by Calculated Risk on 4/27/2020 09:09:00 PM

Monday, April 27, 2020

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

CR Note: The Case-Shiller report is for February (before crisis). The Richmond Fed manufacturing survey is the last of the regional surveys for April. All of the surveys have been very weak.

Tuesday:

• At 9:00 AM, S&P/Case-Shiller House Price Index for February. The consensus is for a 3.1% year-over-year increase in the Comp 20 index for February.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

• Also at 10:00 AM, the Q1 2020 Housing Vacancies and Homeownership from the Census Bureau.

April 27 Update: US COVID-19 Test Results: Disappointing

by Calculated Risk on 4/27/2020 04:58:00 PM

Disappointing, but might be weekend related.

From The Hill: Fauci confident US will double coronavirus testing capacity over next several weeks

Fauci said in a webcast hosted by the National Academy of Sciences that that the U.S. is currently averaging between 1.5 million and 2 million tests per week.Based on these comments, the US might be able to test 400,000 to 600,000 people per day in several weeks - and that would probably be sufficient for test and trace.

"We probably should get up to twice that as we get into the next several weeks, and I think we will," Fauci said. "Testing is an important part of what we’re doing, but it is not the only part."

…

"You need enough tests so when you’re doing what we’re trying to do right now, which is trying to ease our way back, that you can very easily identify, test, contact trace and get those who are infected out of society so they don’t infect others," he said, adding that positive test results should account for less than 10 percent of tests administered.

There were 135,505 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 16.2% (red line). The US probably needs enough tests to push the percentage positive below 5%, although Dr. Fauci said below 10% (probably much lower based on testing in New Zealand).

Freddie Mac: Mortgage Serious Delinquency Rate Unchanged in March

by Calculated Risk on 4/27/2020 04:42:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in March was 0.60%, unchanged from 0.60% in February. Freddie's rate is down from 0.67% in March 2019.

This matches the last two months as the lowest delinquency rate since November 2007.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is close to a cycle bottom. However, with COVID-19, this rate will increase in a few months (it takes time since these are mortgage three months or more past due).

Note: Fannie Mae will report for March soon.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 6.99%" of Portfolio Volume

by Calculated Risk on 4/27/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Increases to 6.99%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 5.95% of servicers’ portfolio volume in the prior week to 6.99% as of April 19, 2020.

“Over 26 million Americans have filed for unemployment over the last month, leading to nearly 7 percent – 3.5 million – of all mortgage borrowers asking to be put into forbearance plans. For FHA and VA borrowers, the share of loans in forbearance is even higher, at 10 percent,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance requests fell relative to the prior week but remain roughly 100 times greater than the early March baseline. While the pace of job losses have slowed from the astronomical heights of just a few weeks ago, millions of people continue to file for unemployment. We expect forbearance requests will pick up again as we approach May payment due dates.”

Added Fratantoni, “The combination of stimulus payments, expanded unemployment insurance benefits, further fiscal and monetary actions, and states reopening will hopefully begin to stabilize forbearance requests and the overall economy.”

emphasis added

Click on graph for larger image.

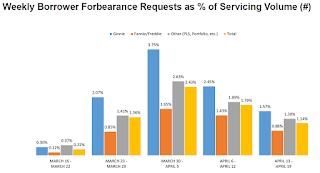

Click on graph for larger image.This graph shows the weekly forbearance requests as a percent of servicer's portfolio volume.

The requests peaked in the week of March 30th to April 5th, but might pick up again when May payments are due.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) dropped relative to the prior week: from 1.79% to 1.14%."

Dallas Fed: "Contraction in Texas Manufacturing Sector Worsens", Record Low Activity Index

by Calculated Risk on 4/27/2020 10:35:00 AM

From the Dallas Fed: Contraction in Texas Manufacturing Sector Worsens

Texas factory activity declined further in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, pushed further negative from -35.3 to -55.3, suggesting the contraction in output has steepened since last month.The last of the regional Fed surveys for April will be released tomorrow (Richmond Fed).

Other measures of manufacturing activity also point to a sharper decline in April. The new orders index dropped 26 points to -67.0, its lowest reading since the survey began in 2004. Similarly, the growth rate of orders index fell to -62.2. The capacity utilization and shipments indexes fell to -54.5 and -56.6, respectively. The capital expenditures index declined 20 points to -54.3. Each of these April readings represents a historical low.

Perceptions of broader business conditions remained very pessimistic in April. The general business activity index inched down from -70.0 to -73.7, pushing to a new historical low. The company outlook index remained near an all-time low but inched up from -65.6 to -62.6. The index measuring uncertainty regarding companies’ outlooks retreated slightly to 54.4, a reading still indicative of sharply increased uncertainty.

Labor market measures indicate further employment declines and shorter workweeks this month. The employment index held steady at -21.2. Three percent of firms noted net hiring, while 24 percent noted net layoffs. The hours worked index dropped 18 points to -40.2, signaling a notably reduced workweek length.

emphasis added

TSA checkpoint travel numbers

by Calculated Risk on 4/27/2020 09:37:00 AM

The TSA is providing daily travel numbers.

This is another measure that will be useful to track when the economy starts to reopen.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On April 26th there were 128,875 travelers compared to 2,506,809 a year ago.

That is a decline of 95%.

Sunday, April 26, 2020

Sunday Night Futures

by Calculated Risk on 4/26/2020 09:51:00 PM

Weekend:

• Schedule for Week of April 26, 2020

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $15.52 per barrel and Brent at $21.00 barrel. A year ago, WTI was at $63, and Brent was at $71 - so WTI oil prices are down about 75% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.74 per gallon. A year ago prices were at $2.88 per gallon, so gasoline prices are down $1.14 per gallon year-over-year.

April 26 Update: US COVID-19 Test Results: Fauci Expects Testing to Double

by Calculated Risk on 4/26/2020 05:01:00 PM

From The Hill: Fauci confident US will double coronavirus testing capacity over next several weeks

Fauci said in a webcast hosted by the National Academy of Sciences that that the U.S. is currently averaging between 1.5 million and 2 million tests per week.Based on these comments, the US might be able to test 400,000 to 600,000 people per day in several weeks - and that would probably be sufficient for test and trace.

"We probably should get up to twice that as we get into the next several weeks, and I think we will," Fauci said. "Testing is an important part of what we’re doing, but it is not the only part."

…

"You need enough tests so when you’re doing what we’re trying to do right now, which is trying to ease our way back, that you can very easily identify, test, contact trace and get those who are infected out of society so they don’t infect others," he said, adding that positive test results should account for less than 10 percent of tests administered.

There were 256,444 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.7% (red line). The US probably needs enough tests to push the percentage positive below 5%, although Dr. Fauci said below 10% (probably much lower based on testing in New Zealand).

April 2020: Unofficial Problem Bank list Decreased to 64 Institutions

by Calculated Risk on 4/26/2020 08:11:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for April 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2020. During the month, the list declined by one to 64 banks after one removal. Aggregate assets were little changed at $48.4 billion. A year ago, the list held 73 institutions with assets of $52.1 billion. Exiting the list via failure was The First State Bank, Barboursville, WV ($152 million). This was the second failure in 2020 and the first failure in West Virginia since 2008 when Ameribank, Northfork, WV ($104 million) failed on September 19, 2008.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and has steadily declined to well below 100 institutions.

Saturday, April 25, 2020

April 25 Update: US COVID-19 Test Results: Making Progress!

by Calculated Risk on 4/25/2020 05:16:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 300,833 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.5% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We appear to be making progress.