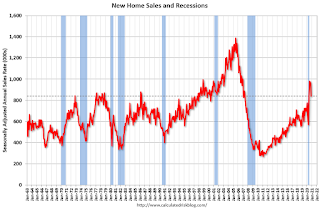

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The last five months saw the highest sales rates since 2006. This is strong year-over-year growth.

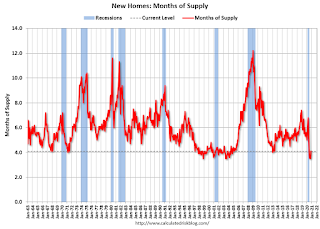

The second graph shows New Home Months of Supply.

The months of supply was increased in November to 4.1 months from 3.5 months in October.

The months of supply was increased in November to 4.1 months from 3.5 months in October. The all time record high was 12.1 months of supply in January 2009. The all time record low is 3.5 months, most recently in September 2020.

This is at the low end of the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of November was 286,000. This represents a supply of 4.1 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is low, and the combined total of completed and under construction is lower than normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2020 (red column), 55 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in November.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was well below expectations and sales in the three previous months were revised down sharply. I'll have more later today.

Personal Income decreased 1.1% in November, Spending decreased 0.4%

by Calculated Risk on 12/23/2020 08:51:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income decreased $221.8 billion (1.1 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $218.0 billion (1.2 percent) and personal consumption expenditures (PCE) decreased $63.3 billion (0.4 percent).The decrease in personal income was below expectations, and the decrease in PCE was also below expectations

Real DPI decreased 1.3 percent in November and Real PCE decreased 0.4 percent. The PCE price index had no change. Excluding food and energy, the PCE price index had no change .

The November PCE price index increased 1.1 percent year-over-year and the November PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

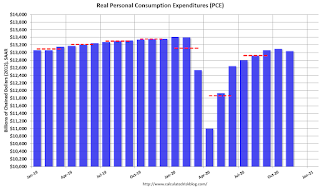

The following graph shows real Personal Consumption Expenditures (PCE) since January 2019 through November 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 6.8% annual rate in Q4 2020. (using the mid-month method, PCE was increasing at 4.0%). However, it appears the economy contracted in December - so PCE growth could be lower than 4%.

Weekly Initial Unemployment Claims decreased to 803,000

by Calculated Risk on 12/23/2020 08:37:00 AM

The DOL reported:

In the week ending December 19, the advance figure for seasonally adjusted initial claims was 803,000, a decrease of 89,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 885,000 to 892,000. The 4-week moving average was 818,250, an increase of 4,000 from the previous week's revised average. The previous week's average was revised up by 1,750 from 812,500 to 814,250.This does not include the 397,511 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 454,471 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 818,250.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,457,870 (SA) from 5,766,196 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,271,112 receiving Pandemic Unemployment Assistance (PUA) that increased from 9,244,556 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was lower than expected.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/23/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 18, 2020.

... The Refinance Index increased 4 percent from the previous week and was 124 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“Mortgage rates are closing the year at record lows. The 30-year fixed rate – at 2.86 percent – is a full percentage point below a year ago. Last week’s increase in refinance applications was driven by FHA and VA activity, while conventional refinances saw a slight decline. Overall refinance activity was 124 percent higher than in 2019, as borrowers continue to seek lower monthly payments or different loan terms,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications decreased for the second time in three weeks, as both conventional and government applications saw a drop-off. Despite the decline, purchase applications remained 26 percent higher than the same week a year ago, and the average loan balance reached another record high.”

Added Kan, “There are still signs of relative strength in the housing market as 2020 ends. However, housing affordability will be worth monitoring next year. The lower loan size segment of the market – particularly for entry-level and first-time buyers – continues to be impacted by rapidly increasing home prices and tight inventory.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 2.86 percent from 2.85 percent, with points remaining unchanged at 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 26% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 22, 2020

Wednesday: New Home Sales, Unemployment Claims, Personal Income & Outlays and more

by Calculated Risk on 12/22/2020 09:11:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 900,000 initial claims, up from 885,000 last week.

• Also at 8:30 AM, Durable Goods Orders for November. The consensus is for a 0.6% increase in durable goods.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.2% decrease in personal income, and for a 0.1% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for 990 thousand SAAR, down from 999 thousand in October.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for December). The consensus is for a reading of 81.0.

December 22 COVID-19 Test Results; Record Hospitalizations, Record 7-Day Deaths

by Calculated Risk on 12/22/2020 08:26:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,688,785 test results reported over the last 24 hours.

There were 188,614 positive tests.

Over 54,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

• Record 7 Day Average Deaths

Freddie Mac: Mortgage Serious Delinquency Rate decreased in November

by Calculated Risk on 12/22/2020 05:46:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in November was 2.75%, down from 2.89% in October. Freddie's rate is up from 0.62% in November 2019.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Note: Fannie Mae will report for November soon.

Also - for multifamily - delinquencies were at 0.16%, up from 0.14% in October, and up more than double from 0.06% in November 2019.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 3.4% YoY

by Calculated Risk on 12/22/2020 03:22:00 PM

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 89.8 percent of apartment households made a full or partial rent payment by December 20 in its survey of 11.5 million units of professionally managed apartment units across the country.

This is a 3.4 percentage point, or 392,952 household decrease from the share who paid rent through December 20, 2019 and compares to 90.3 percent that had paid by November 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th (dark color) and 20th (light color) of the month.

This is mostly for large, professionally managed properties.

Comments on November Existing Home Sales

by Calculated Risk on 12/22/2020 12:22:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 6.69 million in November

A few key points:

1) This was the highest sales rate for November since 2005. Some of the increase over the last several months was probably related to pent up demand from the shutdowns in March and April. Other reasons include record low mortgage rates, a move away from multi-family rentals, strong second home buying (to escape the high-density cities) and favorable demographics.

2) Inventory is very low, and was down 22% year-over-year (YoY) in November. This is the lowest level of inventory for November since at least the early 1990s. Months-of-supply is at a record low. Inventory will be important to watch in 2021, see: Some thoughts on Housing Inventory

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are up about 4% compared to the same period in 2019.

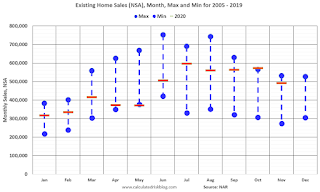

The second graph shows existing home sales Not Seasonally Adjusted (NSA) by month (Red dashes are 2020), and the minimum and maximum for 2005 through 2019.

The second graph shows existing home sales Not Seasonally Adjusted (NSA) by month (Red dashes are 2020), and the minimum and maximum for 2005 through 2019.Sales NSA in November (492,000) were 22% above sales last year in November (404,000). This was the highest sales for November (NSA) since 2005.

NAR: Existing-Home Sales Decreased to 6.69 million in November

by Calculated Risk on 12/22/2020 10:14:00 AM

From the NAR: Existing-Home Sales Decrease 2.5% in November

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 2.5% from October to a seasonally-adjusted annual rate of 6.69 million in November. However, sales in total rose year-over-year, up 25.8% from a year ago (5.32 million in November 2019).

...

Total housing inventory at the end of November totaled 1.28 million units, down 9.9% from October and down 22% from one year ago (1.64 million). Unsold inventory sits at an all-time low 2.3-month supply at the current sales pace, down from 2.5 months in October and down from the 3.7-month figure recorded in November 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (6.69 million SAAR) were down 2.5% from last month, and were 25.8% above the November 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.28 million in November from 1.42 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.28 million in November from 1.42 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 22% year-over-year in November compared to November 2019.

Inventory was down 22% year-over-year in November compared to November 2019. Months of supply decreased to 2.3 months in November (an all time low).

This was close to the consensus forecast. I'll have more later.