by Calculated Risk on 10/07/2020 10:02:00 PM

Wednesday, October 07, 2020

Thursday: Unemployment Claims

Thursday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for September.

• At 8:30 AM, The initial weekly unemployment claims report will be released. Initial claims were 837 thousand the previous week.

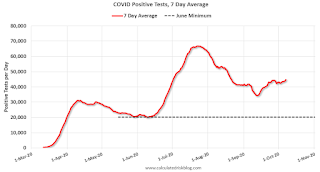

October 7 COVID-19 Test Results

by Calculated Risk on 10/07/2020 07:26:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 774,092 test results reported over the last 24 hours.

There were 50,602 positive tests.

Almost 4,700 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.5% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people would stay vigilant, the number of cases might drop to the June low in November - but that is looking unlikely.

FOMC Minutes: "most forecasters were assuming that an additional pandemic-related fiscal package would be approved this year"

by Calculated Risk on 10/07/2020 02:38:00 PM

From the Fed: Minutes of the Federal Open Market Committee, September 15-16, 2020. A few excerpts:

While the economic outlook had brightened, market participants continued to see significant risks ahead. Some noted concerns about elevated asset valuations in certain sectors. Many also cited geopolitical events as heightening uncertainty. In addition, most forecasters were assuming that an additional pandemic-related fiscal package would be approved this year, and noted that, absent a new package, growth could decelerate at a faster-than-expected pace in the fourth quarter. In light of these and other risks, as well as the ongoing pandemic, market participants continued to suggest that the supportive policy environment and the backstops to market functioning remained important stabilizers.

...

Participants continued to see the uncertainty surrounding the economic outlook as very elevated, with the path of the economy highly dependent on the course of the virus; on how individuals, businesses, and public officials responded to it; and on the effectiveness of public health measures to address it. Participants cited several downside risks that could threaten the recovery. While the risk of another broad economic shutdown was seen as having receded, participants remained concerned about the possibility of additional virus outbreaks that could undermine the recovery. Such scenarios could result in increases in bankruptcies and defaults, put stress on the financial system, and lead to disruptions in the flow of credit to households and businesses. Most participants raised the concern that fiscal support so far for households, businesses, and state and local governments might not provide sufficient relief to these sectors. A couple of participants saw an upside risk that further fiscal stimulus could be larger than anticipated, though it might come later than had been expected. Several participants raised concerns regarding the longer-run effects of the pandemic, including how it could lead to a restructuring in some sectors of the economy that could slow employment growth or could accelerate technological disruption that was likely limiting the pricing power of firms.

emphasis added

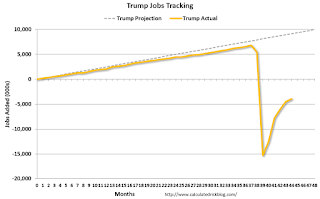

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 10/07/2020 01:00:00 PM

Note: I usually post this monthly, but I hesitated recently due to the COVID-19 pandemic. But I've received a number of requests lately - the recent numbers are ugly.

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (44 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 824,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 387,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,970,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,849,000 under President Obama (dark blue).

During the first 44 months of Mr. Trump's term, the economy has lost 3,408,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 277,000 jobs).

During the 44 months of Mr. Trump's term, the economy has lost 499,000 public sector jobs.

After 44 months of Mr. Trump's presidency, the economy has lost 3,907,000 jobs, about 13,074,000 behind the projection.

Update: Framing Lumber Prices Up 65% Year-over-year

by Calculated Risk on 10/07/2020 10:25:00 AM

Here is another monthly update on framing lumber prices.

This graph shows CME framing futures through Oct 2nd.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Clearly there has been a surge in demand for lumber and the mills are struggling to meet demand.

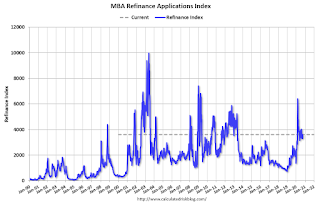

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 10/07/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 2, 2020.

... The Refinance Index increased 8 percent from the previous week and was 50 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 21 percent higher than the same week one year ago.

“Mortgage rates declined across the board last week – with most falling to record lows – and borrowers responded. The refinance index jumped 8 percent and hit its highest level since mid-August,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Continuing the trend seen in recent months, the purchase market is growing at a strong clip, with activity last week up 21 percent from a year ago. The average loan size increased again to a new record at $371,500, as activity in the higher loan size categories continues to lead growth.”

Added Kan, “There are signs that demand is waning at the entry-level portion of the market because of supply and affordability hurdles, as well as the adverse economic impact the pandemic is having on hourly workers and low-and moderate-income households. As a result, the lower price tiers are seeing slower growth, which is contributing to the rising trend in average loan balances.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.01 percent from 3.05 percent, with points decreasing to 0.37 from 0.52 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 21% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 06, 2020

Wednesday: FOMC Minutes

by Calculated Risk on 10/06/2020 09:14:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes, Meeting of September 15-16, 2020

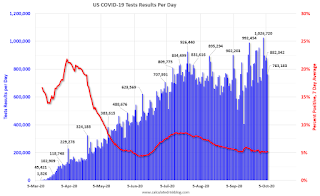

October 6 COVID-19 Test Results

by Calculated Risk on 10/06/2020 06:49:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 763,183 test results reported over the last 24 hours.

There were 38,696 positive tests.

Over 3,700 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.1% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low in November (that would still be a large number of new cases, but progress).

Reis: Office, Mall and Apartment Vacancy Rates Increased in Q3

by Calculated Risk on 10/06/2020 02:39:00 PM

From Reis economist Barbara Byrne Denham:

The Apartment Vacancy Rate rose to 5.0% in the third quarter, the highest rate since the first quarter of 2012.

The Office Vacancy Rate rose 0.3% to 17.4%, the highest since Q3 2011 as occupancy declined by 5.85 million square feet; the Average Office Asking Rent increased 0.2%, but the Effective Rent declined 0.2% in the quarter.

The Retail Vacancy Rate increased 0.2% in the quarter to 10.4%, the highest since Q4 2013 as occupancy declined 2.63 million square feet; the Average Asking Rent declined 0.1% while the Average Effective Rent fell 0.4%.

The average Mall Vacancy Rate climbed 0.3% in the quarter to 10.1%, the highest in more than 20 years. The average Asking Rent decreased 0.7% in the quarter and 0.6% over the year.

…

Conclusion

The third quarter statistics clearly show that property owners started to feel the impact of the pandemic. Ironically, occupancy growth in the apartment market was net positive, yet rents fell dramatically, especially in some high-priced markets as tenants had the upper hand and property owners recognized this and lowered rents to maintain occupancy.

...

Finally, the office market may have seen the smallest impact thus far, but this was likely due to the term structure of leases – the average lease term is 9 years. Still, the continued work-from-home option driven by the pandemic has prompted many office planners to re-consider future office needs which will impact the office market for years.

Thus, our outlook remains cautious: vacancies will continue to rise and rents will decline further. However, rent declines will likely not accelerate until 2021 as layoffs from airlines and other industries that had been supported by the CARES Act will hit the economy; and more leases up for renewal are either not renewed, get downsized and/or are renewed at lower rents.

Click on graph for larger image.

Click on graph for larger image.This graph shows the regional and strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.4% in Q3, up from 10.2% in Q2, and up from 10.1% in Q3 2019.

For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

For Regional malls, the vacancy rate was 10.1% in Q3, up from 9.8% in Q2, and up from 9.4% in Q3 2019.

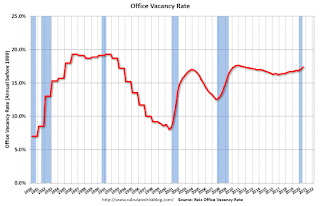

This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).Reis reported the vacancy rate was at 17.4% in Q3, up from 17.1% in Q2, and up from 16.9% in Q3 2019. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased over the last two years. And will likely increase further as leases expire.

The third graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The third graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.Reis reported the vacancy rate was at 5.0% in Q3, up from 4.9% Q2, and up from 4.6% in Q3 2019.

The apartment vacancy rate will probably stay fairly low if there is additional disaster relief. However, the vacancy rate could increase sharply if the eviction moratoriums end and there is minimal additional disaster relief.

All vacancy data courtesy of Reis

Las Vegas Real Estate in September: Sales up 16% YoY, Inventory down 31% YoY

by Calculated Risk on 10/06/2020 01:02:00 PM

This report is for closed sales in September; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in July and August.

The Las Vegas Realtors reported Southern Nevada home prices keep climbing amid housing shortage, LVR housing statistics for September 2020

LVR reported a total of 3,996 existing local homes, condos and townhomes were sold during September. Compared to the same time last year, September sales were up 18.9% for homes and up 6.8% for condos and townhomes.1) Overall sales were down 16.5% year-over-year to 3,996 in September 2020 from 3,430 in September 2019.

...

By the end of September, LVR reported 4,798 single-family homes listed for sale without any sort of offer. That’s down 34.6% from one year ago. For condos and townhomes, the 1,525 properties listed without offers in September represent a 16.7% drop from one year ago.

…

Despite the coronavirus crisis, the number of so-called distressed sales remains near historically low levels. The association reported that short sales and foreclosures combined accounted for just 1.0% of all existing local property sales in September. That compares to 2.0% of all sales one year ago, 2.5% two years ago and 5.2% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 9,164 in September 2019 to 6,323 in September 2020. Note: Total inventory was down 31.0% year-over-year. And months of inventory is low.

3) Low level of distressed sales.