by Calculated Risk on 9/14/2020 09:12:00 PM

Monday, September 14, 2020

Tuesday: Industrial Production, NY Fed Mfg

Tuesday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 5.9, up from 3.7.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 1.0% increase in Industrial Production, and for Capacity Utilization to increase to 71.5%.

September 14 COVID-19 Test Results

by Calculated Risk on 9/14/2020 07:11:00 PM

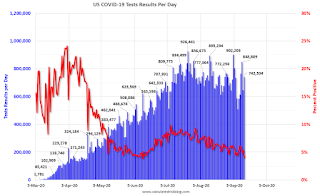

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 742,504 test results reported over the last 24 hours.

There were 29,853 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 7.01%", Forbearance Requests Increase

by Calculated Risk on 9/14/2020 04:00:00 PM

Note: This is as of September 6th.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 15 basis points from 7.16% of servicers’ portfolio volume in the prior week to 7.01% as of September 6, 2020. According to MBA’s estimate, 3.5 million homeowners are in forbearance plans.

...

“The beginning of September brought another drop in the share of loans in forbearance, with declines in both GSE and Ginnie Mae forbearance shares. However, at least a portion of the decline in the Ginnie Mae share was due to servicers buying delinquent loans out of pools and placing them on their portfolios. As a result of this transfer, the share of portfolio loans in forbearance increased,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance requests increased over the week, particularly for Ginnie Mae loans. With just under 1 million unemployment insurance claims still being filed every week, the lack of additional fiscal support for the unemployed could lead to even higher increases of those needing forbearance.”

By stage, 33.69% of total loans in forbearance are in the initial forbearance plan stage, while 65.35% are in a forbearance extension. The remaining 0.96% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last ten weeks.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.09% to 0.11%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.

Recession Measures and NBER

by Calculated Risk on 9/14/2020 11:59:00 AM

Calling the beginning or end of a recession usually takes time. However, the economic decline in March was so severe that the National Bureau of Economic Research (NBER) has already called the end of the expansion in February.

The committee has determined that a peak in monthly economic activity occurred in the U.S. economy in February 2020. The peak marks the end of the expansion that began in June 2009 and the beginning of a recession. The expansion lasted 128 months, the longest in the history of U.S. business cycles dating back to 1854. The previous record was held by the business expansion that lasted for 120 months from March 1991 to March 2001.The NBER will probably wait some time before calling the end of the recession, this process can take from 18 months to two years or longer.

...

The usual definition of a recession involves a decline in economic activity that lasts more than a few months. However, in deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration, and whether economic activity declined broadly across the economy (the diffusion of the downturn). The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions. Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.

In the mean time, if the economy slides into recession again, the committee will only consider it a new recession if most major indicators were close to or above their previous highs. Otherwise it will just be considered a continuation of the previous recession.

A good example of the NBER calling two separate recessions was in the early '80s, from the NBER memo:

"The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs."It will take some time for most major indicators to be above their previous high after the current recession because of the severe contraction as the graphs below show.

emphasis added

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.

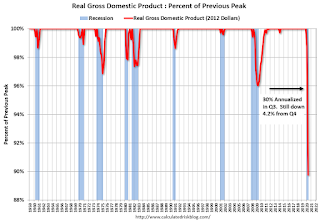

Click on graph for larger image.

Click on graph for larger image.This graph is for real GDP through Q2 2020.

This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession (April and in Q2).

As of Q2, real GDP was 10.2% below the pre-recession peak.

Most forecasters expect GDP to rebound strongly in Q3, but even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

It will take some time for real GDP to be above Q4 2019 levels.

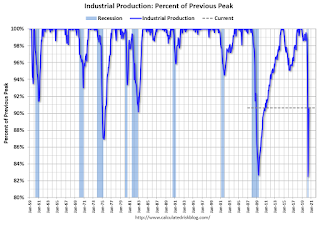

The second graph is for monthly industrial production based on data from the Federal Reserve through July 2020.

The second graph is for monthly industrial production based on data from the Federal Reserve through July 2020.Industrial production is off over 9.4% from the pre-recession peak, and will probably increase further in August (to be released this week).

Note that industrial production was weak prior to the onset of the pandemic.

Industrial production usually takes a long time to recover after a significant decline.

The third graph is for employment through August 2020.

The third graph is for employment through August 2020.Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous three recessions (1990-1991, 2001, 2007-2009).

Employment is currently off about 7.6% from the pre-recession peak (dashed line). This is an improvement from off 14.5% in April, but this was from returning temporary layoffs and not from an actual recovery.

It is likely that employment will not recover to pre-recession levels for some time.

And the last graph is for real personal income excluding transfer payments through July 2020.

And the last graph is for real personal income excluding transfer payments through July 2020.Real personal income less transfer payments was still off 5% in July.

Once again it will take a long time to return to pre-recession levels.

These graphs are useful in trying to identify peaks and troughs in economic activity.

Economic activity bottomed in Q2 (in April), but the pace of the actual recovery will depend on the course of the virus.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 9/14/2020 08:28:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

This data is as of September 13th.

The seven day average is down 66% from last year (33% of last year).

There has been a slow increase from the bottom.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 12, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

The 7 day average for New York is still off 62% YoY, and down 22% in Florida. There was a surge in restaurant dining around Labor Day - hopefully mostly outdoor dining.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through September 10th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through September 10th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up over the last few weeks, and were at $30 million last week (compared to usually under $200 million per week in the late Summer / early Fall).

Movie theaters are reopening (probably with limited seating at first).

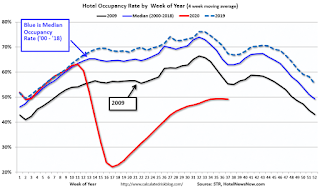

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This data is through September 5th.

COVID-19 crushed hotel occupancy, and is currently down 19% year-over-year (boosted by fires and a hurricane).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

The leisure travel season usually peaks at the beginning of August, and then the occupancy rate typically declines sharply in the Fall.

With so many schools closed, the leisure travel season might have lasted longer than usual this year, but it is unlikely business travel will pickup significantly in the Fall.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of September 4th, gasoline supplied was only off about 14.5% YoY (about 85.5% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer - and summer vacation might have lasted a little longer this year.

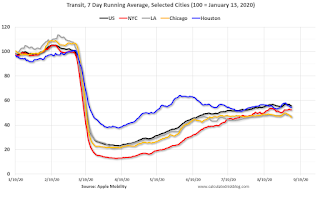

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 11th for the United States and several selected cities.

This data is through September 11th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 56% of the January level. It is at 46% in Chicago, and 54% in Houston.

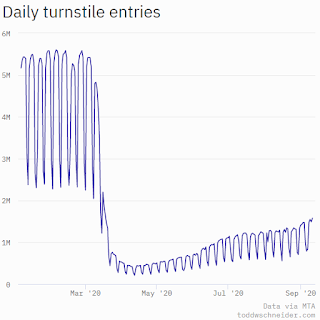

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, September 11th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"

Sunday, September 13, 2020

Sunday Night Futures

by Calculated Risk on 9/13/2020 09:00:00 PM

Weekend:

• Schedule for Week of September 13, 2020

• FOMC Preview

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 18 and DOW futures are up 135 (fair value).

Oil prices were down over the last week with WTI futures at $37.36 per barrel and Brent at $39.72 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.56 per gallon, so gasoline prices are down $0.38 per gallon year-over-year.

September 13 COVID-19 Test Results

by Calculated Risk on 9/13/2020 06:51:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 733,710 test results reported over the last 24 hours.

There were 38,543 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

FOMC Preview

by Calculated Risk on 9/13/2020 09:47:00 AM

Expectations are there will be no change to policy when the FOMC meets this week.

Here are some comments from Goldman Sachs economist David Mericle:

The Fed concluded its framework review between meetings with the adoption of a new flexible average inflation targeting strategy in August. We expect the FOMC to modify its post-meeting statement to recognize the new approach by replacing the current reference to its “symmetric 2 percent inflation objective” with a reference to “inflation that averages 2% over time.”For review, here are the June FOMC projections. Projections will be updated at this meeting and there will be substantial changes to GDP, the unemployment rate, and inflation projections.

The Summary of Economic Projections is likely to show large upgrades to the growth and unemployment forecasts in recognition of the surprisingly strong data over the last few months. But we expect that the median projection will still show an unemployment rate modestly above the longer-run rate and inflation just below 2% even at the end of the forecast horizon in 2023, a bit short of the conditions that we expect to eventually trigger liftoff.

Note that GDP decreased at a 5.0% annual rate in Q1, and decreased at a 31.7% annual rate in Q2.

Most forecasts are for GDP to increase at a 25% to 35% annual rate in Q3.

It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Merrill Lynch is projecting:

We revise up our 3Q GDP forecast to 27% qoq saar from 15% previously, but take down 4Q to 3.0% qoq saar from 5.0%. 2Q GDP is tracking -31.6% qoq saar.Based on Merrill's projections, GDP would decline 4.0% in Q4 2020 compared to Q4 2019.

This suggests the FOMC will revise up their GDP projections for 2020, and possibly revise down their projections for the following years.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | -7.6 to -5.5 | 4.5 to 6.0 | 3.0 to 4.5 | |

The unemployment rate was at 8.4% in August. The unemployment rate declined faster than most expectations.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there almost 14 million people unemployed, close to 4 million people have left the labor force since January. And millions more are being supported by various provisions for the CARES Act - that hasn't been renewed

The unemployment rate will be revised down for all three years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 9.0 to 10.0 | 5.9 to 7.5 | 4.8 to 6.1 | |

As of July 2020, PCE inflation was up 1.0% from July 2019. The projections for inflation will be revised up this month.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.6 to 1.0 | 1.4 to 1.7 | 1.6 to 1.8 | |

PCE core inflation was up 1.3% in July year-over-year. Projections for core inflation will be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.9 to 1.1 | 1.4 to 1.7 | 1.6 to 1.8 | |

Projections will change significantly this month, with GDP being revised up for 2020, and the unemployment rate revised down. Inflation will also be revised up.

Saturday, September 12, 2020

September 12 COVID-19 Test Results

by Calculated Risk on 9/12/2020 06:27:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 763,682 test results reported over the last 24 hours.

There were 37,295 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

Schedule for Week of September 13, 2020

by Calculated Risk on 9/12/2020 08:11:00 AM

The key economic reports this week are August Housing Starts and Retail Sales.

For manufacturing, August Industrial Production, and the September New York and Philly Fed surveys, will be released this week.

The FOMC meets this week, and no change to policy is expected.

No major economic releases scheduled.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 5.9, up from 3.7.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 1.0% increase in Industrial Production, and for Capacity Utilization to increase to 71.5%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 1.0% increase in retail sales.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 1.0% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis in July.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 78, unchanged from 78 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

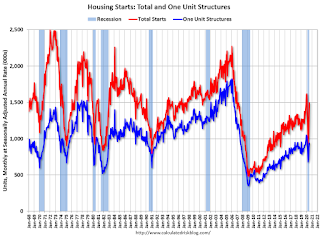

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.470 million SAAR, down from 1.496 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The early consensus is for a 900 thousand initial claims, up from 884 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 15.5, down from 17.2.

10:00 AM: State Employment and Unemployment (Monthly) for August 2020

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for September).