by Calculated Risk on 8/27/2020 11:45:00 AM

Thursday, August 27, 2020

Hotels: Occupancy Rate Declined 30.3% Year-over-year, "Fell to a three-week low"

From HotelNewsNow.com: STR: US hotel results for week ending 22 August

U.S. hotel occupancy fell to a three-week low during the period of 16-22 August, according to the latest data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

16-22 August 2020 (percentage change from comparable week in 2019):

• Occupancy: 48.8% (-30.3%)

• Average daily rate (ADR): US$100.08 (-22.7%)

• Revenue per available room (RevPAR): US$48.81 (-46.1%)

The prior week, the industry had reached 50% occupancy for the first time since mid-March. Lower occupancy came as U.S. room demand declined week over week for the first time since mid-April. Reflective of school openings and less vacation travel, the industry sold 492,000 fewer room nights than the previous week, which represented a decrease of 2.7%. STR projects similar challenges with no corporate demand to replace leisure demand lost to the beginning of the school year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The leisure travel season usually peaks at the beginning of August, and then the occupancy rate typically declines sharply in the Fall.

With so many schools closed, the leisure travel season might have lasted longer than usual this year, but it is unlikely business travel will pickup significantly in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Pending Home Sales Increase 5.9% in July

by Calculated Risk on 8/27/2020 10:03:00 AM

From the NAR: Pending Home Sales Rise 5.9% in July

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose 5.9% to 122.1 in July. Year-over-year, contract signings rose 15.5%. An index of 100 is equal to the level of contract activity in 2001.This was slightly above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

...

The Northeast PHSI grew 25.2% to 112.3 in July, a 20.6% jump from a year ago. In the Midwest, the index rose 3.3% to 114.6 last month, up 15.4% from July 2019.

Pending home sales in the South increased 0.9% to an index of 142.0 in July, up 14.9% from July 2019. The index in the West rose 6.8% in July to 106.4, up 13.2% from a year ago.

emphasis added

Fed Chair Jerome Powell: Monetary Policy Framework Review

by Calculated Risk on 8/27/2020 09:07:00 AM

From Fed Chair Powell: Monetary Policy Framework Review

Federal Open Market Committee announces approval of updates to its Statement on Longer-Run Goals and Monetary Policy Strategy

This is on YouTube here.

Weekly Initial Unemployment Claims decrease to 1,006,000

by Calculated Risk on 8/27/2020 08:44:00 AM

The DOL reported:

In the week ending August 22, the advance figure for seasonally adjusted initial claims was 1,006,000, a decrease of 98,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 1,106,000 to 1,104,000. The 4-week moving average was 1,068,000, a decrease of 107,250 from the previous week's revised average. The previous week's average was revised down by 500 from 1,175,750 to 1,175,250.The previous week was revised down.

emphasis added

This does not include the 607,806 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 524,986 the previous week.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,068,000.

Initial weekly claims was below the consensus forecast of 1.100 million initial claims, and the previous week was revised down.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 14,535,000 (SA) from 14,758,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 10,972,770 receiving Pandemic Unemployment Assistance (PUA) that decreased from 11,224,774 the previous week. This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Q2 GDP Revised up to -31.7% Annual Rate

by Calculated Risk on 8/27/2020 08:34:00 AM

From the BEA: Gross Domestic Product, 2nd Quarter 2020 (Second Estimate); Corporate Profits, 2nd Quarter 2020 (Preliminary Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 31.7 percent in the second quarter of 2020, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 5.0 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up to -34.1% from -34.6%. Residential investment was revised up from -38.7% to -37.9%. This was close to the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the decrease in real GDP was 32.9 percent. With the second estimate, private inventory investment and personal consumption expenditures (PCE) decreased less than previously estimated.

emphasis added

Wednesday, August 26, 2020

Thursday: GDP, Unemployment Claims, Fed Chair Powell Speech, Pending Home Sales

by Calculated Risk on 8/26/2020 08:50:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2020 (second estimate). The consensus is that real GDP decreased 32.6% annualized in Q2, up from the advance estimate of -32.9% in Q2.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The early consensus is for a 1.100 million initial claims, down from 1.106 million the previous week.

• At 9:10 AM, Speech, Fed Chair Jerome Powell, Monetary Policy Framework Review, At the Jackson Hole Economic Policy Symposium - Navigating the Decade Ahead: Implications for Monetary Policy

• At 10:00 AM, Pending Home Sales Index for July. The consensus is for a 4.5% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

August 26 COVID-19 Test Results

by Calculated Risk on 8/26/2020 07:48:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 675 thousand test results reported over the last 24 hours.

There were 43 thousand positive tests.

There have been over 26,000 COVID reported deaths in the first 26 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Zillow Case-Shiller Forecast: Year-over-year House Price Growth to Increase Slightly in July

by Calculated Risk on 8/26/2020 03:01:00 PM

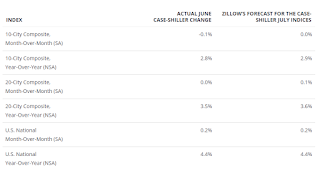

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: June Case-Shiller Results and July Forecast: Housing Continues to Withstand Pandemic

The June Case-Shiller numbers show the housing market continues to withstand the pandemic-driven blows that have caused so many other facets of the economy to suffer. ...

...

Mortgage rates and for-sale inventory are each plumbing new lows, ratcheting up competition for the few homes on the market. That’s placed consistent upward pressure on home prices, a trend that has held through the summer. While recent data suggest headwinds such as the enduring spread of the coronavirus and uncertainty surrounding the next round of relief payments could jeopardize the path of the economic recovery, these concerns haven’t materialized in home prices to this point. It could be that the housing market will eventually suffer as these concerns linger, but it appears that low rates are here to stay for now, which should continue to send prices higher.

Annual growth in July as reported by Case-Shiller is expected to speed up slightly in the 10- and 20-city indices, and stay steady in the national index. S&P Dow Jones Indices is expected to release data for the July S&P CoreLogic Case-Shiller Indices on Tuesday, September 29.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.4% in July, up from 4.3% in June (table says 4.4% in June, but CS reported a 4.3% gain).

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.4% in July, up from 4.3% in June (table says 4.4% in June, but CS reported a 4.3% gain). The Zillow forecast is for the 20-City index to be up 3.6% YoY in July from 3.5% in June, and for the 10-City index to increase to be up 2.9% YoY compared to 2.8% YoY in June.

New Home Prices

by Calculated Risk on 8/26/2020 10:12:00 AM

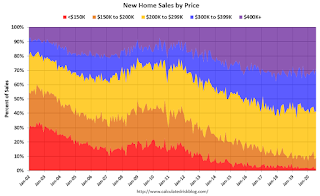

As part of the new home sales report released yesterday, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in July 2020 was $330,600. The average sales price was $391,300."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in July 2020 was $391,300, up 2.5% from June, and down 2.9% from the peak in 2017. The median price was $330,600, down 1.9% from June, and down 3.9% from the peak in 2017.

The average and median house prices have mostly moved sideways since 2017 due to home builders offering more lower priced homes.

The second graph shows the percent of new homes sold by price.

The $400K+ bracket increased significantly since the housing recovery started, but has been holding steady recently - and declined over the last year. A majority of new homes (about 62%) in the U.S., are in the $200K to $400K range.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/26/2020 07:00:00 AM

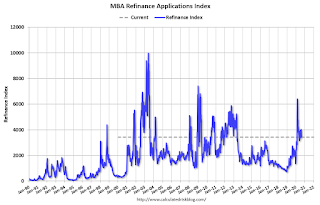

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 21, 2020.

... The Refinance Index decreased 10 percent from the previous week and was 34 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 0.4 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 33 percent higher than the same week one year ago.

“Mortgage rates were mixed last week, but the rates for 30-year fixed mortgages and 15-year fixed mortgages declined. Despite the lower rates, conventional refinance applications fell 11 percent and government refinance applications fell 6 percent, which pushed the total refinance index to its lowest weekly level since July,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The home purchase market remains a bright spot for the overall economy. Purchase applications were essentially unchanged but were 33 percent higher than a year ago – the 14th straight week of year-over-year gains. Mortgage rates at record lows and households looking for more space are driving this summer’s surge in demand.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.11 percent from 3.13 percent, with points increasing to 0.38 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 33% year-over-year.

Note: Red is a four-week average (blue is weekly).