by Calculated Risk on 6/23/2020 11:06:00 AM

Tuesday, June 23, 2020

A few Comments on May New Home Sales

New home sales for May were reported at 676,000 on a seasonally adjusted annual rate basis (SAAR). However sales for the previous three months were revised down.

This was above consensus expectations. New home sales are counted when the contract is signed, whereas existing home sales are counted when the transaction closes. So new home sales performed better than existing home sales in May. Based on mortgage applications and regional pending home sales reports, there will be a pickup in existing home sales in June (or July), and builder reports suggest there will probably be a further pickup in new home sales too.

No one should get too excited. I've long argued that new home sales and housing starts (especially single family starts) were some of the best leading indicators for the economy. However, I've noted that there are times when this isn't true. NOW is one of those times. The course of the economy will be determined by the course of the virus, and New Home Sales tell us nothing about the future of the pandemic.

The longer the pandemic lasts, the more long term damage to the economy - and, if the pandemic worsens and persists - that will eventually negatively impact housing. The outlook for housing depends on the outlook for the pandemic.

Earlier: New Home Sales increased to 676,000 Annual Rate in May.

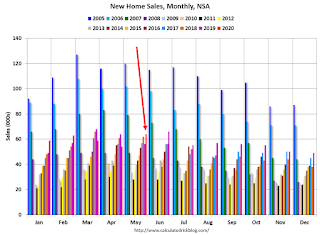

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 12.7% year-over-year (YoY) in May. Year-to-date (YTD) sales are still up 1.9%. (the comparison to May of last year was pretty easy).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed (with help from the sharp decline in existing home sales due to the pandemic).

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 676,000 Annual Rate in May

by Calculated Risk on 6/23/2020 10:12:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 676 thousand.

The previous three months were revised down.

Sales of new single-family houses in May 2020 were at a seasonally adjusted annual rate of 676,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 16.6 percent above the revised April rate of 580,000 and is 12.7 percent above the May 2019 estimate of 600,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 5.6 months from 6.7 months in April.

The months of supply decreased in May to 5.6 months from 6.7 months in April. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of May was 318,000. This represents a supply of 5.6 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2020 (red column), 64 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 30 thousand in 2011.

This was above expectations of 640 thousand sales SAAR, however sales in the three previous months were revised down. I'll have more later today.

Monday, June 22, 2020

Tuesday: New Home Sales

by Calculated Risk on 6/22/2020 07:34:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Ground Near Lows. Can it Continue?

Mortgage rates held their ground today, with the average lender in roughly the same shape as they were on Friday. Incidentally, that's great shape! When it comes to the best-case scenario conventional 30yr fixed quote, rates are still very close to the all-time lows seen two weeks ago. [30YR FIXED - 3.00%]Tuesday:

emphasis added

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 640 thousand SAAR, up from 623 thousand in April. Note that new home sales are reported when a contract is signed, so we should see a rebound in sales in May (unlike existing home sales).

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June.

June 22 COVID-19 Test Results, Highest Percent Positive since Late May

by Calculated Risk on 6/22/2020 05:35:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 474,592 test results reported over the last 24 hours.

There were 27,928 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for First Time in Series to 8.48%" of Portfolio Volume

by Calculated Risk on 6/22/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases for First Time in Series to 8.48%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14, 2020. According to MBA’s estimate, 4.2 million homeowners are now in forbearance plans – down from almost 4.3 million homeowners the prior week.

...

“The lower share of loans in forbearance was led by declines in GSE and portfolio and PLS loans, as more of those borrowers exited than entered a new forbearance plan,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Fewer homeowners in forbearance underscores the continued improvements in the job market, and provides another sign of the fundamental health of the housing market, which has rebounded considerably over the past several weeks.”

Added Fratantoni, “The big unknown with respect to this positive development is the extent to which it relies upon policy measures put in place to help families through this crisis, particularly the stimulus payments and enhanced unemployment insurance benefits that were key parts of the CARES Act. We expect to see further improvements in the weeks ahead given the drop in forbearance requests this week.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) increased across all investor types for the first time since the week of March 30-April 5: from 0.17% to 0.19%."

Comments on May Existing Home Sales

by Calculated Risk on 6/22/2020 01:22:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 3.91 million in May, Rebound Expected in Coming Months

A few key points:

1) Existing home sales are counted at the close of escrow, so this report is mostly for contracts signed in March and April - when the economy was mostly shutdown.

Sales NSA for May were below the housing bust low for May. However, there has been a rebound in mortgage purchase applications and regional pending home sales, so we can expect a rebound in existing home sales in June or July.

2) Inventory is very low, and was down 18.8% year-over-year (YoY) in May. This is the lowest level of inventory for May since at least the early 1990s.

3) As usual, housing economist Tom Lawler was much closer to the actual NAR report than the consensus forecast.

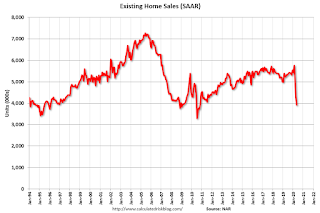

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April and May, sales to date are only down about 9.1% compared to the same period in 2019.

Sales NSA in May (372,000) were well below sales last year in April (452,000).

Sales NSA in May were just BELOW the housing bust minimum for May in 2009 (376,000).

Black Knight: National Mortgage Delinquency Rate Increased Sharply in May, Highest Rate since 2011

by Calculated Risk on 6/22/2020 11:59:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but these loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: Mortgage Delinquencies Increase Another 20% in May to Hit Highest Level Since 2011, But June Payment Data Suggests Rise May Be Cresting

• Another 723,000 homeowners became past due on their mortgages in May, pushing the national delinquency rate to its highest level in 8.5 yearsAccording to Black Knight's First Look report for March, the percent of loans delinquent increased 20.4% in May compared to April, and increased 131% year-over-year.

• There are now 4.3 million homeowners past due on their mortgages or in active foreclosure – including those in forbearance who have missed scheduled payments as part of their plans – up from 2 million at the end of March

• Serious delinquencies are on the rise as well, increasing by more than 50% over the past two months

• However, Black Knight’s McDash Flash Payment Tracker shows a higher share of payments have been made thus far in June than at the same time in May, suggesting the rise in delinquencies may be leveling off

• Both foreclosure starts and sales (completions), halted by COVID-19 moratoriums, remain at record lows

• The share of homeowners in active foreclosure has fallen to its lowest level on record since Black Knight began reporting the figure in January 2000 emphasis added

The percent of loans in the foreclosure process decreased 5.8% in May and were down 22.7% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 7.76% in May, up from 6.45% in April.

The percent of loans in the foreclosure process decreased in May to 0.38% from 0.40% in April.

The number of delinquent properties, but not in foreclosure, is up 2,363,000 properties year-over-year, and the number of properties in the foreclosure process is down 55,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2020 | Apr 2020 | May 2019 | May 2018 | |

| Delinquent | 7.76% | 6.45% | 3.36% | 3.64% |

| In Foreclosure | 0.38% | 0.40% | 0.49% | 0.59% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 4,123,000 | 3,400,000 | 1,760,000 | 1,867,000 |

| Number of properties in foreclosure pre-sale inventory: | 200,000 | 211,000 | 255,000 | 303,000 |

| Total Properties | 4,324,000 | 3,611,000 | 2,015,000 | 2,171,000 |

NAR: Existing-Home Sales Decreased to 3.91 million in May, Rebound Expected in Coming Months

by Calculated Risk on 6/22/2020 10:09:00 AM

From the NAR: Existing-Home Sales Fall 9.7% in May While NAR Expects Strong Rebound in Coming Months

Existing-home sales fell in May, marking a three-month decline in sales as a result of the coronavirus outbreak, according to the National Association of Realtors®. Each of the four major regions witnessed dips in month-over-month and year-over-year sales, with the Northeast experiencing the greatest month-over-month drop.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, slumped 9.7% from April to a seasonally-adjusted annual rate of 3.91 million in May. Overall, sales fell year-over-year, down 26.6% from a year ago (5.33 million in May 2019).

...

Total housing inventory at the end of May totaled 1.55 million units, up 6.2% from April, and down 18.8% from one year ago (1.91 million). Unsold inventory sits at a 4.8-month supply at the current sales pace, up from 4.0 months in April and up from the 4.3-month figure recorded in May 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May (3.91 million SAAR) were down 9.7% from last month, and were 26.6% below the May 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.55 million in May from 1.46 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.55 million in May from 1.46 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 18.8% year-over-year in May compared to May 2019.

Inventory was down 18.8% year-over-year in May compared to May 2019. Months of supply increased to 4.8 months in May.

This was below the consensus forecast. I'll have more later … but I expect closed sales to rebound in coming months.

Six High Frequency Indicators for a Recovery

by Calculated Risk on 6/22/2020 08:35:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will probably recover very slowly.

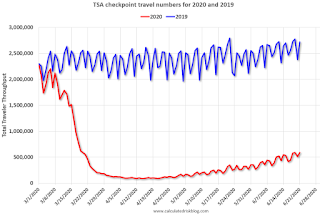

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On June 21st there were 590,456 travelers compared to 2,719,643 a year ago.

That is a decline of 78.3%. There has been a slow steady increase from the bottom, but air travel is still down significantly.

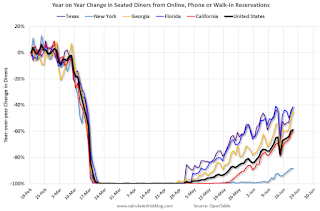

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through June 20, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

New York is still off 88%.

Florida is only down 41% YoY.

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have picked up a little, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for three months.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

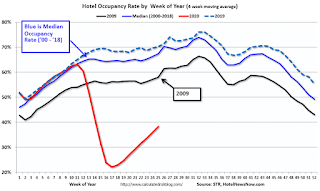

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June. So even though the occupancy rate was up slightly compared to last week, the year-over-year decline was about the same this week as the previous two weeks (43.4% decline vs. 45.3% last week, and 43.2% decline two weeks ago).

At one point, gasoline consumption was off almost 50% YoY.

As of June 12th, gasoline consumption was off about 21% YoY (about 79% of normal). After rebounding from the low in early April, gasoline consumption has remained down about 20% YoY since early May.

The final graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the US is still only about 46% of the January level. It is at 33% in New York, and 61% in Houston.

Chicago Fed National Activity "Suggests Economic Growth Increased Substantially in May"

by Calculated Risk on 6/22/2020 08:34:00 AM

From the Chicago Fed: Index Suggests Economic Growth Increased Substantially in May

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +2.61 in May from –17.89 in April. All four broad categories of indicators used to construct the index made positive contributions in May, and all four categories increased from April. The index’s three-month moving average, CFNAI-MA3, moved up to –6.65 in May from –7.50 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was in a recession starting in March (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.