by Calculated Risk on 11/02/2020 04:00:00 PM

Monday, November 02, 2020

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.83%"

Note: This is as of October 25th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020. According to MBA’s estimate, 2.9 million homeowners are in forbearance plans.

...

“With more borrowers exiting forbearance in the prior week, the share of loans in forbearance declined across all loan types. Almost half of forbearance exits to date have been from borrowers who remained current while in forbearance, or who were reinstated by paying back past-due amounts,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The share of loans in forbearance has returned to levels last seen in early April, but it still remains remarkably high. Further improvement will require ongoing recovery in the job market, as well as additional fiscal stimulus.”

...

By stage, 23.95% of total loans in forbearance are in the initial forbearance plan stage, while 74.49% are in a forbearance extension. The remaining 1.56% are forbearance re-entries.

emphasis added

Click on graph for larger image.

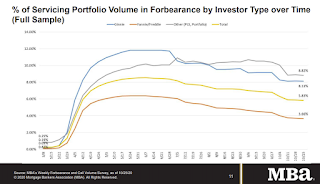

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits, but improvement might haved slowed.

The Election and 2021 Economic Forecast

by Calculated Risk on 11/02/2020 12:50:00 PM

Looking ahead to 2021, there are two key economic issues.

The first (and most important) is the course of the pandemic. The course of the economy will be determined by the course of the pandemic.

The second is the size, timing and composition of further disaster relief and economic stimulus.

On the pandemic, there is no question that a Biden administration will be more effective in addressing the pandemic, in both health and economic terms, than the current administration. Biden will tell the American people the truth, and Americans can handle the truth! Trump falsely says we are "rounding the corner" (apparently into an oncoming speeding truck). And Biden will listen to the scientists, like the CDC's Dr. Nancy Messonnier, who was completely muzzled by the current administration. This will be a hard winter, but an effective administration will make progress next year.

Black Knight Mortgage Monitor for September: "2020 Originations Will Surpass $4 Trillion for First Time Ever"

by Calculated Risk on 11/02/2020 11:56:00 AM

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 6.66% of mortgages were delinquent in September, down from 6.88% in August, and up from 3.53% in September 2019. Black Knight also reported that 0.34% of mortgages were in the foreclosure process, down from 0.48% a year ago.

This gives a total of 7.00% delinquent or in foreclosure.

Press Release: Rate Lock Data Suggests 2020 Originations Will Surpass $4 Trillion for First Time Ever; Q3 Originations Likely to Set New Quarterly Records

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, the company looked into rate lock data – historically a good indicator of lending activity – and found that Q3 2020 mortgage originations are set to break quarterly records in terms of refinance, purchase and total lending volumes. As Black Knight Data & Analytics President Ben Graboske explained, the data and market conditions also suggest that origination volumes could remain elevated into November and beyond.

“Rate lock data from Black Knight’s Compass Analytics division shows that Q3 2020 mortgage originations are on track to break quarterly records across the board and remain strong moving into Q4,” said Graboske. “This suggests that origination and prepayment activity will likely remain elevated well into Q4 2020. September lock activity held relatively level with August, but through October 19, lock activity overall is up 4% from the month prior – with purchase locks up 6% and refinance locks up 3% thus far. Interest rates setting new record lows in mid- and late October will likely continue to fuel lock activity in coming weeks.

“Assuming a 45-day lock-to-close period, not only could Q3 2020 set quarterly records for refinance, purchase and total origination volumes alike, but that volume could remain at or near peak levels through November 2020 – if not longer. Estimated origination volumes based on underlying locks suggest both Q3 refinance and total originations could be up 25% or more from Q2 while purchase lending could be up by 35% or more. This would push 2020 purchase lending to the highest level since 2005 and both refinance lending and total origination volumes to their highest levels ever. Indeed, total lending in 2020 is well on its way to easily eclipse the $4 trillion mark for the first time in history.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the status of loans that have left forbearance by loan product.

From Black Knight:

Not only have forbearance take-up rates varied widely by loan product, but the rate at which borrowers are leaving such plans has varied greatly as wellThere is much more in the mortgage monitor - especially related to forbearance.

• The GSEs have seen the highest removal rates, with 57% of borrowers having left their plans, 42% now re-performing on their loans and another 10% having paid off their loans in full

• VA loans show an even higher payoff rate at 11%, but only 21% of VA borrowers are re-performing and only 46% have left their plans

• Similarly, 45% of FHA borrowers have left forbearance plans, while 27% are re-performing and only 6% have paid off their mortgages in full

Construction Spending Increased 0.3% in September

by Calculated Risk on 11/02/2020 10:24:00 AM

From the Census Bureau reported that overall construction spending decreased in June:

Construction spending during September 2020 was estimated at a seasonally adjusted annual rate of $1,414.0 billion, 0.3 percent above the revised August estimate of $1,410.4 billion. The September figure is 1.5 percent above the September 2019 estimate of $1,393.3 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,074.9 billion, 0.9 percent above the revised August estimate of $1,065.6 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $339.1 billion, 1.7 percent below the revised August estimate of $344.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 10% below the previous peak.

Non-residential spending is 12% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 4% above the previous peak in March 2009, and 29% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 9.9%. Non-residential spending is down 6.0% year-over-year. Public spending is down 1.3% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential, and public spending (depending on disaster relief), will be under pressure. For example, lodging is down 15% YoY, multi-retail down 15% YoY, and office down 7% YoY.

ISM Manufacturing index Increased to 59.3 in October

by Calculated Risk on 11/02/2020 10:05:00 AM

The ISM manufacturing index indicated expansion in October. The PMI was at 59.3% in October, up from 55.4% in September. The employment index was at 53.2%, up from 49.6% last month, and the new orders index was at 67.9%, up from 60.2%.

From ISM: Manufacturing PMI® at 59.3%; October 2020 Manufacturing ISM® Report On Business®

conomic activity in the manufacturing sector grew in October, with the overall economy notching a sixth consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was above expectations and the employment index moved above 50.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee.

"The October Manufacturing PMI® registered 59.3 percent, up 3.9 percentage points from the September reading of 55.4 percent and the highest since September 2018 (59.3 percent). This figure indicates expansion in the overall economy for the sixth month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 67.9 percent, an increase of 7.7 percentage points from the September reading of 60.2 percent. The Production Index registered 63 percent, an increase of 2 percentage points compared to the September reading of 61 percent. The Backlog of Orders Index registered 55.7 percent, 0.5 percentage point higher compared to the September reading of 55.2 percent. The Employment Index registered 53.2 percent, an increase of 3.6 percentage points from the September reading of 49.6 percent. The Supplier Deliveries Index registered 60.5 percent, up 1.5 percentage points from the September figure of 59 percent. The Inventories Index registered 51.9 percent; 4.8 percentage points higher than the September reading of 47.1 percent. The Prices Index registered 65.5 percent, up 2.7 percentage points compared to the September reading of 62.8 percent. The New Export Orders Index registered 55.7 percent; an increase of 1.4 percentage points compared to the September reading of 54.3 percent. The Imports Index registered 58.1 percent, a 4.1-percentage point increase from the September reading of 54 percent.

emphasis added

This suggests manufacturing expanded at a faster pace in October than in September.

Eight High Frequency Indicators for the Economy

by Calculated Risk on 11/02/2020 08:06:00 AM

NOTE: I've added another indicator - the occupancy rate for office buildings with security from Kastle Systems (ht Burt). This is near the bottom.

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of Nov 1st.

The seven day average is down 63% from last year (37% of last year).

There has been a slow increase from the bottom.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 31, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is generally turning down in the northern states - Illinois, Pennsylvania, and New York - but holding up in the southern states.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through October 92th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through October 92th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, and were at $12 million last week (compared to usually around $150 million per week in the early Fall).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through October 24th. Hotel occupancy is currently down 31.7% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

This suggests no improvement over the last 6 weeks. So far there has been little business travel pickup that usually happens in the Fall.

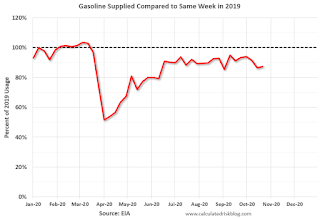

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of October 23rd, gasoline supplied was off about 12.7% YoY (about 87.3% of last year).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might have boosted gasoline consumption in the Summer and early Fall at the expense of air travel.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 31st for the United States and several selected cities.

This data is through October 31st for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 54% of the January level. It is at 44% in Chicago, and 57% in Houston - and declining slightly recently.

Note: This graph is from Kastle, and the data isn't available online to do a 7-day average. Here is some interesting data from Kastle Systems on office occupancy.

This is just a screen shot. Here is the interactive data. This data is through October 28th.

This is just a screen shot. Here is the interactive data. This data is through October 28th.Currently Office Occupancy is 27% of normal, with a low of 15% in San Francisco, and a high of 41% in Dallas.

"View the average occupancy rate of commercial properties across 10 major U.S. cities, by each municipality and in aggregate, to show the pace of Americans returning to work based on daily unique access entries in Kastle-secured buildings across the nation."

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data for the last several years.

This graph is from Todd W Schneider. This is weekly data for the last several years.This data is through Friday, October 30th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, November 01, 2020

Monday: ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 11/01/2020 07:47:00 PM

Weekend:

• Schedule for Week of November 1, 2020

• FOMC Preview

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for October. The consensus is for 55.8%, up from 55.4%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for 0.9% increase in spending.

• All day, Light vehicle sales for October. The consensus is for sales of 16.5 million SAAR, up from 16.3 million SAAR in September (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 12 and DOW futures are down 150 (fair value).

Oil prices were down over the last week with WTI futures at $34.18 per barrel and Brent at $36.36 barrel. A year ago, WTI was at $56, and Brent was at $60 - so WTI oil prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.11 per gallon. A year ago prices were at $2.58 per gallon, so gasoline prices are down $0.47 per gallon year-over-year.

November 1 COVID-19 Test Results

by Calculated Risk on 11/01/2020 07:35:00 PM

Note: I look forward to when I will not be posting this daily!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 838,148 test results reported over the last 24 hours.

There were 74,443 positive tests. (New Sunday record)

Over 23,000 Americans deaths from COVID were reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.9% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average for the USA.

FOMC Preview

by Calculated Risk on 11/01/2020 01:31:00 PM

Expectations are there will be no change to policy when the FOMC meets on Wednesday and Thursday (not the usual Tuesday-Wednesday).

Here are some comments from Goldman Sachs economist David Mericle:

"Without any further discussion of policy changes, the November meeting should be fairly quiet. The economy has continued to recover at a healthy pace since the FOMC last met, but faces risks ahead from the withdrawal of fiscal support and a second virus resurgence. Neither risk is entirely new at this point, and we expect few changes to the FOMC statement.For review, here are the September FOMC projections.

If a severe winter virus resurgence proved more economically damaging than we expect and the FOMC wanted to respond, its options would be limited. The most likely response would be to adjust the composition or pace of asset purchases, but Fed officials have expressed only lukewarm support for such a move because they see it as unlikely to be particularly effective.

Note that GDP decreased at a 5.0% annual rate in Q1, decreased at a 31.7% annual rate in Q2, and increased at 33.1% annual rate in Q3. This leaves real GDP down 3.5% from Q4 2019.

Early forecasts are for GDP to increase at a 2% to 3% annual rate in Q4. These early forecasts would put the economy down around 3% Q4-over-Q4. That would be at the top end of their September forecast.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | -4.0 to -3.0 | 3.6 to 4.7 | 2.5 to 3.3 | 2.4 to 3.0 |

The unemployment rate was at 7.9% in September and will probably decrease more in Q4. This will put the unemployment rate in the middle of the range of September projections.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there 12.5 million people unemployed, and 4.5 million people have left the labor force since January. And millions more are being supported by various provisions of the CARES Act - that hasn't been renewed

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 7.0 to 8.0 | 5.0 to 6.2 | 4.0 to 5.0 | 3.5 to 4.4 |

As of September 2020, PCE inflation was up 1.4% from September 2019. This was above the September projections for Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.1 to 1.3 | 1.6 to 1.9 | 1.7 to 1.9 | 1.9 to 2.0 |

PCE core inflation was up 1.5% in September year-over-year. This was at the high end of the September projections for Q4. Note that inflation will not be a concern for the FOMC for the foreseeable future.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.3 to 1.5 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 |

Unofficial Problem Bank list Decreased to 64 Institutions

by Calculated Risk on 11/01/2020 08:12:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for October 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for October 2020. During the month, the list decreased by one to 64 banks after a removal. A year ago, the list held 71 institutions with assets of $53.4 billion. First City Bank of Florida, Fort Walton Beach, FL ($135 million) exited the list through failure on October 16, 2020.

On October 7, 2020, the OCC issued a couple of formal actions against Citibank, National Association, Sioux Falls, SD (FDIC Cert#7213, 2q2020 assets -- $1.633 trillion). The formal actions included a Consent Orderand a Civil Money Penalty Order. The Consent Order states that “the OCC intends to intends to initiate cease and desist proceedings against the Bank pursuant to 12 U.S.C. § 1818(b), through the issuance of a Notice of Charges, for deficiencies in its data governance, risk management, and internal controls that constitute unsafe or unsound practices and that contributed to violations of law or regulation” Because of the deficiencies specified in the Consent Order, the OCC issued a $400 million Civil Money Penalty against Citibank. Separately, the Federal Reserve issued a formal enforcement action against the parent bank holding company, Citigroup Inc., that states “… Citigroup has not adequately remediated the longstanding enterprise-wide risk management and control deficiencies …” The substance and nature of these enforcement actions would land most banks on the problem bank list, but our guess is that the FDIC will not designate Citibank as a problem bank. As some observers say, size does have its privileges.