by Calculated Risk on 3/04/2020 08:31:00 AM

Wednesday, March 04, 2020

BEA: February Vehicles Sales decreased to 16.8 Million SAAR

The BEA released their estimate of February vehicle sales this morning. The BEA estimated light vehicle sales of 16.83 million SAAR in February 2020 (Seasonally Adjusted Annual Rate), down 0.5% from the revised January sales rate, and up 1.9% from February 2019.

Sales in January were revised up from 16.84 million SAAR to 16.92 million SAAR.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for February 2020 (red).

A small decline in sales last year wasn't a concern. My view - before the health crisis - was that sales would move mostly sideways at near record levels this year. Going forward, the impact of COVID-19 on vehicle sales is unclear.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.83 million SAAR.

Sales have been generally decreasing slightly, but are still at a high level.

ADP: Private Employment increased 183,000 in February

by Calculated Risk on 3/04/2020 08:19:00 AM

Private sector employment increased by 183,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

“The labor market remains firm, as private-sector payrolls continued to expand in February,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Job creation remained heavily concentrated in large companies, which continue to be the strongest performer.”

Mark Zandi, chief economist of Moody’s Analytics, said, “COVID-19 will need to break through the job market firewall if it is to do significant damage to the economy. The firewall has some cracks, but judging by the February employment gain it should be strong enough to weather most scenarios.”

The BLS report will be released Friday, and the consensus is for 175,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

by Calculated Risk on 3/04/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 15.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2020. The results for the week ending February 21, 2020, included an adjustment for the Presidents’ Day holiday.

... The Refinance Index increased 26 percent from the previous week and was 224 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“The 30-year fixed rate mortgage dropped to its lowest level in more than seven years last week, amidst increasing concerns regarding the economic impact from the spread of the coronavirus, as well as the tremendous financial market volatility. Refinance demand jumped as a result, with conventional refinance applications increasing more than 30 percent," said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Given the further drop in Treasury rates this week, we expect refinance activity will increase even more until fears subside and rates stabilize.”

Added Fratantoni, “We are now at the start of the spring homebuying season. While purchase applications were down a bit for the week, they are still up about 10 percent from a year ago. The next few weeks are key in whether these low mortgage rates bring in more buyers, or if economic uncertainty causes some home shoppers to temporarily delay their search.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.57 percent from 3.73 percent, with points decreasing to 0.26 from 0.27 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

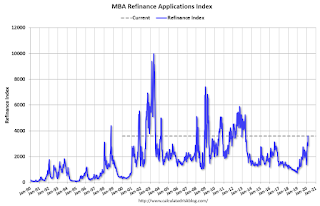

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, and with the further decline in rates this week, we will probably see a huge increase in refinance activity in the survey next week.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

As Fratantoni noted, a key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China).

Tuesday, March 03, 2020

Wednesday: ADP Employment, ISM non-Mfg, Beige Book

by Calculated Risk on 3/03/2020 09:08:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in February, down from 291,000 added in January.

• Early, Light vehicle sales for February from the BEA. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).

• At 10:00 AM, the ISM non-Manufacturing Index for February.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

30 Year Mortgage Rates at 3.0%

by Calculated Risk on 3/03/2020 06:52:00 PM

From Matthew Graham at MortgageNewsDaily: Rates at All-Time Lows No Thanks to Fed's Emergency Cut

The Fed announced an emergency rate cut of 50bps today (0.50%). Great! So your mortgage rate could be 0.5% lower, right? Not exactly... Rates definitely moved lower today, and the Fed was definitely involved in that, but more so because their surprise rate cut proved to disillusion financial markets, thus setting off a wave of panic that benefited bonds. Excess demand for bonds means lower mortgage rates (all-time lows, by the end of the day). [Today's Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.0%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since January 2011.

More than a 1/4 percentage point below the previous record low levels of late 2012.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for interactive graph.

Policy Proposal: Enhanced Automatic Stabilizer

by Calculated Risk on 3/03/2020 03:11:00 PM

This is an unusual situation, and this calls for targeted fiscal policy. Here is a proposal to enhance a key automatic stabilizer: unemployment insurance.

The idea is to increase the amount paid (based on various triggers) and to include parents with school closures (to help with child care).

First, based on certain triggers, the Federal Government would pay an additional 60% of whatever the state is paying for unemployment insurance (if the state is paying $300 per week, the Federal government would add $180 per week). (Note: The 60% is just an arbitrary number)

Triggers could be based on an increase in the 4-week average of unemployment claims above a certain threshold (like 250K), or industry triggers (workers in leisure industries such as airlines, hotels, etc. could qualify), or there could be geographical triggers based on a serious regional outbreak of the virus.

So this wouldn't go into effect until certain triggers happen.

Second, based on school closures, the Federal Government would pay a parent both the state share and the 60% extra. School closures are easy to verify. There should be a "reduction in hours" clause, so a person can keep working during a school closure, and still receive some benefits.

Third, there should be a provision to extend the benefits (entirely paid by the Federal government) if the crisis is still ongoing.

This type of program is targeted and builds confidence. One of the concerns during a downturn is that people will slow their spending because they become worried about their financial situation if they lose their job. This will alleviate that fear somewhat.

This kind of policy would be easy to enact, fairly easy to implement, and would receive bi-partisan support.

Pandemic: A Slowdown or a Recession?

by Calculated Risk on 3/03/2020 11:54:00 AM

Back in 2013, I wrote "Predicting the Next Recession". Since then, I've updated that post several times, most recently last September.

In that post I noted that the next recession could be caused by ...

"An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable ..."Now that a pandemic is here, the question is: Will the economy just slow down, or will there be a recession?

emphasis added

A recession or a slowdown depends on the severity of the pandemic and the actions of the Federal Government (both on coordinating the response and fiscal policy). The Federal Reserve cut rates 50 bps this morning, but they can only do so much.

The severity of the pandemic is unpredictable, although looking at China - and now South Korea - the economic disruptions could be huge.

The actions of the Chinese government, and the US actions to limit travel from China, bought policymakers in the US time to plan for the pandemic. Unfortunately it appears US policymakers were caught flat-footed, apparently expecting containment would be successful (even though the experts were saying containment would most likely fail).

At this point, the Government should follow the advice of the medical experts - obviously increase testing dramatically and making testing free for every person in the US..

On fiscal policy, tax cuts would be pointless. I think even a payroll tax cut would have limited benefit. We need policies aimed directly at those impacted. For example, if schools close, how will parents handle child care? If a parent needs to stay at home to take care of their kids, what about their income?

My suggestion is to strengthen the automatically stabilizers (increase the amount of unemployment insurance for the next several months), and target fiscal policy directly at those impacted. I offered some suggestions yesterday that were aimed at those impacted.

The actions of the Federal Government over the next few weeks, on coordinating the response and putting in place targeted policies, will be important in determining whether we see a slowdown or a recession. The course of the pandemic is unpredictable - and we might get lucky (perhaps seasonality will play a role - but that is an unknown).

Fear and confidence are important factors too. The Government needs to be honest and transparent about the extent of the pandemic, and provide accurate and timely updates on the situation.

In China, the epidemic brought the housing market to a stand still, and even with very low mortgage rates, that might happen in the US too (People might just stop looking). If the housing market slows sharply for more than a few months, a recession will be very likely.

I will focus on high frequency indicators (like weekly unemployment claims) and provide updates on my outlook.

Federal Reserve Cuts Rate 1/2 percentage point

by Calculated Risk on 3/03/2020 10:35:00 AM

From the Federal Reserve: Federal Reserve issues FOMC statement

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

CoreLogic: House Prices up 4.0% Year-over-year in January

by Calculated Risk on 3/03/2020 09:29:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports January Home Prices Increased by 4% Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2020, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4% from January 2019. On a month-over-month basis, prices increased by 0.1% in January 2019. (December 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will be 5.4% from January 2020 to January 2021. On a month-over-month basis, the forecast calls for U.S. home prices to increase by 0.2% from January 2020 to February 2020. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“January marked the third consecutive month that annual home price growth accelerated in our national index, as low mortgage rates and rising income supported home sales,” said Dr. Frank Nothaft, chief economist at CoreLogic. “In February, mortgage rates fell to the lowest level in more than three years, which likely will spur additional home shopping activity and price appreciation.”

emphasis added

Click on graph for larger image in graph gallery.

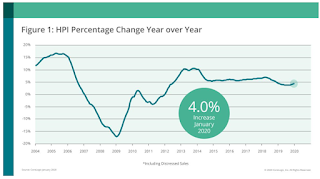

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the YoY change in the index.

CR Note: The YoY change in the CoreLogic index decreased over the last year, but lately the YoY change has been increasing.

Monday, March 02, 2020

Tuesday: Vehicle Sales, Corelogic House Prices

by Calculated Risk on 3/02/2020 06:28:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit All-Time Lows, Is It Time To Lock?

Mortgage rates officially hit all-time lows this morning. Even so, it continues to be the case that Treasury yields (often referred to as the basis for mortgage rates) are falling much faster. That's because Treasuries aren't actually the basis for mortgage rates. They're simply a very important source of guidance and momentum in the bigger picture for all kinds of rates. I've written on this extensively in recent days. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.125-3.25%]Tuesday:

emphasis added

• All day, Light vehicle sales for February. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).

• 10:00 AM ET, Corelogic House Price index for January.