by Calculated Risk on 11/04/2020 09:00:00 PM

Wednesday, November 04, 2020

Thursday: FOMC Announcement, Unemployment Claims

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 725 thousand from 751 thousand last week.

• At 2:00 PM, FOMC Meeting Announcement. No change in policy is expected at this meeting..

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

November 4 COVID-19 Test Results; Over 100,000 Cases Reported Today

by Calculated Risk on 11/04/2020 07:04:00 PM

Note: I look forward to when I will not be posting this daily!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 966,851 test results reported over the last 24 hours.

There were 103,087 positive tests. (New record)

Over 3,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

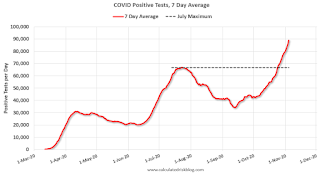

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average cases for the USA.

October Vehicles Sales decreased to 16.2 Million SAAR

by Calculated Risk on 11/04/2020 11:26:00 AM

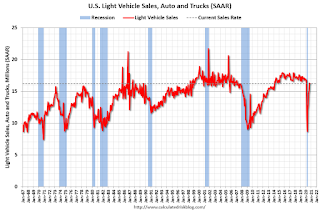

The BEA released their estimate of light vehicle sales for October this morning. The BEA estimates sales of 16.21 million SAAR in October 2020 (Seasonally Adjusted Annual Rate), down 0.5% from the September sales rate, and down 3.3% from October 2019.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for October (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down 3.3% from last year.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 16.21 million SAAR.

Note: dashed line is current estimated sales rate of 16.21 million SAAR.Sales-to-date are down 17.3% in 2020 compared to the same period in 2019.

In 2019, there were 14.48 million light vehicle sales through October. In 2020, there have been 11.97 million sales.

ISM Services Index Decreased to 56.6% in October

by Calculated Risk on 11/04/2020 10:08:00 AM

The October ISM Services index was at 56.6%, down from 57.8% last month. The employment index decreased to 50.1%, from 51.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: Services PMI™ at 56.6%; October 2020 Services ISM® Report On Business®

Business Activity Index at 61.2%; New Orders Index at 58.8%; Employment Index at 50.1%; Supplier Deliveries Index at 56.2%This was below the consensus forecast, and the employment index was barely above 50.

Economic activity in the services sector grew in October for the fifth month in a row, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: "The Services PMI™ registered 56.6 percent, 1.2 percentage points lower than the September reading of 57.8 percent. This reading represents a fifth straight month of growth for the services sector, which has expanded for all but two of the last 129 months.

emphasis added

Trade Deficit Decreased to $63.9 Billion in September

by Calculated Risk on 11/04/2020 08:39:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $63.9 billion in September, down $3.2 billion from $67.0 billion in August, revised.

September exports were $176.4 billion, $4.4 billion more than August exports. September imports were $240.2 billion, $1.2 billion more than August imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in September.

Exports are down 16% compared to September 2019; imports are down 6.5% compared to September 2019.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $37.59 per barrel in September, up from $37.43 per barrel in August, and down from $53.10 in September 2019.

The trade deficit with China decreased to $29.7 billion in September, from $31.6 billion in September 2019.

ADP: Private Employment increased 365,000 in October

by Calculated Risk on 11/04/2020 08:19:00 AM

Private sector employment increased by 365,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 650 thousand private sector jobs added in the ADP report.

“The labor market continues to add jobs, yet at a slower pace,” said Ahu Yildirmaz, vice president and cohead of the ADP Research Institute. “Although the pace is slower, we’ve seen employment gains across all industries and sizes.

emphasis added

The BLS report will be released Friday, and the consensus is for 600 thousand non-farm payroll jobs added in October. Of course the ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 11/04/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 30, 2020.

... The Refinance Index increased 6 percent from the previous week and was 88 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 25 percent higher than the same week one year ago.

“Mortgage rates continue to hover at record lows this fall. The 30-year fixed mortgage rate remained essentially unchanged at 3.01 percent last week, but rates for 15-year fixed-rate loans, FHA loans and jumbo loans all fell to new MBA survey lows,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The drop in rates spurred an uptick in demand for refinances. Activity increased over 6 percent, with borrowers notably seeking conventional and government loans. After a solid stretch of purchase applications growth, activity decreased for the fifth time in six weeks, but was still over 25 percent higher than a year ago, and has increased year-over-year for six straight months. 2020 continues to overall be a strong year for the housing market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.01 percent from 3.00 percent, with points increasing to 0.38 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

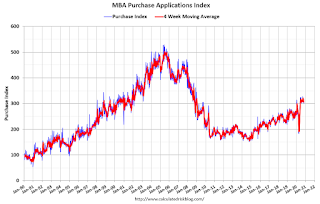

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 25% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, November 03, 2020

Wednesday: ADP Employment, Trade Deficit, ISM Services

by Calculated Risk on 11/03/2020 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 650,000 jobs added, down from 749,000 in September.

• At 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $64.0 billion in September, from $67.1 billion in August.

• At 10:00 AM, the ISM Services Index for October. The consensus is for a decrease to 57.5 from 57.8.

November 3 COVID-19 Test Results

by Calculated Risk on 11/03/2020 06:29:00 PM

Note: I look forward to when I will not be posting this daily!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 927,029 test results reported over the last 24 hours.

There were 86,507 positive tests. (New Tuesday record)

Almost 2,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.3% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

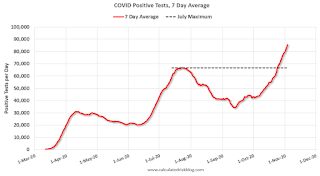

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average cases for the USA.

Early Q4 GDP Forecasts

by Calculated Risk on 11/03/2020 02:29:00 PM

From Merrill Lynch:

We expect growth to slow to 3% qoq saar in 4Q amid the stimulus stalemate. [Oct 30 estimate]From Goldman Sachs:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +4.5%. [Nov 3 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.2% for 2020:Q4. [Oct 30 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 3.4 percent on November 2, up from 2.2 percent on October 30. [Nov 2 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 3.3% annualized increase in Q4 GDP, is about 0.8% QoQ, and would leave real GDP down about 2.7% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q3 2020, and real GDP is currently off 3.5% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 3.3% annualized increase in real GDP would look like in Q4.