by Calculated Risk on 4/14/2020 07:52:00 PM

Tuesday, April 14, 2020

Wednesday: Retail Sales, Industrial Production, NY Fed Mfg, Homebuilder Survey, Beige Book

CR Note: These releases should start to show the impact from COVID-19. The mortgage purchase application survey will give us further hints about the housing market, as will the April homebuilder survey.

The NY Fed manufacturing survey is for April, and will probably be very weak. And the Beige Book will be through April 6th.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for March is scheduled to be released. The consensus is for a 3.0% decrease in retail sales.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -35.0, down from -21.5.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 4.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 73.7%.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 59, down from 72. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

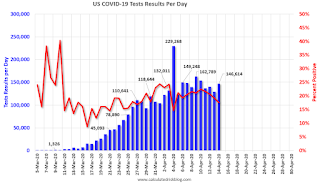

April 14 Update: US COVID-19 Test Results

by Calculated Risk on 4/14/2020 05:56:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 146,614 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 17.5% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

The Sharp Decline in Housing Activity

by Calculated Risk on 4/14/2020 05:33:00 PM

Housing economist Tom Lawler has send me some housing data from a few areas:

The data reflect newly ratified contracts in the week ending 4/11/2020 compared to the comparable week of a year ago.

Northern Virginia, down 35%

Loudoun County, down 37%

Prince William Count down 43%

Prince George's County down 44%

Montgomery County down 44%

DC down 58%.

From the Long Island Business News: Long Island home sales down nearly 67%

The Long Island housing market, which began to feel the impacts of the COVID-19 pandemic towards the end of March, has seen a dramatic drop in sales and listings in the first half of April.From Chicago Now: Coronavirus Impact On Chicago Real Estate Market: Week 5

There were just 491 homes contracted for sale in Nassau and Suffolk counties in the first two weeks of April, down nearly 67 percent from the 1,471 homes contracted for sale in the same period a year ago, according to numbers from OneKey MLS.

The Chicago Association of Realtors released their updated numbers for the week ending April 4 yesterday morning and it continues to show a pretty bleak picture.CR Note: It looks like both sales and new inventory will decline sharply in April.

Single family home activity fell from 318 last year to 172 this year. That's a 46% drop.

Condo and townhome activity fell from 517 to 195 which is a 62% drop. Wow!

Last year there were 528 new single family home listings compared to only 255 this year. That's a 52% drop.

Last year there were 971 new condo townhome listings vs. only 352 this year. That's a 64% drop. Ouch!

Employment: March Diffusion Indexes

by Calculated Risk on 4/14/2020 01:08:00 PM

The BLS diffusion index for total private employment was at 36.0 in March, down from 57.9 in February.

For manufacturing, the diffusion index was at 36.8, down from 50.7 in February.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.Both indexes generally trended down in 2019 - except for a spike up in November - indicating job growth was becoming less widespread across industries (especially manufacturing).

Then both indexes declined sharply in March 2020 due to the impact from COVID-19.

The Top Ten Job Streaks

by Calculated Risk on 4/14/2020 10:37:00 AM

I'm updating these tables since the headline job streak ended in March.

Through February 2020, the employment report indicated positive job growth for a record 113 consecutive months.

| Headline Jobs, Top 10 Streaks | |

|---|---|

| Year Ending | Streak, Months |

| 20201 | 113 |

| 1990 | 48 |

| 2007 | 46 |

| 1979 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 33 |

| 1967 | 29 |

| 1995 | 25 |

| 1974 | 24 |

| 1Ended February 2020 | |

However, if we adjust for Decennial Census hiring and firing (data here) the streak of consecutive positive jobs reports ended in January 2019 at 107 months. It makes sense to adjust for the Census hiring and firing since that was preplanned and unrelated to the business cycle.

| Ex-Census Jobs, Top 10 Streaks | |

|---|---|

| Year Ending | Streak, Months |

| 20191 | 107 |

| 2007 | 46 |

| 1979 | 45 |

| 1990 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 32 |

| 1967 | 29 |

| 1995 | 25 |

| 1974 | 24 |

| 1Ended January 2019 | |

Small Business Optimism Decreased Sharply in March

by Calculated Risk on 4/14/2020 08:29:00 AM

Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): March 2020 Report

The NFIB Small Business Optimism Index fell 8.1 points in March to 96.4, the largest monthly decline in the survey’s history.

.

[H]iring plans experienced a significant drop from February yet finding qualified workers remains the top issue for 24% of small employers who reported this as their No. 1 problem.

…

This survey was conducted in March 2020. A sample of 5,000 small-business owners/members was drawn. Six hundred twenty-seven (627) usable responses were received —a response rate of 12.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 96.4 in March.

This index will decline sharply in April (and the response rate will probably decline).

Monday, April 13, 2020

April 13 Update: US COVID-19 Test Results

by Calculated Risk on 4/13/2020 05:03:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 119,704 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 21% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

MBA Survey: Total Number of Mortgage Loans in Forbearance Jumped from 2.73% to 3.74%

by Calculated Risk on 4/13/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The surge in unemployment claims filed since mid-March resulting from the mitigation efforts to slow the spread of the coronavirus (COVID-19) are straining household budgets and leading to more requests for mortgage forbearance.

That is according to the Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey, which revealed that the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5, 2020. …

“The nationwide shutdown of the economy to slow the spread of COVID-19 continues to create hardships for millions of households, and more are contacting their servicers for relief in accordance with the forbearance provisions under the CARES Act,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The share of loans in forbearance grew the first week of April, and forbearance requests and call center volume further increased. With mitigation efforts seemingly in place for at least several more weeks, job losses will continue and the number of borrowers asking for forbearance will likely to continue to rise at a rapid pace.”

Added Fratantoni, “There was a decline in call center hold times and abandonment rates in the latest survey, which indicates the mortgage industry is adapting to the current environment by adding or reallocating staff and increasingly utilizing its websites to help borrowers.”

emphasis added

What is a Recession? What is a Depression?

by Calculated Risk on 4/13/2020 11:38:00 AM

People frequently say a recession is two quarters of declining GDP. That is not the definition used by the National Bureau of Economic Research (NBER):

The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. For more information, see the latest announcement from the NBER's Business Cycle Dating Committee, dated 9/20/10.I was using the NBER definition when I made a call that a recession started in March 2020. Clearly there has been "a significant decline in economic activity spread across the economy" that will last more than a few months.

But what is a Depression? Back in March 2009, I wrote:

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.It appears likely that GDP will slump more than 10% over the next several months, but will the slump be "prolonged"? My current guess is the worst of the economic slump will be in Q2, and then the economy will slowly start to expand. So that wouldn't be "prolonged". Of course, if we try to open the economy too soon - or too quickly without the proper preparedness (testing, masks, guidance) - then the economic damage will be more prolonged.

Black Knight Mortgage Monitor for Febuary; "Unemployment Spike Triggering Surge in Mortgage Forbearance Requests"

by Calculated Risk on 4/13/2020 09:29:00 AM

Black Knight released their Mortgage Monitor report for February today. According to Black Knight, 3.28% of mortgages were delinquent in February, down from 3.89% in February 2019. Black Knight also reported that 0.45% of mortgages were in the foreclosure process, down from 0.51% a year ago.

This gives a total of 3.73% delinquent or in foreclosure.

Press Release: Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests; Principal and Interest Advances Could Lead to Servicer Liquidity Challenges

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, in light of the growing impact of the COVID-19 pandemic on the economy, Black Knight drilled down into aspects of its extensive white paper exploring the ramifications of this crisis for the real estate and mortgage industries. As Black Knight Data & Analytics President Ben Graboske explained, any attempt to quantify potential delinquencies from the current situation is challenging, as there have been no true corollaries in history.

“Trying to gauge the impact of COVID-19 on mortgage performance is as much an art right now as a science,” said Graboske. “The fact is that there is no true point of comparison in the nation’s recent history for analysts to model against. That said, there are some historical clues that can help shed light. In the Great Recession, for example, the number of past- due mortgages tripled over four years, increasing by more than 5.5 million, as the unemployment rate rose relatively sharply from 4.5% in 2006 to 10% by the end of 2009. Today, we’ve seen more than 10 million people file for unemployment since the coronavirus was labeled a pandemic on March 11, which should put the unemployment rate at roughly 9.5%. Using the Great Recession as a point of comparison, Black Knight’s AFT modeling team looked at potential delinquencies under different unemployment scenarios, and at 10%, we could expect 2 million new mortgage delinquencies. That would put the total at 4 million delinquencies with a national non-current rate of 7.5%. If unemployment climbs to the 15% recently projected by Goldman Sachs[1], we could be looking at 5.5 million past-due mortgages. Should unemployment reach the 32% projected by the Federal Reserve Bank of St. Louis[2], the non-current rate could spike to nearly 19%, surpassing what we saw during the Great Recession, with 10 million homeowners past due on their mortgages.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National Delinquency Rate.

From Black Knight:

• As of February, the national delinquency rate was 3.28%; just one month removed from its record low and with the rate of improvement accelerating in recent monthsThe second graph shows the impact of COVID-19 on real estate showings:

• Likewise, the national foreclosure rate was only 1 BPS above its all-time low and was trending downward heading into 2020

• Foreclosure starts hit their lowest level on record in February as well and were down by some 20% from the same time last year

• While these historically low levels of past due mortgages provide a strong foundation for the market leading up to the COVID-19 pandemic, they also mean that default servicing staff had been greatly reduced in recent years

• This will compound the challenge that servicers face in managing the wave of new forbearance and deferral requests on the horizon in coming weeks/months

• According to the online home showing service ShowingTime, the number of in-person real estate showings as of March 25 was down nearly 50% from the 2020 peak on March 11There is much more in the mortgage monitor.

• Likewise, aggregate data from Paragon, Black Knight’s Multiple Listing Service (MLS) platform, shows that as of March 22 online property views by prospective homebuyers were down 24% over the prior two weeks

• While social distancing efforts are likely having an outsized impact on in person showings, the declines in online searches suggest potential trepidation from homeowners about economic uncertainty, rate volatility, and/or job security