by Calculated Risk on 11/06/2020 08:22:00 PM

Friday, November 06, 2020

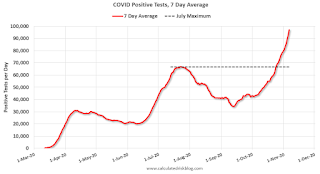

November 6 COVID-19 Test Results; Record Cases; Hospitalizations almost 55,000

Note: I look forward to when I will not be posting this daily!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,238,980 test results reported over the last 24 hours.

There were 125,552 positive tests. (New record)

Over 5,800 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.1% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average cases for the USA.

Seattle Real Estate in October: Sales up 40% YoY, Inventory UP 16% YoY

by Calculated Risk on 11/06/2020 06:19:00 PM

The Northwest Multiple Listing Service reported October Statistical Data

The Northwest MLS report recapping October activity showed a 40% drop in active listings compared to the same month a year ago, an increase of 16% in pending sales (mutually accepted offers), and a year-over-year (YOY) jump of nearly 30% in closed sales. The median price of single family homes and condominiums that sold last month was $500,000, up 19% from the same period a year ago, according to the MLS summary, which encompasses 23 counties, mostly in Western and Central Washington.The press release is for the Northwest MLS area. There were 10,806 sales in October 2020, up 29.7% from 8,335 sales in October 2019.

...

Matthew Gardner, chief economist at Windermere Real Estate, said his biggest concern continues to be the ongoing lack of homes for sale in the Central Puget Sound area. “Keep in mind that a four month supply of homes for sale is a sign of a balanced housing market, but in 14 counties, including the King/Pierce/Snohomish region, there is currently less than one month of supply. This is what is allowing home prices to escalate at double digit rates.”

emphasis added

In King County, sales were up 40% year-over-year, and active inventory was down 21% year-over-year.

In Seattle, sales were up 39.9% year-over-year, and inventory was up 16% year-over-year.. This puts the months-of-supply in Seattle at just 1.7 months.

AAR: October Rail Carloads down 6.6% YoY, Intermodal Up 10.0% YoY

by Calculated Risk on 11/06/2020 02:33:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Back in April 2020, when the U.S. economy was basically in a coma, U.S. intermodal originations averaged 219,085 units per week. That was the fewest for any month in more than seven years and the fewest for April in ten years. Back then, no one would have thought that six months later, in October 2020, U.S. railroads would have their best intermodal month in history. Yet that’s where we are: U.S. railroads originated an average of 292,469 containers and trailers per week in October 2020, more than ever before and up a stunning 33.5% over April 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Total U.S. carloads are trending higher, but at a much slower pace than in July and August. U.S. railroads originated an average of 228,193 total carloads per week in October 2020, the most since February 2020 but down 6.6% from October 2019. The 6.6% year-over-year decline is the smallest since the pandemic began.

For the first 10 months of 2020, total carloads were 9.48 million, down 14.5% (1.61 million carloads) from the first 10 months of 2019.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):In the 31 years from 1989 to 2019, October was the top U.S. rail intermodal month (in terms of average weekly originations) 25 times. This year will make 26. In October 2020, U.S. railroads originated an average of 292,469 containers and trailers per week, up 10.0% over October 2019 and the highest weekly average for any month in history. (The previous record was 289,994 in June 2018.) The weekly average in October 2020 was 33.5% higher than in April 2020, when they averaged just 219,085 units. That’s the biggest six-month gain in history. Few would have expected that six months ago.Note that rail traffic was weak prior to the pandemic, and intermodal has come back strong.

Las Vegas Real Estate in October: Sales up 11% YoY, Inventory down 34% YoY

by Calculated Risk on 11/06/2020 12:16:00 PM

This report is for closed sales in October; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in August and September.

The Las Vegas Realtors reported With rising prices and supply not meeting demand, local housing market looking like rest of U.S.; LVR housing statistics for October 2020

“COVID-19 appears to have extended the typical summer buying period by several months,” said 2020 LVR President Tom Blanchard, a longtime local REALTOR®. “The continued demand in our housing market is still not being met and is putting upward pressure on home values. Although we see increased permits by local homebuilders, they are still not meeting the demand that is out there.”1) Overall sales were up 10.9% year-over-year to 3,961 in October 2020 from 3,571 in October 2019.

...

LVR reported a total of 3,961 existing local homes, condos and townhomes were sold during October. Compared to the same time last year, October sales were up 11.2% for homes and up 9.5% for condos and townhomes.

...

By the end of October, LVR reported 4,501 single-family homes listed for sale without any sort of offer. That’s down 37.6% from one year ago. For condos and townhomes, the 1,428 properties listed without offers in October represent a 21.0% drop from one year ago.

…

Despite the coronavirus crisis, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.9% of all existing local property sales in October. That compares to 2.4% of all sales one year ago, 3.0% two years ago and 5.2% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 9,164 in October 2019 to 5,929 in October 2020. Note: Total inventory was down 34.3% year-over-year. And months of inventory is low.

3) Low level of distressed sales.

Comments on October Employment Report

by Calculated Risk on 11/06/2020 09:23:00 AM

The October employment report was at expectations, and employment for the previous two months were revised up slightly.

Leisure and hospitality added another 271 thousand jobs in October, following 4.56 million jobs added in May through September. Leisure and hospitality lost 8.3 million jobs in March and April, so about 58% of those jobs were added back in the May through October period.

Earlier: October Employment Report: 638 Thousand Jobs Added, 6.9% Unemployment Rate

In October, the year-over-year employment change was minus 9.18 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the October report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In October, the number of permanent job losers decreased to 3.684 million from 3.756 million in September.

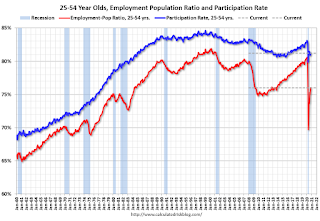

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in October 81.2% to from 80.9% in September, and the 25 to 54 employment population ratio increased to 76.0% from 75.0%.

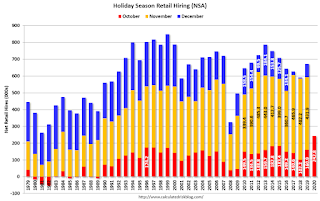

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring had increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring had increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.Retailers hired 243 thousand workers (NSA) net in October. Note: this is NSA (Not Seasonally Adjusted).

This might be distorted this year by a combination of seasonal hiring - and some bounce back in employment from the shutdowns earlier this year.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 383,000 to 6.7 million in October, after declines totaling 4.6 million over the prior 5 months. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in October to 6.684 million from 6.300 million in September.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.1% in October. This is down from the record high in April 22.8% for this measure since 1994.

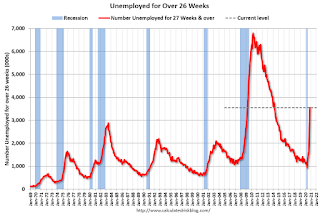

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.556 million workers who have been unemployed for more than 26 weeks and still want a job.

This increased sharply in October - since the largest number of layoffs were in April - and will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was at expectations, and the previous two months were revised up 15,000 combined. The headline unemployment rate decreased to 6.9%. However the number of part time workers increased, and the number of long term unemployed increased sharply.

October Employment Report: 638 Thousand Jobs Added, 6.9% Unemployment Rate

by Calculated Risk on 11/06/2020 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 638,000 in October, and the unemployment rate declined to 6.9 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it. In October, notable job gains occurred in leisure and hospitality, professional and business services, retail trade, and construction. Employment in government declined.

...

In October, the unemployment rate declined by 1.0 percentage point to 6.9 percent, and the number of unemployed persons fell by 1.5 million to 11.1 million. Both measures have declined for 6 consecutive months but are nearly twice their February levels (3.5 percent and 5.8 million, respectively).

...

The change in total nonfarm payroll employment for August was revised up by 4,000 from +1,489,000 to +1,493,000, and the change for September was revised up by 11,000 from +661,000 to +672,000. With these revisions, employment in August and September combined was 15,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In October, the year-over-year change was negative 9.18 million jobs.

Total payrolls increased by 638 thousand in October.

Payrolls for August and September were revised up 15 thousand combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and is still worse than the worst of the "Great Recession".

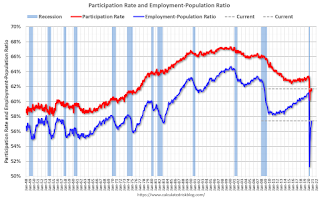

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.7% in October. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.7% in October. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 57.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in October to 6.9%.

This was close to consensus expectations, and August and September were revised up by 15,000 combined.

I'll have much more later …

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 11/06/2020 08:15:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of November 3rd.

From Black Knight: Forbearance Fall 5% After Slight Increase

After last week’s slight increase, the latest data from Black Knight’s McDash Flash Forbearance Tracker shows that nationwide forbearance volumes have fallen by 152,000 (-5%) since last Tuesday, driven by October forbearance expiration activity. This was roughly what was expected for the first week of the month, though we will be on the lookout for further potential drops, given the remaining scheduled expirations. With some 161,000 active forbearance plans having expired at the end of October, additional extension and/or removal activity could be seen in coming days.

...

As of Nov. 3, there are 2.9 million active forbearance plans, representing some 5.4% of mortgage-holders, down from 5.7% last week and the lowest we’ve seen since mid-April during the onset of the pandemic. Together, they represent $584 billion in unpaid principal.

Click on graph for larger image.

There were 87,000 starts over the past week, the largest volume since April, but 57% of these were repeat starts for borrowers who had previously been in forbearance, left their plans, and have since returned. These forbearance starts and restarts are worth watching, as we see them trending upward. It may well be that this is still due to the drop in early October, but given the rising trend, they warrant a close eye.

emphasis added

Thursday, November 05, 2020

Friday: Employment Report

by Calculated Risk on 11/05/2020 09:15:00 PM

My October Employment Preview

Goldman October Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for October. The consensus is for 600 thousand jobs added, and for the unemployment rate to decrease to 7.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms through September.

The current employment recession was by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

November 5 COVID-19 Test Results; Record Cases; Hospitalizations over 53,000

by Calculated Risk on 11/05/2020 06:50:00 PM

Note: I look forward to when I will not be posting this daily!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,271,748 test results reported over the last 24 hours.

There were 116,255 positive tests. (New record)

Over 4,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.1% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average cases for the USA.

Goldman October Payrolls Preview

by Calculated Risk on 11/05/2020 03:06:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 500k in October, below consensus of 600k. High-frequency labor market information indicates further deceleration in job growth, consistent with a drag from the virus resurgence and fiscal fizzle. ...CR Note: The consensus is for 600 thousand jobs added, and for the unemployment rate to decrease to 7.6%.

We estimate the unemployment rate declined by two tenths to 7.7%.

emphasis added