by Calculated Risk on 7/23/2020 09:50:00 AM

Thursday, July 23, 2020

Comments on Weekly Unemployment Claims

A few comments:

On a monthly basis, most analysts focus on initial unemployment claims for the BLS reference week of the employment report. For July, the BLS reference week was July 12th through the 18th, and initial claims for that week were released today.

Note that a couple of states have not released Pandemic Unemployment Assistance (PUA) claims this week, so the number of PUA claims is too low. However, there may also be processing delays that are impacting the numbers.

Continued claims decreased last week to 16,197,000

(SA) from 17,304,000 (SA) the previous week. Continued claims are down 8.7 million from the peak, suggesting a large number of people have returned to their jobs (as the employment report showed). However, continued claims NSA increased to 17,188,772 from 16,410,059 the previous week - and the seasonal adjustment may be off this year due to the pandemic.

Continued claims are released with a one week lag, so continued claims for the reference week will be released next week. The decrease in continued claims does not suggest a sharp drop in July employment.

The following graph shows regular initial unemployment claims (blue) and PUA claims (red) since early February.

This was the 18th consecutive week with extraordinarily high initial claims.

It is possible that we are starting to see some layoffs associated with the end of some early Payroll Protection Plan (PPP) participants.

We are probably seeing some layoffs in states with more COVID cases.

Note that these states don't have to lockdown to see a decline in economic activity. As Merrill Lynch economists noted: "Most of the slowdown occurred due to voluntary social distancing rather than lockdown policies."

Weekly Initial Unemployment Claims increase to 1,416,000

by Calculated Risk on 7/23/2020 08:38:00 AM

The DOL reported:

In the week ending July 18, the advance figure for seasonally adjusted initial claims was 1,416,000, an increase of 109,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 1,300,000 to 1,307,000. The 4-week moving average was 1,360,250, a decrease of 16,500 from the previous week's revised average. The previous week's average was revised up by 1,750 from 1,375,000 to 1,376,750.The previous week was revised up.

emphasis added

This does not include the 974,999 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,360,250.

Initial weekly claims was above the consensus forecast of 1.3 million initial claims and the previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 16,197,000 (SA) from 17,304,000 (SA) last week and will likely stay at a high level until the crisis abates. Note that continued claims are released with a one week lag, but this decline suggests further improvement in the labor market.

Note: There are an additional 13,179,880 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, July 22, 2020

Thursday: Unemployment Claims

by Calculated Risk on 7/22/2020 09:01:00 PM

Note: This initial claims report will be for the period matching the BLS July employment report reference week. Continued claims are currently more important , and they are released with a one week lag.

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.300 million initial claims, unchanged from 1.300 million the previous week.

July 22 COVID-19 Test Results

by Calculated Risk on 7/22/2020 06:23:00 PM

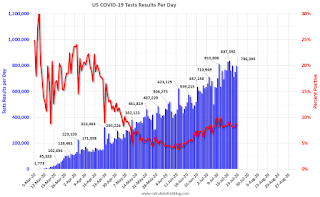

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 796,395 test results reported over the last 24 hours.

There were 70,043 positive tests.

Sadly, over 1,100 deaths reported today, the most since last May (excluding one day with a data dump).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent as of July 20th

by Calculated Risk on 7/22/2020 04:30:00 PM

Without further disaster relief, there will a significant housing and financial issue.

From the NMHC: NMHC Rent Payment Tracker Finds 91.3 Percent of Apartment Households Paid Rent as of July 20

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 91.3 percent of apartment households made a full or partial rent payment by July 20 in its survey of 11.1 million units of professionally managed apartment units across the country.CR Note: It appears fewer people are paying their rent compared to last year (down 2.1 percentage points from a year ago). In the previous surveys, over the last few months, people were paying their rents at about the same pace as last year. The disaster relief has been key to helping people pay their bills, especially the extra unemployment benefits and the PPP.

This is a 2.1-percentage point decrease from the share who paid rent through July 20, 2019 and compares to 92.2 percent that had paid by June 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"The extended unemployment benefits and other government support that have proven critical to keeping apartment residents in their homes expire in just a few days,” said Doug Bibby, NMHC President. "Lawmakers are currently negotiating, but Members of Congress and Trump administration leaders need to understand that unless comprehensive action is taken now to protect the tens of millions of Americans who live in an apartment home, they risk destabilizing the nation's housing market, undermining the nascent economic recovery, and turning the ongoing health and economic crisis into a housing crisis."

emphasis added

AIA: "Architecture billings remain in negative territory, begin to stabilize"

by Calculated Risk on 7/22/2020 02:49:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings remain in negative territory, begin to stabilize

Demand for design services from architecture firms began to stabilize in June, following their peak declines in April, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for June was 40.0 compared to 32.0 in May. The May ABI score indicates that a significant share of architecture firms still saw their billings decline from May to June, however the share reporting declines slowed significantly. Index scores for new project inquiries and new design contracts also showed signs of stabilizing, posting scores of 49.3 and 44.0 respectively.

“While business conditions remained soft at firms across the country, those with a multifamily residential specialization saw the most positive signs,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Unfortunately, conditions at firms with a commercial/industrial specialization are likely to remain weak for an extended period of time, until hospitality, office and retail facilities can fully reopen, and design demand for this space begins to increase.”

...

• Regional averages [3 month average]: Midwest (36.8); West (36.8); South (35.9); Northeast (34.2)

• Sector index breakdown: multi-family residential (44.7); institutional (38.9); mixed practice (35.3); commercial/industrial (30.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 40.0 in June, up from 32.0 in May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This represents a significant decrease in design services, and suggests a decline in CRE investment in the first half of 2021 (This usually leads CRE investment by 9 to 12 months).

Comments on June Existing Home Sales

by Calculated Risk on 7/22/2020 12:41:00 PM

Earlier: NAR: Existing-Home Sales Increased to 4.72 million in June

A few key points:

1) Existing home sales are counted at the close of escrow, so the June report was mostly for contracts signed in April and May. Some of the increase this month was probably related to pent up demand from the shutdowns in March and April. I expect a further increase in sales in July (July will be mostly contracts signed in May and June when the economy was much more open). However, with the high unemployment rate - and the recent surge in COVID infections, housing might be under some pressure later this year. That is difficult to predict and depends on the course of the pandemic.

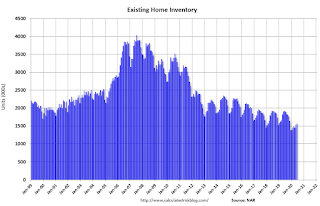

2) Inventory is very low, and was down 18.2% year-over-year (YoY) in June. This is the lowest level of inventory for June since at least the early 1990s.

3) As usual, housing economist Tom Lawler was closer to the actual NAR report than the consensus forecast.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 8% compared to the same period in 2019.

Sales NSA in June (510,000) were 3.4% below sales last year in June (528,000).

Census: Household Pulse Survey shows 26.4% Missed or Expect to Miss Rent or Mortgage Payment

by Calculated Risk on 7/22/2020 10:41:00 AM

First, from @ernietedeschi

Employment in the @uscensusbureau Household Pulse Survey fell by -4.1 million last week alone.This graph is from Ernie Tedeschi (former US Treasury economist).

That's a cumulative loss of -6.7 million jobs between the reference weeks used for the June & July monthly jobs report.

Seasonality and survey noise may be factors here -- the HPS is a new, experimental survey with limited history.

However it also did an admirable job of predicting the strong employment growth in June.

CR Note on above graph: The Pulse Survey doesn't align exactly with the BLS reference week. The release today is for July 9th - July 14th, and the release next week will be for the period July 16th - July 21th. The BLS reference week is the 12th - 18th.

Also note on the question below on lost income is always since March 13, 2020 - so this percentage will not decline - but might increase.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the recent survey results today. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis.

Click on graph for larger image.

Click on graph for larger image.The data was collected between July 9 and July 14, 2020.

Definitions:

Loss in employment income: "Percentage of adults in households where someone had a loss in employment income since March 13, 2020."

This number is since March 13, and has increased to 50.1% from 47% in the initial survey.

Expected Loss in Employment Income: "Percentage of adults who expect someone in their household to have a loss in employment income in the next 4 weeks."

35.1% of households expect a loss in income over the next 4 weeks. This is down from 38.8% in late April, but up from 31% four weeks ago. This might suggest the job gains stalled after the data was collected for the June employment report.

Food Scarcity: Percentage of adults in households where there was either sometimes or often not enough to eat in the last 7 days.

10.8% of households report food scarcity. This has increased slightly since March.

Delayed Medical Care: "Percentage of adults who delayed getting medical care because of the COVID-19 pandemic in the last 4 weeks."

40.6% of households report they delayed medical care over the last 4 weeks. This increased slightly from last week.

Housing Insecurity: "Percentage of adults who missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time."

26.4% of households reported they missed last month's rent or mortgage payment (or little confidence in making this month's payment). This has increased from a low of 22.1% in the survey of June 4th - June 9th.

Without an extension of the extra unemployment benefits, we will likely see a significant increase in housing stress.

K-12 Educational Changes: "Percentage of adults in households with children in public or private school, where classes were taught in a distance learning format, or changed in some other way."

Essentially all households with children are reporting were not being taught in a normal format.

NAR: Existing-Home Sales Increased to 4.72 million in June

by Calculated Risk on 7/22/2020 10:11:00 AM

From the NAR: Existing-Home Sales Climb Record 20.7% in June

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June. Sales overall, however, dipped year-over-year, down 11.3% from a year ago (5.32 million in June 2019).

...

Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May, but still down 18.2% from one year ago (1.92 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, down from both 4.8 months in May and from the 4.3-month figure recorded in June 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (4.72 million SAAR) were up 20.7% from last month, and were 11.3% below the June 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.57 million in June from 1.55 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.57 million in June from 1.55 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 18.2% year-over-year in June compared to June 2019.

Inventory was down 18.2% year-over-year in June compared to June 2019. Months of supply decreased to 4.0 months in June.

This was below the consensus forecast. I'll have more later … as expected, sales rebounded in June.

Black Knight: National Mortgage Delinquency Rate Decreased in June, "Serious Delinquencies Surge to 9-Year High"

by Calculated Risk on 7/22/2020 09:47:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but these loans are not reported as delinquent to the credit bureaus.

From Black Knight: Mortgage Delinquencies Improve for the First Time Since January, While Serious Delinquencies Surge to 9-Year High

• After rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of past-due mortgages declined by 98,000According to Black Knight's First Look report for March, the percent of loans delinquent decreased 2.3% in June compared to May, and increased 104% year-over-year.

• Serious delinquencies – those 90 or more days past due – rose by more than 1.2 million as the initial wave of borrowers financially impacted by COVID-19 missed their third mortgage payment

• At 1.87 million, the number of seriously delinquent mortgages is now at its highest level since early 2011

• With federal foreclosure moratoriums still in place, active foreclosure inventory continues to dwindle; June’s 192,000 active foreclosures were the fewest on record, dating back to 2000

• Prepayment activity hit its highest level in 16 years in June, fueled by record-low 30-year interest rates and surging refinance incentive

emphasis added

The percent of loans in the foreclosure process decreased 4.2% in June and were down 27.1% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 7.59% in June, down from 7.76% in May.

The percent of loans in the foreclosure process decreased in June to 0.36% from 0.38% in May.

The number of delinquent properties, but not in foreclosure, is up 2,084,000 properties year-over-year, and the number of properties in the foreclosure process is down 67,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2020 | May 2020 | June 2019 | June 2018 | |

| Delinquent | 7.59% | 7.76% | 3.73% | 3.74% |

| In Foreclosure | 0.36% | 0.38% | 0.50% | 0.56% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 4,034,000 | 4,123,000 | 1,950,000 | 1,925,000 |

| Number of properties in foreclosure pre-sale inventory: | 192,000 | 200,000 | 259,000 | 291,000 |

| Total Properties | 4,226,000 | 4.324,000 | 2,209,000 | 2,216,000 |