by Calculated Risk on 10/02/2020 08:15:00 PM

Friday, October 02, 2020

September Vehicles Sales increased to 16.3 Million SAAR

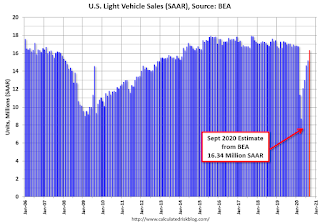

The BEA released their estimate of light vehicle sales for September this morning. The BEA estimates sales of 16.34 million SAAR in September 2020 (Seasonally Adjusted Annual Rate), up 7.6% from the August sales rate, and down 4.3% from September 2019.

This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for September (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down 4.3% from last year.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales-to-date are down 18.8% in 2020 compared to the same period in 2019.

In 2019, there were 12.70 million light vehicle sales through September. In 2020, there have been 10.31 million sales.

October 2 COVID-19 Test Results

by Calculated Risk on 10/02/2020 07:08:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,026,720 test results reported over the last 24 hours.

There were 49,534 positive tests.

Almost 1,700 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.8% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low towards the end of October (that would still be a large number of new cases, but progress).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 10/02/2020 12:29:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of September 29th.

From Forbearances up Slightly, First Rise in 6 Weeks

According to the latest weekly snapshot of Black Knight’s McDash Flash daily forbearance tracking data, the number of mortgages in active forbearance increased for the first time in six weeks, as plans rose by 21,000 over the last seven days.

The increase was driven primarily by an uptick among portfolio-held and private labeled security loans which rose by 28,000 for the week. FHA/VA loans also saw a slight increase of 2,000. Those increases were partially offset by a 9,000 decline in GSE forbearances.

Click on graph for larger image.

As of September 29, 3.6 million homeowners remain in COVID-19-related forbearance plans, or 6.8% of all active mortgages, unchanged from last week. Together, they represent $751 billion in unpaid principal.

Over the past month, active forbearance volumes are now down by 305,000 (-8%), with the strongest monthly declines seen among GSE and Portfolio/Private loans which have each fallen by 10%, with a more modest 4% decline among FHA/VA loans.

...

Of the 3.6 million loans still in active forbearance, more than 75% have had their terms extended at some point since March.

With more than a million forbearance plans for which September’s mortgage payment was the last payment covered under forbearance plan – and another million set to expire in October – significant removal/extension activity is still likely over the next few weeks.

The ongoing COVID-19 pandemic continues to represent significant uncertainty for the weeks ahead. Black Knight will continue to monitor the situation and report our findings on this blog.

emphasis added

Q3 GDP Forecasts

by Calculated Risk on 10/02/2020 12:20:00 PM

From Merrill Lynch:

Growth in 3Q could be 24.6% qoq saar, posing some downside risk for our forecast for a 27.0% qoq annualized growth rate [Sept 30 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +35% (qoq ar). [Oct 2 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 14.0% for 2020:Q3 and 4.8% for 2020:Q4. [Oct 2 estimate]And from the Altanta Fed: GDPNow

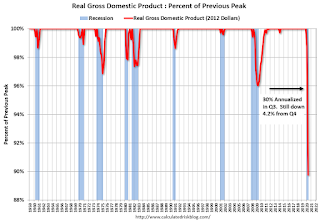

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 34.6 percent on October 1, up from 32.0 percent on September 25. [Oct 1 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Comments on September Employment Report

by Calculated Risk on 10/02/2020 10:58:00 AM

The September employment report was below expectations, although employment for the previous two months were revised up.

Leisure and hospitality added another 318 thousand jobs in September, following 4.16 million jobs added in May through August. Leisure and hospitality lost 8.3 million jobs in March and April, so about 54% of those jobs were added back in the May through September period.

Earlier: September Employment Report: 661 Thousand Jobs Added, 7.9% Unemployment Rate

In August, the year-over-year employment change was minus 9.65 million jobs.

Permanent Job Losers

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the September report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In September, the number of permanent job losers increased to 3.756 million from 3.411 million in August.

Prime (25 to 54 Years Old) Participation

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate decreased in September to 80.9% from 81.4% in August, and the 25 to 54 employment population ratio decreased to 75.0% from 75.3%.

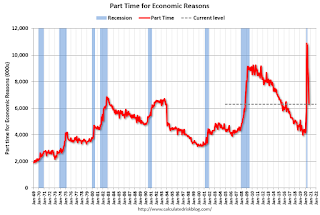

Part Time for Economic Reasons

"In September, the number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 1.3 million to 6.3 million, reflecting a decrease in the number of persons whose hours were cut due to slack work or business conditions."The number of persons working part time for economic reasons decreased in September to 6.300 million from 7.572 million in August.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.8% in September. This is down from the record high in April 22.8% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.405 million workers who have been unemployed for more than 26 weeks and still want a job.

This will increase sharply in October - since the largest number of layoffs were in April - and will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was below expectations, however the previous two months were revised up 145,000 combined. The headline unemployment rate decreased to 7.9%, however this was somewhat due to the wrong reasons (decline in participation).

September Employment Report: 661 Thousand Jobs Added, 7.9% Unemployment Rate

by Calculated Risk on 10/02/2020 08:42:00 AM

From the BLS:

Total nonfarm payroll employment rose by 661,000 in September, and the unemployment rate declined to 7.9 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it. In September, notable job gains occurred in leisure and hospitality, in retail trade, in health care and social assistance, and in professional and business services. Employment in government declined over the month, mainly in state and local government education.

...

In September, the unemployment rate declined by 0.5 percentage point to 7.9 percent, and the number of unemployed persons fell by 1.0 million to 12.6 million. Both measures have declined for 5 consecutive months but are higher than in February, by 4.4 percentage points and 6.8 million, respectively.

...

The change in total nonfarm payroll employment for July was revised up by 27,000, from +1,734,000 to +1,761,000, and the change for August was revised up by 118,000, from +1,371,000 to +1,489,000. With these revisions, employment in July and August combined was 145,000 more than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In September, the year-over-year change was negative 9.65 million jobs.

Total payrolls increased by 661 thousand in September.

Payrolls for July and August were revised up 145 thousand combined.

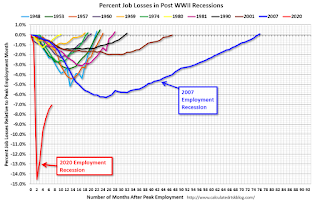

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and is still worse than the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 61.4% in September. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 61.4% in September. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 56.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in September to 7.9%.

This was below consensus expectations, however July and August were revised up by 145,000 combined.

I'll have much more later …

Thursday, October 01, 2020

September Employment Preview

by Calculated Risk on 10/01/2020 09:00:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for 850 thousand jobs added, and for the unemployment rate to decrease to 8.2%.

The decennial Census will subtract 41,400 temporary jobs. Also, due to the delays in school openings, it is likely the education will show a solid decline since many schools are online (support staff will probably be lower than usual).

The ADP employment report showed a gain of 749,000 private sector jobs, above the consensus estimate of 605 thousand jobs. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be weaker than expected.

The ISM manufacturing employment index increased in September to 49.6% from, 46.3% in August. This would suggest few manufacturing jobs added in September - although ADP showed 130,000 manufacturing jobs added!

The weekly claims report showed a high number total continuing unemployment claims during the reference week, although this might not be very useful right now.

There are other indicators that analysts are looking at - like Homebase hours worked and Kronos (see Ernie Tedeschi comments).

Homebase data has flatlined in recent weeks. Pairing their data with UI claims yields a forecast of +290K jobs in September, not seasonally adjusted.Goldman Sachs forecasts:

Kronos meanwhile has accelerated. Using them instead leads to a +2.4 million forecast.

We estimate nonfarm payrolls rose 1.1mn in September ... We estimate the unemployment rate declined by three tenths to 8.1%.And Merrill Lynch forecasts: "We expect nonfarm payroll growth of 800k in September and the unemployment rate to improve to 8.1% from 8.4%."

• Conclusion: There is a wide range of estimates for the September report. The employment related data has been all over the place. My guess is the report will be lower than the consensus.

October 1 COVID-19 Test Results

by Calculated Risk on 10/01/2020 07:32:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 805,559 test results reported over the last 24 hours.

There were 45,694 positive tests.

847 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low towards the end of October (that would still be a large number of new cases, but progress).

Goldman September Payrolls Preview

by Calculated Risk on 10/01/2020 05:50:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 1.1mn in September, above consensus of +0.875mn. High-frequency labor market information indicates strong September job gains, and the second derivative improvement in the public-health situation suggests scope for a pickup in Sun Belt job growth. ...CR Note: The consensus is for 850 thousand jobs added, and for the unemployment rate to decrease to 8.2%.

We estimate the unemployment rate declined by three tenths to 8.1%.

emphasis added

Zillow Case-Shiller Forecast: Year-over-year House Price Growth to Increase Significantly in August

by Calculated Risk on 10/01/2020 02:40:00 PM

The Case-Shiller house price indexes for July were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: July Case-Shiller Results and August Forecast: Pushing Decisively Higher

Home prices continued to push pandemic-related uncertainties aside and reach new heights into the summer months, as demand for housing outpaced supply....

...

An unprecedented lack of for-sale homes combined with persistently low mortgage rates have stoked a competition for housing in recent months that will not relent. Sales volume has held firm at a time when it would normally show signs of cooling, and home prices continue to push decisively higher. The question now is how much longer this will continue. While coronavirus-related developments will dictate the path forward for the economy, thus far, the housing market has withstood basically every obstacle that the pandemic has thrown its way, and home prices have grown without restriction. With mortgage rates poised to remain low for the near future, barring a sudden surge in inventory, it appears that upward price pressures should endure into the fall.

Annual growth in August as reported by Case-Shiller is expected to accelerate in all three main indices. S&P Dow Jones Indices is expected to release data for the August S&P CoreLogic Case-Shiller Indices on Tuesday, October 27.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 5.3% in August, up from 4.8% in July.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 5.3% in August, up from 4.8% in July. The Zillow forecast is for the 20-City index to be up 4.5% YoY in August from 3.9% in July, and for the 10-City index to increase to be up 3.9% YoY compared to 3.3% YoY in July.