by Calculated Risk on 2/13/2020 07:25:00 PM

Thursday, February 13, 2020

Friday: Retail Sales, Industrial Production

Friday:

• At 8:30 AM ET, Retail sales for January is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 76.8%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 99.3.

Hotels: Occupancy Rate Decreases Year-over-year

by Calculated Risk on 2/13/2020 03:53:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 8 February

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 2-8 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 February 2019, the industry recorded the following:

• Occupancy: -1.4% to 59.0%

• Average daily rate (ADR): +1.5% to US$128.75

• Revenue per available room (RevPAR): 0.0% at US$75.98

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a solid start, however, STR notes that the new coronavirus could have a significant negative impact on hotels.

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in January, Core PCE below 2%

by Calculated Risk on 2/13/2020 11:36:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.7% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for January here. Motor fuel decreased at a 17.3% annualized rate in January.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in January. The CPI less food and energy rose 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for December and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.7% annualized and trimmed-mean CPI was at 2.9% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

Weekly Initial Unemployment Claims Increase to 205,000

by Calculated Risk on 2/13/2020 08:37:00 AM

The DOL reported:

In the week ending February 8, the advance figure for seasonally adjusted initial claims was 205,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 202,000 to 203,000. The 4-week moving average was 212,000, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 211,750 to 212,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 212,000.

This was lower than the consensus forecast.

BLS: CPI increased 0.1% in January, Core CPI increased 0.2%

by Calculated Risk on 2/13/2020 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in January on a seasonally adjusted basis, after rising 0.2 percent in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.5 percent before seasonal adjustment.Overall inflation was slightly lower than expectations in January. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.2 percent in January after increasing 0.1 percent in December.

...

The all items index increased 2.5 percent for the 12 months ending January, the largest 12-month increase since the period ending October 2018. The index for all items less food and energy rose 2.3 percent over the last 12 months, the same 12-month increase as reported in the previous 3 months.

emphasis added

Wednesday, February 12, 2020

Thursday: CPI, Unemployment Claims

by Calculated Risk on 2/12/2020 08:12:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 212,000 initial claims, up from 202,000 last week.

• Also at 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

LA area Port Traffic Down Year-over-year in January

by Calculated Risk on 2/12/2020 05:00:00 PM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, most of this traffic was prior to the widespread outbreak of COVID-19 in China.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.3% in January compared to the rolling 12 months ending in December. Outbound traffic was down 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports both imports and exports have turned down recently - and will probably be negatively impacted by COVID-19 over the next couple of months.

Houston Real Estate in January: Sales up 15.2% YoY, Inventory Up 3.7% YoY

by Calculated Risk on 2/12/2020 01:03:00 PM

From the HAR: Houston Real Estate Enjoys a Strong Start to 2020

Fresh on the heels of a record-breaking 2019, home sales across greater Houston began the new year with a strong showing as consumers continued to take advantage of historically low interest rates. ...Sales in Houston set a record in 2019 and are off to a strong start in 2020.

According to the latest monthly Market Update from the Houston Association of REALTORS® (HAR), 4,699 single-family homes sold in January compared to 4,112 a year earlier. That represents a 14.3 percent increase – the seventh consecutive positive month and the greatest January sales volume hike in seven years.

...

Sales of all property types totaled 5,800, up 15.2 percent from January 2019. Total dollar volume for the month surged 17.1 percent to about $1.6 billion.

"January is a traditionally slower month for home sales coming off the holidays, but the Houston market continues to benefit from low mortgage interest rates and a generally robust economy with healthy employment numbers,” said HAR Chairman John Nugent with RE/MAX Space Center. “All the January home buying activity lowered our housing inventory a little, but we expect to see that grow again as we approach the spring months when more homes typically hit the market."

...

Total active listings, or the total number of available properties, rose 3.7 percent to 39,699. … Single-family homes inventory recorded a 3.5-months supply in January, down fractionally from a 3.6-months supply a year earlier.

emphasis added

Energy expenditures as a percentage of PCE

by Calculated Risk on 2/12/2020 10:13:00 AM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the December 2019 PCE report released last week.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2019.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In December 2019, energy expenditures as a percentage of PCE was at 4.05% of PCE, up somewhat from the all time low of 3.65% in February 2016.

Energy as a percent of GDP has been generally trending down, and historically this is a low percentage of PCE for energy expenditures.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 2/12/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 7, 2020.

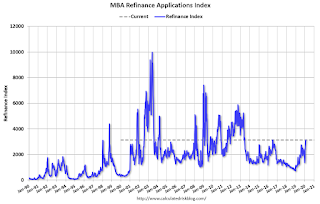

... The Refinance Index increased 5 percent from the previous week and was 207 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index increased 0.3 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

“The mortgage market continues to be active in early 2020, as applications increased for the third straight week. Rates also rose, but still remained close to their lowest levels since October 2016,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The refinance index climbed to its highest level since June 2013, and refinance loan sizes also increased as a result of an active jumbo lending market.”

Added Kan, “Last month was the strongest January for purchase applications since 2009, which is perhaps a sign that mild weather brought out prospective buyers earlier than normal. Despite a decline last week, purchase activity was still up almost 16 percent from a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.72 percent from 3.71 percent, with points remaining unchanged at 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a 2012 size refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 16% year-over-year.