by Calculated Risk on 8/24/2020 04:00:00 PM

Monday, August 24, 2020

MBA Survey: "Share of Mortgage Loans in Forbearance Declines Slightly to 7.20%"

Note: This is as of August 16th.

From the MBA: Share of Mortgage Loans in Forbearance Declines Slightly to 7.20%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 7.21% of servicers’ portfolio volume in the prior week to 7.20% as of August 16, 2020. According to MBA’s estimate, 3.6 million homeowners are in forbearance plans.

...

“The share of loans in forbearance declined for the tenth week in a row, but the rate of improvement has slowed markedly. The extremely high rate of initial claims for unemployment insurance and high level of unemployment remain a concern, and are indications of the challenges many households are facing,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While new forbearance requests remain low, particularly for Fannie Mae and Freddie Mac loans, the pace of exits from forbearance has declined for two straight weeks.”

By stage, 37.91% of total loans in forbearance are in the initial forbearance plan stage, while 61.34% are in a forbearance extension. The remaining 0.75% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last ten weeks.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) decreased to 0.10 percent from 0.11 percent the previous week."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.

NMHC: Rent Payment Tracker Shows Decline in Households Paying Rent

by Calculated Risk on 8/24/2020 10:12:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 90 Percent of Apartment Households Paid Rent as of August 20

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 90 percent of apartment households made a full or partial rent payment by August 20 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: This is mostly for large, professionally managed properties. It appears fewer people are paying their rent this year compared to last year - down 2.1 percentage points from a year ago - and also down 1.3 percentage points compared to last month (July 2020). This hasn't fallen off a cliff - yet.

This is a 2.1-percentage point, or 237,056 -household decrease from the share who paid rent through August 20, 2019 and compares to 91.3 percent that had paid by July 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“Lawmakers in Congress and the Administration need to come back to the table and work together on comprehensive legislation that protects and supports tens of millions of American renters by extending unemployment benefits and providing desperately needed rental assistance,” said Doug Bibby, NMHC President. “The industry remains encouraged by the degree residents have prioritized their housing obligations so far, but each passing day means more distress for individuals and families, and greater risk for the nation’s housing sector. If policymakers want to prevent a health and economic crisis from quickly evolving into a housing crisis, they should act quickly to extend financial assistance to renters.”

emphasis added

People were still receiving the extra unemployment benefits for most of July, and were able to make their August rent payment. Without additional disaster relief, I expect more people will miss their September rent payment.

Chicago Fed National Activity "Index Suggests Slower, but Still Well-Above-Average Growth in July"

by Calculated Risk on 8/24/2020 10:00:00 AM

Note: This is a composite index of other data.

From the Chicago Fed: Index Suggests Slower, but Still Well-Above-Average Growth in July

Led by some moderation in the growth of production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) declined to +1.18 in July from +5.33 in June. Three of the four broad categories of indicators used to construct the index made positive contributions in July, but all four categories decreased from June. The index’s three-month moving average, CFNAI-MA3, rose to +3.59 in July from –2.78 in June.This graph from the Chicago Fed shows the Chicago Fed National Activity Index by category.

emphasis added

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Eight High Frequency Indicators for the Economy

by Calculated Risk on 8/24/2020 08:22:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

This data is as of August 23rd.

The seven day average is down 70% from last year. There had been a slow steady increase from the bottom, but air travel is just creeping up over the last several weeks.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through Aug 22, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

The 7 day average for New York is still off 65% YoY, and down 44% in Texas.

It appears dining is increasing again, probably mostly outdoor dining.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through August 20th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through August 20th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up over the last two weeks, and were over $2 million last week (compared to usually around $300 million per week).

Most movie theaters are still closed, but a few seem to be reopening (probably with limited seating at first).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This data is through August 15th.

COVID-19 crushed hotel occupancy, however the occupancy rate has increased in 17 of the last 18 weeks, and is currently down 30% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June and declines toward the end of summer. So some of the recent pickup might be seasonal (summer travel). The leisure travel season usually peaks at the beginning of August (right now), and the occupancy rate typically declines sharply in the Fall.

With so many schools closed, the leisure travel season might be lasting longer this year than usual.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline consumption compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline consumption compared to the same week last year of .At one point, gasoline consumption was off almost 50% YoY.

As of August 14th, gasoline consumption was only off about 10% YoY (about 90% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 22nd for the United States and several selected cities.

This data is through August 22nd for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 56% of the January level. It is at 48% in Los Angeles, and 56% in Houston.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, August 21st.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"

Sunday, August 23, 2020

Sunday Night Futures

by Calculated Risk on 8/23/2020 10:32:00 PM

Weekend:

• Schedule for Week of August 23, 2020

• The Failed Promises of the 2017 Tax Cuts and Jobs Act (TCJA)

• Q3 GDP Forecasts

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 80 (fair value).

Oil prices were mixed over the last week with WTI futures at $42.34 per barrel and Brent at $44.35 barrel. A year ago, WTI was at $54, and Brent was at $59 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.58 per gallon, so gasoline prices are down $0.40 per gallon year-over-year.

August 23 COVID-19 Test Results

by Calculated Risk on 8/23/2020 06:24:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 611,382 test results reported over the last 24 hours.

There were 38,234 positive tests.

There have been 23,458 COVID reported deaths in the first 23 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The Failed Promises of the 2017 Tax Cuts and Jobs Act (TCJA)

by Calculated Risk on 8/23/2020 11:36:00 AM

We all remember the promises for the 2017 Tax Cuts and Jobs Act (TCJA):

1) "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate."

2) Boost business investment

3) Pay for itself (No increase in the deficit)

4) Give the typical American household around a $4,000 pay raise

Here are a few quotes from 2017:

"This change, along with a lower business tax rate, would likely give the typical American household around a $4,000 pay raise." Donald Trump, October 19, 2017

“Not only will this tax plan pay for itself, but it will pay down debt,” Treasury Secretary Steve Mnuchin, Sept 2017

“I think this tax bill is going to reduce the size of our deficits going forward,” Sen. Pat Toomey (R-PA), November 2017

First, on that $4,000 pay raise, from Motley Fool: Want a Tax Cut? Here's How Much Typical Americans Saved in 2018. The analysis suggests around $1,600 to $1,900, not $4,000.

And from the Heritage Foundation: The Truth About How Much Americans Are Paying in Taxes.

"the average American household paid about $1,400 less in taxes"And on GDP, the following table shows quarterly real GDP growth (annualized) from the BEA since the TCJA was signed. The average growth in the first eight quarters was 2.4% - nothing special - and definitely not the promised "3.5 percent per year on average". And basically the same growth rate prior to Trump taking office.

Note: There was some pickup in early 2018 (as expected), but growth slowed in 2019. This does not include the economic collapse in the first half of 2020.

| Quarter | Real GDP Growth Annualized |

|---|---|

| Q1 2018 | 3.8% |

| Q2 2018 | 2.7% |

| Q3 2018 | 2.1% |

| Q4 2018 | 1.3% |

| Q1 2019 | 2.9% |

| Q2 2019 | 1.5% |

| Q3 2019 | 2.6% |

| Q4 2019 | 2.4% |

What about investment?

Click on graph for larger image.

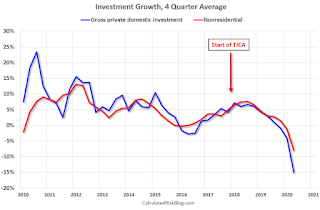

Click on graph for larger image.This graph shows a 4 quarter average growth in Gross private domestic investment (Blue) and Nonresidential Private Investment (Red).

There was a slump in investment in 2015 and 2016 due to the collapse in oil prices, but there has been no discernible pickup in investment growth since the passage of the TCJA.

In fact, Gross private domestic investment had turned negative prior to the impact of the pandemic!

And what about the deficit?

The deficit has increased sharply during the pandemic, but the deficit had already increased significantly prior to the impact of COVID-19.

From the CBO December 2019 monthly budget review:

The federal budget deficit was $358 billion in the first quarter of fiscal year 2020, the Congressional Budget Office estimates, $39 billion more than the deficit recorded during the same period last year.Compare that to December 2017 (before the TCJA):

The federal budget deficit was $228 billion in the first quarter of fiscal year 2018So the TCJA didn't pay for itself and caused a significant increase in the deficit.

In summary, there was no discernible boost in investment (investment actually fell). No sustained increase in GDP growth. No $4,000 pay raise. And the TCJA didn't pay for itself.

Saturday, August 22, 2020

August 22 COVID-19 Test Results

by Calculated Risk on 8/22/2020 05:48:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 745,384 test results reported over the last 24 hours.

There were 46,295 positive tests.

There have been 22,886 COVID reported deaths in the first 22 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.2% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Q3 GDP Forecasts

by Calculated Risk on 8/22/2020 09:35:00 AM

From Merrill Lynch:

2Q GDP is likely to be revised up to -32% qoq saar in the second release. We are tracking 17% for 3Q GDP. [August 17 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 14.6% for 2020:Q3. [August 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 25.6 percent on August 18, down from 26.2 percent on August 14. [August 18 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 15% annualized increase in GDP is about 3.6% quarter-over-quarter (QoQ). Also, a 15% annualized increase would leave real GDP down about 7.5% from Q4 2019.

A 25% annualized increase in Q3 GDP, is about 5.7% QoQ, and would leave real GDP down about 5.5% from Q4 2019.

The following graph illustrates these declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.6% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The two black arrows show what a 15% or 25% annualized increase in real GDP would look like in Q3.

Even with a 25% annualized increase (about 5.7% QoQ), real GDP will be down about 5.5% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Schedule for Week of August 23, 2020

by Calculated Risk on 8/22/2020 08:11:00 AM

The key reports this week are the second estimate of Q2 GDP and July New Home sales.

Other key reports include Personal Income and Outlays for July and Case-Shiller house prices for June.

For manufacturing, the August Richmond and Kansas City Fed surveys will be released.

In widely anticipated speech, Fed Chair Jerome Powell will discuss the Monetary Policy Framework Review at the Jackson Hole Symposium on Thursday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 3.6% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for June 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 786 thousand SAAR, down from 776 thousand in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 4.3% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 2nd quarter 2020 (second estimate). The consensus is that real GDP decreased 32.6% annualized in Q2, up from the advance estimate of -32.9% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The early consensus is for a 1.100 million initial claims, down from 1.106 million the previous week.

9:10 AM: Speech, Fed Chair Jerome Powell, Monetary Policy Framework Review, At the Jackson Hole Economic Policy Symposium - Navigating the Decade Ahead: Implications for Monetary Policy

10:00 AM: Pending Home Sales Index for July. The consensus is for a 4.5% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM ET: Personal Income and Outlays, July 2020. The consensus is for a 0.2% decrease in personal income, and for a 1.5% increase in personal spending. And for the Core PCE price index to increase 0.5%.

9:45 AM: Chicago Purchasing Managers Index for August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 72.8.