by Calculated Risk on 5/01/2020 12:26:00 PM

Friday, May 01, 2020

Q2 GDP Forecasts: Probably Around 30% Annual Rate Decline

The NY Fed Nowcast and Atlanta Fed GDPNow models are based on released data and aren't capturing the entire collapse in the economy. These models will catch up as more data is released. All forecasts, including the Merrill Lynch and other forecasts, are for the seasonally adjust annual rate (SAAR) of decline.

From Merrill Lynch:

We expect a 30% qoq saar decline in 2Q. Following the 1Q GDP report, our forecast for annual GDP growth this year was adjusted to -5.6%. [SAAR May 1 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -9.3% for 2020:Q2. [May 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -16.1 percent on May 1, down from -12.1 percent on April 30. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. In particular, it does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. It does not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the model. [May 1 estimate]

Construction Spending Increased in March

by Calculated Risk on 5/01/2020 10:24:00 AM

From the Census Bureau reported that overall construction spending increased in March:

Construction spending during March 2020 was estimated at a seasonally adjusted annual rate of $1,360.5 billion, 0.9 percent above the revised February estimate of $1,348.4 billion. The March figure is 4.7 percent above the March 2019 estimate of $1,299.1 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,012.5 billion, 0.7 percent above the revised February estimate of $1,005.8 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $348.0 billion, 1.6 percent above the revised February estimate of $342.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018. It started increasing again, but will slow due to the pandemic. Residential spending is 19% below the previous peak.

Non-residential spending is 11% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 7% above the previous peak in March 2009, and 33% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 8.8%. Non-residential spending is down 1.8% year-over-year. Public spending is up 7.9% year-over-year.

This was well above consensus expectations of a 3.9% decrease in spending, however construction spending for January and February were revised down.

Construction spending will decline due to COVID-19, although construction is considered an essential service in most areas.

ISM Manufacturing index Decreased to 41.5 in April

by Calculated Risk on 5/01/2020 10:05:00 AM

The ISM manufacturing index indicated contraction in April. The PMI was at 41.5% in April, down from 49.1% in March. The employment index was at 27.5%, down from 43.8% last month, and the new orders index was at 27.1%, down from 42.2%.

From the Institute for Supply Management: April 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in April, and the overall economy contracted after 131 consecutive months of expansion, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This was slightly above expectations of 36.7%, but the declines in new orders and employment were even worse than the headline. This suggests manufacturing contracted sharply in April.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The April PMI® registered 41.5 percent, down 7.6 percentage points from the March reading of 49.1 percent. The New Orders Index registered 27.1 percent, a decrease of 15.1 percentage points from the March reading of 42.2 percent. The Production Index registered 27.5 percent, down 20.2 percentage points compared to the March reading of 47.7 percent. The Backlog of Orders Index registered 37.8 percent, a decrease of 8.1 percentage points compared to the March reading of 45.9 percent. The Employment Index registered 27.5 percent, a decrease of 16.3 percentage points from the March reading of 43.8 percent. The Supplier Deliveries Index registered 76 percent, up 11 percentage points from the March reading of 65 percent, limiting the decrease in the composite PMI®.

emphasis added

Black Knight: More than 3.8 Million Homeowners Now in COVID-19-Related Forbearance Plans

by Calculated Risk on 5/01/2020 07:00:00 AM

From Black Knight: More than 3.8 million homeowners are now in forbearance plans

• As of April 30, more than 3.8 million homeowners are now in forbearance plans, representing 7.3% of all active mortgages.

• Together, they account for $841 billion in unpaid principal and includes 6.1% of all GSE-backed loans and 10.5% of all FHA/VA loans.

• At today’s level, mortgage servicers would need to advance a combined $3 billion/month to holders of government-backed mortgage securities on COVID-19-related forbearances. Another $1. 5 billion in lost funds will be faced each month by those with portfolio-held or privately securitized mortgages (some 6.7% of these loans are in forbearance as well).

• Ginnie Mae announced a pass through assistance program through which it will advance principal and interest payments to investors on behalf of servicers, and FHFA announced last week that P&I advance payments will be capped at four months for servicers of GSE-backed mortgages.

• Even so, given today’s number of loans in forbearance (and these numbers are climbing every day), servicers of GSE-backed loans still face nearly $8 billion in advances over that four-month period.

Thursday, April 30, 2020

Friday: ISM Mfg Survey, Construction Spending

by Calculated Risk on 4/30/2020 07:06:00 PM

Note: The ISM survey will be for April. The lowest reading during the great recession was 33.1, and the lowest reading since 1948 was 29.4 in May 1980.

Friday:

• At 10:00 AM ET, ISM Manufacturing Index for April. The consensus is for the ISM to be at 36.7, down from 49.1 in March.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 3.9% decrease in construction spending.

• All day, Light vehicle sales for April. The consensus is for light vehicle sales to be 6.5 million SAAR in April, down from 11.4 million in March (Seasonally Adjusted Annual Rate).

April 30 Update: US COVID-19 Test Results

by Calculated Risk on 4/30/2020 04:51:00 PM

The US might be able to test 400,000 to 600,000 people per day in several weeks according to Dr. Fauci - and that would probably be sufficient for test and trace.

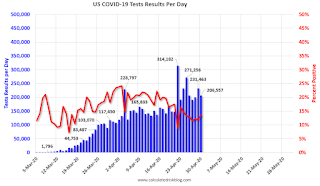

There were 206,557 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.5% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Fannie Mae: Mortgage Serious Delinquency Rate Increased Slightly in March

by Calculated Risk on 4/30/2020 04:10:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased to 0.66% in March, from 0.65% in February. The serious delinquency rate is down from 0.74% in March 2019.

IMPORTANT: These are mortgage loans that are "three monthly payments or more past due or in foreclosure". So it will take three months for the impact of COVID-19 to show up in this series.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.48% are seriously delinquent. For loans made in 2005 through 2008 (3% of portfolio), 4.11% are seriously delinquent, For recent loans, originated in 2009 through 2018 (95% of portfolio), only 0.35% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will increase in a few months due to COVID-19.

Note: Freddie Mac reported earlier.

Hotels: Occupancy Rate Declined 62.2% Year-over-year

by Calculated Risk on 4/30/2020 01:32:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 25 April

Reflecting the continued impact of the COVID-19 pandemic, the U.S. hotel industry reported significant year-over-year declines in the three key performance metrics during the week of 19-25 April 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 21-27 April 2019, the industry recorded the following:

• Occupancy: -62.2% to 26.0%

• Average daily rate (ADR): -42.9% to US$73.61

• Revenue per available room (RevPAR): -78.4% to US$19.13

Year-over-year declines were less steep than previous weeks due to a comparison with the time of Passover in 2019. Additionally, absolute occupancy rose slightly from the levels of the previous two weeks (23.4% and 21.0%).

“Demand has grown slightly across the country during the last two weeks, which could provide some hope that the levels seen in early April were indeed the bottom—especially with some states now moving to ease social distancing guidance,” said Jan Freitag, STR’s senior VP of lodging insights. “The 1.4 million additional room nights sold the last two weeks only represent around 100,000 new rooms occupied per night, but gains even that small are certainly better than further declines.

“Five states—California, Texas, New York, Florida and Georgia—represent 40% of that demand gain from the last two weeks. The list of hotel demand generators is long, but in general, it is not unreasonable to assume that part of the increased business is coming from essential workers, homeless housing initiatives and government-contracted guests.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Zillow Case-Shiller March Forecast: Still Showing Increasing YoY Price Gains, Mostly Pre-Crisis

by Calculated Risk on 4/30/2020 12:09:00 PM

The Case-Shiller house price indexes for February were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: February Case-Shiller Results & March Forecast: Last Look at The World that Was

the Case-Shiller home price index for February – the last before the data begin to show effects of the coronavirus outbreak – offers a final look at a housing market that was primed for a stellar spring selling season. ...

Things were looking up for the housing market in mid-winter, with low interest rates and still-secure job prospects combining to boost demand for housing just as a growing share of millennials were looking to finally take the leap into home ownership. Teamed with record-low levels of for-sale inventory, these demand factors had begun to push home prices upward after the growth rate spent most of 2019 decelerating. The economic carnage that’s occurred since, particularly in the labor markets, has been well documented and the true impact on home prices remains to be seen.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.4% in March, up from 4.2% in February.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.4% in March, up from 4.2% in February. The Zillow forecast is for the 20-City index to be up 3.8% YoY in March from 3.5% in February, and for the 10-City index to increase to 3.3% YoY compared to 2.9% YoY in February.

Note that Case-Shiller is a three month average, so the March data will include both January and February. Also, Case-Shiller uses closed transactions, and most of the transactions that closed in March were signed in January and February - so the March price indexes will still be mostly pre-crisis data.

Q1 2020 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 4/30/2020 10:26:00 AM

The BEA has released the underlying details for the Q1 initial GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 9.7% annual pace in Q1.

Investment in petroleum and natural gas exploration decreased in Q1 compared to Q4, and was down 24% year-over-year. This will probably collapse in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q1, but was only down slightly year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 27% year-over-year in Q1 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q1, and lodging investment was down 8% year-over-year.

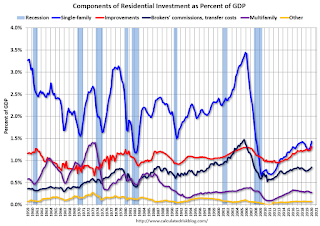

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases - once the healthcare crisis abates.

Investment in single family structures was $308 billion (SAAR) (about 1.4% of GDP)..

Investment in multi-family structures decreased in Q1.

Investment in home improvement was at a $283 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.3% of GDP). Home improvement spending has been solid and might hold up during the pandemic.