by Calculated Risk on 9/04/2020 07:17:00 PM

Friday, September 04, 2020

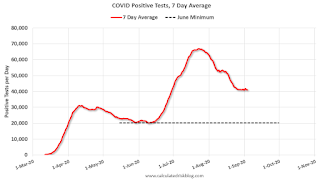

September 4 COVID-19 Test Results

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 902,125 test results reported over the last 24 hours.

There were 51,513 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.7% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

AAR: August Rail Carloads down 14.9% YoY, Intermodal Up 3.0% YoY

by Calculated Risk on 9/04/2020 02:32:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Does slow and steady really win the race? U.S. railroads might find out, because slow and steady (with a long way to go) generally describes the improvements in U.S. carload traffic in recent months.

Total U.S. rail carloads fell 14.9% in August 2020 from August 2019. their 19th straight year-over year decline. That’s not great, obviously, but it’s the smallest percentage decline since March 2020. ... Intermodal, though, is doing great. ... Relatively strong consumer spending on goods is helping intermodal.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

U.S. railroads originated an average of 224,557 total carloads per week in August 2020. That’s the lowest weekly average for total carloads for August since sometime before 1988, when our data begin. It’s also down 14.9% from August 2019. Still, there’s progress: August 2020 had the highest weekly average carloads and the smallest year-over-year percentage decline in five months.

In the first eight months of 2020, total carloads were down 16.0%, or 1.42 million carloads, from 2019.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. intermodal volume averaged 280,739 containers and trailers per week in August 2020 — the most since October 2018, the fifth most for any month in history, and up 3.0% over August 2019. The last time intermodal had a year-over-year monthly increase of any size was January 2019. ... total U.S. consumer spending is still well below pre-pandemic levels, but spending on goods (as opposed to services) is actually above pre-pandemic levels. That’s sure to be helping rail intermodal volumes.Note that rail traffic was weak prior to the pandemic.

Q3 GDP Forecasts

by Calculated Risk on 9/04/2020 12:22:00 PM

From Merrill Lynch:

We continue to track 2Q GDP at -31.7% qoq saar, unchanged from the second estimate. 3Q GDP tracking is now at 25% qoq saar, up from 19% last week owing to strong exports and auto sales. [Sept 4 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 15.6% for 2020:Q3 and 7.3% for 2020:Q4. [Sept 4 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 29.6 percent September 3, up from 28.5 percent on September 1 [Sept 3 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 25% annualized increase in Q3 GDP, is about 5.7% QoQ, and would leave real GDP down about 5.1% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 25% annualized increase in real GDP would look like in Q3.

Even with a 25% annualized increase (about 5.7% QoQ), real GDP will be down about 5.1% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Comments on August Employment Report

by Calculated Risk on 9/04/2020 09:21:00 AM

The labor market swings have been huge, and the August employment report was at expectations of 1.4 million jobs added, although private employment was below expectations.

Leisure and hospitality added another 174 thousand jobs in August, following 4 million jobs added in May, June and July. Leisure and hospitality lost 8.3 million jobs in March and April, so about 50% of those jobs were added back in May, June, July and August.

Earlier: August Employment Report: 1.4 Million Jobs Added, 8.4% Unemployment Rate

In August, the year-over-year employment change was minus 10.25 million jobs.

As expected, there were 238 thousand temporary Decennial Census workers hired (and included in this report). These jobs will be lost in a few months. "A job gain in federal government (+251,000) reflected

the hiring of 238,000 temporary 2020 Census workers."

Permanent Job Losers

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the August report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In August, the number of permanent job losers increased sharply to 3.411 million from 2.877 million in July.

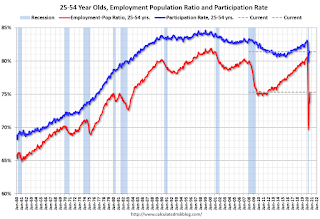

Prime (25 to 54 Years Old) Participation

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased slightly in August to 81.4%, and the 25 to 54 employment population ratio increased to 75.3%.

Part Time for Economic Reasons

"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 871,000 to 7.6 million in August, reflecting a decrease in the number of people who worked part time due to slack work or business conditions (-1.1 million)."The number of persons working part time for economic reasons decreased in August to 7.572 million from 8.443 million in July.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 14.2% in August. This is down from the record high in April 22.8% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.501 million workers who have been unemployed for more than 26 weeks and still want a job.

This will increase sharply in September or October - since the largest number of layoffs were in April - and will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was at expectations but the previous two months were revised down 39,000 combined. The headline unemployment rate decreased to 8.4%.

August Employment Report: 1.4 Million Jobs Added, 8.4% Unemployment Rate

by Calculated Risk on 9/04/2020 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 1.4 million in August, and the unemployment rate fell to 8.4 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it. In August, an increase in government employment largely reflected temporary hiring for the 2020 Census.

...

In August, the unemployment rate declined by 1.8 percentage points to 8.4 percent, and the number of unemployed persons fell by 2.8 million to 13.6 million. Both measures have declined for 4 consecutive months but are higher than in February, by 4.9 percentage points and 7.8 million, respectively.

...

The change in total nonfarm payroll employment for June was revised down by 10,000, from +4,791,000 to +4,781,000, and the change for July was revised down by 29,000, from +1,763,000 to +1,734,000. With these revisions, employment in June and July combined was 39,000 less than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In August, the year-over-year change was negative 10.25 million jobs.

Total payrolls increased by 1.4 million in August.

Payrolls for June and July were revised down 39 thousand combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.7% in August. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.7% in August. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 56.5% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in August to 8.4%.

This was at consensus expectations of 1.4 million jobs added, and June and July were revised down by 39,000 combined.

I'll have much more later …

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 9/04/2020 07:00:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of September 1st.

From Forbearances Improve Slightly

After holding flat for the last couple of weeks, the total number of mortgages in active forbearance saw stronger than expected improvement, with the number of active forbearance plans declining by 147k (-4%) over the past week.

Active forbearances are now down about 1M (-21%) since the peak in May.

According to Black Knight’s McDash Flash Forbearance Tracker, as of September 1, 3.8M mortgages remain in active COVID-19 related forbearance plans, representing 7.1% of all active mortgages, down from 7.4%. Together, they represent $804 billion in unpaid principal. Of these, 75% have had their terms extended

...

As we covered in the most recent Mortgage Monitor report, forbearance starts have shown little impact from the reduction in expanded unemployment benefits thus far. Through the first four weeks of August, forbearance starts were down 13% M/M from the comparable 4-week period in July. September may provide the true test, though, as impacted borrowers were still receiving full expanded unemployment benefits up through July 31.

More than 2M COVID-19-related forbearance plans are now set to expire in September, setting up a significant volume of extension/removal activity in late September/early October, reminiscent to what was seen in late June and early July, albeit to a slightly lesser degree.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: I'm still expecting another disaster relief package soon, but we might see an increase in forbearance activity in the coming weeks as we wait for additional relief.

Thursday, September 03, 2020

Friday: Employment Report

by Calculated Risk on 9/03/2020 09:00:00 PM

My August Employment Preview

Goldman August Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for August. The consensus is for 1.40 million jobs added, and for the unemployment rate to decrease to 9.8%.

This graph shows the job losses from the start of the employment recession, in percentage terms through July.

The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

September 3 COVID-19 Test Results

by Calculated Risk on 9/03/2020 06:28:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 723,524 test results reported over the last 24 hours.

There were 44,294 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

Goldman August Payrolls Preview

by Calculated Risk on 9/03/2020 03:54:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payroll growth rose 1.9mn in August, above consensus of +1.35mn. The resurgence of the coronavirus did not produce a meaningful increase in layoffs in the Sun Belt based on jobless claims data, and high-frequency surveys replicating the BLS approach indicate robust August job gains. ... We also expect a 0.25mn boost from Census canvassing activities.

…

We estimate the unemployment rate declined by 0.4pp to 9.8%

emphasis added

August Employment Preview

by Calculated Risk on 9/03/2020 12:57:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for an increase of 1.4 million non-farm payroll jobs, and for the unemployment rate to decrease to 9.8%.

There will be at least two distortions to the August report. (For details, see: August Employment Report: Comments on Temporary Decennial Census Hiring and Education). The decennial Census will add 237,800 temporary jobs (the jobs data should be reported ex-Census to show the underlying trend). Also, due to the delays in school openings, the usual number of educators were probably not hired in August. The BLS model will expect about 415,000 seasonal education jobs added in August. If fewer jobs are added, the BLS will report that education jobs were lost Seasonally Adjusted. For example, if only 115,000 jobs are added in August, then the BLS will report around 300 thousand education jobs lost.

The ADP employment report showed a gain of 428,000 private sector jobs, far below the consensus estimate of 900 thousand jobs. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be weaker than expected.

The ISM manufacturing employment index increased in August to 46.3% from 44.3% in July, but still well below 50. This would suggest around 40,000 manufacturing jobs lost in August - although ADP showed 9,000 manufacturing jobs added.

The ISM Services employment index increased in August to 47.9%, from 42.1% in July, and is still below 50. This would suggest little change in service jobs lost in August. Combined, the ISM surveys suggest around 40,000 private sector jobs lost in July.

The weekly claims report showed a high number total continuing unemployment claims during the reference week, although this was down about 2 million from the reference week in July.

There are other indicators that analysts are looking at - like Homebase hours worked (see Ernie Tedeschi comments). Ernie estimates 800 thousand jobs added (SA) and for the unemployment rate to decline to 9.4%. This doesn't include temporary decennial hiring, and also excludes any distortion from education delays.

Merrill Lynch forecasts: "August nonfarm payrolls are likely to rise by 1.2mn and the unemployment rate should improve to 9.6%, falling back down to single digit territory."

• Conclusion: There is a wide range of estimates for the August report. In general, the employment related data has been weaker than expected, and I'll take the under, ex-Census.