by Calculated Risk on 7/05/2020 07:25:00 PM

Sunday, July 05, 2020

Sunday Night Futures

Weekend:

• Schedule for Week of July 5, 2020

Monday:

• At 10:00 AM ET, 1the ISM non-Manufacturing Index for June. The consensus is for a reading of 50.0, up from 45.4.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 13 and DOW futures are up 95 (fair value).

Oil prices were up over the last week with WTI futures at $40.48 per barrel and Brent at $43.06 barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.17 per gallon. A year ago prices were at $2.73 per gallon, so gasoline prices are down $0.56 per gallon year-over-year.

July 5 COVID-19 Test Results

by Calculated Risk on 7/05/2020 05:05:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 654,489 test results reported over the last 24 hours.

There were 42,551 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

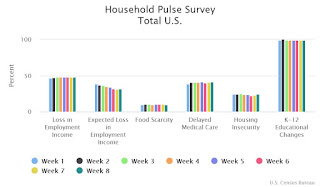

Census: Household Pulse Survey shows 32% of Households Expect Loss in Income; 24.5% Concerned about Housing

by Calculated Risk on 7/05/2020 01:42:00 PM

Note: The question on lost income is always since March 13, 2020 - so this percentage will not decline.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the recent survey results last Wednesday. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis.

Click on graph for larger image.

Click on graph for larger image.The data was collected between June 18 and June 23, 2020.

Definitions:

Loss in employment income: "Percentage of adults in households where someone had a loss in employment income since March 13, 2020."

This number is since March 13, and hasn't changed significantly.

Expected Loss in Employment Income: "Percentage of adults who expect someone in their household to have a loss in employment income in the next 4 weeks."

32% of households expect a loss in income over the next 4 weeks. This is down from 38.8% in late April, but up from 31% the previous (the previous week was the reference week for the BLS employment report). This might suggest the job gains stalled after the data was collected for the June employment report.

Food Scarcity: Percentage of adults in households where there was either sometimes or often not enough to eat in the last 7 days.

About 10% of households report food scarcity.

Delayed Medical Care: "Percentage of adults who delayed getting medical care because of the COVID-19 pandemic in the last 4 weeks."

41.5% of households report they delayed medical care over the last 4 weeks. This has not declined.

Housing Insecurity: "Percentage of adults who missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time."

24.5% of households reported they missed last month's rent or mortgage payment. This has increased from a low of 22.1% in the survey of June 4th - June 9th.

K-12 Educational Changes: "Percentage of adults in households with children in public or private school, where classes were taught in a distance learning format, or changed in some other way."

Essentially all households with children are reporting were not being taught in a normal format.

Saturday, July 04, 2020

July 4 COVID-19 Test Results

by Calculated Risk on 7/04/2020 11:53:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 644,930 test results reported over the last 24 hours.

There were 52,406 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Schedule for Week of July 5, 2020

by Calculated Risk on 7/04/2020 09:45:00 AM

This will be a light week for economic data.

The focus will be on Job Openings and Weekly unemployment claims.

10:00 AM: the ISM non-Manufacturing Index for June. The consensus is for a reading of 50.0, up from 45.4.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in April to 5.046 million from 6.011 million in March.

The number of job openings (yellow) were down 31% year-over-year, and Quits were down 49% year-over-year.

10:00 AM: Corelogic House Price index for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit from the Federal Reserve.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.400 million initial claims, down from 1.427 million the previous week.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.1% increase in core PPI.

Friday, July 03, 2020

July 3 COVID-19 Test Results, Record Tests, Record Number Positive

by Calculated Risk on 7/03/2020 05:23:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 721,054 test results reported over the last 24 hours.

There were 57,562 positive tests. This is a new record.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Comments on Weekly Unemployment Claims

by Calculated Risk on 7/03/2020 12:25:00 PM

A few comments:

On a monthly basis, most analysts focus on initial unemployment claims for the BLS reference week of the employment report. For July, the BLS reference week will be July 12th through the 18th, and initial claims for that week will be released on Thursday, July 23rd.

Note that a few states have not released Pandemic Unemployment Assistance (PUA) claims yet. This includes Georgia, New Hampshire and a few other areas - so the number of PUA claims is too low. However, there may also be processing delays that are impacting the numbers.

Continued claims increased slightly last week to 19,290,000 (SA) from 19,231,000 (SA) the previous week. However, continued claims are down 5.6 million from the peak, suggesting a large number of people have returned to their jobs (as the employment report showed).

The following graph shows regular initial unemployment claims (blue) and PUA claims (red) since early February.

This was the 15th consecutive week with extraordinarily high initial claims.

It is possible that we are starting to see some layoffs associated with the end of some early Payroll Protection Plan (PPP) participants.

We should start seeing layoffs associated with the rising COVID cases and hospitalization in some states (like Arizona, Florida and Texas). With bar and restaurant closings in some areas, we will probably see more initial claims in those states in the coming week, and that will show up in the report the following week.

Note that these states don't have to lockdown to see a decline in economic activity. As Merrill Lynch economists noted last month: "Most of the slowdown occurred due to voluntary social distancing rather than lockdown policies."

Initial unemployment claims, and continued claims (and PUA claims) are important high frequency indicators to follow right now.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declined

by Calculated Risk on 7/03/2020 08:50:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: Forbearances Reverse Course, See Largest Weekly Decline Yet

Overall, the number of active forbearance plans is down 104K from last week for the lowest weekly total active forbearances we’ve seen since the first week of May. This latest drop brings us down 183K from the peak on May 22 and brings us back to the trend of improvement we’d seen throughout June.

According to daily mortgage payment tracking data, as of the end of June, roughly a quarter of homeowners in forbearance had remitted their June payment. That’s as compared to 46% in April and approximately 30% in May.

What remains to be seen is what impact the new spikes in COVID-19 around much of the country will have on forbearance requests moving forward. If they lead to another round of shutdowns – or extensions of those already in effect – and put upward pressure on unemployment numbers, we could see yet another reversal of this trend. The same holds true for the looming expiration of expanded unemployment benefits.

Click on graph for larger image.

As of June 30, 4.58 million homeowners are in forbearance plans, representing 8.6% of all active mortgages, down from 8.8% last week. Together, they represent just under $1 trillion in unpaid principal ($995B).

emphasis added

Thursday, July 02, 2020

July 2 COVID-19 Test Results

by Calculated Risk on 7/02/2020 05:58:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 634,822 test results reported over the last 24 hours.

There were 52,815 positive tests. This is the second consecutive day over 50,000.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Hotels: Occupancy Rate Declined 38.7% Year-over-year

by Calculated Risk on 7/02/2020 02:32:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 27 June

U.S. hotel performance data for the week ending 27 June showed another small rise from previous weeks and less severe year-over-year declines, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

21-27 June 2020 (percentage change from comparable week in 2019):

• Occupancy: 46.2% (-38.7%)

• Average daily rate (ADR): US$95.37 (-29.0%)

• Revenue per available room (RevPAR): US$44.03 (-56.5%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

According to STR, the improvement appears related mostly to leisure travel as opposed to business travel.

Note: Y-axis doesn't start at zero to better show the seasonal change.