by Calculated Risk on 6/15/2020 08:41:00 AM

Monday, June 15, 2020

NY Fed: Manufacturing "Business activity steadied in New York State" in June

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity steadied in New York State, according to firms responding to the June 2020 Empire State Manufacturing Survey. After breaching record lows in April and May, the headline general business conditions index climbed forty-eight points to -0.2.This was well above expectations, and showed activity "steadied" (at a low level) in June.

...

The index for number of employees was little changed at -3.5, pointing to a second consecutive month of slight employment declines. Notably, 18 percent of firms said that employment levels increased in June. The average workweek index increased ten points, but remained negative at -12.0, indicating an ongoing decline in hours worked, though at a slower pace than in recent months.

emphasis added

Sunday, June 14, 2020

Sunday Night Futures

by Calculated Risk on 6/14/2020 07:30:00 PM

Weekend:

• Schedule for Week of June 14, 2020

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -27.5, up from -48.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 42 and DOW futures are down 375 (fair value).

Oil prices were down over the last week with WTI futures at $35.70 per barrel and Brent at $38.32 barrel. A year ago, WTI was at $53, and Brent was at $67 - so WTI oil prices are down about 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.09 per gallon. A year ago prices were at $2.68 per gallon, so gasoline prices are down $0.59 per gallon year-over-year.

June 14 COVID-19 Test Results

by Calculated Risk on 6/14/2020 05:53:00 PM

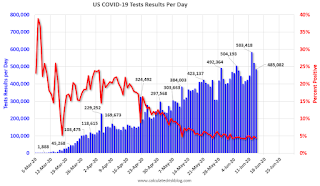

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 485,082 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Recession Measures and NBER

by Calculated Risk on 6/14/2020 09:08:00 AM

Calling the beginning or end of a recession usually takes time. However, the economic decline in March was so severe that the National Bureau of Economic Research (NBER) has already called the end of the expansion in February.

The committee has determined that a peak in monthly economic activity occurred in the U.S. economy in February 2020. The peak marks the end of the expansion that began in June 2009 and the beginning of a recession. The expansion lasted 128 months, the longest in the history of U.S. business cycles dating back to 1854. The previous record was held by the business expansion that lasted for 120 months from March 1991 to March 2001.The NBER will probably wait some time before calling the end of the recession, this process can take from 18 months to two years or longer.

...

The usual definition of a recession involves a decline in economic activity that lasts more than a few months. However, in deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration, and whether economic activity declined broadly across the economy (the diffusion of the downturn). The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions. Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.

In the mean time, if the economy slides into recession again, the committee will only consider it a new recession if most major indicators were close to or above their previous highs. Otherwise it will just be considered a continuation of the previous recession.

A good example of the NBER calling two separate recessions was in the early '80s, from the NBER memo:

"The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs."It will take some time for most major indicators to be above their previous high after the current recession because of the severe contraction as the graphs below show.

emphasis added

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.

Click on graph for larger image.

Click on graph for larger image.This graph is for real GDP through Q1 2020.

This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession.

Real GDP is only 1.2% below the pre-recession peak - however real GDP is expected to decline another 7% to 8% in Q2 (A much larger decline than the Great Recession).

Most forecasters expect GDP to be positive in Q3, but will remain below the pre-recession peak until sometime in 2021.

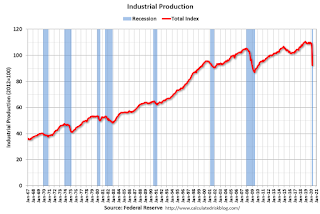

The second graph is for monthly industrial production based on data from the Federal Reserve through Apr 2020.

The second graph is for monthly industrial production based on data from the Federal Reserve through Apr 2020.Industrial production is off over 16% from the pre-recession peak, but is expected to increase in May (to be released this week).

Note that industrial production was weak prior to the onset of the pandemic.

Industrial production usually takes a long time to recover after a significant decline.

The third graph is for employment through May 2020.

The third graph is for employment through May 2020.Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous three recessions (1990-1991, 2001, 2007-2009).

Employment is currently off about 12.8% from the pre-recession peak (dashed line). This is an improvement from off 14.5% in April.

It is likely that employment will not recover to pre-recession levels for some time.

And the last graph is for real personal income excluding transfer payments through Apr 2020.

And the last graph is for real personal income excluding transfer payments through Apr 2020.Real personal income less transfer payments was off 9% in April. This was a larger decline than the worst of the great recession.

Once again it will take a long time to return to pre-recession levels.

These graphs are useful in trying to identify peaks and troughs in economic activity.

My guess is that economic activity will bottom in Q2 (it may have already happened in April), but the pace of the recovery will depend on the course of the virus.

Saturday, June 13, 2020

June 13 COVID-19 Test Results

by Calculated Risk on 6/13/2020 06:09:00 PM

Positive cases are increasing significantly in some areas.

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 523,042 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Schedule for Week of June 14, 2020

by Calculated Risk on 6/13/2020 08:11:00 AM

The key reports this week are Retail sales and Housing Starts.

For manufacturing, the Industrial Production report, and the NY and Philly Fed manufacturing surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -27.5, up from -48.5.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for 8.0% increase in retail sales.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for 8.0% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, decreased by 19.7% on a YoY basis in April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 3.0% increase in Industrial Production, and for Capacity Utilization to increase to 66.9%.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 45, up from 37. Any number below 50 indicates that more builders view sales conditions as poor than good.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.100 million SAAR, up from 0.891 million SAAR in April.

12:00 PM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.450 million initial claims, down from 1.542 million the previous week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of -25.0, up from -43.1.

10:00 AM: State Employment and Unemployment (Monthly) for May 2020

1:00 PM: Discussion, Fed Chair Jerome Powell, At the Federal Reserve Bank of Cleveland Virtual Discussion on Building a Resilient Workforce During the COVID-19 Era

Friday, June 12, 2020

Seattle Real Estate in May: Sales down 41% YoY, Inventory down 37% YoY

by Calculated Risk on 6/12/2020 06:48:00 PM

The Northwest Multiple Listing Service reported Housing activity in Western Washington shows resiliency as buyers, sellers and brokers adjust to COVID-19 restrictions

Not surprisingly, year-over-year comparisons showed sharp declines. The number of new listings fell nearly 33%, total active listings plummeted nearly 36%, pending sales declined 13.5%, and closed sales dropped about 35%. Prices remained in positive territory, rising about 2.3% from a year ago.There were 5,957 sales in May 2020, down from 9,153 sales in May 2019.

…

“The local real estate market is hot, but it looks different than it traditionally does,” remarked J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “The constraint on available inventory makes it feel like we’re running out of homes to sell.”

Brokers added 9,871 new listings to the MLS database during May, which compares to 14,689 for the same period a year ago. At month-end the selection included 10,357 active listings; that volume was 5,766 fewer than the year ago total of 16,133.

emphasis added

The press release is for the Northwest. In King County, sales were down 41.2% year-over-year, and active inventory was down 40.0% year-over-year.

In Seattle, sales were down 41.2% year-over-year, and inventory was down 36.8% year-over-year.. This puts the months-of-supply in Seattle at just 2.1 months.

The closed sales are for contracts mostly signed in March and April (when showing were limited). There will likely be some rebound in the July report.

June 12 COVID-19 Test Results

by Calculated Risk on 6/12/2020 05:52:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now usually conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 583,961 test results reported over the last 24 hours. This was a new high for the number of test results reported (some states might have had a data dump).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Seat Belts and Face Masks

by Calculated Risk on 6/12/2020 02:16:00 PM

I believe there is a strong parallel here (and an economic argument).

Auto manufacturers started offering seat belts as an option back in the ‘50s and ‘60s. Early research showed that wearing a seat belt dramatically reduced deaths and serious injuries in car crashes. But most people thought they’d never have an accident, so few people bought the optional seat belts.

With the rising costs of preventable deaths and serious injuries in the 1960s, it was easy to show that the savings from mandating seat belts would far outweigh the cost of all cars having seat belts. So, in 1968, the US passed a law mandating seat belts in all new vehicles.

This was strongly opposed by various anti-seat belt groups – this was “socialism” and impinged on their individual freedom. Many people refused to wear the seat belts, so eventually most state required the use of seat belts.

Further research has shown that the savings from mandating seat belts has been enormous in both lives and cost to society.

That brings us to face masks during a pandemic. Studies show that wearing a face mask substantially reduces the spread of the SARS-CoV-2 coronavirus.

Masks offer some protection to the person wearing the mask, but masks offer significant protection to the people that the mask wearer encounters. So, when you pass someone wearing a mask – thank them – they are wearing the mask for you!

Unfortunately, there is a strong anti-mask group in the US. They have harassed public health officials into resigning, and convinced some politicians to make mask wearing optional. These people are making the “socialism” argument and asserting their individual freedom.

The evidence is overwhelming that ubiquitous mask wearing significantly reduces the transmission of the virus, saving lives, reducing medical costs, and boosting the economy. The benefits of wearing masks far outweigh the negligible costs.

The bottom line is the US should follow the lead of other countries and mandate mask wearing during the pandemic – with strong enforcement and significant fines for those not wearing masks.

Q2 GDP Forecasts: Probably Around 40% Annual Rate Decline

by Calculated Risk on 6/12/2020 12:15:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 40% Q2 decline is around 9% decline from Q1 (SA).

From Merrill Lynch:

2Q GDP is tracking at -39.8% qoq saar. [June 12 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -25.9% for 2020:Q2 and -12.5% for 2020:Q3. [June 12 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -48.5 percent on June 9, up from -53.8 percent on June 4. [June 9 estimate]