by Calculated Risk on 4/11/2020 08:11:00 AM

Saturday, April 11, 2020

Schedule for Week of April 12, 2020

The key reports this week are March housing starts and retail sales, and weekly unemployment claims.

For manufacturing, the March Industrial Production report and the April NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 3.0% decrease in retail sales.

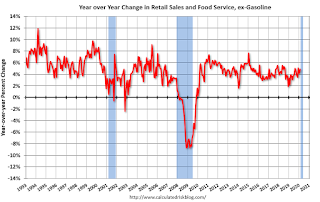

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 3.0% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis in February.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -35.0, down from -21.5.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

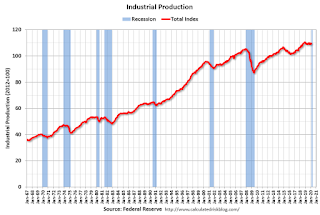

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 4.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 73.7%.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 59, down from 72. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 6.500 million initial claims, down from 6.606 million the previous week.

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and total housing starts since 1968.

The consensus is for 1.307 million SAAR, down from 1.599 million SAAR in February.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of -30.0, down from -12.7.

10:00 AM: State Employment and Unemployment (Monthly) for March 2019

Friday, April 10, 2020

April 10 Update: US COVID-19 Test Results

by Calculated Risk on 4/10/2020 05:17:00 PM

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

This is just test results reported daily.

There were 144,942 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 23% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

Test. Test. Test. Protect healthcare workers first!

Reopening: Milestones, Not Dates

by Calculated Risk on 4/10/2020 03:12:00 PM

It appears the US is close to peak cases per day. Social distancing, hand washing and shelter-in-place orders are workings.

This means we need to redouble our efforts over the next several weeks. Minimize our contacts (social distancing), wash our hands, and wear a mask or face cover whenever we are in public.

We need to shift the reopening discussion away from being date specific to milestone specific. I believe there are two clear milestones that we need to achieve before reopening (these are my suggestions, and I'll defer to the experts on the milestones).

First, Impact on Hospitals and First Responders:

a) We need to return to standard levels of care. Dr. Gottlieb, et. al. described this as "Hospitals in the state are safely able to treat all patients requiring hospitalization without resorting to crisis standards of care"

b) We need to have adequate PPE for all healthcare workers and first responders. We must do everything possible to prevent further deaths of healthcare workers.

c) Healthcare workers and first responders should be able to be tested on demand.

Second, we need a robust Test-and-Trace program:

a) Apple and Google announced today software that can help with contact tracing.

b) We need to increase testing capabilities to several hundred thousand per day (maybe close to a million per day).

c) We need a well trained team to follow-up on tracing, and also to regularly contact all people in self-quarantine.

d) This requires naming someone to head the test-and-trace taskforce with extensive logistics and medical experience (maybe co-chairs). Perhaps the states should name someone.

With clear milestones we can progress toward slowly reopening the economy.

We will need clear guidelines in advance of reopening (mask wearing, minimize groups, etc) and consistent messaging. We can do this.

Q1 GDP Forecasts: Around -7% SAAR

by Calculated Risk on 4/10/2020 11:48:00 AM

Note: The NY Fed Nowcast and Atlanta Fed GDPNow models are based on released data and aren't capturing the collapse in the economy in the 2nd half of March. All forecasts, including the Merrill Lynch and Goldman Sachs forecasts, are for the seasonally adjust annual rate (SAAR) of decline.

From Merrill Lynch:

We continue to expect a 7% decline in 1Q [SAAR Apr 10 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP forecast unchanged at -9.0% (qoq ar). However, we continue to expect the advance reading on April 29th to register a smaller decline of -6.5%, reflecting incomplete source data and non-response bias. [Apr 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.5% for 2020:Q1 and -0.4% for 2020:Q2. [Apr 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 1.0 percent on April 9, down from 1.3 percent on April 2. … There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. In particular, it does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. It does not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the model. [Apr 9 estimate]CR Note: These estimate suggest GDP declined around 7% in Q1.

CDC: Seasonal Flu Activity Very Low

by Calculated Risk on 4/10/2020 11:38:00 AM

This will be my last update on this Flu season.

Seasonal flu activity has slowed sharply, and is now low, and that will help with the COVID-19 pandemic.

From the CDC: Weekly U.S. Influenza Surveillance Report

Laboratory confirmed flu activity as reported by clinical laboratories continues to decrease sharply and is now low. Influenza-like illness activity, while lower than last week, is still elevated.Note that ILI (influenza-like illness) activity is somewhat elevated due to COVID-19.

…

Nationally, the percent of laboratory specimens testing positive for influenza at clinical laboratories continued to decrease and is now low. … Recent changes in healthcare seeking behavior, including increasing use of telemedicine and recommendations to limit emergency department (ED) visits to severe illness, as well as increasing levels of social distancing, are affecting the number of persons with ILI and their reasons for seeking care in outpatient and ED settings.

Click on graph for larger image.

Click on graph for larger image.This graph from the CDC shows the number of positive specimens, and the percent of tests positive.

If we look back at previous reports (for week 14), activity slowed faster this year than in most previous years.

Influenza is seasonal, but social distancing and hand washing has helped lower flu activity too.

The CDC estimates there were 410,000 hospitalization due to the flu this season (spread over 6 months). Since new flu hospitalizations are now close to zero, this takes some of the load off the healthcare workers.

Cleveland Fed: Key Measures Show Inflation Near 2% YoY in March

by Calculated Risk on 4/10/2020 11:10:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in March. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for March here. Motor fuel decreased at a 73% annualized rate in March!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-5.0% annualized rate) in March. The CPI less food and energy fell 0.1% (-1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

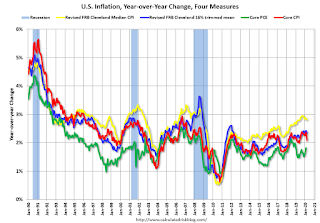

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.1%. Core PCE is for February and increased 1.8% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized and trimmed-mean CPI was at 1.9% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%). Inflation will not be a concern during the crisis.

Sacramento Housing in March: Sales decline 11.4% YoY, Active Inventory down 11.9% YoY

by Calculated Risk on 4/10/2020 08:52:00 AM

The housing market will slow sharply soon, but here are the stats from March. Note that March sales are for contracts typically signed in January and February - before the COVID crisis.

From SacRealtor.org: March 2020 Statistics – Sacramento Housing Market – Single Family Homes

March closed with 1,170 sales, up 15.4% from the 1,014 sales in February. Compared to one year ago (1,320), the current figure is an 11.4% drop.1) Overall sales decreased to 1,170 in March, down 11.4% from 1,320 in March 2019. Sales were up from February 2020 (previous month).

...

The Active Listing Inventory increased 16.6% from February to March, from 1,422 units to 1,658 units. Compared with March 2019 (1,883), inventory is down 11.9%. The Months of Inventory remained at 1.4 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) decreased from 10 to 8 and the Average DOM decreased from 29 to 26. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,658, down from 1,883 in March 2019. That is down 11.9% year-over-year. This is the eleventh consecutive month with a YoY decline in inventory.

BLS: CPI decreased 0.4% in March, Core CPI decreased 0.1%

by Calculated Risk on 4/10/2020 08:36:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.4 percent in March on a seasonally adjusted basis, the largest monthly decline since January 2015, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.Overall inflation was below expectations in March. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

A sharp decline in the gasoline index was a major cause of the monthly decrease in the seasonally adjusted all items index, with decreases in the indexes for airline fares, lodging away from home, and apparel also contributing. The energy index fell 5.8 percent as the gasoline index decreased 10.5 percent.

...

The index for all items less food and energy fell 0.1 percent in March, its first monthly decline since January 2010.

…

The all items index increased 1.5 percent for the 12 months ending March, a notably smaller increase than the 2.3-percent increase for the period ending February. The index for all items less food and energy rose 2.1 percent over the last 12 months.

emphasis added

Thursday, April 09, 2020

Friday: CPI, Markets Closed for Good Friday

by Calculated Risk on 4/09/2020 08:55:00 PM

Note: Inflation is not a concern with the COVID-19.

Friday:

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 0.3% decrease in CPI, and a 0.1% increase in core CPI.

April 9 Update: US COVID-19 Test Results

by Calculated Risk on 4/09/2020 05:45:00 PM

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: I read that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

This is just test results reported daily.

There were 162,769 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 21% (red line). The US needs enough tests to push the percentage below 5% (probably much lower).

Test. Test. Test. Protect healthcare workers first!