by Calculated Risk on 7/15/2020 09:23:00 AM

Wednesday, July 15, 2020

Industrial Production Increased 5.4 Percent in June; Still 10.8% Below Pre-Crisis Level

From the Fed: Industrial Production and Capacity Utilization

Total industrial production rose 5.4 percent in June after increasing 1.4 percent in May; even so, it remained 10.9 percent below its pre-pandemic February level. For the second quarter as a whole, the index fell 42.6 percent at an annual rate, its largest quarterly decrease since the industrial sector retrenched after World War II. Manufacturing output climbed 7.2 percent in June, as all major industries posted increases. The largest gain—105.0 percent—was registered by motor vehicles and parts, while factory production elsewhere rose 3.9 percent. Mining production fell 2.9 percent, and the output of utilities increased 4.2 percent. At 97.5 percent of its 2012 average, the level of total industrial production was 10.8 percent lower in June than it was a year earlier. Capacity utilization for the industrial sector increased 3.5 percentage points to 68.6 percent in June, a rate that is 11.2 percentage points below its long-run (1972–2019) average but 1.9 percentage points above its trough during the Great Recession.

emphasis added

Click on graph for larger image.

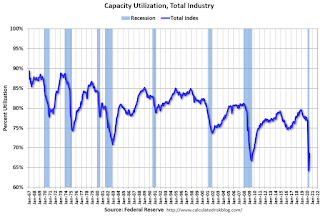

Click on graph for larger image.This graph shows Capacity Utilization. This series is up slightly from the record low set last month, and still below the trough of the Great Recession (the series starts in 1967).

Capacity utilization at 68.6% is 11.2% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 97.5. This is 10.8% below the February 2020 level.

The change in industrial production was slightly above consensus expectations.

NY Fed: Manufacturing "Business activity increased in New York State" in July

by Calculated Risk on 7/15/2020 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity increased in New York State for the first time in several months, according to firms responding to the July 2020 Empire State Manufacturing Survey. The headline general business conditions index rose to 17.2, its first positive reading since February. New orders and shipments also increased, and unfilled orders were steady.This was above expectations, and showed activity increased from a low level in July.

...

The index for number of employees edged up to 0.4, signaling that employment levels were steady. Notably, 22 percent of firms said that employment levels increased in July, the same proportion that reported a decrease. The average workweek index increased nine points to -2.6, pointing to a small decline in hours worked.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/15/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 10, 2020. Last week’s results included an adjustment for the Fourth of July holiday.

... The Refinance Index increased 12 percent from the previous week and was 107 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 16 percent higher than the same week one year ago.

“Mortgage rates continued their downward trend, with the 30-year fixed rate falling 7 basis points to 3.19 percent – another record low in MBA’s survey and 63 basis points lower than the recent high in late March. The drop in rates led to a jump in refinance activity to the highest level in a month, with refinance loan balances also climbing to a high last seen in March,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications fell over the week but remained 15 percent higher than a year ago – the eighth consecutive week of year-over-year increases. Purchase activity remains relatively strong, despite the continued economic uncertainty and high unemployment caused by the ongoing pandemic.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.19 percent from 3.26 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 16% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 14, 2020

Wednesday: Industrial Production, NY Fed Mfg, Beige Book

by Calculated Risk on 7/14/2020 08:50:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 7.9, up from -0.2.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 4.6% increase in Industrial Production, and for Capacity Utilization to increase to 68.1%.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

July 14 COVID-19 Test Results

by Calculated Risk on 7/14/2020 05:47:00 PM

The US is now conducting over 700,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

There were 760,282 test results reported over the last 24 hours.

There were 62,879 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Leading Index for Commercial Real Estate Decreased Further in June

by Calculated Risk on 7/14/2020 02:04:00 PM

From Dodge Data Analytics: Dodge Momentum Index Loses Ground in June

The Dodge Momentum Index dropped 6.6% in June to 121.5 (2000=100) from the revised May reading of 130.1. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The institutional component of the Momentum Index fell 11.7% while the commercial component declined by 3.5%.

The Momentum Index has shifted noticeably lower as the fallout from recession continues to hold its grip on the construction sector. The overall Momentum Index fell 13% in the second quarter from the first three months of the year, with the commercial component 14% lower and the institutional component down 11%. While the recession has ended and recovery underway, the return from one of the steepest downturns in U.S. history will be slow and fraught with risk. This holds true for the construction sector as well. While projects continue to enter planning, the slower pace suggests that recovery in the construction sector will be modest in coming months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 121.5 in June, down from 130.1 in May.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests a decline in Commercial Real Estate construction in 2020 and early 2021.

First Look at 2021 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/14/2020 12:08:00 PM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.5 percent over the last 12 months to an index level of 251.054 (1982-84=100). For the month, the index rose 0.6 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2019, the Q3 average of CPI-W was 250.200.

The 2019 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 0.5% year-over-year in June, and although this is very early - we need the data for July, August and September - my current guess is COLA will probably be under 1% this year, the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2019 yet, but wages probably increased again in 2019. If wages increased the same as in 2018, then the contribution base next year will increase to around $142,700 in 2020, from the current $137,700.

The law - as currently written - prohibits an increase in the contribution and benefit base if COLA is not greater than zero (this is possible this year). However if the there is even a small increase in CPI-W, the contribution base will be adjusted using the National Average Wage Index.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

Cleveland Fed: Key Measures Show Inflation Soft Year-over-year in June

by Calculated Risk on 7/14/2020 11:17:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% June. The 16% trimmed-mean Consumer Price Index rose 0.2% in June. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for June here. Motor fuel increased at a 290% annualized rate in June!

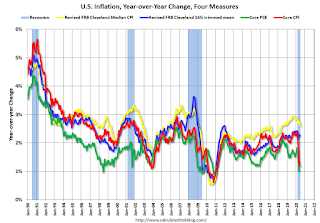

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.6%, the trimmed-mean CPI rose 2.3%, and the CPI less food and energy rose 1.2%. Core PCE is for May and increased 1.0% year-over-year.

Inflation will not be a concern during the crisis.

BLS: CPI increased 0.6% in June, Core CPI increased 0.2%

by Calculated Risk on 7/14/2020 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in June on a seasonally adjusted basis after falling 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.6 percent before seasonal adjustment.Overall inflation was at expectations in June. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The gasoline index rose sharply in June after recent declines and accounted for over half of the monthly increase in the seasonally adjusted all items index. The energy index increased 5.1 percent in June as the gasoline index rose 12.3 percent. The food index also rose in June, increasing 0.6 percent as the index for food at home continued to rise.

The index for all items less food and energy rose 0.2 percent in June, its first monthly increase since February. The index for motor vehicle insurance increased sharply in June after recent declines. The indexes for apparel, shelter, and medical care also increased in June, while the indexes for used cars and trucks, recreation, and communication all declined.

The all items index increased 0.6 percent for the 12 months ending June; this compares to a 0.1-percent increase for the 12 months ending May. The index for all items less food and energy increased 1.2 percent over the last 12 months. The food index increased 4.5 percent over the last 12 months, with the index for food at home rising 5.6 percent. Despite increasing in June, the energy index fell 12.6 percent over the last 12 months.

emphasis added

Monday, July 13, 2020

Tuesday: CPI

by Calculated Risk on 7/13/2020 07:34:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Have Moved Up From Last Week's Lows

Mortgage rates definitely hit the lowest all-time lows of all-time last week, at least for conventional 30yr fixed scenarios without many risk-based adjustments. The most recently available Freddie Mac rate survey (which drives a majority of mortgage rate headlines) reported all-time lows as of last Thursday. Indeed, that was still true as of Thursday, but things have changed since then. ... Context is important here. We're not even talking about an eighth of a percentage point in interest on average (though some lenders/programs have moved by as much as .25%.) [Top Tier Scenarios 30YR FIXED - 2.93%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

• At 8:30 AM, The Consumer Price Index for June from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.1% increase in core CPI.