by Calculated Risk on 4/10/2020 03:12:00 PM

Friday, April 10, 2020

Reopening: Milestones, Not Dates

It appears the US is close to peak cases per day. Social distancing, hand washing and shelter-in-place orders are workings.

This means we need to redouble our efforts over the next several weeks. Minimize our contacts (social distancing), wash our hands, and wear a mask or face cover whenever we are in public.

We need to shift the reopening discussion away from being date specific to milestone specific. I believe there are two clear milestones that we need to achieve before reopening (these are my suggestions, and I'll defer to the experts on the milestones).

First, Impact on Hospitals and First Responders:

a) We need to return to standard levels of care. Dr. Gottlieb, et. al. described this as "Hospitals in the state are safely able to treat all patients requiring hospitalization without resorting to crisis standards of care"

b) We need to have adequate PPE for all healthcare workers and first responders. We must do everything possible to prevent further deaths of healthcare workers.

c) Healthcare workers and first responders should be able to be tested on demand.

Second, we need a robust Test-and-Trace program:

a) Apple and Google announced today software that can help with contact tracing.

b) We need to increase testing capabilities to several hundred thousand per day (maybe close to a million per day).

c) We need a well trained team to follow-up on tracing, and also to regularly contact all people in self-quarantine.

d) This requires naming someone to head the test-and-trace taskforce with extensive logistics and medical experience (maybe co-chairs). Perhaps the states should name someone.

With clear milestones we can progress toward slowly reopening the economy.

We will need clear guidelines in advance of reopening (mask wearing, minimize groups, etc) and consistent messaging. We can do this.

Q1 GDP Forecasts: Around -7% SAAR

by Calculated Risk on 4/10/2020 11:48:00 AM

Note: The NY Fed Nowcast and Atlanta Fed GDPNow models are based on released data and aren't capturing the collapse in the economy in the 2nd half of March. All forecasts, including the Merrill Lynch and Goldman Sachs forecasts, are for the seasonally adjust annual rate (SAAR) of decline.

From Merrill Lynch:

We continue to expect a 7% decline in 1Q [SAAR Apr 10 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP forecast unchanged at -9.0% (qoq ar). However, we continue to expect the advance reading on April 29th to register a smaller decline of -6.5%, reflecting incomplete source data and non-response bias. [Apr 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.5% for 2020:Q1 and -0.4% for 2020:Q2. [Apr 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 1.0 percent on April 9, down from 1.3 percent on April 2. … There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. In particular, it does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. It does not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the model. [Apr 9 estimate]CR Note: These estimate suggest GDP declined around 7% in Q1.

CDC: Seasonal Flu Activity Very Low

by Calculated Risk on 4/10/2020 11:38:00 AM

This will be my last update on this Flu season.

Seasonal flu activity has slowed sharply, and is now low, and that will help with the COVID-19 pandemic.

From the CDC: Weekly U.S. Influenza Surveillance Report

Laboratory confirmed flu activity as reported by clinical laboratories continues to decrease sharply and is now low. Influenza-like illness activity, while lower than last week, is still elevated.Note that ILI (influenza-like illness) activity is somewhat elevated due to COVID-19.

…

Nationally, the percent of laboratory specimens testing positive for influenza at clinical laboratories continued to decrease and is now low. … Recent changes in healthcare seeking behavior, including increasing use of telemedicine and recommendations to limit emergency department (ED) visits to severe illness, as well as increasing levels of social distancing, are affecting the number of persons with ILI and their reasons for seeking care in outpatient and ED settings.

Click on graph for larger image.

Click on graph for larger image.This graph from the CDC shows the number of positive specimens, and the percent of tests positive.

If we look back at previous reports (for week 14), activity slowed faster this year than in most previous years.

Influenza is seasonal, but social distancing and hand washing has helped lower flu activity too.

The CDC estimates there were 410,000 hospitalization due to the flu this season (spread over 6 months). Since new flu hospitalizations are now close to zero, this takes some of the load off the healthcare workers.

Cleveland Fed: Key Measures Show Inflation Near 2% YoY in March

by Calculated Risk on 4/10/2020 11:10:00 AM

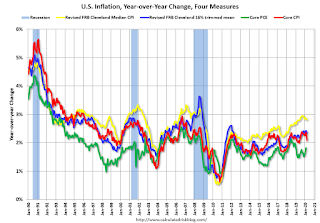

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in March. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for March here. Motor fuel decreased at a 73% annualized rate in March!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-5.0% annualized rate) in March. The CPI less food and energy fell 0.1% (-1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.1%. Core PCE is for February and increased 1.8% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized and trimmed-mean CPI was at 1.9% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%). Inflation will not be a concern during the crisis.

Sacramento Housing in March: Sales decline 11.4% YoY, Active Inventory down 11.9% YoY

by Calculated Risk on 4/10/2020 08:52:00 AM

The housing market will slow sharply soon, but here are the stats from March. Note that March sales are for contracts typically signed in January and February - before the COVID crisis.

From SacRealtor.org: March 2020 Statistics – Sacramento Housing Market – Single Family Homes

March closed with 1,170 sales, up 15.4% from the 1,014 sales in February. Compared to one year ago (1,320), the current figure is an 11.4% drop.1) Overall sales decreased to 1,170 in March, down 11.4% from 1,320 in March 2019. Sales were up from February 2020 (previous month).

...

The Active Listing Inventory increased 16.6% from February to March, from 1,422 units to 1,658 units. Compared with March 2019 (1,883), inventory is down 11.9%. The Months of Inventory remained at 1.4 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) decreased from 10 to 8 and the Average DOM decreased from 29 to 26. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,658, down from 1,883 in March 2019. That is down 11.9% year-over-year. This is the eleventh consecutive month with a YoY decline in inventory.

BLS: CPI decreased 0.4% in March, Core CPI decreased 0.1%

by Calculated Risk on 4/10/2020 08:36:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.4 percent in March on a seasonally adjusted basis, the largest monthly decline since January 2015, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.Overall inflation was below expectations in March. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

A sharp decline in the gasoline index was a major cause of the monthly decrease in the seasonally adjusted all items index, with decreases in the indexes for airline fares, lodging away from home, and apparel also contributing. The energy index fell 5.8 percent as the gasoline index decreased 10.5 percent.

...

The index for all items less food and energy fell 0.1 percent in March, its first monthly decline since January 2010.

…

The all items index increased 1.5 percent for the 12 months ending March, a notably smaller increase than the 2.3-percent increase for the period ending February. The index for all items less food and energy rose 2.1 percent over the last 12 months.

emphasis added

Thursday, April 09, 2020

Friday: CPI, Markets Closed for Good Friday

by Calculated Risk on 4/09/2020 08:55:00 PM

Note: Inflation is not a concern with the COVID-19.

Friday:

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 0.3% decrease in CPI, and a 0.1% increase in core CPI.

April 9 Update: US COVID-19 Test Results

by Calculated Risk on 4/09/2020 05:45:00 PM

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: I read that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

This is just test results reported daily.

There were 162,769 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 21% (red line). The US needs enough tests to push the percentage below 5% (probably much lower).

Test. Test. Test. Protect healthcare workers first!

University of Michigan: Largest Decline on Record for Consumer Sentiment

by Calculated Risk on 4/09/2020 02:24:00 PM

From the University of Michigan: Preliminary Results for April 2020

Consumer sentiment plunged 18.1 Index-points in early April, the largest monthly decline ever recorded. When combined with last month's decline, the two-month drop of 30.0 Index-points was 50% larger than the prior record. Of the two Index components, the Current Conditions Index plunged by 31.3 Index-points, nearly twice the prior record decline of 16.6 points set in October 2008. In contrast, the Expectations Index fell by 9.7 points, a substantial decline, but not nearly as steep as the record 16.5 point drop in December of 1980. This suggests that the free-fall in confidence would have been worse were it not for the expectation that the infection and death rates from covid-19 would soon peak and allow the economy to restart. As noted in last week's special report, anticipating a quick and sustained economic expansion is likely to be a failed expectation, resulting in a renewed and deeper slump in confidence. Indeed, the peak decline in the Expectations Index recorded in December 1980 reflected a relapse following the end of the short January to July 1980 recession, signaling the start of a longer and deeper recession that lasted from July 1981 to November 1982. Consumers need to be prepared for a longer and deeper recession rather than the now discredited message that pent-up demand will spark a quick, robust, and sustained economic recovery. Continued declines in the seven-day average Sentiment Index can be expected in the weeks ahead (see the featured chart). Sharp additional declines may occur when consumers adjust their views to a slower expected pace of the economic recovery.

emphasis added

Hotels: Occupancy Rate Declined 68.5% Year-over-year to All Time Record Low

by Calculated Risk on 4/09/2020 09:51:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 4 April

Reflecting the continued impact of the COVID-19 pandemic, the U.S. hotel industry reported significant year-over-year declines in the three key performance metrics during the week of 29 March through 4 April 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 31 March through 6 April 2019, the industry recorded the following:

• Occupancy: -68.5% to 21.6%

• Average daily rate (ADR): -41.5% to US$76.51

• Revenue per available room (RevPAR): -81.6% to US$16.50

“Data worsened a bit from last week, and certain patterns were extended around occupancy,” said Jan Freitag, STR’s senior VP of lodging insights. “Economy hotels continued to run the highest occupancy, while interstate and suburban properties once again posted the top occupancy rates among location types. This shows there are still pockets of demand while more than 75% of the rooms around the country are empty. We don’t expect any material change in the magnitude of RevPAR declines for the time being.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

This is the lowest weekly occupancy on record, even considering seasonality. Note the graph is a 4-week average.