by Calculated Risk on 5/20/2020 10:38:00 AM

Wednesday, May 20, 2020

U.S. Births decreased in 2019, "Lowest number of births since 1985"

From the National Center for Health Statistics: Births: Provisional Data for 2019. The NCHS reports:

The provisional number of births for the United States in 2019 was 3,745,540, down 1% from the number in 2018 (3,791,712). This is the fifth year that the number of births has declined after the increase in 2014, down an average of 1% per year, and the lowest number of births since 1985.Here is a long term graph of annual U.S. births through 2018.

The provisional general fertility rate (GFR) for the United States in 2019 was 58.2 births per 1,000 females aged 15–44, down 2% from the rate in 2018 (59.1), another record low for the nation. From 2014 to 2019, the GFR declined by an average of 2% per year.

…

The birth rate for teenagers in 2019 was 16.6 births per 1,000 females aged 15–19, down 5% from 2018 (17.4), reaching another record low for this age group. The rate has declined by 60% since 2007 (41.5), the most recent period of continued decline, and 73% since 1991, the most recent peak.

Click on graph for larger image.

Click on graph for larger image.Births have declined for five consecutive years following increases in 2013 and 2014.

Note the amazing decline in teenage births.

With fewer births, and less net migration, demographics will not be as favorable as I was expecting a few years ago.

There is much more in the report.

AIA: Architecture Billings Index Decreased in April to Record Low

by Calculated Risk on 5/20/2020 08:32:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings continue historic contraction

Demand for design services in April saw its steepest decline on record, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 29.5 for April reflects a decrease in design services provided by U.S. architecture firms (any number below 50 indicates a decrease in billings). During April, both the new project inquiries and design contracts scores also declined significantly, posting scores of 28.4 and 27.6 respectively.

“With the dramatic deceleration that we have seen in the economy since mid-March, it’s not surprising that businesses and households are waiting for signs of stability before proceeding with new facilities,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Once business activity resumes, demand for design services should pick up fairly quickly. Unfortunately, the precipitous drop in demand for design services will have lasting consequences for some firms.”

...

• Regional averages: West (38.1); Midwest (31.2); South (31.1); Northeast (23.0)

• Sector index breakdown: institutional (36.1); multi-family residential (30.3); mixed practice (29.0); commercial/industrial (27.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 29.5 in April, down from 33.3 in March. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This is the lowest level for this index on record, even below the lowest level during the Great Recession.

MBA: Mortgage Applications Decreased, Purchase Applications up 6% Week over Week

by Calculated Risk on 5/20/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 15, 2020.

... The Refinance Index decreased 6 percent from the previous week and was 160 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 1.5 percent lower than the same week one year ago.

...

“Applications for home purchases continue to recover from April’s sizeable drop and have now increased for five consecutive weeks. Purchase activity – which was 35 percent below year-ago levels six weeks ago – increased across all loan types and was only 1.5 percent lower than last year,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Government purchase applications, which include FHA, VA, and USDA loans, are now 5 percent higher than a year ago, which is an encouraging turnaround after the weakness seen over the past two months. As states gradually re-open and both home buyer and seller activity increases, we will be closely watching to see if these positive trends continue, or if they reflect shorter-term, pent-up demand.”

Added Kan, “Despite mortgage rates remaining close to record-lows, refinance activity slid to its lowest level in over a month. The average loan amount for refinances fell to its lowest level since January – potentially a sign that part of the drop was attributable to a retreat in cash-out refinance lending as credit conditions tighten. We still expect a strong pace of refinancing for the remainder of the year because of low mortgage rates. With many homeowners still facing economic and employment uncertainty, these refinance opportunities will allow them to save money on their monthly payments, which can then be used to help other areas of their budgets.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.41 percent from 3.43 percent, with points increasing to 0.33 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year (over triple last year).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 1.5% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 19, 2020

Wednesday: MBA Mortgage Applications, FOMC Minutes

by Calculated Risk on 5/19/2020 08:31:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of April 28-29, 2020

May 19 Update: US COVID-19 Test Results

by Calculated Risk on 5/19/2020 06:07:00 PM

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 399,479 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

NOTE: A few states are apparently including antibody tests with virus tests. The Covid tracking project is working to straighten that out.

Merrill: "Most of the slowdown occurred due to voluntary social distancing rather than lockdown policies"

by Calculated Risk on 5/19/2020 02:39:00 PM

This is an important note and suggests the economy is dependent on the course of the pandemic.

Merrill Lynch economists put out a note this morning: Nordic Lessons. Here are a few brief excerpts:

One of our core views is that both voluntary and mandated social distancing have significant impacts on the economy. A new academic paper out of the University of Copenhagen and CEBI quantifies the effect of each kind of social distancing on consumer spending during the COVID-19 pandemic. ...

Let us start with the facts. The outbreak began at the end of February in Denmark and Sweden. … Since then the two countries have diverged significantly in terms of health care outcomes. As of May 18, Denmark had 95 deaths per million people, while Sweden (363 per million) has had among the highest COVID-19 mortality rates in the world. This difference points to a large healthcare benefit from lockdown policies. What about the economic costs?

The paper finds that consumer spending dropped by 25% in Sweden and by 29% in Denmark. The 4pp difference between the two declines quantifies the cost of lockdown policies. While 4% of consumer spending is not trivial, it is a small share of the total decrease in consumer spending. Therefore the data indicate that most of the slowdown occurred due to voluntary social distancing rather than lockdown policies.

...

If the paper’s results are applicable to other countries, they have important implications for the economic outlook. … Even as restrictions are lifted, consumer spending will likely remain highly impaired, with services getting hit the hardest. Ending lockdowns might also limit the activity of more vulnerable people, further delaying the recovery.

In summary, the economic downturn has been primarily because of the virus, not the policy response.

emphasis added

Sacramento Housing in April: Sales decline 32% YoY, Active Inventory down 15% YoY

by Calculated Risk on 5/19/2020 12:23:00 PM

As expected, the housing market slumped in April. There is some evidence of a pickup in activity recently, but any lasting resurgence will be dependent on the course of the pandemic. Note that April sales are for contracts typically signed in February and March. So the report for May will probably be even worse (based on March and April contracts).

From SacRealtor.org: April 2020 Statistics – Sacramento Housing Market – Single Family Homes

April closed with 1,013 sales, down 13.4% from the 1,170 sales in March. Compared to one year ago (1,496), the current figure is a 32.3% drop.1) Overall sales decreased to 1,013 in April, down 32.3% from 1,496 in April 2019. Sales were down 13.4% from March 2020 (previous month).

...

The Active Listing Inventory increased 10% from March to April, from 1,658 units to 1,823 units. Compared with April 2019 (2,094), inventory is down 14.9%. The Months of Inventory increased from 1.4 to 1.8 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) decreased from 8 to 7 and the Average DOM decreased from 26 to 16. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,823, down from 2,094 in April 2019. That is down 14.9% year-over-year. This is the twelfth consecutive month with a YoY decline in inventory.

Comments on April Housing Starts

by Calculated Risk on 5/19/2020 10:05:00 AM

Although housing starts declined significantly, residential construction is considered essential, and starts did not decline as sharply as some other sectors.

Earlier: Housing Starts decreased to 891 Thousand Annual Rate in April

Total housing starts in April were below expectations, however revisions to prior months were positive.

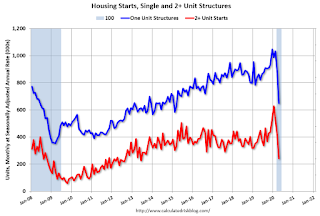

The housing starts report showed starts were down 30.2% in April compared to March, and starts were down 29.7% year-over-year compared to April 2019.

Single family starts were down 24.8% year-over-year, and multi-family starts were down 40.2% YoY.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were down 29.7% in April compared to April 2019.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons are easy early in the year.

Starts, year-to-date, are still up 3.7% compared to the same period in 2019.

Starts will be down YoY for at least the next few months due to the impact from COVID-19.

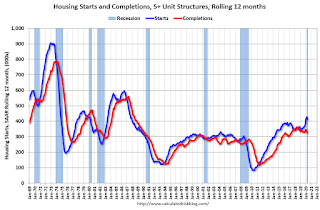

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- although starts picked up a little again lately.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis abates.

Testimony by Chair Powell on the Federal Reserve's response to the coronavirus and the CARES Act

by Calculated Risk on 5/19/2020 09:59:00 AM

Note: Chair Powell provides an overview of the actions taken so far by the Fed.

From Fed Chair Jerome Powell: Coronavirus and CARES Act Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

The Federal Reserve's response to this extraordinary period has been guided by our mandate to promote maximum employment and stable prices for the American people, along with our responsibilities to promote stability of the financial system. We are committed to using our full range of tools to support the economy in this challenging time even as we recognize that these actions are only a part of a broader public-sector response. Congress's passage of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was critical in enabling the Federal Reserve and the Treasury Department to establish many of the lending programs that I discuss below.

Housing Starts decreased to 891 Thousand Annual Rate in April

by Calculated Risk on 5/19/2020 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 891,000. This is 30.2 percent below the revised March estimate of 1,276,000 and is 29.7 percent below the April 2019 rate of 1,267,000. Single-family housing starts in April were at a rate of 650,000; this is 25.4 percent below the revised March figure of 871,000. The April rate for units in buildings with five units or more was 234,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,074,000. This is 20.8 percent below the revised March rate of 1,356,000 and is 19.2 percent below the April 2019 rate of 1,330,000. Single-family authorizations in April were at a rate of 669,000; this is 24.3 percent below the revised March figure of 884,000. Authorizations of units in buildings with five units or more were at a rate of 373,000 in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in April compared to March. Multi-family starts were down 40.2% year-over-year in April.

Multi-family is volatile month-to-month, and had been mostly moving sideways the last several years.

Single-family starts (blue) decreased in April, and were down 24.8% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in April were below expectations, however starts in March were revised up.

Residential construction is considered an essential business, and held up better than some other sectors of the economy, but was still negatively impacted by COVID-19.

I'll have more later …