by Calculated Risk on 11/16/2020 09:07:00 AM

Monday, November 16, 2020

NY Fed: Manufacturing: Business activity "expanded slightly" in New York State in November

From the NY Fed: Empire State Manufacturing Survey

Manufacturing activity in New York State expanded only to a small degree in November. After falling seven points last month, the general business conditions index fell four points to 6.3 this month, indicating that growth continued to slow.This was well below expectations, and showed activity "expanded slightly" in November.

...

The index for number of employees rose two points to 9.4, its highest level in nearly a year, indicating a modest increase in employment levels. After rising sharply last month, the average workweek index fell eleven points to 4.8, its positive value signaling a small increase in hours worked.

emphasis added

Eight High Frequency Indicators for the Economy

by Calculated Risk on 11/16/2020 08:24:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of Nov 15th.

The seven day average is down 65% from last year (35% of last year).

There has been a slow increase from the bottom, but has been weak lately.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 14, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York - and only down slightly in the southern states.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through November 12th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through November 12th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, and were at $13 million last week (compared to usually around $200 million per week in the Fall).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through November 7th. Hotel occupancy is currently down 35.9% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

This suggests no improvement over the last 8 weeks, and occupancy might be getting worse.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of November 6th, gasoline supplied was off about 6.0% YoY (about 94.0% of last year).

Note: People driving instead of flying might have boosted gasoline consumption.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 14th for the United States and several selected cities.

This data is through November 14th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 51% of the January level. It is at 40% in Chicago, and 55% in Houston - and declining slightly recently.

Note: This graph is from Kastle, and the data isn't available online to do a 7-day average. Here is some interesting data from Kastle Systems on office occupancy.

This data is through November 8th.

This data is through November 8th.Currently Office Occupancy appears to be stalling with the 10-city average down to 25.1% from 27.1% the previous week.

"View the average occupancy rate of commercial properties across 10 major U.S. cities, by each municipality and in aggregate, to show the pace of Americans returning to work based on daily unique access entries in Kastle-secured buildings across the nation."

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data for this year.

This graph is from Todd W Schneider. This is daily data for this year.This data is through Friday, November 13th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, November 15, 2020

Sunday Night Futures

by Calculated Risk on 11/15/2020 09:59:00 PM

Weekend:

• Schedule for Week of November 15, 2020

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 13.8, up from 10.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 23 and DOW futures are up 179 (fair value).

Oil prices were up over the last week with WTI futures at $40.47 per barrel and Brent at $43.04 barrel. A year ago, WTI was at $57, and Brent was at $62 - so WTI oil prices are down over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.12 per gallon. A year ago prices were at $2.61 per gallon, so gasoline prices are down $0.49 per gallon year-over-year.

November 15 COVID-19 Test Results

by Calculated Risk on 11/15/2020 08:07:00 PM

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,169,428 test results reported over the last 24 hours.

There were 139,109 positive tests. Highest for a Sunday.

Over 15,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

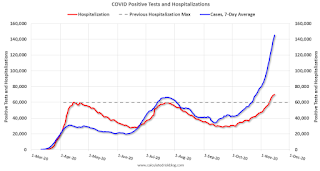

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• Record Hospitalizations.

Mortgage Rates and Ten Year Yield

by Calculated Risk on 11/15/2020 01:41:00 PM

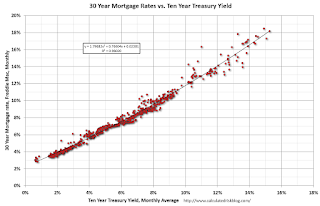

With the ten year yield at 0.89%, and based on an historical relationship, 30-year rates should currently be around 3.0%.

Mortgage News Daily reports that the most prevalent 30 year fixed rate is now at 2.94% for top tier scenarios. So mortgage rates are about as expected.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

The record low in the Freddie Mac survey was 2.78% in the week ending November 5, 2020 (Survey started in 1971).

Freddie Mac has a similar graph here with a linear fit (using data since 1990). Using their formula, 30 year rates would be around 2.77%.

Saturday, November 14, 2020

November 14 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/14/2020 06:04:00 PM

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,343,467 test results reported over the last 24 hours.

There were 163,473 positive tests.

Over 14,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

This is a new record 7-day average cases for the USA.

Schedule for Week of November 15, 2020

by Calculated Risk on 11/14/2020 08:11:00 AM

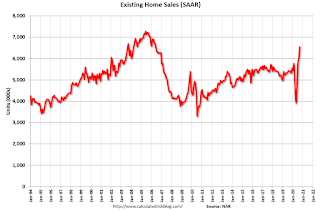

The key economic reports this week are October Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, October industrial production, and the November New York, Philly and Kansas City Fed surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 13.8, up from 10.5.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.The consensus is for a 0.5% increase in retail sales.

This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 1.0% increase in Industrial Production, and for Capacity Utilization to increase to 72.4%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 85, unchanged from 85. Any number above 50 indicates that more builders view sales conditions as good than poor.

11:00 AM: NY Fed: Q3 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.460 million SAAR, up from 1.415 million SAAR.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 700 thousand from 709 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 24.0, down from 32.3.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.54 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.54 million in September.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: State Employment and Unemployment (Monthly) for October 2019

Friday, November 13, 2020

November 13 COVID-19 Test Results; Record Cases, Record Hospitalizations

by Calculated Risk on 11/13/2020 07:08:00 PM

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,383,088 test results reported over the last 24 hours.

There were 170,333 positive tests. This is a new record.

Over 13,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.3% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

This is a new record 7-day average cases for the USA.

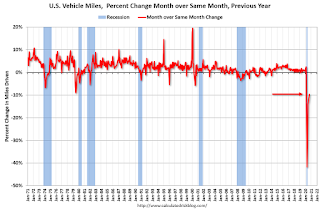

DOT: Vehicle Miles Driven decreased 9.7% year-over-year in September

by Calculated Risk on 11/13/2020 02:14:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -8.6% (-23.4 billion vehicle miles) for September 2020 as compared with September 2019. Travel for the month is estimated to be 248.3 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for September 2020 is 247.2 billion miles, a -9.7% (-26.7 billion vehicle miles) decline from September 2019. It also represents 2.8% increase (6.7 billion vehicle miles) compared with August 2020.

Cumulative Travel for 2020 changed by -14.5% (-355.5 billion vehicle miles). The cumulative estimate for the year is 2,093.1 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Miles driven declined during the great recession, and the rolling 12 months stayed below the previous peak for a record 85 months.

Miles driven declined sharply in March, and really collapsed in April.

This graph shows the YoY change in vehicle miles driven.

This graph shows the YoY change in vehicle miles driven.Miles driven rebounded in May through August, but is still down 9.7% YoY (seasonally adjusted).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 11/13/2020 01:32:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of November 10th.

From Black Knight: Another Week of Strong Forbearance Improvement

After declining by 5% last week, the number of loans in active forbearance saw another week of strong improvement.

According to the latest weekly snapshot of Black Knight’s McDash Flash daily forbearance tracking data, active forbearance plans fell by 121,000 (-4%) over the last week. Overall, that puts forbearance volumes down 9% (-416,000) since the start of November..

...

As of November 10, there are now 2.74 million homeowners in active forbearance plans, representing approximately 5.2% of all active mortgages, down from 5.4% from last week. Together, they represent $559 billion in unpaid principal.

Click on graph for larger image.

Forbearance starts pulled back, with the week’s 68,000 starts marking the lowest weekly total since the first week of October. New forbearance starts (excluding restarts) hit a COVID-era low of just 31,000. Another 98,000 homeowners had their forbearance plans extended this week.

...

Of the 2.74 million loans still in active forbearance, 81% have had their terms extended at some point since March.

With COVID-19 cases rising across the country, it will be important to keep an eye on unemployment numbers and forbearance starts over the coming weeks. Black Knight will continue to monitor the situation and report our findings on this blog.

emphasis added