by Calculated Risk on 7/02/2020 02:10:00 PM

Thursday, July 02, 2020

Trade Deficit increased to $54.6 Billion in May

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $54.6 billion in May, up $4.8 billion from $49.8 billion in April, revised.

May exports were $144.5 billion, $6.6 billion less than April exports. May imports were $199.1 billion, $1.8 billion less than April imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in May.

Exports are down 32% compared to May 2019; imports are down 25% compared to May 2019.

Both imports and exports have decreased sharply due to COVID-19.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $27.55 per barrel in May, down from $34.72 per barrel in April, and down from $62.60 in May 2019.

The trade deficit with China decreased to $27.0 billion in May, from $30.1 billion in May 2019.

BEA: June Vehicles Sales increased to 13.0 Million SAAR

by Calculated Risk on 7/02/2020 11:59:00 AM

The BEA released their estimate of May vehicle sales this morning. The BEA estimated light vehicle sales of 13.05 million SAAR in June 2020 (Seasonally Adjusted Annual Rate), up 5.7% from the revised May sales rate, and down 24.1% from June 2019.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for June 2020 (red).

The impact of COVID-19 is significant, and it appears April was the worst month.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales collapsed in the second half of March, and really declined in April.

However sales rebounded in May, and increased further in June.

Comments on June Employment Report

by Calculated Risk on 7/02/2020 11:09:00 AM

The labor market swings have been huge, and the June employment report was better than expected with 4.8 million jobs added.

Leisure and hospitality led the way with 2.088 million jobs added in June, following 1.403 million jobs added in May. Leisure and hospitality lost 8.318 million jobs in March and April, so about 42% of those jobs were added back in May and June.

However, these are the jobs most susceptible to a surge in COVID infections, and leisure and hospitality will likely be under pressure in July.

Earlier: June Employment Report: 4.8 Million Jobs Added, 11.1% Unemployment Rate

In June, the year-over-year employment change was minus 13 million jobs.

One of the keys to follow will be the number of workers on temporary layoff. This increased from 801 thousand in February, to 1.848 million in March, and to 18.063 million in April. This decreased in May to 15.343 million, and decreased further in June to 10.565 million.

Meanwhile permanent job losers increased in June to 2.883 million from 2.295 million in May.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in June to 81.5%, and the 25 to 54 employment population ratio increased to 73.5%.

Part Time for Economic Reasons

"The number of persons employed part time for economic reasons declined by 1.6 million to 9.1 million in June but is still more than double its February level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. This group includes persons who usually work full time and persons who usually work part time."The number of persons working part time for economic reasons decreased in June to 9.062 million from 10.633 million in May.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 18.0% in June. This is down from the record high in April 22.8% (and down from 21.2% in May) for this measure since 1994. The previous peak was 17.2% during the Great Recession.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.391 million workers who have been unemployed for more than 26 weeks and still want a job. This will increase sharply in 3 or 4 months, and will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well above expectations and the previous two months were revised up 90,000 combined. The headline unemployment rate decreased to 11.1% .

Last month I noted that the "reopenings" would be a June story, and that is what this report suggests. In addition, companies using PPP had to rehire employees to convert the loans to a grants. Unfortunately, the surge in virus infections and related closures, will probably negatively impact the July report. In addition, we will probably start to see more PPP related layoffs.

As a reminder, the course of the economy will be determined by the course of the pandemic.

Weekly Initial Unemployment Claims decrease to 1,427,000

by Calculated Risk on 7/02/2020 08:55:00 AM

The DOL reported:

In the week ending June 27, the advance figure for seasonally adjusted initial claims was 1,427,000, a decrease of 55,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 1,480,000 to 1,482,000. The 4-week moving average was 1,503,750, a decrease of 117,500 from the previous week's revised average. The previous week's average was revised up by 500 from 1,620,750 to 1,621,250.The previous week was revised up.

emphasis added

This does not include the 839,563 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,503,750.

This was close to the consensus forecast of 1.4 million initial claims and the previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims increased to 19,290,000 (SA) from 19,231,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 12,853,163 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

June Employment Report: 4.8 Million Jobs Added, 11.1% Unemployment Rate

by Calculated Risk on 7/02/2020 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 4.8 million in June, and the unemployment rate declined to 11.1 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflected the continued resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In June, employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services.

...

The change in total nonfarm payroll employment for April was revised down by 100,000, from -20.7 million to -20.8 million, and the change for May was revised up by 190,000, from +2.5 million to +2.7 million. With these revisions, employment in April and May combined was 90,000 higher than previously reported.

emphasis added

Click on graph for larger image.

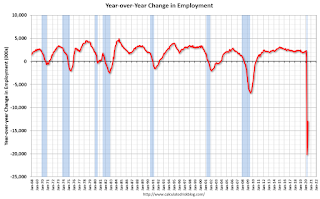

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In June, the year-over-year change was -12.957 million jobs.

Total payrolls increased by 4.8 million in June.

Payrolls for April and May were revised up 90 thousand combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

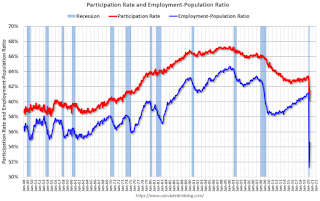

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.5% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.5% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 54.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in June to 11.1%.

This was well above consensus expectations of 3,070,000 jobs added, and April and May were revised up by 90,000 combined.

I'll have much more later …

Wednesday, July 01, 2020

Thursday: Employment Report, Initial Unemployment Claims, Trade Deficit

by Calculated Risk on 7/01/2020 08:47:00 PM

Thursday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 3,074,000 jobs added, and for the unemployment rate to decrease to 12.3%.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a 1.400 million initial claims, down from 1.480 million the previous week.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is the trade deficit to be $52.4 billion. The U.S. trade deficit was at $49.4 Billion the previous month.

July 1 COVID-19 Test Results, Highest Percent Positive Since Early May, Over 50,000 Positive

by Calculated Risk on 7/01/2020 06:40:00 PM

UPDATE: First post didn't include California numbers. Now updated.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 621,114 test results reported over the last 24 hours.

There were 52,982 positive tests. This is the most daily positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

FOMC Minutes: Pandemic "Posed considerable downside risks to the economic outlook over the medium term"

by Calculated Risk on 7/01/2020 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee June 9-10, 2020. A few excerpts:

Over the intermeeting period, risk sentiment improved, on net, as optimism over reopening the economy, potential coronavirus treatments, the unexpectedly positive May employment situation report, and other indicators that suggest that economic activity may be rebounding more than offset concerns arising from otherwise dire economic data releases, warnings from health experts that openings may have been premature, and renewed tensions between the United States and China. Equity prices rose, and corporate bond spreads narrowed notably. ...

...

Participants noted that the coronavirus outbreak was causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health induced sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices were holding down consumer price inflation. Financial conditions had improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

...

In their discussion of monetary policy for this meeting, members agreed that the coronavirus outbreak was causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health had induced sharp declines in economic activity and a surge in job losses. Consumer price inflation was being held down by weaker demand and significantly lower oil prices. Financial conditions had improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households, businesses, and communities. Members agreed that the Federal Reserve was committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum-employment and price-stability goals.

Members further concurred that the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term and posed considerable downside risks to the economic outlook over the medium term. In light of these developments, members decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. Members noted that they expected to maintain this target range until they were confident that the economy had weathered recent events and was on track to achieve the Committee's maximum-employment and price-stability goals.

emphasis added

June Employment Preview

by Calculated Risk on 7/01/2020 01:13:00 PM

On Thursday at 8:30 AM ET, the BLS will release the employment report for June (Friday is a holiday). The consensus is for an increase of 3.1 million non-farm payroll jobs, and for the unemployment rate to decrease to 12.3%.

Last month, the BLS reported 2,509,000 jobs added in May and the unemployment rate decreased to 13.3%.

There was quite a bit of discussion last month on misclassification of workers, and it is likely the actual unemployment rate was much higher than 13.3% last month. The BLS put out a note on Monday discussing this issue: Update on the Misclassification that Affected the Unemployment Rate. The BLS is working with the Census Bureau (Census conducts the survey), to minimize misclassification going forward. This means the unemployment rate might be higher than expected in June.

Merrill Lynch economists wrote this morning: "We expect continued recovery in the June jobs report with nonfarm payroll growth of 2.8mn, picking up from +2.5mn in May. The unemployment rate is likely to fall to 12.5% with strong job gains but also a tick up in labor participation."

Note that the ADP report showed 2.369 million private sector jobs added in June; below expectations.

The usual indicators are somewhat useless again this month. For example, the ISM manufacturing employment index increased in June to 42.1% from 31.1% in May, but still well below 50. This would suggest around 60,000 manufacturing jobs lost in June - although ADP showed 88,000 manufacturing jobs added.

And the weekly claims report showed 1.48 million initial unemployment claims last week (about 2.2 million initial claims including Pandemic Unemployment Assistance). This is extremely high, but well down from the reference weeks in April and May.

IMPORTANT: The employment report will probably show a large increase in state and local government education hiring. This is because of a quirk in the seasonal adjustment, see: Will State and Local Governments Hire 1 Million Teachers in June and July? No, but ...

• Conclusion: It appears that quite a few jobs were added in June, and according to the ADP report, many of the jobs were in leisure and hospitality, as restaurants and bars reopened. Some of those jobs will probably be lost in July with the surge in COVID cases.

No matter what the June report shows, there will be millions and millions of people unemployed, and the course of the economy will be determined by the course of the virus.

Construction Spending Decreased in May

by Calculated Risk on 7/01/2020 11:05:00 AM

From the Census Bureau reported that overall construction spending decreased in May:

Construction spending during May 2020 was estimated at a seasonally adjusted annual rate of $1,356.4 billion, 2.1 percent below the revised April estimate of $1,386.1 billion. The May figure is 0.3 percent above the May 2019 estimate of $1,352.9 billion. During the first five months of this year, construction spending amounted to $543.2 billion, 5.7 percent above the $513.7 billion for the same period in 2019.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,001.2 billion, 3.3 percent below the revised April estimate of $1,035.2 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $355.2 billion, 1.2 percent above the revised April estimate of $350.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 21% below the previous peak.

Non-residential spending is 12% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 9% above the previous peak in March 2009, and 35% above the austerity low in February 2014.

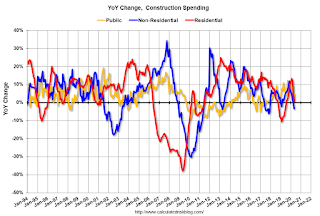

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up slightly. Non-residential spending is down 3.4% year-over-year. Public spending is up 4.7% year-over-year.

This was below consensus expectations of a 1% increase in spending, however construction spending for the previous year was revised up.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors.