by Calculated Risk on 6/04/2020 09:11:00 PM

Thursday, June 04, 2020

Friday: Employment Report

My May Employment Preview.

Goldman's May Payrolls preview.

Friday:

• At 8:30 AM ET, 8:30 AM: Employment Report for May. The consensus is for 8,250,000 jobs lost, and for the unemployment rate to increase to 19.7%.

Goldman May Payrolls Preview

by Calculated Risk on 6/04/2020 06:23:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill, et. al.:

We estimate nonfarm payrolls declined by 7.25 million in May … Downward revisions to April payrolls are also likely, in our view.

...

We estimate the unemployment rate rose from 14.7% to 21.5%.

…

In interpreting tomorrow’s report, we will again pay special attention to the number and share of workers on furlough or temporary layoff.

emphasis added

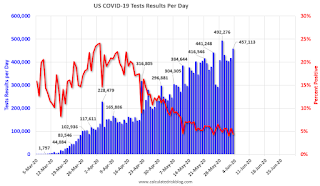

June 4 COVID-19 Test Results, Eighth Consecutive Day with Over 400,000 Tests

by Calculated Risk on 6/04/2020 05:31:00 PM

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US might need to double the number of tests per day again.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 465,579

test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Hotels: Occupancy Rate Declined 43.2% Year-over-year, Seventh Consecutive Week of Higher Demand

by Calculated Risk on 6/04/2020 05:00:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 30 May

STR data ending with 30 May showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded previously.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

24-30 May 2020 (percentage change from comparable week in 2019):

• Occupancy: 36.6% (-43.2%)

• Average daily rate (ADR): US$82.94 (-33.3%)

• Revenue per available room (RevPAR): US$30.34 (-62.1%)

“A seventh consecutive week of higher demand and occupancy was highlighted by three submarkets actually showing positive year-over-year occupancy comparisons for the weekend,” said Jan Freitag, STR’s senior VP of lodging insights. “Two of those areas, Titusville/Cocoa Beach and Melbourne/Palm Bay, likely received a boosted from the SpaceX launch activities on Saturday. The third submarket, Corpus Christi, further supports previous analysis that there is demand ready to return, but for now, it is more visible from leisure sources and in destinations that are set up well for drive-to business.

“Because the situation intensified more toward the end of the week, and because there has not been a great deal of demand in downtown areas because of the pandemic, there wasn’t a noticeable impact from protests and the unrest occurring in major cities. That is something to monitor in our next dataset and perhaps beyond depending on how the situation plays out.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

During 2009 (black line), many hotels were struggling. At this point in the year, the 4-week average in 2009 was 56%. Now it is just at 33.6%! (The median is 65%).

Note: Y-axis doesn't start at zero to better show the seasonal change.

May Employment Preview

by Calculated Risk on 6/04/2020 11:21:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for a decrease of 8,250,000 non-farm payroll jobs, and for the unemployment rate to increase to 19.7%.

Last month, the BLS reported 20,500,000 jobs lost in April and the unemployment rate increased to 14.7%.

The job losses in April were the worst on record (series started in 1939), and the losses in March were the ninth worst on record. The previous worst jobs report was after WWII.

The job losses in May will be the 2nd worst on record, but there is a wide range of estimates.

| Worst Monthly Job Losses Since 1939 | ||

|---|---|---|

| Rank | Date | Jobs Lost (000s) |

| 1 | Apr-2020 | -20,500 |

| 2 | Sep-1945 | -1,959 |

| 3 | Oct-1949 | -838 |

| 4 | Mar-2009 | -800 |

| 5 | Jan-2009 | -784 |

| 6 | Feb-2009 | -743 |

| 7 | Nov-2008 | -727 |

| 8 | Dec-2008 | -706 |

| 9 | Mar-2020 | -701 |

| 10 | Apr-2009 | -695 |

Merrill Lynch economists wrote: "We expect -8mn in May nonfarm payrolls and the unemployment rate to jump to 19% from 14.7%. "

However, the ADP report only showed 2.76 million private sector jobs lost in May.

The usual indicators are somewhat useless again this month. They are signaling significant jobs losses, but we've never seen anything remotely close to the job losses that happened in April and May.

For example, the ISM manufacturing employment index increased in May to 32.1% from 27.5% in April (both readings are very low). And the ISM non-manufacturing employment index increased in May to 31.8% from a record low 31.0% in April. Combined, these surveys suggests significant job losses, but fewer than in April.

• Conclusion: The number of jobs lost in May will be huge, and this will be the 2nd worst jobs report on record. But the number of jobs lost could be anywhere from a few million to 8 or 9 million. My guess is the number of jobs lost will be lower than the consensus.

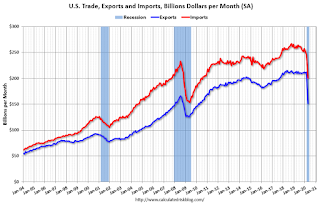

Trade Deficit increased to $49.4 Billion in April

by Calculated Risk on 6/04/2020 09:18:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $49.4 billion in April, up $7.1 billion from $42.3 billion in March, revised.

April exports were $151.3 billion, $38.9 billion less than March exports. April imports were $200.7 billion, $31.8 billion less than March imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in April.

Exports are down 28% compared to April 2019; imports are down 22% compared to April 2019.

Both imports and exports have decreased sharply due to COVID-19.

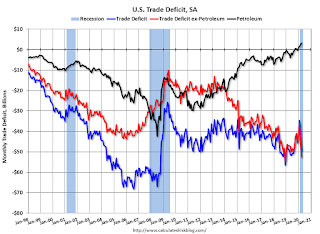

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $34.72 per barrel in April, down from $47.09 in March, and down from $63.47 in April 2019.

The trade deficit with China decreased to $22.5 billion in April, from $26.8 billion in April 2019.

Weekly Initial Unemployment Claims decrease to 1,877,000

by Calculated Risk on 6/04/2020 08:39:00 AM

The DOL reported:

In the week ending May 30, the advance figure for seasonally adjusted initial claims was 1,877,000, a decrease of 249,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 2,123,000 to 2,126,000. The 4-week moving average was 2,284,000, a decrease of 324,750 from the previous week's revised average. The previous week's average was revised up by 750 from 2,608,000 to 2,608,750.The previous week was revised up.

emphasis added

This does not include the 623,073 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 2,284,000.

This was close to the consensus forecast of 1.9 million initial claims.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to 21,487,000 (SA) from 20,838,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 10,740,918 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, June 03, 2020

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 6/03/2020 08:04:00 PM

Thursday:

• At 8:30 AM ET, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $44.3 billion. The U.S. trade deficit was at $44.4 Billion the previous month.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a 1.900 million initial claims, down from 2.123 million the previous week.

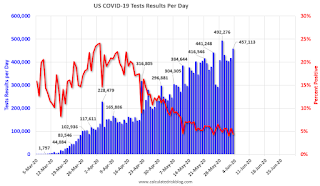

June 3 COVID-19 Test Results

by Calculated Risk on 6/03/2020 05:31:00 PM

The US is now conducting around 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US might need to double the number of tests per day again.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 457,113 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Census: Household Pulse Survey shows 48.1% of Households lost Income

by Calculated Risk on 6/03/2020 04:11:00 PM

Note: The question on lost income is always since March 13, 2020 - so this percentage will not decline.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the fourth week of survey results today. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis.

Click on graph for larger image.

Click on graph for larger image.This survey will be useful in tracking the "opening" of the economy.

The data was collected between May 21 and May 26, 2020.

48.1% of households report loss in employment income since March 13th.

The data will be updated weekly for 90 days.