by Calculated Risk on 8/21/2020 05:59:00 PM

Friday, August 21, 2020

August 21 COVID-19 Test Results

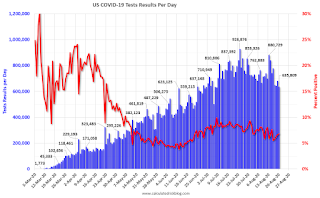

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 731,920 test results reported over the last 24 hours.

There were 46,821 positive tests.

There have been 21,851 COVID reported deaths in the first 21 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

DOT: Vehicle Miles Driven decreased 14.5% year-over-year in June

by Calculated Risk on 8/21/2020 02:47:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -13.0% (-36.5 billion vehicle miles) for June 2020 as compared with June 2019. Travel for the month is estimated to be 244.7 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for June 2020 is 231.3 billion miles, a -14.5% (-39.2 billion vehicle miles) decline from June 2019. It also represents 15.6% increase (31.3 billion vehicle miles) compared with May 2020.

Cumulative Travel for 2020 changed by -16.6% (-264.2 billion vehicle miles). The cumulative estimate for the year is 1,331.2 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Miles driven declined during the great recession, and the rolling 12 months stayed below the previous peak for a record 85 months.

Miles driven declined sharply in March, and really collapsed in April. Miles driven rebounded in May and June, but is still down 14.5% YoY (seasonally adjusted).

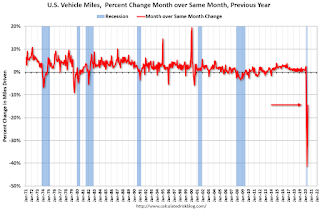

This graph shows the YoY change in vehicle miles driven.

This graph shows the YoY change in vehicle miles driven.Miles driven were down 14.5% year-over-year in June. Based on gasoline consumption, I expect vehicle miles rebounded further in July.

BLS: July Unemployment rates down in 30 states; 3 States at New Series Highs

by Calculated Risk on 8/21/2020 02:06:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in July in 30 states, higher in 9 states, and stable in 11 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. All 50 states and the District had jobless rate increases from a year earlier. The national unemployment rate fell by 0.9 percentage point over the month to 10.2 percent but was 6.5 points higher than in July 2019.

...

Massachusetts had the highest unemployment rate in July, 16.1 percent, followed by New York, 15.9 percent. The rates in Connecticut (10.2 percent), New Mexico (12.7 percent), and New York (15.9 percent) set new series highs. (All state series begin in 1976.) Utah had the lowest unemployment rate, 4.5 percent, followed by Nebraska, 4.8 percent, and Idaho, 5.0 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the unemployment rate in two lockdown states (New York and New Jersey), and two early open states (Florida and Texas).

This will be interesting to track. New York and New Jersey locked down, and then waited to reopen. Florida and Texas reopened sooner.

Currently New York and New Jersey are averaging about 900 new positive cases per day, combined.

Florida and Texas are averaging about 11,500 cases per day.

Black Knight: National Mortgage Delinquency Rate Decreased in July, "Serious Delinquencies Climb"

by Calculated Risk on 8/21/2020 11:53:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Total Number of Past Due Mortgages Improves in July While Serious Delinquencies Climb; Monthly Prepayment Activity Hits 16-Year High

• Mortgage delinquencies continued to improve in July, falling 9% from June, with more than 340,000 fewer past due mortgages than in the month priorAccording to Black Knight's First Look report, the percent of loans delinquent decreased 8.9% in July compared to June, and increased 100% year-over-year.

• Early-stage delinquencies – loans with a single missed payment – have fallen below pre-pandemic levels, suggesting that the initial inflow of new COVID-19-related delinquencies has subsided

• However, serious delinquencies – those 90 or more days past due – rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels

• Foreclosure activity continues to remain muted due to widespread moratoriums; though starts rose for the month, overall activity remains near record lows

• Prepayment activity edged slightly higher in July, hitting its highest monthly mark since early 2004, as low rates continue to drive both refinance and purchase activity

emphasis added

The percent of loans in the foreclosure process decreased 1.8% in July and were down 28% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 6.91% in July, down from 7.59% in June.

The percent of loans in the foreclosure process decreased slightly in July to 0.36% from 0.36% in June.

The number of delinquent properties, but not in foreclosure, is up 1,885,000 properties year-over-year, and the number of properties in the foreclosure process is down 68,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2020 | June 2020 | July 2019 | July 2018 | |

| Delinquent | 6.91% | 7.59% | 3.46% | 3.61% |

| In Foreclosure | 0.36% | 0.36% | 0.49% | 0.57% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 3,692,000 | 4,034,000 | 1,807,000 | 1,861,000 |

| Number of properties in foreclosure pre-sale inventory: | 190,000 | 192,000 | 258,000 | 293,000 |

| Total Properties | 3,881,000 | 4,226,000 | 2,065,000 | 2,154,000 |

Comments on July Existing Home Sales

by Calculated Risk on 8/21/2020 10:24:00 AM

Earlier: NAR: Existing-Home Sales Increased to 5.86 million in July

A few key points:

1) This was the highest sales rate since 2006. Existing home sales are counted at the close of escrow, so the July report was mostly for contracts signed in May and June - when the economy was much more open than in the previous months. Some of the increase over the last two months was probably related to pent up demand from the shutdowns in March and April. However, with the high unemployment rate, the high rate of COVID infections, the increase in mortgage rates (still low, but up from recent lows) housing might be under some pressure later this year. That is difficult to predict and depends on the course of the pandemic.

2) Inventory is very low, and was down 21.1% year-over-year (YoY) in July. This is the lowest level of inventory for July since at least the early 1990s.

3) As usual, housing economist Tom Lawler was much closer to the actual NAR report than the consensus forecast. For July, Lawler forecast the NAR would report 5.85 million, and the NAR reported 5.86 million (almost exact). The consensus was 5.39 million.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 5% compared to the same period in 2019.

Sales NSA in July (597,000) were 10.6% above sales last year in July (540,000).

NAR: Existing-Home Sales Increased to 5.86 million in July

by Calculated Risk on 8/21/2020 10:10:00 AM

From the NAR: Existing-Home Sales Continue Record Pace, Soar 24.7% in July

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, jumped 24.7% from June to a seasonally-adjusted annual rate of 5.86 million in July. The previous record monthly increase in sales was 20.7% in June of this year. Sales as a whole rose year-over-year, up 8.7% from a year ago (5.39 million in July 2019).

...

Total housing inventory at the end of July totaled 1.50 million units, down from both 2.6% in June and 21.1% from one year ago (1.90 million). Unsold inventory sits at a 3.1-month supply at the current sales pace, down from 3.9 months in June and down from the 4.2-month figure recorded in July 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.86 million SAAR) were up 24.7% from last month, and were 8.7% above the July 2019 sales rate.

This was the highest sales rate since 2006.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.50 million in July from 1.57 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.50 million in July from 1.57 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 21.1% year-over-year in July compared to July 2019.

Inventory was down 21.1% year-over-year in July compared to July 2019. Months of supply decreased to 3.1 months in July.

This was above the consensus forecast (as expected). I'll have more later.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans "Remains Flat"

by Calculated Risk on 8/21/2020 08:16:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 18th.

From Number of Loans in Forbearances Remains Flat

According to latest data from Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance remained flat over the past week, with a 15,000 reduction among GSE mortgages offset by a 5,000 rise in FHA forbearances and a 10,000 increase among portfolio/PLS-held loans.

As of August 18, 3.9 million homeowners remain in active forbearance, representing 7.4% of all active mortgages, unchanged from last week. Together, they represent $833 billion in unpaid principal.

...

As we’ve discussed previously, there are a number of factors that continue to represent significant uncertainty as we move forward, including the ongoing COVID-19 pandemic and the expiration of expanded unemployment benefits last month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: There will probably be another disaster relief package soon, but we might see an increase in forbearance activity in the coming weeks as we wait for additional relief.

Thursday, August 20, 2020

Friday: Existing Home Sales

by Calculated Risk on 8/20/2020 07:55:00 PM

Take the over on existing home sales tomorrow. This could be the highest sales rate since 2006!

Friday:

• At 10:00 AM ET, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.39 million SAAR, up from 4.72 million last month.

Housing economist Tom Lawler expects the NAR to report 5.85 million SAAR.

• Also at 10:00 AM State Employment and Unemployment (Monthly) for July 2019

August 20 COVID-19 Test Results

by Calculated Risk on 8/20/2020 06:28:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 635,809 test results reported over the last 24 hours.

There were 43,245 positive tests.

There have been 20,717 COVID deaths in the first 20 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Hotels: Occupancy Rate Declined 30% Year-over-year

by Calculated Risk on 8/20/2020 12:32:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 15 August

U.S. weekly hotel occupancy hit 50.0% for the first time since mid-March, according to the latest data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

9-15 August 2020 (percentage change from comparable week in 2019):

• Occupancy: 50.2% (-30.0%)

• Average daily rate (ADR): US$101.41 (-23.0%)

• Revenue per available room (RevPAR): US$50.87 (-46.1%)

U.S. occupancy has risen week over week for 17 of the last 18 weeks, although growth in demand (room nights sold) has slowed. The week ending 14 March was the last with occupancy of at least 50.0%.

emphasis added

As STR noted, the occupancy rate has increased week-to-week in "17 of the last 18 weeks". The increases in occupancy have slowed and are well below the level for this week last year of 72%.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The leisure travel season usually peaks at the beginning of August (right now), and the occupancy rate typically declines sharply in the Fall.

With so many schools closed, the leisure travel season might be lasting longer this year than usual.

Note: Y-axis doesn't start at zero to better show the seasonal change.