by Calculated Risk on 11/03/2020 09:00:00 PM

Tuesday, November 03, 2020

Wednesday: ADP Employment, Trade Deficit, ISM Services

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 650,000 jobs added, down from 749,000 in September.

• At 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $64.0 billion in September, from $67.1 billion in August.

• At 10:00 AM, the ISM Services Index for October. The consensus is for a decrease to 57.5 from 57.8.

November 3 COVID-19 Test Results

by Calculated Risk on 11/03/2020 06:29:00 PM

Note: I look forward to when I will not be posting this daily!

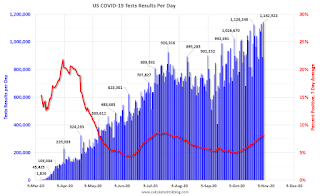

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 927,029 test results reported over the last 24 hours.

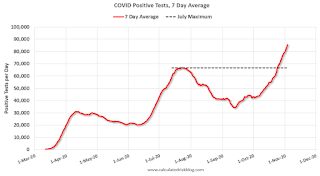

There were 86,507 positive tests. (New Tuesday record)

Almost 2,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.3% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average cases for the USA.

Early Q4 GDP Forecasts

by Calculated Risk on 11/03/2020 02:29:00 PM

From Merrill Lynch:

We expect growth to slow to 3% qoq saar in 4Q amid the stimulus stalemate. [Oct 30 estimate]From Goldman Sachs:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +4.5%. [Nov 3 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.2% for 2020:Q4. [Oct 30 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 3.4 percent on November 2, up from 2.2 percent on October 30. [Nov 2 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 3.3% annualized increase in Q4 GDP, is about 0.8% QoQ, and would leave real GDP down about 2.7% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q3 2020, and real GDP is currently off 3.5% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 3.3% annualized increase in real GDP would look like in Q4.

Update: Framing Lumber Prices Up 23% Year-over-year

by Calculated Risk on 11/03/2020 11:40:00 AM

Here is another monthly update on framing lumber prices.

This graph shows CME framing futures through Oct 30th.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Clearly there was a surge in demand for lumber mid-year, but the mills are now catching up.

CoreLogic: House Prices up 6.7% Year-over-year in September

by Calculated Risk on 11/03/2020 08:00:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Powering Up in 2020: Annual U.S. Home Price Appreciation Jumped to Six-Year High in September, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for September 2020. Nationally, home prices increased 6.7% in September 2020, compared with September 2019, marking the fastest annual acceleration since May 2014. On a month-over-month basis, home prices increased by 1.1% compared to August 2020.

Home-purchase demand maintained pace in the late summer compared to previous years, as record-low mortgage rates continue to motivate prospective homebuyers, including first-time buyers and homeowners looking to trade-up or invest in a second home. However, according to the National Association of Realtors and U.S. Census Bureau, the national supply of homes for sale fell to the lowest recorded level in September at 40% of that seen in September 2008 and 75% of that seen in September 2000. This severe inventory shortage has intensified upward pressure on home price appreciation as consumers compete for the limited number of homes on the market.

“Housing continues to be a bright spot during an otherwise challenging economic time for many U.S. households,” said Frank Martell, president and CEO of CoreLogic. “Those in sectors that weathered the transition to remote work successfully are now able to take advantage of low mortgage rates to purchase a home for the first time or to trade-up to a larger home.”

“COVID has contributed to the acute shortage of inventory as the pace of new construction slowed and older prospective sellers postponed listing their homes until after the pandemic,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Once the pandemic passes or a vaccine is widely administered, we should see a noticeable pick-up in for-sale homes. And if the economy’s recovery is sluggish next year, distressed sales may also add to market inventory.”

emphasis added

Monday, November 02, 2020

November 2 COVID-19 Test Results

by Calculated Risk on 11/02/2020 07:47:00 PM

Note: I look forward to when I will not be posting this daily!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,142,923 test results reported over the last 24 hours.

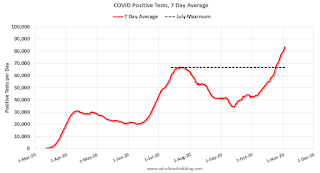

There were 82,895 positive tests. (New Monday record)

This is the highest 7-day average for deaths since the first half of September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.5% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average cases for the USA.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.83%"

by Calculated Risk on 11/02/2020 04:00:00 PM

Note: This is as of October 25th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.83%

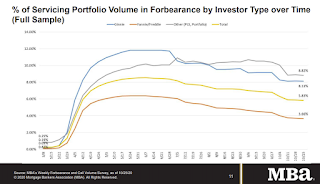

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020. According to MBA’s estimate, 2.9 million homeowners are in forbearance plans.

...

“With more borrowers exiting forbearance in the prior week, the share of loans in forbearance declined across all loan types. Almost half of forbearance exits to date have been from borrowers who remained current while in forbearance, or who were reinstated by paying back past-due amounts,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The share of loans in forbearance has returned to levels last seen in early April, but it still remains remarkably high. Further improvement will require ongoing recovery in the job market, as well as additional fiscal stimulus.”

...

By stage, 23.95% of total loans in forbearance are in the initial forbearance plan stage, while 74.49% are in a forbearance extension. The remaining 1.56% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits, but improvement might haved slowed.

The Election and 2021 Economic Forecast

by Calculated Risk on 11/02/2020 12:50:00 PM

Looking ahead to 2021, there are two key economic issues.

The first (and most important) is the course of the pandemic. The course of the economy will be determined by the course of the pandemic.

The second is the size, timing and composition of further disaster relief and economic stimulus.

On the pandemic, there is no question that a Biden administration will be more effective in addressing the pandemic, in both health and economic terms, than the current administration. Biden will tell the American people the truth, and Americans can handle the truth! Trump falsely says we are "rounding the corner" (apparently into an oncoming speeding truck). And Biden will listen to the scientists, like the CDC's Dr. Nancy Messonnier, who was completely muzzled by the current administration. This will be a hard winter, but an effective administration will make progress next year.

Black Knight Mortgage Monitor for September: "2020 Originations Will Surpass $4 Trillion for First Time Ever"

by Calculated Risk on 11/02/2020 11:56:00 AM

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 6.66% of mortgages were delinquent in September, down from 6.88% in August, and up from 3.53% in September 2019. Black Knight also reported that 0.34% of mortgages were in the foreclosure process, down from 0.48% a year ago.

This gives a total of 7.00% delinquent or in foreclosure.

Press Release: Rate Lock Data Suggests 2020 Originations Will Surpass $4 Trillion for First Time Ever; Q3 Originations Likely to Set New Quarterly Records

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, the company looked into rate lock data – historically a good indicator of lending activity – and found that Q3 2020 mortgage originations are set to break quarterly records in terms of refinance, purchase and total lending volumes. As Black Knight Data & Analytics President Ben Graboske explained, the data and market conditions also suggest that origination volumes could remain elevated into November and beyond.

“Rate lock data from Black Knight’s Compass Analytics division shows that Q3 2020 mortgage originations are on track to break quarterly records across the board and remain strong moving into Q4,” said Graboske. “This suggests that origination and prepayment activity will likely remain elevated well into Q4 2020. September lock activity held relatively level with August, but through October 19, lock activity overall is up 4% from the month prior – with purchase locks up 6% and refinance locks up 3% thus far. Interest rates setting new record lows in mid- and late October will likely continue to fuel lock activity in coming weeks.

“Assuming a 45-day lock-to-close period, not only could Q3 2020 set quarterly records for refinance, purchase and total origination volumes alike, but that volume could remain at or near peak levels through November 2020 – if not longer. Estimated origination volumes based on underlying locks suggest both Q3 refinance and total originations could be up 25% or more from Q2 while purchase lending could be up by 35% or more. This would push 2020 purchase lending to the highest level since 2005 and both refinance lending and total origination volumes to their highest levels ever. Indeed, total lending in 2020 is well on its way to easily eclipse the $4 trillion mark for the first time in history.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the status of loans that have left forbearance by loan product.

From Black Knight:

Not only have forbearance take-up rates varied widely by loan product, but the rate at which borrowers are leaving such plans has varied greatly as wellThere is much more in the mortgage monitor - especially related to forbearance.

• The GSEs have seen the highest removal rates, with 57% of borrowers having left their plans, 42% now re-performing on their loans and another 10% having paid off their loans in full

• VA loans show an even higher payoff rate at 11%, but only 21% of VA borrowers are re-performing and only 46% have left their plans

• Similarly, 45% of FHA borrowers have left forbearance plans, while 27% are re-performing and only 6% have paid off their mortgages in full

Construction Spending Increased 0.3% in September

by Calculated Risk on 11/02/2020 10:24:00 AM

From the Census Bureau reported that overall construction spending decreased in June:

Construction spending during September 2020 was estimated at a seasonally adjusted annual rate of $1,414.0 billion, 0.3 percent above the revised August estimate of $1,410.4 billion. The September figure is 1.5 percent above the September 2019 estimate of $1,393.3 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,074.9 billion, 0.9 percent above the revised August estimate of $1,065.6 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $339.1 billion, 1.7 percent below the revised August estimate of $344.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 10% below the previous peak.

Non-residential spending is 12% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 4% above the previous peak in March 2009, and 29% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 9.9%. Non-residential spending is down 6.0% year-over-year. Public spending is down 1.3% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential, and public spending (depending on disaster relief), will be under pressure. For example, lodging is down 15% YoY, multi-retail down 15% YoY, and office down 7% YoY.