by Calculated Risk on 8/18/2020 11:22:00 AM

Tuesday, August 18, 2020

August Employment Report Will Show an Increase of Several Hundred Thousand Temporary Census Workers

The Census Bureau released an update today on 2020 Census Paid Temporary Workers

As of the July reference week, there were 50,404 decennial Census temporary workers. As of week of August 2nd through August 8th, there were 270,468 temp workers.

That was an increase of around 220,000. Last week was the BLS reference week, and it seems likely another 100,000 or more temporary workers were on the payroll last week (to be released next week).

This means the August employment report will show a sharp increase in Federal employment. Since these are temporary, and only happen every ten years with the decennial Census, it makes sense to adjust the headline monthly Current Employment Statistics (CES) by Census hiring to determine the underlying employment trend.

The correct adjustment method is to take the headline number and subtract the change in the number of Census 2020 temporary and intermittent workers. For more, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

Comments on July Housing Starts

by Calculated Risk on 8/18/2020 09:28:00 AM

As expected, housing starts increased further in July, and were up solidly year-over-year, but are still below the pre-recession level.

Earlier: Housing Starts increased to 1.496 Million Annual Rate in July

Total housing starts in July were above expectations, and revisions to prior months were positive.

Low mortgage rates and limited existing home inventory is giving a boost to housing starts.

The housing starts report showed starts were up 22.6% in July compared to June, and starts were up 23.4% year-over-year compared to July 2019 (easy comparison).

Single family starts were up 7.4% year-over-year.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 22.6% in July compared to July 2019.

Last year, in 2019, starts picked up towards the end of the year, so the comparisons were easy in the first seven months of the year..

Starts, year-to-date, are up 4.7% compared to the same period in 2019. This is below my forecast for 2020, but I didn't expect a pandemic!

I expect a further increase in starts in August, but the growth rate will slow.

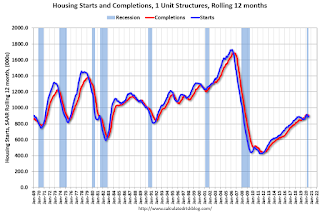

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- although starts picked up a little again lately.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis abates.

Housing Starts increased to 1.496 Million Annual Rate in July

by Calculated Risk on 8/18/2020 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,496,000. This is 22.6 percent above the revised June estimate of 1,220,000 and is 23.4 percent above the July 2019 rate of 1,212,000. Single-family housing starts in July were at a rate of 940,000; this is 8.2 percent above the revised June figure of 869,000. The July rate for units in buildings with five units or more was 547,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,495,000. This is 18.8 percent above the revised June rate of 1,258,000 and is 9.4 percent (±1.5 percent) above the July 2019 rate of 1,366,000. Single-family authorizations in July were at a rate of 983,000; this is 17.0 percent above the revised June figure of 840,000. Authorizations of units in buildings with five units or more were at a rate of 467,000 in July.

emphasis added

Click on graph for larger image.

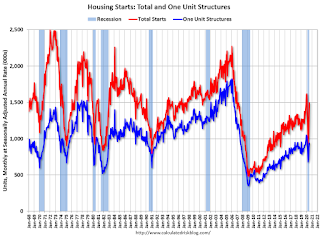

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in July compared to June. Multi-family starts were up solidly year-over-year in July.

Single-family starts (blue) increased in July, and were up 7.4% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in July were above expectations, and starts in May and June were revised up.

I'll have more later …

Monday, August 17, 2020

Tuesday: Housing Starts

by Calculated Risk on 8/17/2020 08:29:00 PM

From Matthew Graham at Mortgage News Daily: Still Reeling From Last Week, Mortgage Rates Tiptoe Lower

Mortgage rates managed to improve modestly for the average lender today, but they remain significantly higher than they were before last week's regulatory drama. By the time we consider the size, scope, and the precipitous imposition of the new refi fee, we've never seen anything remotely similar. Lenders were definitely taken by surprise and they'll definitely be paying dearly for all refis that were already locked.Tuesday:

When lenders get big, negative surprises concerning profitability or new cost requirements, they tend to raise rates very quickly and by a larger-than-necessary amount. [Top Tier Scenarios 30YR FIXED: 3.12%]

emphasis added

• At 8:30 AM ET, Housing Starts for July. The consensus is for 1.237 million SAAR, up from 1.186 million SAAR in June.

August 17 COVID-19 Test Results

by Calculated Risk on 8/17/2020 06:19:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 647,372 test results reported over the last 24 hours.

There were 37,759 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for the Ninth Straight Week to 7.21%"

by Calculated Risk on 8/17/2020 04:00:00 PM

Note: This is as of August 9th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases for the Ninth Straight Week to 7.21%

he Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 23 basis points from 7.44% of servicers’ portfolio volume in the prior week to 7.21% as of August 9, 2020. According to MBA’s estimate, 3.6 million homeowners are in forbearance plans.

...

“More homeowners exited forbearance last week, leading to the ninth straight drop in the share of loans in forbearance. However, the decline in Ginnie Mae loans in forbearance was again because of buyouts of delinquent loans from Ginnie Mae pools, which result in these FHA and VA loans being reported in the portfolio category,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “In a sign that more FHA and VA borrowers are struggling with a very tough job market, more Ginnie Mae borrowers requested than exited forbearance.”

By stage, 38.80% of total loans in forbearance are in the initial forbearance plan stage, while 60.49% are in a forbearance extension. The remaining 0.70% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last nine weeks.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week from 0.12% to 0.11%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.

CAR on California July Housing: Sales up 6% YoY, Active Listings down 48% YoY

by Calculated Risk on 8/17/2020 12:58:00 PM

The CAR reported: California housing recovery continues in July as median home price sets another record high, C.A.R. reports

California’s housing market continued to recover as home sales climbed to their highest level in more than two and a half years in July, while setting another record-high median home price, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in May and June. Sales-to-date, through July, are down 10% compared to the same period in 2019.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 437,890 units in July, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July’s sales total climbed above the 400,000 level for the first time since February 2020, before the COVID-19 crisis depressed the housing market, and was the highest level in more than two and a half years. July sales rose 28.8 percent from 339,910 in June and were up 6.4 percent from a year ago, when 411,630 homes were sold on an annualized basis. July marked the first time in five months that home sales posted an annual gain.

Housing inventory continued to trend downward on a year-over-year basis, with active listings falling more than 25 percent for the eighth consecutive month. The year-over-year 48 percent decline was the biggest drop in active listings since January 2013. The continued recovery in closed escrow sales, combined with a sharp drop in active listings, led to a plunge in the Unsold Inventory Index (UII) to 2.1 months in July, down from 3.2 months a year ago. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales. The July UII was the lowest level since November 2004.

emphasis added

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent in August

by Calculated Risk on 8/17/2020 12:43:00 PM

From the NMHC: NMHC Rent Payment Tracker Finds 86.9 Percent of Apartment Households Paid Rent as of August 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 86.9 percent of apartment households made a full or partial rent payment by August 13 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: This is mostly for large, professionally managed properties. It appears fewer people are paying their rent this year compared to last year (down 2.0 percentage points from a year ago). But this hasn't fallen off a cliff - yet.

This is a 2.0-percentage point, or 222,543 -household decrease from the share who paid rent through August 13, 2019 and compares to 87.6 percent that had paid by July 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“At a time when the country is continuing to face a pandemic and suffering from a recession, lawmakers in Congress and the Trump administration must come back to the table and work together on passing comprehensive legislation in the next COVID-19 relief package,” said Doug Bibby, NMHC President.

“While NMHC’s Rent Payment Tracker continues to show that many residents have continued to meet their monthly housing obligations, that is due in large part to the relief enacted under the CARES Act. With that support now having expired more than two weeks ago, households across the country are grappling with even greater financial distress. We strongly urge Congressional leaders and administration officials to extend critical unemployment benefits and create a rental assistance fund so that America’s tens of millions of apartment residents can remain safely and securely housed.”

emphasis added

People were still receiving the extra unemployment benefits for most of July, and were able to make their August rent payment. Without more disaster relief, I expect more people will miss their September rent payment.

MBA: "Mortgage Delinquencies Spike in the Second Quarter of 2020"

by Calculated Risk on 8/17/2020 10:52:00 AM

From the MBA: Mortgage Delinquencies Spike in the Second Quarter of 2020

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding at the end of the second quarter of 2020, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate increased 386 basis points from the first quarter of 2020 and was up 369 basis points from one year ago. For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

"The COVID-19 pandemic's effects on some homeowners' ability to make their mortgage payments could not be more apparent. The nearly 4 percentage point jump in the delinquency rate was the biggest quarterly rise in the history of MBA's survey," said Marina Walsh, MBA's Vice President of Industry Analysis. "The second quarter results also mark the highest overall delinquency rate in nine years, and a survey-high delinquency rate for FHA loans."

Added Walsh, "There was also a movement of loans to later stages of delinquency, with the 60-day delinquency rate reaching a new survey-high, and the 90+-day delinquency rate climbing to its highest level since the third quarter of 2010. On a more positive note, 30-day delinquencies dropped in the second quarter, which is an indication that the flood of new delinquencies may be dissipating."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Delinquencies increased sharply in Q2.

The increase was mostly in the 60 and day buckets. From the MBA: "the 60-day delinquency rate increased 138 basis points to 2.15 percent - the highest rate since the survey began in 1979 - and the 90-day delinquency bucket increased 279 basis points to 3.72 percent - the highest rate since the third quarter of 2010."

This sharp increase was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process declined further, and was at the lowest level since at least 1985.

Eight High Frequency Indicators for the Economy

by Calculated Risk on 8/17/2020 08:59:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

This data is as of August 16th.

The seven day average is down 71% from last year. There had been a slow steady increase from the bottom, but air travel is just creeping up over the last several weeks.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through Aug 15, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

The 7 day average for New York is still off 70% YoY, and down 47% in Texas.

It appears dining is increasing again, probably mostly outdoor dining.

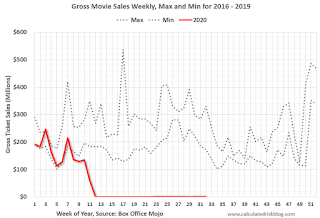

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through August 13th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through August 13th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up a slightly from the bottom, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for twenty one weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This data is through August 8th.

COVID-19 crushed hotel occupancy, however the occupancy rate has increased in 16 of the last 17 weeks, and is currently down 33% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June and decline towards the end of summer. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline consumption compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline consumption compared to the same week last year of .At one point, gasoline consumption was off almost 50% YoY.

As of August 7th, gasoline consumption was only off about 11% YoY (about 89% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through August 15th for the United States and several selected cities.

This data is through August 15th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 55% of the January level. It is at 50% in New York, and 56% in Houston.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.Note: The MTA didn't release data for last week yet. This data is through Friday, August 7th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"