by Calculated Risk on 4/30/2020 09:24:00 AM

Thursday, April 30, 2020

Personal Income decreased 2.0% in March, Spending decreased 7.5%

The BEA released the Personal Income and Outlays report for March:

Personal income decreased $382.1 billion (2.0 percent) in March according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $334.6 billion (2.0 percent) and personal consumption expenditures (PCE) decreased $1,127.3 billion (7.5 percent).The March PCE price index increased 1.3 percent year-over-year and the March PCE price index, excluding food and energy, increased 1.7 percent year-over-year.

Real DPI decreased 1.7 percent in March and Real PCE decreased 7.3 percent. The PCE price index decreased 0.3 percent. Excluding food and energy, the PCE price index decreased 0.1 percent.

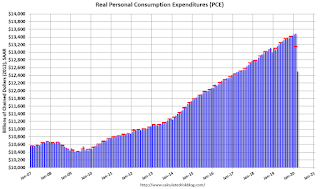

The following graph shows real Personal Consumption Expenditures (PCE) through March 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The change in personal income and the change in PCE were below expectations.

PCE collapsed in March, and will collapse further in April.

Weekly Initial Unemployment Claims decrease to 3,839,000

by Calculated Risk on 4/30/2020 08:35:00 AM

The DOL reported:

In the week ending April 25, the advance figure for seasonally adjusted initial claims was 3,839,000, a decrease of 603,000 from the previous week's revised level. The previous week's level was revised up by 15,000 from 4,427,000 to 4,442,000. The 4-week moving average was 5,033,250, a decrease of 757,000 from the previous week's revised average. The previous week's average was revised up by 3,750 from 5,786,500 to 5,790,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 5,033,250.

This was lower than the consensus forecast.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 17.992 million (SA) and will increase further over the next few weeks - and likely stay at that high level until the crisis abates.

Wednesday, April 29, 2020

Thursday: Unemployment Claims, Personal Income and Outlays, Chicago PMI

by Calculated Risk on 4/29/2020 09:15:00 PM

Merrill: "We expect initial jobless claims of 4.1mn for the week ending April 25, revising up from our preliminary forecast of 3.5mn."

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 3.500 million initial claims, down from 4.427 million the previous week.

• Also at 8:30 AM ET, Personal Income and Outlays, March 2020. The consensus is for a 1.4% decrease in personal income, and for a 5.0% decrease in personal spending. And for the Core PCE price index to decrease 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for April.

April 29 Update: US COVID-19 Test Results

by Calculated Risk on 4/29/2020 05:18:00 PM

Recommended article by Ed Yong in the Atlantic: Why the Coronavirus Is So Confusing

The US might be able to test 400,000 to 600,000 people per day in several weeks according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 230,442 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.0% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

FOMC Statement: "committed to using its full range of tools to support the U.S. economy in this challenging time"

by Calculated Risk on 4/29/2020 02:01:00 PM

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The coronavirus outbreak is causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health are inducing sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices are holding down consumer price inflation. The disruptions to economic activity here and abroad have significantly affected financial conditions and have impaired the flow of credit to U.S. households and businesses.

The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy. In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

To support the flow of credit to households and businesses, the Federal Reserve will continue to purchase Treasury securities and agency residential and commercial mortgage-backed securities in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will closely monitor market conditions and is prepared to adjust its plans as appropriate.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

emphasis added

Q1 GDP: Investment

by Calculated Risk on 4/29/2020 11:55:00 AM

Investment has been weak for some time, and most investment categories were even weaker in Q1 due to COVID-19. However residential investment was very strong in Q1 (increased at 21.0% annual rate in Q1).

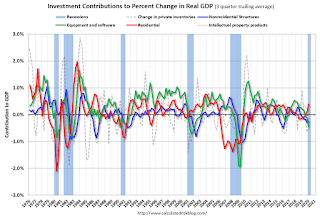

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased in Q1 (21.0% annual rate in Q1). Equipment investment decreased at a 15.2% annual rate, and investment in non-residential structures decreased at a 9.7% annual rate.

On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is negative, and nonresidential structures (blue) is also down.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q1. RI as a percent of GDP is close to the bottom of the previous recessions - and prior to the pandemic, I expected RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

NAR: Pending Home Sales Decrease 20.8% in March

by Calculated Risk on 4/29/2020 10:04:00 AM

From the NAR: NAR Calls Housing Market Slump Temporary as Pending Home Sales Fall in March

Pending home sales fell in March, seeing expected declines as a result of the coronavirus outbreak, according to the National Association of Realtors®. Each of the four major regions saw drops in month-over-month contract activity and year-over-year pending home sales transactions.This was well below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May. Some of these sales will be cancelled or delayed due to COVID-19.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, decreased 20.8% to 88.2 in March. Year-over-year, contract signings declined 16.3%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI dropped 14.5% to 82.3 in March, 11.0% lower than a year ago. In the Midwest, the index decreased 22.0% to 85.6 last month, down 12.4% from March 2019.

Pending home sales in the South sank 19.5% to an index of 103.7 in March, a 17.8% drop from March 2019. The index in the West fell 26.8% in March 2020 to 71.4, down 21.5% from a year ago.

emphasis added

BEA: Real GDP decreased at 4.8% Annualized Rate in Q1

by Calculated Risk on 4/29/2020 08:37:00 AM

Note: This is the advance release. Most analysts expect downward revisions as more data become available.

From the BEA: Gross Domestic Product, 1st Quarter 2020 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 4.8 percent in the first quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2019, real GDP increased 2.1 percent.The advance Q1 GDP report, at minus 4.8% annualized, was close to expectations.

...

The decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The decrease in PCE reflected decreases in services, led by health care, and goods, led by motor vehicles and parts. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

emphasis added

Personal consumption expenditures (PCE) decreased at 7.6% annualized rate in Q1, down from 1.8% increase in Q4. Residential investment (RI) increased at a 21.0% rate in Q1. Equipment investment decreased at a 15.2% annualized rate, and investment in non-residential structures decreased at a 9.7% pace.

I'll have more later ...

MBA: Mortgage Applications Decreased, Purchase Applications up 12% Week over Week

by Calculated Risk on 4/29/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 24, 2020.

... The Refinance Index decreased 7 percent from the previous week and was 218 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 20 percent lower than the same week one year ago.

...

“The news in this week’s release is that purchase applications, still recovering from a five-year low, increased 12 percent last week to the strongest level in almost a month. The ten largest states had increases in purchase activity, which is potentially a sign of the start of an upturn in the pandemic-delayed spring homebuying season, as coronavirus lockdown restrictions slowly ease in various markets,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “California and Washington continued to show increases in purchase activity, with New York seeing a significant gain after declines in five of the last six weeks.”

Added Kan, “Contributing to the uptick in purchase applications was that mortgage rates fell to another record low in MBA’s survey, with the 30-year fixed rate decreasing to 3.43 percent. However, refinance activity declined 7 percent, as rates for refinances likely remained higher than those for purchase loans. Lenders are still working through pipelines at capacity, and observed changes in credit availability for refinance loans have also in turn impacted rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.43 percent from 3.45 percent, with points increasing to 0.34 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year (over triple last year).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 20% year-over-year.

Purchase activity has fallen sharply, but was up 12% week over week.

Note: Red is a four-week average (blue is weekly).

Tuesday, April 28, 2020

Wednesday: GDP, FOMC Announcement, Pending Home Sales

by Calculated Risk on 4/28/2020 08:17:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2020 (Advance estimate). The consensus is that real GDP decreased 4.0% annualized in Q1, down from 2.1% in Q4.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 10.0% decrease in the index.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.