by Calculated Risk on 4/23/2020 02:29:00 PM

Thursday, April 23, 2020

Black Knight: National Mortgage Delinquency Rate Increased in March, First Increase in March Ever

Note: Loans in forbearance will be counted as delinquent in this survey, so the delinquency rate will jump in April (see Black Knight's on this below)

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies See First-Ever March Increase from Early COVID-19 Impact; Foreclosures, Serious Delinquencies Hit Record Lows

• In what’s typically the strongest month of the year for mortgage performance, delinquencies rose by 3.33%, the first March increase since the turn of the century, an early sign of COVID-19’s impact on the marketAccording to Black Knight's First Look report for March, the percent of loans delinquent increased 3.3% in March compared to February, and decreased 7.3% year-over-year.

• Both the national foreclosure and 90-day delinquency rates set new record lows in March, a lingering reminder of the strength of the mortgage market heading into the pandemic

• At just 27,600 for the month, foreclosure starts also fell to their lowest level on record, as COVID-19-related moratoriums began to impact foreclosure inflows

• Prepayment activity jumped by nearly 40% in March, driven by record-low 30-year mortgage rates

• Note: For the purposes of this report going forward, the millions of homeowners who have since entered into forbearance will be counted as past due, but should not be reported as such to the credit bureaus by their servicers

emphasis added

The percent of loans in the foreclosure process decreased 7.7% in March and were down 18.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.39% in March, up from 3.28% in February.

The percent of loans in the foreclosure process decreased in March to 0.42% from 0.45% in February.

The number of delinquent properties, but not in foreclosure, is down 111,000 properties year-over-year, and the number of properties in the foreclosure process is down 44,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2020 | Feb 2020 | Mar 2019 | Mar 2018 | |

| Delinquent | 3.39% | 3.28% | 3.65% | 3.73% |

| In Foreclosure | 0.42% | 0.45% | 0.51% | 0.63% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,792,000 | 1,737,000 | 1,903,000 | 1,191,000 |

| Number of properties in foreclosure pre-sale inventory: | 220,000 | 239,000 | 264,000 | 321,000 |

| Total Properties | 2,013,000 | 1,976,000 | 2,167,000 | 2,232,000 |

A few Comments on March New Home Sales

by Calculated Risk on 4/23/2020 12:28:00 PM

New home sales for March were reported at 627,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down.

New home sales are counted when contracts are signed, so the impact of COVID-19 was probably in the second half of March. I expect sales will decline significantly in the April New Home sales report (to be released in May).

Earlier: New Home Sales Decrease to 627,000 Annual Rate in March.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were down 9.5% year-over-year (YoY) in March. Year-to-date (YTD) sales are still up 6.7%, but sales will be down YTD soon.

The comparisons are easy over the first five months of the year, but sales will probably be down YoY for the next several months - at least - due to COVID-19.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Over the next several months, both new and existing home sales will be negatively impacted by COVID-19.

Kansas City Fed: "Tenth District Manufacturing Activity Decreased Further" in April, Lowest Reading on Record

by Calculated Risk on 4/23/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Decreased Further

Tenth District manufacturing activity decreased further to the lowest reading in survey history (since 1994), while expectations for future activity improved but remained slightly negative. Month-over-month price indexes declined again in April, but District firms expected prices to rise slightly in the next six months.All of the regional surveys for April have been very weak.

The month-over-month composite index was -30 in April, the lowest composite reading in survey history, and down considerably from -17 in March and 5 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The decrease in district manufacturing activity was steepest at durable goods factories such as primary and fabricated metals, and activity at non-durable goods plants including food and beverage manufacturing declined as well. All month-over-month indexes dropped further in April except for supplier delivery time which continued to increase. Year-over-year factory indexes also decreased again in April, and the composite index fell from -14 to -30. The future composite index improved from -19 April, but remained slightly negative at -6.

emphasis added

New Home Sales Decrease to 627,000 Annual Rate in March

by Calculated Risk on 4/23/2020 10:14:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 627 thousand.

The previous three months were revised down.

Sales of new single‐family houses in March 2020 were at a seasonally adjusted annual rate of 627,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 15.4 percent below the revised February rate of 741,000 and is 9.5 percent below the March 2019 estimate of 693,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are just at a normal level.

The second graph shows New Home Months of Supply.

The months of supply increased in March to 6.4 months from 5.2 months in February.

The months of supply increased in March to 6.4 months from 5.2 months in February. The all time record was 12.1 months of supply in January 2009.

This is slightly above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of March was 333,000. This represents a supply of 6.4 months at the current sales rate."

On inventory, according to the Census Bureau:

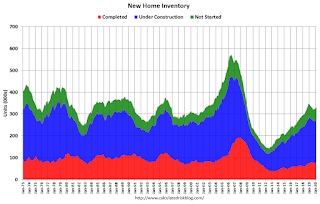

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

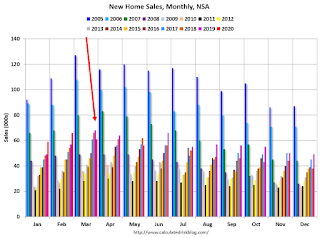

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2020 (red column), 61 thousand new homes were sold (NSA). Last year, 68 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was below expectations of 645 thousand sales SAAR, and sales in the three previous months were revised down. I'll have more later today.

The sales in March were only partially impacted by COVID-19 crisis. Sales in April will probably be much lower.

Weekly Initial Unemployment Claims decrease to 4,427,000

by Calculated Risk on 4/23/2020 08:36:00 AM

The DOL reported:

In the week ending April 18, the advance figure for seasonally adjusted initial claims was 4,427,000, a decrease of 810,000 from the previous week's revised level. The previous week's level was revised down by 8,000 from 5,245,000 to 5,237,000. The 4-week moving average was 5,786,500, an increase of 280,000 from the previous week's revised average. The previous week's average was revised down by 2,000 from 5,508,500 to 5,506,500.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 5,786,500.

This was higher than the consensus forecast.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 15.976 million (SA) and will increase further over the next few weeks - and likely stay at that high level until the crisis abates.

Wednesday, April 22, 2020

Thursday: Unemployment Claims, New Home Sales

by Calculated Risk on 4/22/2020 06:53:00 PM

CR Note: The number of weekly claims will be huge again, but probably lower than the previous weeks. Also, the March New Home Sales report will likely show weakness due to COVID-19.

The Kansas City Fed manufacturing survey is for April, and will probably be very weak.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 4.150 million initial claims, down from 5.245 million the previous week.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 645 thousand SAAR, down from 765 thousand in February.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April.

April 22 Update: US COVID-19 Test Results

by Calculated Risk on 4/22/2020 05:40:00 PM

NOTE: California reported over 165,000 tests. Perhaps they were clearing a backlog, but a majority of the tests were negative - pushing down the percent positive rate. I'd take today's numbers with a grain of salt.

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 311,381 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

NMHC: "April Apartment Market Conditions Showed Weakness Amid COVID-19 Outbreak"

by Calculated Risk on 4/22/2020 02:24:00 PM

The National Multifamily Housing Council (NMHC) released their April report: April Apartment Market Conditions Showed Weakness Amid COVID-19 Outbreak

Apartment market conditions weakened in the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions for April 2020, as the industry confronts the ongoing COVID-19 pandemic. The Market Tightness (12), Sales Volume (6), Equity Financing (13), and Debt Financing (20) indexes all came in well below the breakeven level (50).

“Residents across the country are currently under directives to stay at home and practice social distancing in order to contain the spread of COVID-19. As a result, much of the nation’s economic activity has been put on hold,” noted NMHC Chief Economist Mark Obrinsky. “With upwards of 20 million Americans now out of work, it is not surprising that 82 percent of respondents reported looser market conditions this quarter, and that just 5 percent observed a tighter market.”

“In the market for apartment sales, many respondents appear to have adopted the ‘wait-and-see’ attitude, noting that COVID-19 has created too much uncertainty around asset pricing for much of any transactions to occur. There are some buyers out looking for deals at the moment, but few sellers are willing to adjust prices downward. Only 1 percent of respondents reported higher sales volume, the lowest on record since 2008.”

...

The Market Tightness Index decreased from 48 to 12, indicating looser market conditions. The vast majority (82 percent) of respondents reported looser market conditions than three months prior, compared to 5 percent who reported tighter conditions. A small portion (12 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser in April due to COVID.

Philly Fed: State Coincident Indexes Decreased in 34 states in March

by Calculated Risk on 4/22/2020 11:37:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2020. Over the past three months, the indexes increased in 18 states, decreased in 29, and remained stable in three, for a three-month diffusion index of -22. In the past month, the indexes increased in 12 states, decreased in 34 states, and remained stable in four, for a one-month diffusion index of -44.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the great recession, and all or mostly green during most of the recent expansion.

The map is mostly red on a three month basis, and will turn red everywhere soon.

Note: The BLS reported some issues with some state Unemployment data for March, and that is probably why some states are still green (and this 3 month change).

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In March, 14 states had increasing activity including states with minor increases. (The few positive states are probably due to the issues the BLS has identified - all states will see declining activity in April).

FHFA: House Prices up 5.7% YoY in February

by Calculated Risk on 4/22/2020 09:18:00 AM

From the FHFA: FHFA House Price Index Up 0.7 Percent in February; Up 5.7 Percent from Last Year

U.S. house prices rose in February, up 0.7 percent from the previous month, according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 5.7 percent from February 2019 to February 2020. The previously reported 0.3 percent increase for January 2020 was revised upward to 0.5 percent.This is pre-crisis.

For the nine census divisions, seasonally adjusted monthly house price changes from January 2020 to February 2020 were all positive, ranging from 0.3 percent in the West South Central division to +1.2 percent in the Middle Atlantic division. The 12-month changes were all positive, ranging from +4.2 percent in the West South Central division to +8.1 percent in the Mountain division.

“U.S. house prices posted a strong increase in February," according to Dr. Lynn Fisher, Deputy Director of the Division of Research and Statistics at FHFA. “The growth in home prices coincides with other data showing robust housing market activity in early 2020 preceding the current crisis. House prices had positive monthly gains in every census division. Transactions still do not reflect much, if any, influence from the COVID-19 outbreak as of February."

emphasis added