by Calculated Risk on 7/24/2020 01:21:00 PM

Friday, July 24, 2020

July Vehicle Sales Forecast: 16% Year-over-year Decline

From Wards: U.S. Light-Vehicle Sales Continue Improvement in July Despite Inventory Concerns (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for July (Red).

Sales have bounced back from the April low, but are still down sharply year-over-year.

The Wards forecast of 14.1 million SAAR, would be up 8% from June, and down 16% from July 2019.

This would put sales in 2020, through July, down about 23% compared to the same period in 2019.

Q2 GDP Forecasts: Probably Around 35% Annual Rate Decline

by Calculated Risk on 7/24/2020 11:39:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 35% Q2 decline is around 10% decline from Q1 (SA).

From Merrill Lynch:

The advance 2Q GDP estimate comes out next Thursday and will reveal the depth of the recession. Real activity likely collapsed -36% qoq saar, translating into a peak-to-trough decline of -11.7%. ... We forecast a contraction of -5.7% in 2020, followed by a 3.4% rebound 2021. [July 24 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -14.3% for 2020:Q2 and 13.3% for 2020:Q3. [July 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -34.7 percent on July 17, down from -34.5 percent on July 16. [July 17 estimate]

A few Comments on June New Home Sales

by Calculated Risk on 7/24/2020 10:36:00 AM

New home sales for June were reported at 776,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down slightly, combined.

This was well above consensus expectations, and this was the highest sales rate since 2007. Clearly low mortgages rates, and low sales in March and April (due to the pandemic) have led to a bounce back in sales in May and June (and probably in July).

New home sales are counted when the contract is signed, whereas existing home sales are counted when the transaction closes. So new home sales performed better than existing home sales in May and June (on a year-over-year basis). Based on mortgage applications and regional pending home sales reports, there will be a further pickup in existing home sales in July, and builder reports suggest there will probably be a further pickup in new home sales too.

Important: No one should get too excited. Many years ago, I wrote several article about how new home sales and housing starts (especially single family starts) were some of the best leading indicators for the economy. However, I've noted that there are times when this isn't true. NOW is one of those times.

Currently the course of the economy will be determined by the course of the virus, and New Home Sales tell us nothing about the future of the pandemic. Without the pandemic, I'd be very positive about this report.

The longer the pandemic lasts, the more long term damage to the economy - and, if the pandemic worsens and persists - that will eventually negatively impact housing. The outlook for housing depends on the outlook for the pandemic.

Earlier: New Home Sales increased to 776,000 Annual Rate in June.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 6.9% year-over-year (YoY) in June. Year-to-date (YTD) sales are up 3.2%.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed (with help from the pandemic).

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust - and was close to the historical ratio before the pandemic.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 776,000 Annual Rate in June

by Calculated Risk on 7/24/2020 10:13:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 776 thousand.

This is the highest sales rate since 2007.

The previous three months were revised down slightly, combined.

Sales of new single-family houses in June 2020 were at a seasonally adjusted annual rate of 776,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 13.8 percent above the revised May rate of 682,000 and is 6.9 percent above the June 2019 estimate of 726,000.

emphasis added

Click on graph for larger image.

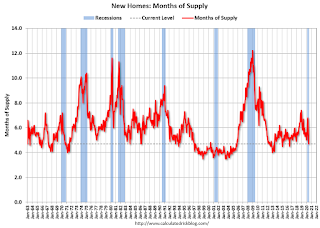

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The second graph shows New Home Months of Supply.

The months of supply decreased in June to 4.7 months from 5.5 months in May.

The months of supply decreased in June to 4.7 months from 5.5 months in May. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of June was 307,000. This represents a supply of 4.7 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2020 (red column), 74 thousand new homes were sold (NSA). Last year, 66 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for June was 28 thousand in 2010 and in 2011.

This was above expectations of 700 thousand sales SAAR, and sales in the three previous months were revised down slightly, combined. I'll have more later today.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 7/24/2020 09:03:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

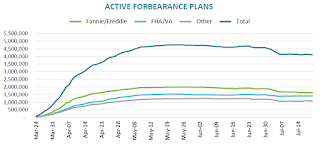

From Forbearance Volumes See Slight Rise to 4,119,000

The latest data from the McDash Flash Forbearance Tracker shows that there was minimal overall change in the number of active forbearance cases this week (+2K), bringing the total number of loans in active forbearance to 4,119,000. The slight rise was driven by a modest increase in forbearance plans among portfolio/private labeled securitization loans (+12k) and FHA/VA loans (+8k). The number of forbearances among GSE loans fell by 18k for the week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: There will be another disaster relief package soon (aka CARES II), but we might see an increase in forbearance activity if the package isn't available by early August.

Thursday, July 23, 2020

Friday: New Home Sales

by Calculated Risk on 7/23/2020 08:49:00 PM

Friday:

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for 700 thousand SAAR, up from 676 thousand in May.

July 23 COVID-19 Test Results

by Calculated Risk on 7/23/2020 05:47:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 774,193 test results reported over the last 24 hours.

There were 71,027 positive tests.

This was the 3rd consecutive day with over 1,000 deaths. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.2% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

NMHC: "July Apartment Market Conditions Showed Continued Impact of COVID-19 Outbreak"

by Calculated Risk on 7/23/2020 03:30:00 PM

The National Multifamily Housing Council (NMHC) released their July report: July Apartment Market Conditions Showed Continued Impact of COVID-19 Outbreak

Apartment market conditions weakened in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for July 2020, as the industry continues to cope with the ongoing COVID-19 pandemic. The Market Tightness (19), Sales Volume (18) and Equity Financing (34) indexes all came in well below the breakeven level (50). However, in a positive sign, the index for Debt Financing (60) signaled improving conditions.

>br ? “Recent spikes in COVID-19 cases have caused many areas of the U.S. to scale back or completely reverse their attempts at reopening their local economy. As a result, unemployment levels stand elevated in double digits as much of the nation’s business activity remains temporarily shuttered,” noted NMHC Chief Economist Mark Obrinsky. “Amidst this COVID economy, 71 percent of respondents reported looser market conditions this quarter compared to the prior three months, marking the second consecutive quarter of deteriorating conditions.”

“The Federal Reserve has countered this economic malaise with aggressively accommodative monetary policy, resulting in historically low interest rates. This, in turn, has created favorable pricing for debt financing, leading more respondents than not (44% to 25%) in this round of the survey to report improving conditions for borrowing. Nevertheless, these improved financing conditions have been largely confined to stabilized multifamily assets, and underwriting standards remain fairly stringent.”

...

The Market Tightness Index increased from 12 to 19, indicating looser market conditions. The majority (71 percent) of respondents reported looser market conditions than three months prior, compared to 8 percent who reported tighter conditions. One in five respondents (21 percent) felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were July in April due to COVID.

Kansas City Fed: "Tenth District Manufacturing Activity Continued to Grow Slightly" in July

by Calculated Risk on 7/23/2020 01:05:00 PM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Grow Slightly

Tenth District manufacturing activity continued to grow slightly after decreasing sharply in the spring, but still remained well below year-ago levels. Expectations for future activity continued to improve slightly. District firms continued to expect prices for both finished goods and raw materials to expand in the next six months.This suggests activity has bottomed, but this is just a slight increase off the bottom.

The month-over-month composite index was 3 in July, up slightly from 1 in June and up considerably from -19 in May. ...The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The improvement in activity was still driven by non-durable goods plants. However, activity in most durable goods factories also improved except for continued decreases in fabricated metals and computer and electronics plants. Most month-over-month indexes were positive. Production, shipments, new orders, and supplier delivery time indexes remained positive, and indexes for order backlog and employment recovered to positive levels. Only new orders for exports and inventories indexes remained negative. Most year-over-year factory indexes increased but remained negative in July. The future composite index continued to rise in July, increasing slightly from 9 to 14.

emphasis added

Hotels: Occupancy Rate Declined 39% Year-over-year

by Calculated Risk on 7/23/2020 11:01:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 18 July

U.S. hotel performance data for the week ending 18 July showed slightly higher occupancy and room rates from the previous week, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

12-18 July 2020 (percentage change from comparable week in 2019):

• Occupancy: 47.5% (-38.9%)

• Average daily rate (ADR): US$98.56 (-28.0%)

• Revenue per available room (RevPAR): US$46.87 (-56.0%)

emphasis added

The occupancy rate for the last five weeks was 43.9%, 46.2%, 45.6%, 45.9% and 47.5% The increases in occupancy have slowed and are well below the median for this week of 78%.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

According to STR, the improvement appears related mostly to leisure travel as opposed to business travel.

Note: Y-axis doesn't start at zero to better show the seasonal change.