by Calculated Risk on 6/16/2020 09:23:00 AM

Tuesday, June 16, 2020

Industrial Production Increased 1.4 Percent in May

From the Fed: Industrial Production and Capacity Utilization

Total industrial production increased 1.4 percent in May, as many factories resumed at least partial operations following suspensions related to COVID-19. Even so, total industrial production in May was 15.4 percent below its pre-pandemic level in February. Manufacturing output—which fell sharply in March and April—rose 3.8 percent in May; most major industries posted increases, with the largest gain registered by motor vehicles and parts. The indexes for mining and utilities declined 6.8 percent and 2.3 percent, respectively. At 92.6 percent of its 2012 average, the level of total industrial production was 15.3 percent lower in May than it was a year earlier. Capacity utilization for the industrial sector increased 0.8 percentage point to 64.8 percent in May, a rate that is 15.0 percentage points below its long-run (1972–2019) average and 1.9 percentage points below its trough during the Great Recession.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up slightly from the record low set last month, and still below the trough of the Great Recession (the series starts in 1967).

Capacity utilization at 64.8% is 15.0% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

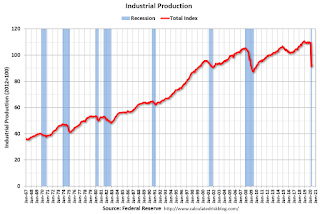

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in May to 92.6. This is 6.3% above the Great Recession low.

The change in industrial production was below consensus expectations.

Retail Sales increased 17.7% in May

by Calculated Risk on 6/16/2020 08:37:00 AM

On a monthly basis, retail sales increased 17.7 percent from April to May (seasonally adjusted), and sales were down 6.1 percent from May 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $485.5 billion, an increase of 17.7 percent from the previous month, but 6.1 percent below May 2019. Total sales for the March 2020 through May 2020 period were down 10.5 percent from the same period a year ago. The March 2020 to April 2020 percent change was revised from down 16.4 percent to down 14.7 percent.

emphasis added

Click on graph for larger image.

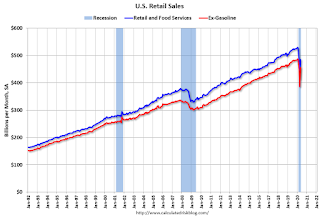

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 18.0% in April.

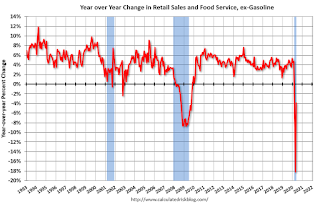

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, decreased by 3.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, decreased by 3.9% on a YoY basis.The increase in May was well above expectations, and sales in March and April were revised up.

Monday, June 15, 2020

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey, Fed Chair Powell Testimony

by Calculated Risk on 6/15/2020 08:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher, But Still Near All-Time Lows

Mortgage rates were slightly higher today for the average lender. Additionally, some lenders bumped rates a bit in the middle of the day in response to weakness in the bond market. … the average lender doesn't have a ton of incentive to drop rates very quickly given that top tier scenarios are increasingly seeing rates under 3%. [30YR FIXED - 2.96%]Tuesday:

emphasis added

• At 8:30 AM ET, Retail sales for May is scheduled to be released. The consensus is for 8.0% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 3.0% increase in Industrial Production, and for Capacity Utilization to increase to 66.9%.

• At 10:00 AM, The June NAHB homebuilder survey. The consensus is for a reading of 45, up from 37. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Monetary Policy Report submitted to the Congress on June 12, 2020, pursuant to section 2B of the Federal Reserve Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

June 15 COVID-19 Test Results

by Calculated Risk on 6/15/2020 05:34:00 PM

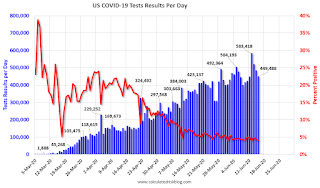

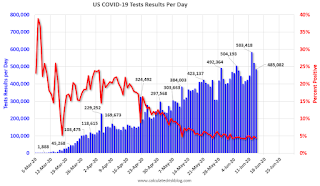

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 449,488 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases Slightly to 8.55%" of Portfolio Volume

by Calculated Risk on 6/15/2020 04:03:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 8.55%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 8.53% of servicers’ portfolio volume in the prior week to 8.55% as of June 7, 2020. According to MBA’s estimate, almost 4.3 million homeowners are now in forbearance plans.

...

“MBA’s survey results from the first week of June showed a slight uptick in the overall share of loans in forbearance, but this increase was primarily driven by a larger share of portfolio and PLS loans in forbearance. Half of the servicers in our sample saw the forbearance share decline for at least one investor category,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Although there continues to be layoffs, the job market does appear to be improving, and this is likely leading to many borrowers in forbearance deciding to opt out of their plan.”

Added Fratantoni, “With June mortgage payments due, servicers did report the first increase in forbearance requests in two months. The level of forbearance requests is still quite low, but there was a noticeable increase in call volume over the course of the week.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) increased across all investor types for the first time since the week of March 30-April 5: from 0.17% to 0.19%."

LA area Port Traffic Down Sharply Year-over-year in May

by Calculated Risk on 6/15/2020 10:59:00 AM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

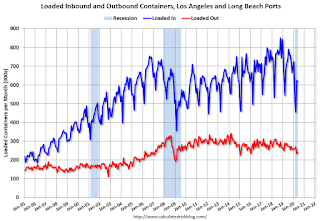

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.2% in May compared to the rolling 12 months ending in April. Outbound traffic was down 1.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Because of the timing of the New Year, we would have expected traffic to decline in February without an impact from COVID-19, but bounce back in March and April.

Imports were down 14% YoY in May, and exports were down 17% YoY.

In general imports both imports and exports have turned down recently. There might be some bounce back soon.

Six High Frequency Indicators for a Recovery

by Calculated Risk on 6/15/2020 08:44:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On June 14th there were 544,046 travelers compared to 2,642,083 a year ago.

That is a decline of 79.4%. There has been a steady increase from the bottom, but air travel is still down significantly.

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through June 13, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

New York is still off 92%.

Texas is only down 43% YoY.

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have picked up a little, but have been essentially at zero for three months.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 45.3% year-over-year last week. Occupancy has increased over the last few of weeks, but is still very low.

At one point, gasoline consumption was off almost 50% YoY.

As of June 5th, gasoline consumption was off about 20% YoY (about 80% of normal). This was the same decline as the previous week.

The final graph is from Apple mobility.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data public transit in the US is still only about 45% of the January level. It is at 31% in New York, and 63% in Houston.

NY Fed: Manufacturing "Business activity steadied in New York State" in June

by Calculated Risk on 6/15/2020 08:41:00 AM

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity steadied in New York State, according to firms responding to the June 2020 Empire State Manufacturing Survey. After breaching record lows in April and May, the headline general business conditions index climbed forty-eight points to -0.2.This was well above expectations, and showed activity "steadied" (at a low level) in June.

...

The index for number of employees was little changed at -3.5, pointing to a second consecutive month of slight employment declines. Notably, 18 percent of firms said that employment levels increased in June. The average workweek index increased ten points, but remained negative at -12.0, indicating an ongoing decline in hours worked, though at a slower pace than in recent months.

emphasis added

Sunday, June 14, 2020

Sunday Night Futures

by Calculated Risk on 6/14/2020 07:30:00 PM

Weekend:

• Schedule for Week of June 14, 2020

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -27.5, up from -48.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 42 and DOW futures are down 375 (fair value).

Oil prices were down over the last week with WTI futures at $35.70 per barrel and Brent at $38.32 barrel. A year ago, WTI was at $53, and Brent was at $67 - so WTI oil prices are down about 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.09 per gallon. A year ago prices were at $2.68 per gallon, so gasoline prices are down $0.59 per gallon year-over-year.

June 14 COVID-19 Test Results

by Calculated Risk on 6/14/2020 05:53:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 485,082 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.