by Calculated Risk on 7/17/2020 01:59:00 PM

Friday, July 17, 2020

CAR on California June Housing: Sales down 13% YoY, Listing down 25% YoY

The CAR reported: California housing market claws back past two months of losses in June as median home price sets another record high, C.A.R. reports

Existing, single-family home sales totaled 339,910 in June on a seasonally adjusted annualized rate, up 42.4 percent from May and down 12.8 percent from June 2019.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in April and May.

After falling to the lowest level since the Great Recession, California’s housing market rebounded in June with the largest month-to-month sales increase in nearly 40 years, while the median home price set another record high, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 339,910 units in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

Housing supply continued to trend downward on a year-over-year basis, with active listings falling more than 25 percent for the seventh consecutive month. A sizable year-over-year drop in active listings of 43 percent, coupled with a robust gain in closed sales, led to a decline in C.A.R.’s Unsold Inventory Index (UII) in June. The Index dropped to 2.7 months in June from 4.3 months in May and was down from 3.4 months in June 2019. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/17/2020 12:44:00 PM

As expected, housing starts bounced back in June.

Earlier: Housing Starts increased to 1.186 Million Annual Rate in June

Total housing starts in June were at expectations, and revisions to prior months were positive.

Low mortgage rates and limited existing home inventory is giving a boost to housing starts.

The housing starts report showed starts were up 17.3% in June compared to May, and starts were down 4.0% year-over-year compared to June 2019.

Single family starts were down 3.9% year-over-year.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were down 4.0% in June compared to June 2019.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons were easy early in the year.

Starts, year-to-date, are still up 0.7% compared to the same period in 2019.

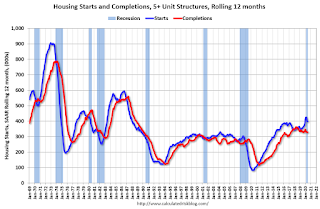

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- although starts picked up a little again lately.

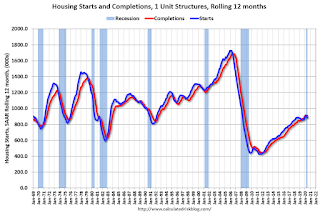

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis abates.

LA area Port Traffic Down Year-over-year in June

by Calculated Risk on 7/17/2020 12:24:00 PM

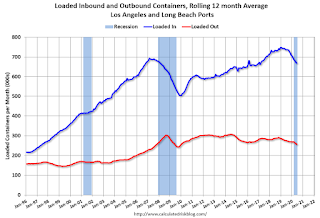

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.7% in June compared to the rolling 12 months ending in May. Outbound traffic was down 1.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Because of the timing of the New Year, we would have expected traffic to decline in February without an impact from COVID-19, but bounce back in March and April.

Imports were down 8% YoY in June, and exports were down 17% YoY.

In general imports both imports and exports have turned down recently YoY.

Q2 GDP Forecasts: Probably Around 35% Annual Rate Decline

by Calculated Risk on 7/17/2020 11:18:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 35% Q2 decline is around 10% decline from Q1 (SA).

Note: I'm just trying to make it clear the economy didn't decline by one-third in Q2. Previously I just divided by 4 (an approximation) to show the quarter to quarter decline. The actually formula is (1-.35) ^ .25 - 1 = -0.102 (a 10.2% decline from Q1)

From Merrill Lynch:

2Q GDP tracking was unchanged at -36% qoq saar as the June surprise in retail sales was offset by negative May revisions. [July 17 estimate]From Goldman Sachs:

emphasis added

Our Q2 GDP tracking estimate remained unchanged at -33% (qoq ar). We expect -29% in the initial vintage of the report, reflecting incomplete source data and non-response bias [July 16 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at -14.3% for 2020:Q2 and 13.2% for 2020:Q3. [July 17 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -34.7 percent on July 17, down from -34.5 percent on July 16. [July 17 estimate]

BLS: June Unemployment rates down in 42 states; 3 States at New Record Highs

by Calculated Risk on 7/17/2020 10:25:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in June in 42 states, higher in 5 states, and stable in 3 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District had jobless rate increases from a year earlier, while one state had no change. The national unemployment rate declined by 2.2 percentage points over the month to 11.1 percent but was 7.4 points higher than in June 2019.

...

Massachusetts had the highest unemployment rate in June, 17.4 percent, followed by New Jersey, 16.6 percent, and New York, 15.7 percent. The rates in these three states set new series highs. (All state series begin in 1976.) Kentucky had the lowest unemployment rate, 4.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

Currently 20 states are above 10% unemployment rate.

Four states are above 15%.

Note that the three states setting new highs were still in lockdown (the states that were hit hard by the virus early).

The second graph compares the unemployment rate in two lockdown states (New York and New Jersey), and two early open states (Florida and Texas).

The second graph compares the unemployment rate in two lockdown states (New York and New Jersey), and two early open states (Florida and Texas).It seems likely the recent surge in COVID-19 cases in Florida and Texas will lead to higher unemployment rates in those states.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decline, Lowest Since May

by Calculated Risk on 7/17/2020 09:43:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Loans in Forbearance Decline for Third Consecutive Week to Lowest Rate Since May at 4.12M

The latest data from the McDash Flash Forbearance Tracker shows that forbearance starts fell by 4% from last week. The number of loans in active forbearance declined for the 3rd consecutive week, falling by 27k from the previous week to 4.12M as of July 14th.CR Note: There will be another disaster relief package soon (aka CARES II), but we might see an increase in forbearance activity if the package isn't available by early August.

An estimated 7.77% of all mortgages are now in active forbearance, down from 7.82% last week, marking the lowest such forbearance rate since peaking in late May. Together, they represent nearly $900 billion in unpaid principal.

Click on graph for larger image.

This week’s decline was driven almost entirely by a decrease in GSE related forbearances, which fell by 35k over the past week. We also observed a 2,000-loan decline in forbearances among portfolio held and private labeled security mortgages. FHA/VA loans saw a slight increase in forbearance volumes of +10k over the past 7 days.

emphasis added

Housing Starts increased to 1.186 Million Annual Rate in June

by Calculated Risk on 7/17/2020 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,186,000. This is 17.3 percent above the revised May estimate of 1,011,000, but is 4.0 percent below the June 2019 rate of 1,235,000. Single-family housing starts in June were at a rate of 831,000; this is 17.2 percent above the revised May figure of 709,000. The June rate for units in buildings with five units or more was 350,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,241,000. This is 2.1 percent above the revised May rate of 1,216,000, but is 2.5 percent below the June 2019 rate of 1,273,000. Single-family authorizations in June were at a rate of 834,000; this is 11.8 percent above the revised May figure of 746,000. Authorizations of units in buildings with five units or more were at a rate of 368,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in June compared to May. Multi-family starts were down 4.1% year-over-year in June.

Single-family starts (blue) increased in June, and were down 3.9% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in June were at expectations, and starts in May were revised up.

Residential construction is considered an essential business, and held up better than some other sectors of the economy, but was still negatively impacted by COVID-19.

I'll have more later …

Thursday, July 16, 2020

Friday: Housing Starts

by Calculated Risk on 7/16/2020 09:03:00 PM

Friday:

• At 8:30 AM ET, Housing Starts for June. The consensus is for 1.180 million SAAR, up from 0.974 million SAAR in May.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for July).

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for June 2020

July 16 COVID-19 Test Results, Record Positive Tests

by Calculated Risk on 7/16/2020 05:57:00 PM

The US is now conducting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 831,918 test results reported over the last 24 hours. This is a new record.

There were 71,229 positive tests. This is a new record.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Comments on Weekly Unemployment Claims

by Calculated Risk on 7/16/2020 01:36:00 PM

A few comments:

On a monthly basis, most analysts focus on initial unemployment claims for the BLS reference week of the employment report. For July, the BLS reference week will be July 12th through the 18th, and initial claims for that week will be released next week, on Thursday, July 23rd.

Note that a couple of states have not released Pandemic Unemployment Assistance (PUA) claims this week, so the number of PUA claims is too low. However, there may also be processing delays that are impacting the numbers.

Note: The seasonal adjustment is likely off this year due to the pandemic. If we look at initial claims Not Seasonally Adjusted (NSA), claims increased sharply this week to 1,503,892 from 1,395,081 the previous week. That could be more representative of what is actually happening.

Continued claims decreased last week to 17,338,000

(SA) from 17,760,000 (SA) the previous week. However, continued claims are down 7.6 million from the peak, suggesting a large number of people have returned to their jobs (as the employment report showed).

The following graph shows regular initial unemployment claims (blue) and PUA claims (red) since early February.

This was the 17th consecutive week with extraordinarily high initial claims.

It is possible that we are starting to see some layoffs associated with the end of some early Payroll Protection Plan (PPP) participants.

We should start seeing layoffs associated with the rising COVID cases and hospitalization in some states (like Arizona, California, Florida and Texas). With bar and restaurant closings in some areas, we will probably see more initial claims in those states this week, and that will show up in the report in the coming weeks.

Note that these states don't have to lockdown to see a decline in economic activity. As Merrill Lynch economists noted: "Most of the slowdown occurred due to voluntary social distancing rather than lockdown policies."