by Calculated Risk on 9/22/2020 02:20:00 PM

Tuesday, September 22, 2020

September Employment Report Will Show a Decrease of 41,403 Temporary Census Workers

The Census Bureau released an update today on 2020 Census Paid Temporary Workers. The release today was for the BLS reference week for the September employment report.

As of the August reference week, there were 288,204 decennial Census temporary workers. As of the September reference week, there were 246,801 temporary Census workers.

This means the September employment report will show a decrease of 41,403 temporary Census workers. This will decrease the headline number.

Richmond Fed: "Manufacturing Activity Improved in September"

by Calculated Risk on 9/22/2020 02:14:00 PM

Earlier from the Richmond Fed: Manufacturing Activity Improved in September

Manufacturing activity in the Fifth District improved in September, according to the most recent survey from the Richmond Fed. The composite index climbed from 18 in August to 21 in September, buoyed by increases in the indicators for new orders and employment. The third component index—shipments—decreased but remained positive, suggesting continued expansion. Survey results also reflected improvement in local business conditions and increased capital spending. Overall, respondents were optimistic that conditions would continue to improve in the next six months.This was above consensus expectations.

Results reflected higher employment among many survey participants in September and suggested several manufacturers raised wages over the month.

emphasis added

Comments on August Existing Home Sales

by Calculated Risk on 9/22/2020 10:29:00 AM

Earlier: NAR: Existing-Home Sales Increased to 6.00 million in August

A few key points:

1) This was the highest sales rate since 2006. Existing home sales are counted at the close of escrow, so the August report was mostly for contracts signed in June and July - when the economy was much more open than in March and April. Some of the increase over the last three months was probably related to pent up demand from the shutdowns in March and April. However, with the high unemployment rate and the high rate of COVID infections, housing might be under some pressure later this year or in 2021. That is difficult to predict and depends on the course of the pandemic.

2) Inventory is very low, and was down 18.6% year-over-year (YoY) in August. This is the lowest level of inventory for August since at least the early 1990s.

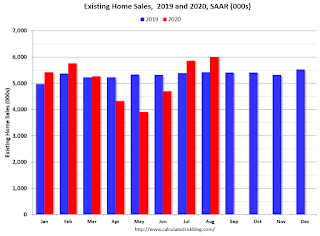

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 3.2% compared to the same period in 2019.

Sales NSA in August (561,000) were 5.5% above sales last year in August (532,000).

Fed Chair Powell Testimony: "Coronavirus Aid, Relief, and Economic Security Act" at 10:30 AM ET

by Calculated Risk on 9/22/2020 10:16:00 AM

Here is Fed Chair Powell's prepared testimony: Coronavirus Aid, Relief, and Economic Security Act

NAR: Existing-Home Sales Increased to 6.00 million in August

by Calculated Risk on 9/22/2020 10:10:00 AM

From the NAR: Existing-Home Sales Hit Highest Level Since December 2006

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.4% from July to a seasonally-adjusted annual rate of 6.00 million in August. Sales as a whole rose year-over-year, up 10.5% from a year ago (5.43 million in August 2019).

...

Total housing inventory at the end of August totaled 1.49 million units, down 0.7% from July and down 18.6% from one year ago (1.83 million). Unsold inventory sits at a 3.0-month supply at the current sales pace, down from 3.1 months in July and down from the 4.0-month figure recorded in August 2019.

emphasis added

Click on graph for larger image.

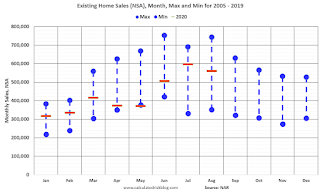

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (6.00 million SAAR) were up 2.4% from last month, and were 10.5% above the August 2019 sales rate.

This was the highest sales rate since 2006.

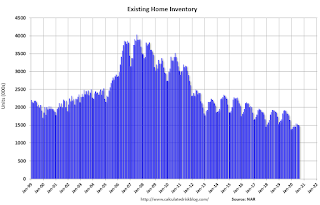

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.49 million in August from 1.50 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

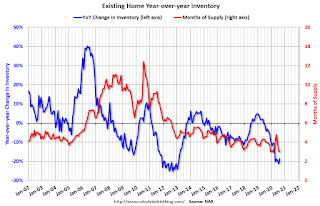

According to the NAR, inventory decreased to 1.49 million in August from 1.50 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 18.6% year-over-year in August compared to August 2019.

Inventory was down 18.6% year-over-year in August compared to August 2019. Months of supply decreased to 3.0 months in August.

This was at the consensus forecast. I'll have more later.

Monday, September 21, 2020

Tuesday: Existing Home Sales, Fed Chair Powell Testimony

by Calculated Risk on 9/21/2020 09:00:00 PM

Tuesday:

• At 10:00 AM ET, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 6.00 million SAAR, up from 5.86 million in July. Housing economist Tom Lawler expects the NAR to report 5.92 million SAAR.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for September.

• At 10:30 AM, Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Financial Services, U.S. House of Representatives

September 21 COVID-19 Test Results

by Calculated Risk on 9/21/2020 06:24:00 PM

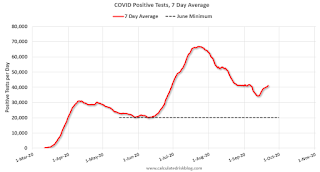

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 676,903 test results reported over the last 24 hours.

There were 39,467 positive tests.

Over 16,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.8% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 6.93%"

by Calculated Risk on 9/21/2020 04:00:00 PM

Note: This is as of September 13th.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 6.93%

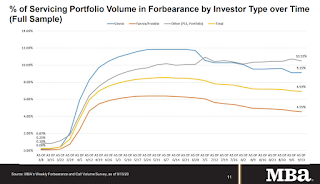

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 8 basis points from 7.01% of servicers’ portfolio volume in the prior week to 6.93% as of September 13, 2020. According to MBA’s estimate, 3.5 million homeowners are in forbearance plans.

...

“The share of loans in forbearance has dropped to its lowest level in five months, driven by a consistent decline in the GSE share in forbearance,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “However, not only the did the share of Ginnie Mae loans in forbearance increase, new requests for forbearance for these loans have increased for two consecutive weeks. While housing market data continue to show a quite strong recovery, the job market recovery appears to have slowed, and we are seeing the impact of this slowdown on FHA and VA borrowers in the Ginnie Mae portfolio.”

By stage, 31.65% of total loans in forbearance are in the initial forbearance plan stage, while 67.01% are in a forbearance extension. The remaining 1.34% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.

Mortgage Equity Withdrawal Increased in Q2

by Calculated Risk on 9/21/2020 02:53:00 PM

Note 1: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2020, the Net Equity Extraction was $28 billion, or a 0.60% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $81 billion in Q2.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth Increased $6.2 Trillion in Q2

by Calculated Risk on 9/21/2020 01:13:00 PM

The Federal Reserve released the Q2 2020 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $119.0 trillion during the second quarter of 2020. The value of directly and indirectly held corporate equities increased $5.7 trillion and the value of real estate increased $0.5 trillion.

Household debt increased 0.5 percent at an annual rate in the second quarter of 2020. Consumer credit shrank at an annual rate of 6.6 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 3 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2020, household percent equity (of household real estate) was at 65.6% - up from Q1.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 56.6% equity - and about 1.7 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.Mortgage debt increased by $81 billion in Q2.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 54.4% - up from Q2 due to the decline in GDP - but down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q2, and is above the average of the last 30 years.