by Calculated Risk on 10/31/2020 08:11:00 AM

Saturday, October 31, 2020

Schedule for Week of November 1, 2020

The key report this week is the October employment report on Friday.

Other key indicators include the October ISM manufacturing and services indexes, October vehicle sales, and the September trade deficit.

The FOMC meets on Wednesday and Thursday this week, and no change in policy is expected.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 55.8%, up from 55.4%.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 55.8%, up from 55.4%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 55.4% in September, the employment index was at 49.6%, and the new orders index was at 60.2%

10:00 AM: Construction Spending for September. The consensus is for 0.9% increase in spending.

All day: Light vehicle sales for October.

All day: Light vehicle sales for October.The consensus is for sales of 16.5 million SAAR, up from 16.3 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:00 AM ET: Corelogic House Price index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 650,000 jobs added, down from 749,000 in September.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $64.0 billion in September, from $67.1 billion in August.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $64.0 billion in September, from $67.1 billion in August.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for a decrease to 57.5 from 57.8.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 725 thousand from 751 thousand last week.

2:00 PM: FOMC Meeting Announcement. No change in policy is expected at this meeting..

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

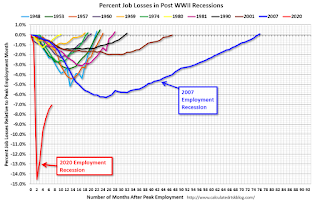

8:30 AM: Employment Report for October. The consensus is for 600 thousand jobs added, and for the unemployment rate to decrease to 7.6%.

8:30 AM: Employment Report for October. The consensus is for 600 thousand jobs added, and for the unemployment rate to decrease to 7.6%.There were 661 thousand jobs added in September, and the unemployment rate was at 7.9%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

Friday, October 30, 2020

October 30 COVID-19 Test Results; Record 97,000 Cases

by Calculated Risk on 10/30/2020 07:12:00 PM

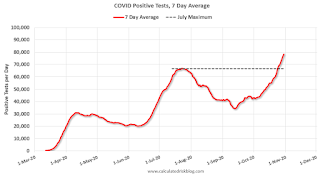

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,077,164 test results reported over the last 24 hours.

There were 97,080 positive tests. This is a new record.

Almost 22,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.0% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average for the USA.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in September

by Calculated Risk on 10/30/2020 04:12:00 PM

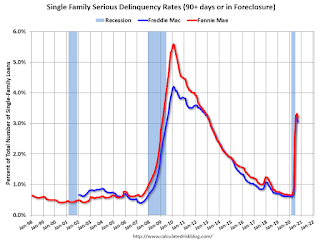

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 3.20% in September, from 3.32% in August. The serious delinquency rate is up from 0.68% in September 2019.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.81% are seriously delinquent (up from 5.79% in August). For loans made in 2005 through 2008 (3% of portfolio), 9.84% are seriously delinquent (up from 9.74%), For recent loans, originated in 2009 through 2018 (95% of portfolio), 2.74% are seriously delinquent (down from 2.86%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 51% YoY in September

by Calculated Risk on 10/30/2020 01:45:00 PM

From the Las Vegas Visitor Authority: September 2020 Las Vegas Visitor Statistics

Gradual increases continued in September as the destination hosted approx. 1.7M visitors, just under half of last year's estimated tally but up 10.9% from last month.Here is the data from the Las Vegas Convention and Visitors Authority.

While operating at varying capacities, open properties in September represented an inventory of 133,079 rooms.* Total occupancy reached 46.8% for the month as weekend occupancy improved to 66.1% and midweek occupancy reached 38.5%.

Average daily rates among open properties reached $108.13 (+9.0% MoM, -21.1% YoY) while RevPAR came in at roughly $50.60, down -58.2% vs. last September.

* Reflects weighted average of daily room tallies

Click on graph for larger image.

Click on graph for larger image. The blue and red bars are monthly visitor traffic (left scale) for 2019 and 2020. The dashed blue and orange lines are convention attendance (right scale).

Convention traffic in September was down 100% compared to September 2019.

And visitor traffic was down 51% YoY.

The casinos started to reopen on June 4th (it appears about 89% of rooms have now opened).

Q3 2020 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/30/2020 12:46:00 PM

The BEA has released the underlying details for the Q3 advance GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 14.6% annual pace in Q3. This is the fourth consecutive quarterly decline (weakness started before the pandemic).

Investment in petroleum and natural gas exploration decreased sharply in Q3 compared to Q2, and was down 60% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q3, but was only down 5.9% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 24% year-over-year in Q3 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q3, and lodging investment was down 14% year-over-year.

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Even though investment in single family structures has increased from the bottom, single family investment is still low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases in single family investment.

Investment in single family structures was $285 billion (SAAR) (about 1.3% of GDP)..

Investment in multi-family structures increased in Q3.

Investment in home improvement was at a $296 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (about 1.4% of GDP). Home improvement spending has been solid and might hold up during the pandemic.

Real Personal Income less Transfer Payments

by Calculated Risk on 10/30/2020 09:41:00 AM

Government transfer payments were mostly unchanged in September compared to August, but were still almost $1 trillion (on SAAR basis) above the February level. Most of the increase in transfer payments - compared to the level prior to the crisis - is from unemployment insurance and "other" (CARES ACT).

There was a sharp decline in unemployment insurance in both August and September.

This table shows the amount of unemployment insurance and "Other" transfer payments since February 2020 (pre-crisis level). The increase in "Other" was mostly due to other parts of the CARES Act such as the $1,200 one time payment.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Feb | $506 | $28 |

| Mar | $515 | $74 |

| Apr | $3,379 | $493 |

| May | $1,360 | $1,356 |

| Jun | $758 | $1,405 |

| Jul | $771 | $1,318 |

| Aug | $716 | $631 |

| Sep | $964 | $365 |

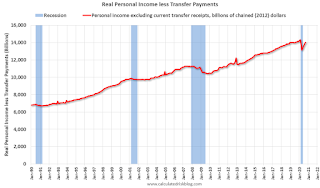

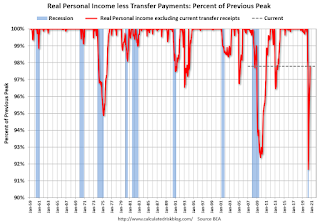

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows real personal income less transfer payments since 1990.

This measure of economic activity increased 0.7% in September, compared to August, and was down 2.2% compared to February 2020 (previous peak).

Another way to look at this data is as a percent of the previous peak.

Another way to look at this data is as a percent of the previous peak.Real personal income less transfer payments was off 8.3% in April. This was a larger decline than the worst of the great recession.

Currently personal income less transfer payments are still off 2.2% (dashed line).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 10/30/2020 09:16:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 27th.

From Forbearance Numbers Rise Above 3 Million Once Again

In the past week, we saw the number of mortgages in active forbearance rise by 31,000 (a 1% increase). This increase was driven by limited extension and removal activity, along with an increase in forbearance starts. There were 50,000 forbearance removals this week, the lowest of any week during the recovery, while the 89,000 extensions were the fewest we’ve seen in nine weeks. We also saw about 33,000 new forbearance plans begin.

In total, forbearance plan starts are up 15% in October compared to the month prior, with the rise driven by borrowers reactivating previously expired plans. New forbearance activations are down 7% from September, while re-activations are up 50%. This is most likely in reaction to the large volume of plans than were removed early in the month.

As of Oct. 27, the number of active forbearances has ticked back up over 3 million again for the first time since early October, representing approximately 5.7% of all active mortgages, up from 5.6% from last week. Together, they represent $619 billion in unpaid principal.

Click on graph for larger image.

Of the just over 3 million loans still in active forbearance, more than 80% have had their terms extended at some point since March.

With 365,000 forbearance plans still set to expire in October, we could see increased levels of extension and removal activity in the coming weeks, so be sure to continue to monitor this blog for future findings.br /> emphasis added

Personal Income increased 0.9% in September, Spending increased 1.4%

by Calculated Risk on 10/30/2020 08:38:00 AM

The BEA released the Personal Income and Outlays report for September:

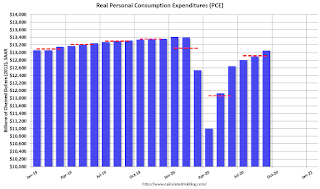

Personal income increased $170.3 billion (0.9 percent) in September according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $150.3 billion (0.9 percent) and personal consumption expenditures (PCE) increased $201.4 billion (1.4 percent).The September PCE price index increased 1.4 percent year-over-year and the September PCE price index, excluding food and energy, increased 1.5 percent year-over-year.

Real DPI increased 0.7 percent in September and Real PCE increased 1.2 percent. The PCE price index increased 0.2 percent (table 9). Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through September 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was higher than expected, and the increase in PCE was above expectations.

Thursday, October 29, 2020

Friday: Personal Income and Outlays

by Calculated Risk on 10/29/2020 09:08:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.5% increase in personal income, and for a 1.0% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 59.3, down from 62.4 in September.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 81.2.

October 29 COVID-19 Test Results

by Calculated Risk on 10/29/2020 06:58:00 PM

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,096,494 test results reported over the last 24 hours.

There were 88,452 positive tests. This is a new record.

Almost 21,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.1% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average for the USA.