by Calculated Risk on 6/06/2020 08:11:00 AM

Saturday, June 06, 2020

Schedule for Week of June 7, 2020

The key report this week is CPI.

The FOMC meets on Tuesday and Wednesday, and are expected to release updated economic projections on Wednesday.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for May.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in March to 6.191 million from 7.004 million in February.

The number of job openings (yellow) were down 16% year-over-year, and Quits were down 21% year-over-year.

2:15 PM, (11:15 AM PT) June 2020 Market & Economic Update. Free Registration Link for June 2020 Market & Economic Update.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for 0.1% decrease in CPI, and a 0.1% decrease in core CPI.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.200 million initial claims, down from 1.877 million the previous week.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.1% decrease in core PPI.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 05, 2020

June 5 COVID-19 Test Results, Over 500,000 Tests, Most Positive in Over a Month

by Calculated Risk on 6/05/2020 07:01:00 PM

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 550,915 test results reported over the last 24 hours.

This was the highest number of positive tests (28,615) in over a month.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.2% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Will State and Local Governments Hire 1 Million Teachers in June and July? No, but ...

by Calculated Risk on 6/05/2020 03:39:00 PM

There will be some weird seasonal adjustments this year!

Every year, state and local governments let about 2 million teachers go in late Spring, and then hire them back at the end of Summer.

Since this happens every year, the BLS adjusts for this seasonal pattern in the monthly employment report.

However, in 2020, state and local governments let almost 1.2 million teachers go in March, April and May, Not Seasonally Adjusted (NSA). On a seasonally adjusted basis, this was just over 1 million teaching jobs lost (State governments usually start letting teachers go in May, so some of the NSA job losses were expected).

What this means is that instead of letting close to 2 million teachers go in late Spring (NSA), state and local governments will only let go less than 1 million teachers.

This creates a weird seasonal adjustment problem. By the end of July, the normal number of teachers (around 2 million) will probably have been let go.

Since the BLS has already reported over 1 million teaching jobs lost seasonally adjusted (SA), the seasonally adjusted number from the BLS will have to show something like an increase of 1 million teacher jobs in June and July!

State and local governments will not hire 1 million teachers in June and July, but the BLS seasonally adjusted report will show those hires to make the numbers balance out. Just something to remember over the next two months.

AAR: May Rail Carloads down 27.7% YoY, Intermodal Down 13.0% YoY

by Calculated Risk on 6/05/2020 01:27:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Huge swaths of the U.S. and global economies remained shut in May and the impact on rail traffic was predictable. Total U.S. carloads fell 27.7% in May 2020 from May 2019, the biggest year-over- year decline for any month on record (our year-over-year comparisons begin in 1989) and worse than the 25.2% decline in April. For intermodal, things were bad but not as bad: originations were down 13.0% in May, better than the 17.2% decline in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Average weekly total carloads in May 2020 of 185,043 were also the lowest on record. Of the 20 commodity categories we track, just one (farm products excluding grain) had carload gains over last May.

In 2020 through May, total U.S. carloads were down 14.7%, or 815,413 carloads, from last year.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. intermodal originations were down 13.0% in May 2020, an improvement from the 17.2% decline in April 2020 but still the 16th straight year-over-year monthly decline for intermodal. Prior to the pandemic, the average monthly decline was around 6%, which is clearly much less than the declines of the past two months. Intermodal is suffering from, among other things, weak consumer demand and fewer cargo ships calling on U.S. ports.Note that rail traffic was weak prior to the pandemic.

Tuesday June 9th: June 2020 Market & Economic Update

by Calculated Risk on 6/05/2020 12:00:00 PM

On June 9th, at 11:15 AM Pacific Time, UCI Finance Professor Christopher Schwarz and I will be discussing the June 2020 economic outlook.

This is a free event, and you can register at Registration Link for June 2020 Market & Economic Update. The presentation will be about 30 minutes, followed by a Q&A period.

Click on banner for a larger image.

Click on banner for a larger image.

Comments on May Employment Report

by Calculated Risk on 6/05/2020 10:27:00 AM

The May employment report was surprising. Every key indicator - ISM surveys, ADP employment report, unemployment claims and more - suggested further job losses in May. Instead the BLS reported job gains of 2.5 million (about 10 million better than consensus forecasts), and the unemployment rate decreased to 13.3%.

The reference week in May (includes the 12th) was too soon to be impacted by most areas "reopening". One possibility is that many companies brought back employees to qualify for the PPP (Payroll Protection Plan).

Earlier: May Employment Report: 2,500,000 Jobs Added, 13.3% Unemployment Rate

In April, the year-over-year employment change was minus 17.7 million jobs.

One of the keys to follow will be the number of workers on temporary layoff. This increased from 801 thousand in February, to 1.848 million in March, and to 18.063 million in April. This decreased by 2.7 million

in May to 15.343 million. It could be that companies let too many workers go in April and brought some back - or this might be related to PPP adjustments.

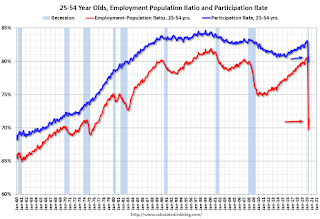

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in May to 80.7%, and the 25 to 54 employment population ratio increased to 71.4%.

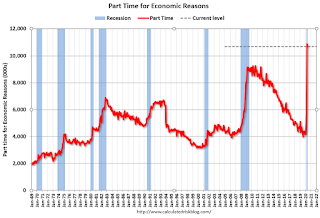

Part Time for Economic Reasons

"The number of persons employed part time for economic reasons, at 10.6 million, changed little in May, but is up by 6.3 million since February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. This group includes persons who usually work full time and persons who usually work part time."The number of persons working part time for economic reasons decreased in May to 10.633 million from 10.887 million in April.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 21.2% in May. This is down slightly from the record high last month for this measure (since 1994). The previous peak was 17.2% during the Great Recession.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.164 million workers who have been unemployed for more than 26 weeks and still want a job. This will increase sharply in 4 or 5 months, and will be a key measure to follow during the eventual recovery.

Summary:

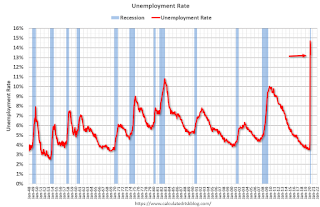

The headline monthly jobs number was surprising, and well above expectations. However, the previous two months were revised down significantly. The headline unemployment rate decreased to 13.3% (probably closer to 16% according to the BLS).

Since the reference week included the 12th of May, this was too soon to be impacted by "reopenings" in most areas. That will be more of a June story. Instead this increase in employment was likely due to companies rehiring because they let too many people go in April, and because some companies needed to rehire to qualify for PPP forgiveness.

As a reminder, the course of the economy will be determined by the course of the pandemic.

May Employment Report: 2,500,000 Jobs Added, 13.3% Unemployment Rate

by Calculated Risk on 6/05/2020 08:47:00 AM

From the BLS:

Total nonfarm payroll employment rose by 2.5 million in May, and the unemployment rate declined to 13.3 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflected a limited resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In May, employment rose sharply in leisure and hospitality, construction, education and health services, and retail trade. By contrast, employment in government continued to decline sharply.

...

The change in total nonfarm payroll employment for March was revised down by 492,000, from -881,000 to -1.4 million, and the change for April was revised down by 150,000, from -20.5 million to -20.7 million. With these revisions, employment in March and April combined was 642,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In May, the year-over-year change was -17.665 million jobs.

Total payrolls increased by 2.5 million in May.

Payrolls for March and April were revised down 642 thousand combined.

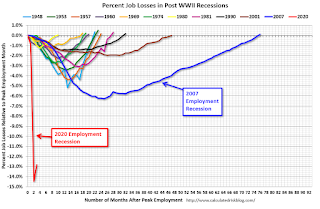

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 60.8% in May. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 60.8% in May. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 52.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in May to 13.3%.

This was well above consensus expectations of 8,250,000 jobs lost, however March and April were revised down by 642,000 combined.

This was a surprising employment report since all other data pointed to more job losses in May. I'll have much more later …

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declines Slightly

by Calculated Risk on 6/05/2020 07:00:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Falls for First Time Since Crisis Began; 8.9% of All Mortgages Now in Forbearance

• According to the McDash Flash Forbearance Tracker, as of June 2, 2020, 4.73 million homeowners – or 8.9% of all mortgages – are in COVID-19 mortgage forbearance plansCR Note: The delinquency rate in April increased sharply to 6.45%, but it would have been much higher if so many borrowers in forbearance hadn't made their mortgage payments (unpaid loans in forbearance are counted as delinquent in the survey). It appears there will be another significant increase in the delinquency rate in May.

• Active forbearance volumes decreased by a net 34,000 over the past week, marking the first weekly decline since the crisis began

• According to the McDash Flash Payment Tracker, as of May 26, a significantly lower share of homeowners in forbearance had remitted May payments (22%) than did in April (46%), pointing to another likely rise in the delinquency rate for May

“After rising sharply in April and then leveling off toward the end of May, the number of American homeowners in forbearance plans has now decreased for the first time since the crisis began,” said Jabbour. “There were a net 34,000 fewer homeowners in forbearance as of June 2. The decline was actually greater among government-backed mortgages, which saw 43,000 fewer total forbearance plans than last week, but this was partially offset by an increase of 9,000 new plans on mortgages held in bank portfolios and private-label securities.”

The McDash Flash Forbearance tracker shows that the 4.73 million loans in forbearance represent 8.9% of all active mortgages and account for a little over $1 trillion in unpaid principal. An estimated 7.1% of all GSE-backed loans and 12.3% of FHA/VA mortgages are now in forbearance.

...

“While this decline is welcome news,” Jabbour continued, “there are still concerning signs in the data. According to Black Knight’s McDash Flash Payment Tracker, far fewer homeowners in forbearance remitted May payments than did in April. If that trend holds true through the end of the month, the market should be prepared for another likely rise in the delinquency rate for May. Also, expanded unemployment benefits are scheduled to end on July 31. It remains to be seen how that will impact both forbearance requests and overall mortgage delinquencies.”

emphasis added

Thursday, June 04, 2020

Friday: Employment Report

by Calculated Risk on 6/04/2020 09:11:00 PM

My May Employment Preview.

Goldman's May Payrolls preview.

Friday:

• At 8:30 AM ET, 8:30 AM: Employment Report for May. The consensus is for 8,250,000 jobs lost, and for the unemployment rate to increase to 19.7%.

Goldman May Payrolls Preview

by Calculated Risk on 6/04/2020 06:23:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill, et. al.:

We estimate nonfarm payrolls declined by 7.25 million in May … Downward revisions to April payrolls are also likely, in our view.

...

We estimate the unemployment rate rose from 14.7% to 21.5%.

…

In interpreting tomorrow’s report, we will again pay special attention to the number and share of workers on furlough or temporary layoff.

emphasis added