by Calculated Risk on 7/23/2020 03:30:00 PM

Thursday, July 23, 2020

NMHC: "July Apartment Market Conditions Showed Continued Impact of COVID-19 Outbreak"

The National Multifamily Housing Council (NMHC) released their July report: July Apartment Market Conditions Showed Continued Impact of COVID-19 Outbreak

Apartment market conditions weakened in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for July 2020, as the industry continues to cope with the ongoing COVID-19 pandemic. The Market Tightness (19), Sales Volume (18) and Equity Financing (34) indexes all came in well below the breakeven level (50). However, in a positive sign, the index for Debt Financing (60) signaled improving conditions.

>br ? “Recent spikes in COVID-19 cases have caused many areas of the U.S. to scale back or completely reverse their attempts at reopening their local economy. As a result, unemployment levels stand elevated in double digits as much of the nation’s business activity remains temporarily shuttered,” noted NMHC Chief Economist Mark Obrinsky. “Amidst this COVID economy, 71 percent of respondents reported looser market conditions this quarter compared to the prior three months, marking the second consecutive quarter of deteriorating conditions.”

“The Federal Reserve has countered this economic malaise with aggressively accommodative monetary policy, resulting in historically low interest rates. This, in turn, has created favorable pricing for debt financing, leading more respondents than not (44% to 25%) in this round of the survey to report improving conditions for borrowing. Nevertheless, these improved financing conditions have been largely confined to stabilized multifamily assets, and underwriting standards remain fairly stringent.”

...

The Market Tightness Index increased from 12 to 19, indicating looser market conditions. The majority (71 percent) of respondents reported looser market conditions than three months prior, compared to 8 percent who reported tighter conditions. One in five respondents (21 percent) felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were July in April due to COVID.

Kansas City Fed: "Tenth District Manufacturing Activity Continued to Grow Slightly" in July

by Calculated Risk on 7/23/2020 01:05:00 PM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Grow Slightly

Tenth District manufacturing activity continued to grow slightly after decreasing sharply in the spring, but still remained well below year-ago levels. Expectations for future activity continued to improve slightly. District firms continued to expect prices for both finished goods and raw materials to expand in the next six months.This suggests activity has bottomed, but this is just a slight increase off the bottom.

The month-over-month composite index was 3 in July, up slightly from 1 in June and up considerably from -19 in May. ...The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The improvement in activity was still driven by non-durable goods plants. However, activity in most durable goods factories also improved except for continued decreases in fabricated metals and computer and electronics plants. Most month-over-month indexes were positive. Production, shipments, new orders, and supplier delivery time indexes remained positive, and indexes for order backlog and employment recovered to positive levels. Only new orders for exports and inventories indexes remained negative. Most year-over-year factory indexes increased but remained negative in July. The future composite index continued to rise in July, increasing slightly from 9 to 14.

emphasis added

Hotels: Occupancy Rate Declined 39% Year-over-year

by Calculated Risk on 7/23/2020 11:01:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 18 July

U.S. hotel performance data for the week ending 18 July showed slightly higher occupancy and room rates from the previous week, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

12-18 July 2020 (percentage change from comparable week in 2019):

• Occupancy: 47.5% (-38.9%)

• Average daily rate (ADR): US$98.56 (-28.0%)

• Revenue per available room (RevPAR): US$46.87 (-56.0%)

emphasis added

The occupancy rate for the last five weeks was 43.9%, 46.2%, 45.6%, 45.9% and 47.5% The increases in occupancy have slowed and are well below the median for this week of 78%.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

According to STR, the improvement appears related mostly to leisure travel as opposed to business travel.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Comments on Weekly Unemployment Claims

by Calculated Risk on 7/23/2020 09:50:00 AM

A few comments:

On a monthly basis, most analysts focus on initial unemployment claims for the BLS reference week of the employment report. For July, the BLS reference week was July 12th through the 18th, and initial claims for that week were released today.

Note that a couple of states have not released Pandemic Unemployment Assistance (PUA) claims this week, so the number of PUA claims is too low. However, there may also be processing delays that are impacting the numbers.

Continued claims decreased last week to 16,197,000

(SA) from 17,304,000 (SA) the previous week. Continued claims are down 8.7 million from the peak, suggesting a large number of people have returned to their jobs (as the employment report showed). However, continued claims NSA increased to 17,188,772 from 16,410,059 the previous week - and the seasonal adjustment may be off this year due to the pandemic.

Continued claims are released with a one week lag, so continued claims for the reference week will be released next week. The decrease in continued claims does not suggest a sharp drop in July employment.

The following graph shows regular initial unemployment claims (blue) and PUA claims (red) since early February.

This was the 18th consecutive week with extraordinarily high initial claims.

It is possible that we are starting to see some layoffs associated with the end of some early Payroll Protection Plan (PPP) participants.

We are probably seeing some layoffs in states with more COVID cases.

Note that these states don't have to lockdown to see a decline in economic activity. As Merrill Lynch economists noted: "Most of the slowdown occurred due to voluntary social distancing rather than lockdown policies."

Weekly Initial Unemployment Claims increase to 1,416,000

by Calculated Risk on 7/23/2020 08:38:00 AM

The DOL reported:

In the week ending July 18, the advance figure for seasonally adjusted initial claims was 1,416,000, an increase of 109,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 1,300,000 to 1,307,000. The 4-week moving average was 1,360,250, a decrease of 16,500 from the previous week's revised average. The previous week's average was revised up by 1,750 from 1,375,000 to 1,376,750.The previous week was revised up.

emphasis added

This does not include the 974,999 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,360,250.

Initial weekly claims was above the consensus forecast of 1.3 million initial claims and the previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 16,197,000 (SA) from 17,304,000 (SA) last week and will likely stay at a high level until the crisis abates. Note that continued claims are released with a one week lag, but this decline suggests further improvement in the labor market.

Note: There are an additional 13,179,880 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, July 22, 2020

Thursday: Unemployment Claims

by Calculated Risk on 7/22/2020 09:01:00 PM

Note: This initial claims report will be for the period matching the BLS July employment report reference week. Continued claims are currently more important , and they are released with a one week lag.

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.300 million initial claims, unchanged from 1.300 million the previous week.

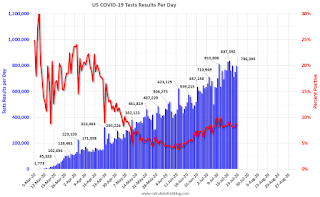

July 22 COVID-19 Test Results

by Calculated Risk on 7/22/2020 06:23:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 796,395 test results reported over the last 24 hours.

There were 70,043 positive tests.

Sadly, over 1,100 deaths reported today, the most since last May (excluding one day with a data dump).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent as of July 20th

by Calculated Risk on 7/22/2020 04:30:00 PM

Without further disaster relief, there will a significant housing and financial issue.

From the NMHC: NMHC Rent Payment Tracker Finds 91.3 Percent of Apartment Households Paid Rent as of July 20

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 91.3 percent of apartment households made a full or partial rent payment by July 20 in its survey of 11.1 million units of professionally managed apartment units across the country.CR Note: It appears fewer people are paying their rent compared to last year (down 2.1 percentage points from a year ago). In the previous surveys, over the last few months, people were paying their rents at about the same pace as last year. The disaster relief has been key to helping people pay their bills, especially the extra unemployment benefits and the PPP.

This is a 2.1-percentage point decrease from the share who paid rent through July 20, 2019 and compares to 92.2 percent that had paid by June 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"The extended unemployment benefits and other government support that have proven critical to keeping apartment residents in their homes expire in just a few days,” said Doug Bibby, NMHC President. "Lawmakers are currently negotiating, but Members of Congress and Trump administration leaders need to understand that unless comprehensive action is taken now to protect the tens of millions of Americans who live in an apartment home, they risk destabilizing the nation's housing market, undermining the nascent economic recovery, and turning the ongoing health and economic crisis into a housing crisis."

emphasis added

AIA: "Architecture billings remain in negative territory, begin to stabilize"

by Calculated Risk on 7/22/2020 02:49:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings remain in negative territory, begin to stabilize

Demand for design services from architecture firms began to stabilize in June, following their peak declines in April, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for June was 40.0 compared to 32.0 in May. The May ABI score indicates that a significant share of architecture firms still saw their billings decline from May to June, however the share reporting declines slowed significantly. Index scores for new project inquiries and new design contracts also showed signs of stabilizing, posting scores of 49.3 and 44.0 respectively.

“While business conditions remained soft at firms across the country, those with a multifamily residential specialization saw the most positive signs,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Unfortunately, conditions at firms with a commercial/industrial specialization are likely to remain weak for an extended period of time, until hospitality, office and retail facilities can fully reopen, and design demand for this space begins to increase.”

...

• Regional averages [3 month average]: Midwest (36.8); West (36.8); South (35.9); Northeast (34.2)

• Sector index breakdown: multi-family residential (44.7); institutional (38.9); mixed practice (35.3); commercial/industrial (30.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 40.0 in June, up from 32.0 in May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This represents a significant decrease in design services, and suggests a decline in CRE investment in the first half of 2021 (This usually leads CRE investment by 9 to 12 months).

Comments on June Existing Home Sales

by Calculated Risk on 7/22/2020 12:41:00 PM

Earlier: NAR: Existing-Home Sales Increased to 4.72 million in June

A few key points:

1) Existing home sales are counted at the close of escrow, so the June report was mostly for contracts signed in April and May. Some of the increase this month was probably related to pent up demand from the shutdowns in March and April. I expect a further increase in sales in July (July will be mostly contracts signed in May and June when the economy was much more open). However, with the high unemployment rate - and the recent surge in COVID infections, housing might be under some pressure later this year. That is difficult to predict and depends on the course of the pandemic.

2) Inventory is very low, and was down 18.2% year-over-year (YoY) in June. This is the lowest level of inventory for June since at least the early 1990s.

3) As usual, housing economist Tom Lawler was closer to the actual NAR report than the consensus forecast.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 8% compared to the same period in 2019.

Sales NSA in June (510,000) were 3.4% below sales last year in June (528,000).