by Calculated Risk on 3/19/2020 11:57:00 AM

Thursday, March 19, 2020

Sacramento Housing in February: Sales Unchanged YoY, Active Inventory down 28.7% YoY

The housing market will slow soon, but here are the stats from February. Note that the median sales price finally passed the previous high in August 2005 (almost 15 years ago, and not adjusted for inflation).

From SacRealtor.org: February 2020 Statistics – Sacramento Housing Market – Single Family Homes

February closed with 1,014 sales, up 7.4% from the 944 sales in January. Compared to one year ago (1,015), the current figure nearly unchanged.1) Overall sales decreased to 1,014 in February, down 1 from 1015 in February 2019. Sales were up from January 2020 (previous month), and essentially unchanged from February 2019.

...

The Active Listing Inventory increased .9% from January to February, from 1,409 units to 1,422 units. Compared with February 2019 (1,994), inventory is down 28.7%. The Months of Inventory decreased from 1.5 to 1.4 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) decreased from 17 to 10 and the Average DOM decreased from 33 to 29. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,422, down from 1,994 in February 2019. That is down 28.7% year-over-year. This is the tenth consecutive month with a YoY decline in inventory, following 20 months of YoY increases in inventory.

Hotels: Occupancy Rate Declined 24.4% Year-over-year

by Calculated Risk on 3/19/2020 10:43:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 14 March

Showing further COVID-19 impact, the U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 8-14 March 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 10-16 March 2019, the industry recorded the following:

• Occupancy: -24.4% to 53.0%

• Average daily rate (ADR): -10.7% to US$120.30

• Revenue per available room (RevPAR): -32.5% to US$63.74

Performance declines were uniform across chain scales, classes and location types.

“To no surprise, the hurt continued and intensified for hotels around the country,” said Jan Freitag, STR’s senior VP of lodging insights. “The performance declines were especially pronounced in hotels that cater to meetings and group business, which is a reflection of the latest batch of event cancellations and government guidance to restrict the size of gatherings.

“The questions we are hearing the most right now are around how far occupancy will drop and how long this will last. Through comparative analysis of the occupancy trends in China and Italy over the past weeks, we can with certainty say that we are not yet close to the bottom in the U.S. However, the timeline for that decline and the eventual recovery are much tougher to predict because there is still so much uncertainty around the COVID-19 case numbers in the U.S. and how serious citizens are when practicing social distancing. China and Italy saw a more abrupt decline in occupancy because of stricter lockdowns. That will dictate the speed of recovery.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 is now significantly impacting occupancy.

It is likely the four week average will drop below the 2009 average during the crisis.

Philly Fed "Current Manufacturing Indicators Show a Weakening in Activity in March"

by Calculated Risk on 3/19/2020 08:45:00 AM

From the Philly Fed: Current Manufacturing Indicators Show a Weakening in Activity in March

Manufacturing firms reported a significant weakening in regional manufacturing activity this month, according to results from the Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments fell precipitously this month, coinciding with developments related to the coronavirus. The firms reported a slight overall increase in employment, however, and a near-steady workweek. The broadest indicator of future activity weakened somewhat but remained elevated; however, firms still expect overall growth in new orders, shipments, and employment over the next six months.This was well below the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current activity declined markedly from a three-year high reading of 36.7 in February to -12.7 this month, its lowest reading since July 2012 … The firms reported an overall slight increase in manufacturing employment this month, but the current employment index decreased 6 points to 4.1, its lowest reading since November 2016. The average workweek index fell 10 points but remained slightly positive at 0.5.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

These early reports suggest the ISM manufacturing index will decline significantly in March.

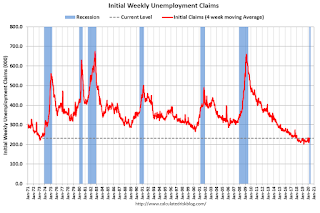

Weekly Initial Unemployment Claims Increase to 281,000

by Calculated Risk on 3/19/2020 08:35:00 AM

Note: Claims for this week (reported next Thursday) will be extremely high.

The DOL reported:

In the week ending March 14, the advance figure for seasonally adjusted initial claims was 281,000, an increase of 70,000 from the previous week's unrevised level of 211,000. This is the highest level for initial claims since September 2, 2017 when it was 299,000. The 4-week moving average was 232,250, an increase of 16,500 from the previous week's revised average. This is the highest level for this average since January 27, 2018 when it was 234,500. The previous week's average was revised up by 1,750 from 214,000 to 215,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 232,250.

This was lower than the consensus forecast.

Note: Companies have just started announcing layoffs related to COVID-19. So we should expect weekly claims to increase to record levels next week.

Wednesday, March 18, 2020

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 3/18/2020 08:31:00 PM

Weekly Claims will be huge this week (reported next week), but we will probably also see an increase in the claims reported for last week. The Philly Fed survey for March will probably be much weaker than the forecast.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 211 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 10.0, down from 36.7.

Update: COVID-19 Tests per Day

by Calculated Risk on 3/18/2020 05:18:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with about one-fifth of the US population, so the US needs to test 70,000 to 100,000 per day.

The US conducted 22,408 tests in the last 24 hours. That is progress, but the US needs the ability to conduct about 70,000 to 100,000 per day.

This data is from the COVID Tracking Project.

Testing it getting better, but is still too low.

Test. Test. Test.

Stay Healthy!

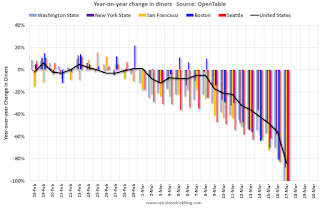

Update: Decline in Restaurant Traffic

by Calculated Risk on 3/18/2020 02:45:00 PM

There are some sectors that will be hit hard over the next several months: hotels, airlines, restaurants, movie theaters, sporting events, and convention centers. People will probably avoid these places as part of social distancing.

Thanks to OpenTable for providing this restaurant data:

This data shows the year-over-year change in diners as tabulated by OpenTable for the US, the states of Washington and New York, and a few impacted cities (Seattle, San Francisco, and Boston).

This data is updated through March 17, 2020.

The US was off 84% YoY as of yesterday.

As of yesterday, San Francisco was off 100% YoY, Boston was off 100% YoY, and Seattle was off 100%. Going forward, restaurants are closing in many states (except take out and pick up)

As of March 17th, 13 states and D.C. were off 100%, Soon it will be all states.

Clearly the US will need to help the employees (and owners) of these impacted sectors.

Lawler: Early Read on Existing Home Sales in February; Lawler "I doubt anyone really cares"

by Calculated Risk on 3/18/2020 01:50:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.58 million in February , up 2.2% from January’s preliminary pace and up 3.7% from last February’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of February was down by about 12.3% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 7.5% from last January.

There are a few things worth noting. First, of course, closed sales in February were not impacted by the current pandemic. Second, some realtor/MLS reports that I use for the “early read” have not yet been released. And finally, getting the seasonal adjustment “right” for February is tricky. 2020 is a leap year, and typically the February existing home sales seasonal factor is significantly higher in a leap year than in other years. However, this February’s “extra day” was on a weekend, and since not many home sales close on a weekend, the “leap year” effect on this February’s seasonal factor should be pretty modest.

CR Note: The National Association of Realtors (NAR) is scheduled to release February existing home sales on Friday, March 20, 2020 at 10:00 AM ET. The consensus is for 5.50 million SAAR.

Phoenix Real Estate in February: Sales up 13.6% YoY, Active Inventory Down 43.5% YoY

by Calculated Risk on 3/18/2020 11:44:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 7,279 in February, up from 6,328 in January, and up from 6,409 in February 2019. Sales were up 15.0% from January 2019 (last month), but up 13.6% from February 2019.

2) Active inventory was at 10,590, down from 18,990 in February 2019. That is down 43.5% year-over-year.

3) Months of supply decreased to 2.14 in February from 2.54 months in January. This remains low.

This was another market with increasing sales and falling inventory.

With the COVID-19 crisis, everything will change for the duration of the crisis. My guess is sales will decline sharply, and inventory will probably stay low (no one wants strangers in their homes).

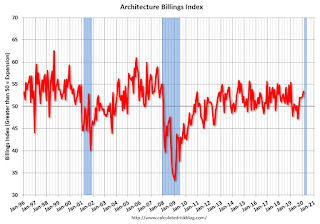

AIA: Architecture Billings Index increased in February, Expected to decline rapidly

by Calculated Risk on 3/18/2020 11:07:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design services saw increase in February but economic footings are rapidly shifting

Demand for design services in February increased at a solid pace for the sixth month in a row, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 53.4 for February reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). During February, both the new project inquiries and design contracts scores moderated slightly but remained in positive territory, posting scores of 56.5 and 52.0 respectively.

“Business conditions at architecture firms have been surprisingly positive so far this year. However, firms were just beginning to feel the impact of the dramatic slowdown caused by COVID-19 as this survey was being conducted in early March.” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The rapid pull-back in activity throughout the economy will obviously be felt in the design and construction sector, and architecture firms will be one of the first to see how these events play out.”

...

• Regional averages: South (56.7); West (52.1); Midwest (51.3); Northeast (45.3)

• Sector index breakdown: mixed practice (51.6); commercial/industrial (51.5); multi-family residential (51.2); institutional (51.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.4 in February, up from 52.2 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some increase in CRE investment in 2020.

However, this will all change in the next survey - when activity will decline significantly.